NVIDIA Corporation (NVDA) is poised to release its fiscal fourth-quarter earnings for 2025 on Wednesday, February 26, 2025, after the market closes. This announcement comes at a pivotal time, as the company navigates both robust demand for its AI-driven technologies and emerging competitive challenges.

Performance Overview and Analyst Expectations

Analysts project that NVIDIA will report record quarterly revenue of approximately $38.34 billion, marking a 73% increase compared to the same period last year. Net income is anticipated to rise to $21.08 billion from $12.84 billion in the previous year. This surge is largely attributed to the escalating demand for NVIDIA’s advanced AI chips, particularly from major technology firms enhancing their AI infrastructure. Notably, companies like Amazon, Meta, and Alphabet have announced significant increases in capital expenditures for AI, with Amazon planning to invest over $100 billion in AI infrastructure in 2025.

The introduction of NVIDIA’s latest chip series, Blackwell, is also expected to contribute substantially to the company’s revenue. UBS analysts have revised their estimates, projecting that Blackwell could generate $9 billion in fourth-quarter revenue, up from an initial estimate of $5 billion.

Despite these optimistic projections, NVIDIA faces competitive pressures, particularly from Chinese startup DeepSeek. DeepSeek’s open-source reasoning model, R1, has demonstrated impressive performance using fewer and less powerful chips, potentially challenging NVIDIA’s dominance in the AI chip market. This development led to a significant drop in NVIDIA’s market capitalization, though the stock has since partially recovered.

Technical Analysis: Elliott Wave Perspective

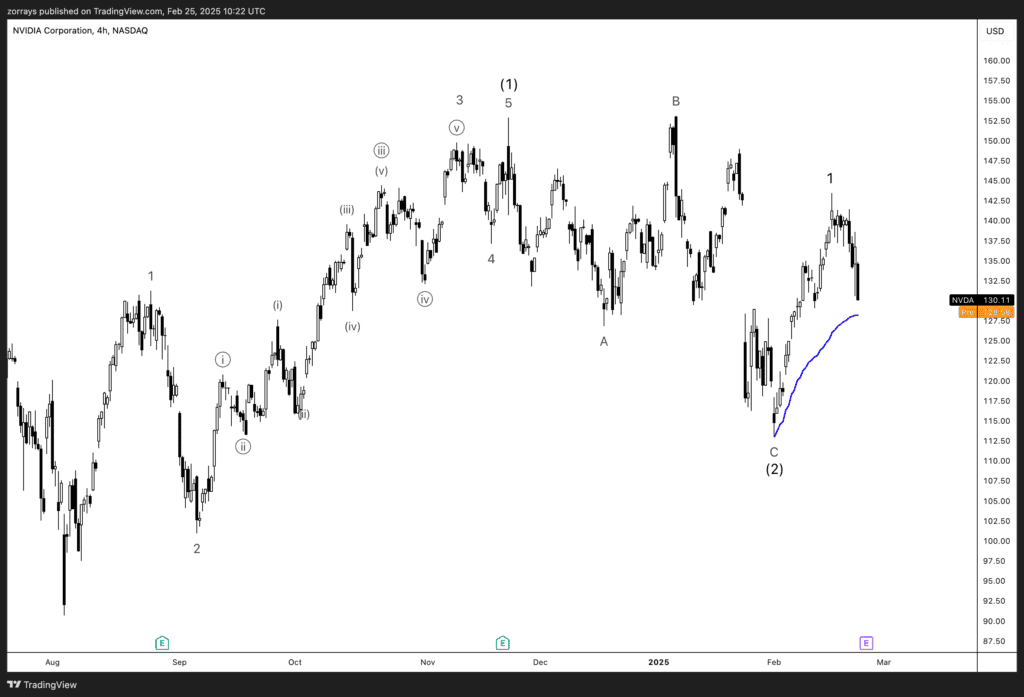

From a technical standpoint, NVIDIA’s stock has recently completed a corrective phase identified as an expanded flat in Elliott Wave terminology. This pattern consists of three waves: wave (A), wave (B), and wave (C). In this scenario, wave (B) exceeded the starting point of wave (A), and wave (C) declined below the ending point of wave (A), completing the corrective structure. The culmination of wave (C) was observed at the $113.09 level, establishing a critical support point.

Following this correction, the stock initiated a new upward impulse, identified as wave 1 of the larger wave (3). During this ascent, the price encountered resistance and has since retraced towards the Anchored Volume Weighted Average Price (VWAP), anchored to the significant low of $113. The Anchored VWAP serves as a dynamic support level, reflecting the average price weighted by volume since the anchor point.

The upcoming earnings report is a potential catalyst that could influence the stock’s trajectory. A strong earnings performance, coupled with positive forward guidance, may reinforce investor confidence, leading to a bounce off the Anchored VWAP support and continuation of the upward trend, affirming that NVIDIA remains in its growth phase. Conversely, if the earnings results disappoint or if guidance reflects potential challenges—such as intensified competition from entities like DeepSeek—the stock may breach the Anchored VWAP support, indicating potential for further downside movement.

As of February 25, 2025, NVIDIA’s stock is trading at $130.28, reflecting a decrease of $4.12 from the previous close. Investors are advised to monitor the earnings release closely, as it will provide critical insights into NVIDIA’s operational performance and strategic direction amidst the evolving AI landscape.