Bitcoin (BTC) has recently experienced a significant decline, trading at approximately $85,761. This downturn has been influenced by a combination of macroeconomic factors, security breaches, and market sentiment.

Fundamental Factors Behind the Recent Decline

- Macroeconomic Uncertainties: The imposition of tariffs by President Donald Trump’s administration on imports from Canada, Mexico, and China has heightened economic uncertainties. These tariffs are perceived as inflationary, potentially limiting the Federal Reserve’s ability to reduce interest rates, thereby exerting downward pressure on assets like Bitcoin.

- Security Breaches: A significant hack of the Bybit crypto exchange resulted in the theft of approximately $1.5 billion, primarily in Ethereum. This event has undermined investor confidence in the security of cryptocurrency platforms, contributing to the market’s decline.

- Market Sentiment and Regulatory Concerns: The collapse of several meme coins, including those promoted by high-profile figures, has led to substantial investor losses and increased skepticism toward the crypto market. Additionally, the anticipated pro-crypto policies from the current administration have not materialised as expected, leading to further market apprehension.

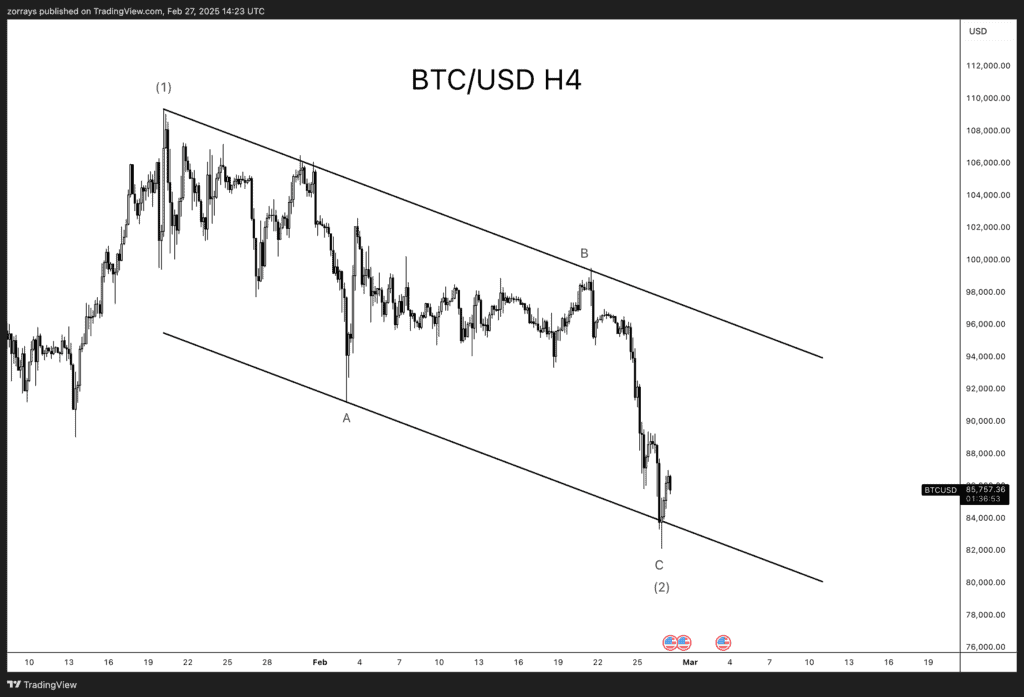

Technical Analysis: Descending Channel and Bullish Prospects

Bitcoin’s price movement has formed a descending channel, characterised by parallel downward-sloping trendlines connecting lower highs and lower lows. This pattern often indicates a potential bullish reversal upon a breakout above the upper trendline. Currently, Bitcoin is approaching the lower boundary of this channel, suggesting a possible rebound.

Forward-Looking Perspective

Despite recent challenges, several factors suggest a potential bullish outlook for Bitcoin:

- Institutional Interest: Increased participation from institutional investors, as evidenced by the growth in Bitcoin exchange-traded funds (ETFs), indicates a maturation of the market and could lead to greater price stability and appreciation over time.

- Market Dominance: Bitcoin’s dominance in the cryptocurrency market has risen to 62%, reflecting its resilience and continued investor confidence relative to other digital assets.

- On-Chain Metrics: Positive on-chain signals, such as increased wallet activity and accumulation by long-term holders, suggest underlying strength and potential for future price increases.

In conclusion, while Bitcoin faces short-term headwinds due to macroeconomic factors and security concerns, its technical setup and fundamental indicators point toward a potentially bullish trajectory in the medium to long term.