- Elliott Wave

- February 24, 2025

- 2min read

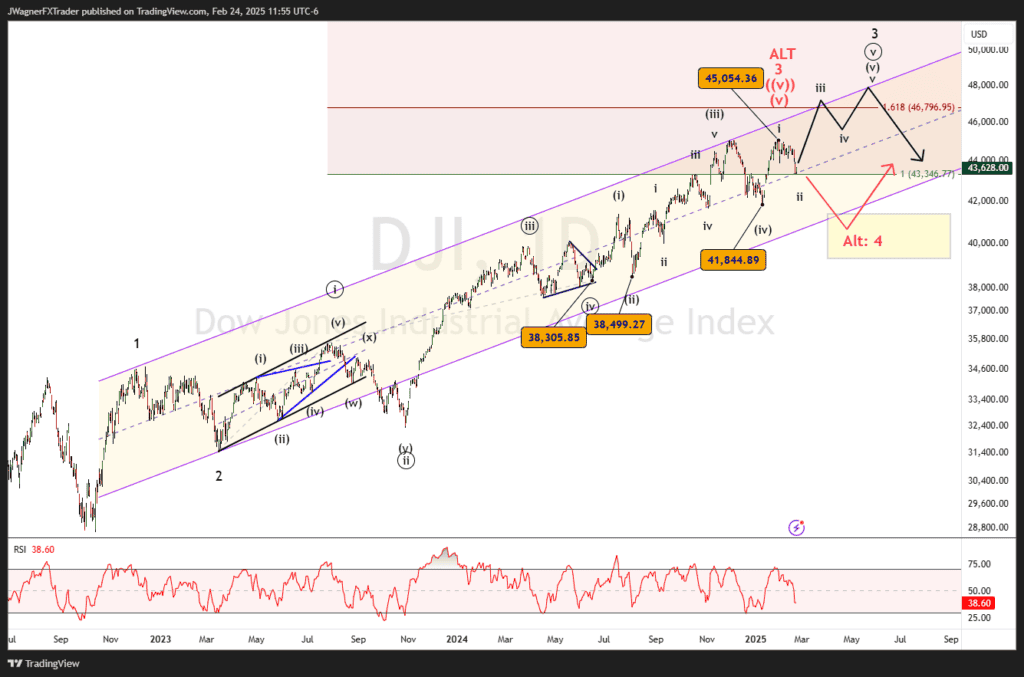

DJI Elliott Wave Forecast: Bullish Momentum Ahead

Executive Summary

- Trend Bias: The Dow Jones Industrial Average (DJI) remains in a long-term bullish impulse, likely in Wave 3 of a larger degree.

- Key Level: 41,844.89 is a key level for the primary wave count.

- If 41,844 breaks, then a decline in wave 4 likely targets 39,700-41,500.

Current Elliott Wave Analysis

The DJI is progressing within an Elliott wave primary Wave 3 inside a larger cycle degree uptrend. The structure suggests:

- At the Intermediate degree, the market is completing Wave (v) of 3, meaning the index is nearing a more significant peak.

- A Fibonacci 0.618 extension projects a wave relationship at 46,796.95, where a Wave 4 correction could begin.

- Alternative count (ALT: 3) suggests that the current minor wave 3 ended in January and DJI is correcting lower in wave 4.

If a larger correction unfolds, Wave 4 could target 39,700-41,500, aligning with Fibonacci retracement levels. This would provide a buy-the-dip opportunity before Wave 5 resumes the broader uptrend.

Bottom Line

The DJI remains bullish, as the current Elliott wave appears to be wave ii of (v) of ((v)) of 3. This primary wave count suggests two more bursts higher to finalize minor wave 3.

The alternate is that wave 3 finished in January and a Wave 4 pullback could emerge to 39,700-41,500. So long as prices remain above 41,844, then anticipate more all-time highs.

You might also be interested in:

DISCLAIMER:

For educational purposes only. Trading comes with substantial risk, leading to possible loss of your capital.

Traders are advised to do their own due diligence before investing.