- Chart of the Day

- Januar 15, 2026

- 3 Min. Lesezeit

Taiwan Semiconductor Q4 Earnings Smash; Sets the Tone for Big Tech

Taiwan Semiconductor Manufacturing Co. delivered a clean Q4 beat, driven by AI demand, strong margins, and expanding advanced-node capacity. This matters because TSMC sits at the centre of the global AI supply chain. When it prints well, it usually lifts the entire complex.

Why this matters now

TSMC’s outlook effectively becomes a proxy for Big Tech capex confidence into Q1 2026. Strong guidance suggests hyperscalers are still spending, not pulling back.

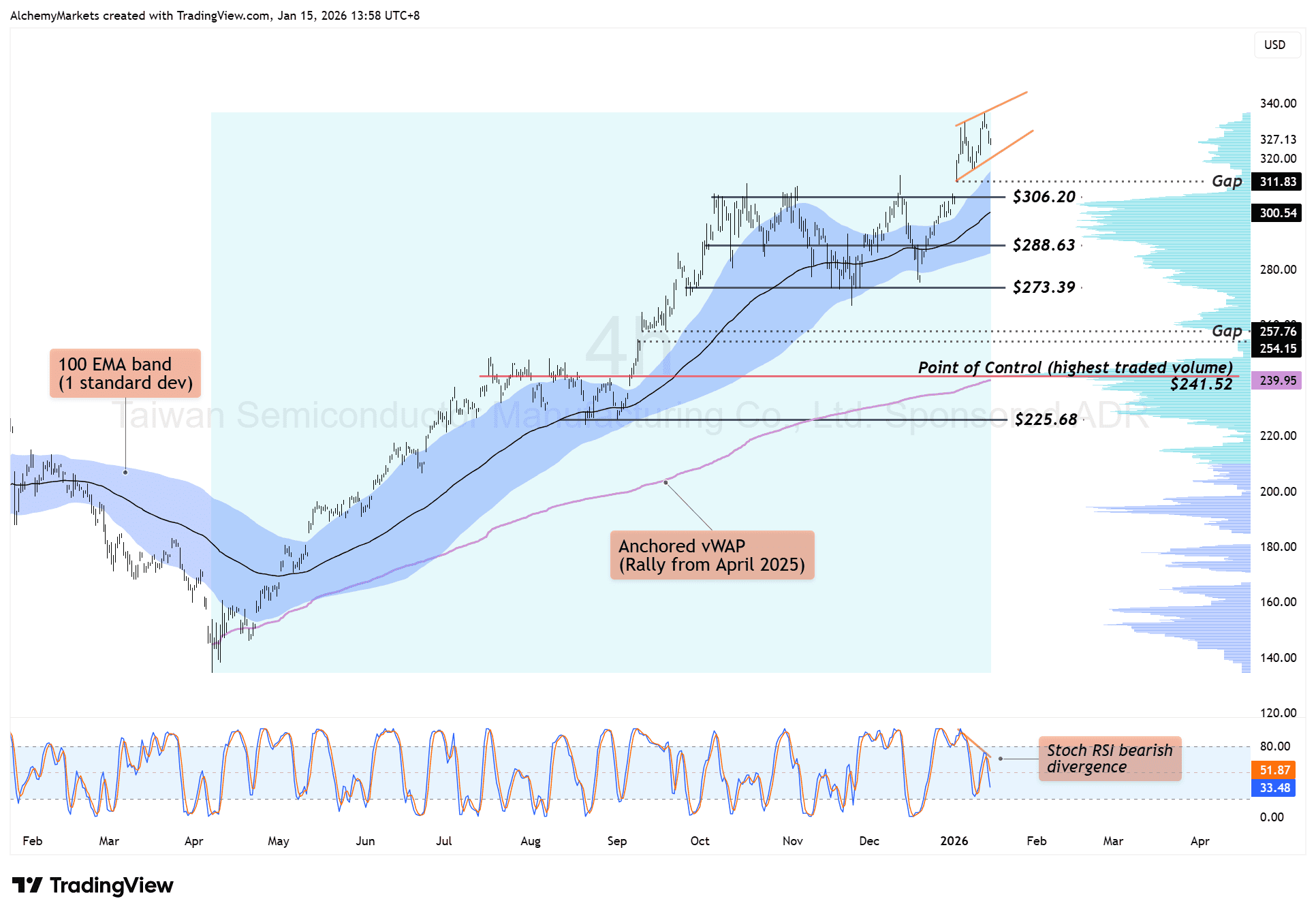

Price Levels

Price is extended above the 100 EMA band (1σ), signalling strong momentum but rising short-term stretch risk.

$306.20 breakout zone has flipped to support. Above here, trend control stays with buyers. This is the first meaningful pullback level, aligned with the rising EMA band.

Deep pullbacks zones to watch are: $300 (4H-100-EMA), $288.63 (Volume Support), $273.39 (Previous Low – More unlikely).

Trend

Anchored vWAP continues to slope higher, confirming a volume-backed uptrend.

The key structural level remains the anchored vWAP from the April 2025 rally, aligned with the Point of Control near $241.52.

While price is unlikely to revisit this zone in the near term, it defines the market’s strongest support and the level where buyers would be expected to re-assert control if momentum meaningfully fades.

Momentum check

Stoch RSI is flashing bearish divergence. That doesn’t kill the trend, but it does warn that upside may pause or rotate into a consolidation before continuation.

What This Means

Fundamentals say that AI demand is still real. The price chart tells us that trend is intact, but momentum is currently flashing overstretched signals (potential pullbacks).

If Big Tech is going to hold up into early 2026, TSMC just gave bulls the green light—but entries are better on dips, not highs.

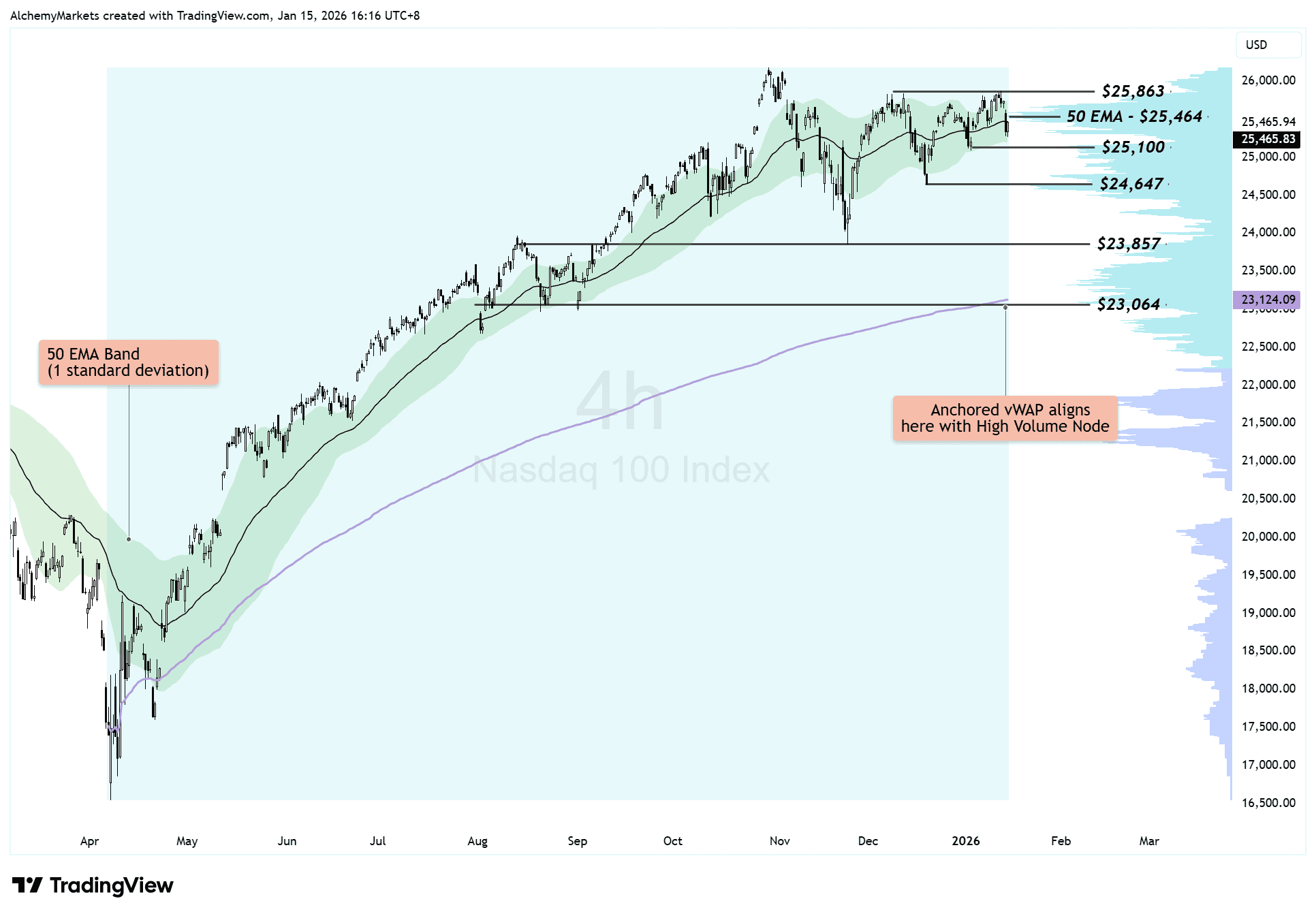

Potential Effects on the Nasdaq

On the Nasdaq 100, TSMC’s earnings act as a confirmation signal, not just a single-stock event.

Semis sit at the core of the index’s leadership, and when the most systemically important foundry delivers strong margins and forward guidance, it reinforces the idea that AI capex is still flowing through the stack. That supports the Nasdaq’s broader uptrend rather than narrowing it.

From a market-structure angle, this helps explain why the Nasdaq continues to hold above its 50 EMA band and prior breakout zones instead of mean-reverting deeper. Strong TSMC results reduce the probability of a sharp tech-led unwind and instead favour range digestion or shallow pullbacks.

That said, the effect is asymmetric:

- Bullish case: Confirms earnings support for AI-heavy index weightings, keeping dips bid and volatility contained.

- Risk case: If the Nasdaq stalls despite this read-through, it would signal exhaustion rather than a fundamental problem.

Bottom line: TSMC strength doesn’t guarantee upside follow-through, but it raises the floor for the Nasdaq. Any weakness is more likely corrective than trend-breaking unless broader macro conditions deteriorate.