What are Ethereum CFDs?

An Ethereum CFD (Contract-for-difference) is a type of derivative enabling traders to gain exposure to Ethereum’s price action without owning the cryptocurrency.

The CFD mimics the price action of the underlying asset – which in this case, is Ethereum, and allows traders to speculate on the price action of Ethereum and enter long/short trades.

These derivatives can be traded via brokers, which also provide exposure to CFDs of traditional assets as well, including foreign exchange pairs, commodities, and stocks, among others. They are different from crypto exchanges, which facilitate the direct purchase and exchange of cryptocurrencies.

Ethereum CFDs follow the price of Ethereum, the second-largest cryptocurrency by market cap.

What is Ethereum?

Ether (ETH) is the native cryptocurrency of Ethereum, a public Layer-1 blockchain network. The blockchain technology allows users to transfer value in a decentralised environment without the supervision of governments, banks, or any other entities. All transactions and operations are collectively approved using a consensus mechanism.

The Ethereum platform officially launched in 2015 in an attempt to improve the scaling issues of Bitcoin. Bitcoin can only handle between 3 and 7 transactions per second (tps).

Nevertheless, on top of its increased efficiency, the Ethereum network has become popular thanks to its ability to support smart contracts, which enable developers to build decentralised applications (dApps), non-fungible tokens (NFTs), and other cryptocurrency tokens to run on the Ethereum blockchain.

Cryptocurrencies built off the Ethereum Network are also referred to as Layer-2 solutions.

Bitcoin, on the other hand, is more rigid and is used as a store of value (SOV) asset. Developers have traditionally not built dApps or tokens on top of Bitcoin.

In 2022, the Ethereum blockchain finalised a major upgrade, called “The Merge”, to transition from a Proof of Work (PoW) consensus algorithm – which is more akin to Bitcoin’s technology – to a Proof of Stake (PoS) algorithm. Thanks to this upgrade, the Ethereum blockchain has increased its efficiency and reduced its electricity consumption by 99.9%.

How Do Ethereum CFDs Work?

An Ethereum CFD is a contract between a trader and a broker where the broker pays the trader the difference in price from when the position is opened to when it is closed, provided the trader correctly predicts the direction of Ethereum’s price. If the price of Ethereum moves against the trader’s prediction, closing the position would result in a loss.

You can either set a buy or sell order on Ethereum CFD to enter a trade position:

- Buy orders or bid orders, will allow you to enter a long position. This means you will profit if you close your trade when Ethereum is above your entry price, and lose funds if Ethereum is below.

- Sell orders or ask orders, will allow you to enter a short position. This means you will profit if you close your trade when Ethereum is below your entry price, and lose funds if Ethereum is above.

The size of the profit or loss depends on the difference between the entry price and the exit price, i.e. the price performance in percentage terms.

Simply put, Ethereum CFDs are financial bets where traders open long positions or short positions.

Ethereum CFD positions can be left open indefinitely, but if the price moves against you, the broker may close positions automatically if your balance doesn’t cover the pending loss. Also, some brokers may charge additional fees for holding positions overnight.

The liquidity of Ethereum CFDs is mainly offered by market makers, which are individual or institutional investors taking positions on both sides.

Key Aspects of an Ethereum CFD

An Ethereum CFD, like any other CFD, has several key elements, including:

- Bid Price is the price at which traders are willing to buy Ethereum, which means it’s the highest price you can instantly sell at.

- Ask Price is the price at which traders are willing to sell Ethereum, which means it’s the lowest price you can instantly buy at.

- Spread – The gap between bids and asks is known as the spread. It represents the hidden commission of the broker. Spread fees are incurred when opening and closing a trade.

Remember, the bid price and ask price are ever changing, and determined by the ebb and flow of the Ethereum Spot market – not the Ethereum CFD market. The CFD is simply mimicking the market conditions of the actual, underlying asset, and has no bearing on the real price of Ethereum.

Leverage with Ethereum CFDs

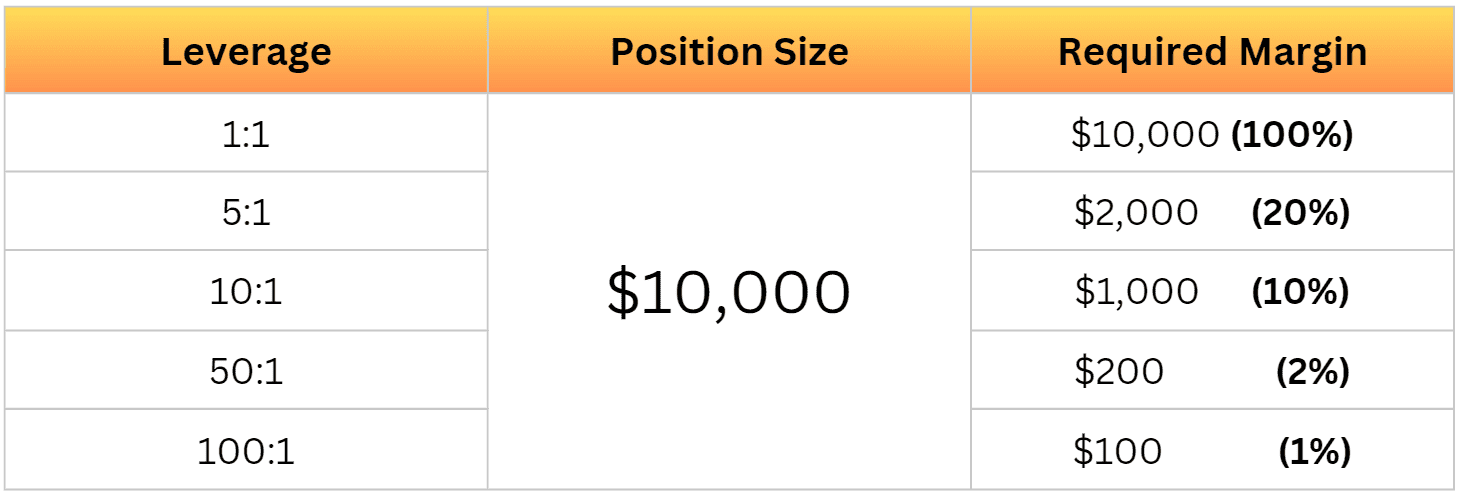

Ethereum CFD traders have the option to use leverage to increase potential returns. With leverage, traders can increase their buying power by committing only a partial of their deposited funds. For example, with 10:1 leverage, a $1,000 trade would only require the trader to commit $100 of their funds.

This personal contribution is called a maintenance margin (or required margin). When the trade goes against the direction of your trade, the floating losses will reduce your available free margin. When the unused and free margin is gone, then the maintenance margin is struck and the trade is then completely closed.

This table shows the margin requirements for the main leverage scenarios:

Given that Ethereum is highly volatile, brokers usually offer leverage up to 10:1, compared to the upper limit of 400:1 or 500:1 for forex pairs. You can find the current margin requirements for cryptocurrency CFDs on Alchemy Markets accounts. For example, a margin requirement of 10:1 leverage translates to a 10% maintenance margin based on the position size.

What Affects the Price of Ethereum CFDs?

Since Ethereum CFDs price mirrors Ethereum’s price, it’s important to keep an eye on the various factors that influence the cryptocurrency, such as Bitcoin’s performance and Ethereum’s supply and demand. In this section, we’ll break down the various factors which sway the price of Ethereum.

Supply and Demand

As with any other asset, Ethereum’s price fluctuations reflect the dynamics of the relationship between its supply and demand. This is especially interesting when it comes to cryptocurrencies, as some tokens operate with a fixed supply, while others have unlimited supply.

Ethereum Supply

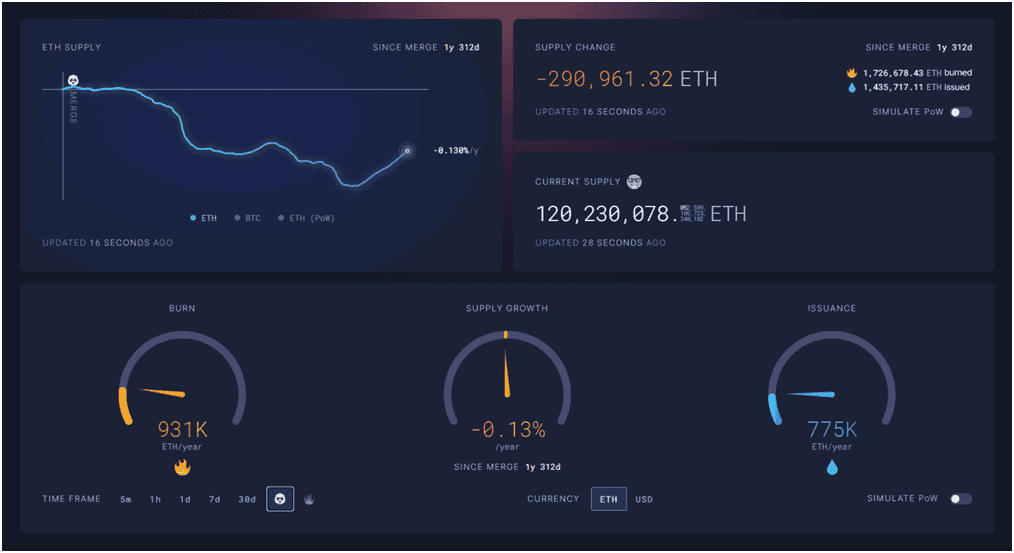

Unlike Bitcoin, Ethereum has no capped supply. However, Ethereum’s upgrade into ETH 2.0 saw it transition from a Proof-of-Work model to a Proof-of-Stake model, which has helped it drastically reduce its inflation rate. Today, Ethereum has an annual inflation rate of only 0.5% versus Bitcoin’s 0.84%.

New ETH coins are issued to validators, users who deposit a minimum of 32 ETH as collateral to participate in transaction validation. In 2021, Ethereum introduced the EIP-1559 upgrade, burning part of the transaction fees since then, therefore reducing supply and acting as a deflationary mechanism.

Since the launch of Ethereum 2.0, the supply has been reduced by over 290,000 ETH.

Source: Ultra Sound Money

Ethereum Demand

The Ethereum network has multiple use cases that could impact its demand, including:

- Decentralised Finance (DeFi) – Ethereum is the most sought-after network in the DeFi sector, which comprises decentralised finance applications that operate without intermediaries and central authorities. Today, Ethereum accounts for 60% of the total value locked (TVL) across DeFi.

Source: DeFi Llama

- Non Fungible Tokens (NFTs) – NFTs are tokens with unique identifiers that provide ownership over tangible or intangible assets, from digital art to real estate. Ethereum is the leading blockchain for NFTs, surpassing the second-ranking chain, Solana, by almost nine times in terms of all time sales.

- Web3 and utility tokens – Ethereum is used by many Web3 apps, including gaming and metaverse projects. Additionally, it hosts thousands of tokens, including major utility tokens like Uniswap (UNI), Arbitrum (ARB), and Maker (MKR).

- Stablecoins – Ethereum hosts many stablecoins, including the two largest ones by market cap: USDC and USDT.

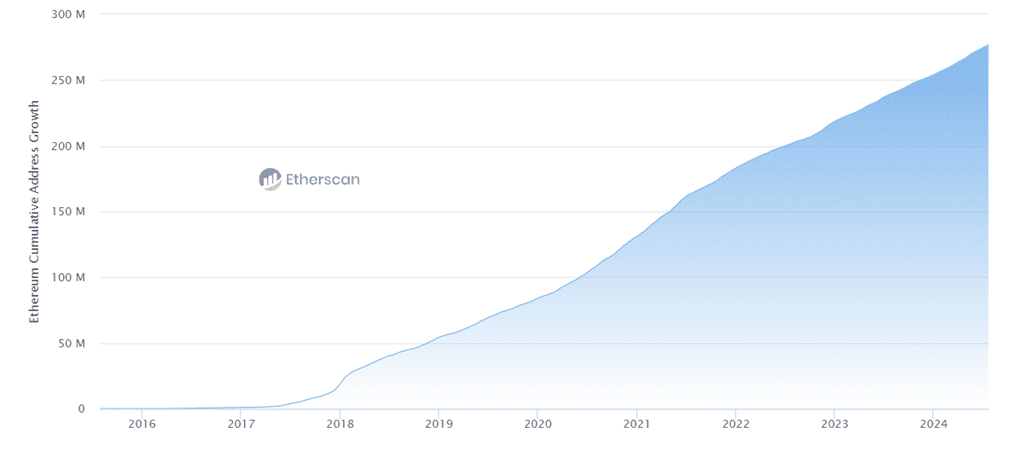

The increasing demand for Ethereum is reflected by the number of ETH wallets, which surged from 20 million in 2018 to over 275 million as of this writing.

Source: Etherscan

Staking

Staking is another key activity driving Ethereum demand and stimulating its supply increase. ETH holders can stake their coins to earn rewards. The reward rate is fluctuating and is currently at about 3%.

As of September 2024, over 34 million ETH, which accounts for approximately 25% of all Ether in circulation, is locked for staking.

Market Sentiment

Assessing the supply/demand dynamics is not enough when it comes to speculating on short-term price fluctuations. Ethereum CFD traders use technical indicators to understand market sentiment.

The market can become more volatile after important events, upgrades, and regulatory updates.

Cryptocurrency Movements – Ethereum and Bitcoin’s Correlation

While Ethereum has a diverse ecosystem of dApps, it still shows a very high correlation to Bitcoin and other cryptocurrencies. It’s often thought that Bitcoin leads the dance for most cryptocurrencies. Therefore, observing the performance of Bitcoin and Ethereum simultaneously is important when trading ETH CFDs.

Just take a look at the correlation between Bitcoin and Ethereum from January to July in 2024. Notice how closely the price action mirrors each other?

Source: TradingView

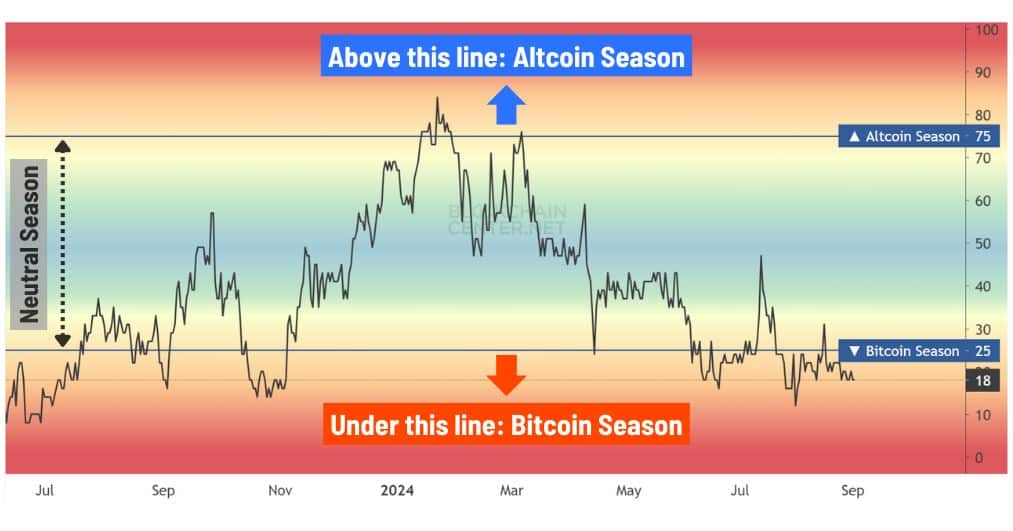

Altcoin Season Index

The Altcoin Season Index is a tool used by crypto traders to gauge market dynamics by comparing Bitcoin’s performance to altcoins over a 90-day period.

When Bitcoin outperforms altcoins significantly, it signals “Bitcoin Season,” a period where Bitcoin typically sees more volatile and substantial price movements. Conversely, during “Altcoin Season,” altcoins outperform Bitcoin, offering traders potential for higher returns due to their increased volatility.

This index helps traders adjust their strategies based on which segment of the market is in control.

Altcoin Season Chart 2023-2024

Source: Blockchain Center

Similar to an oscillator, the Altcoin Season Index uses upper and lower thresholds to indicate market conditions. When the index falls below 25, it signals “Bitcoin Season,” meaning Bitcoin is outperforming altcoins. When it rises above 75, it indicates “Altcoin Season,” where altcoins take the lead.

These extremes often precede market reversals, and traders watch for the index to return to neutral territory to make strategic adjustments.

| Interpretations of the Altcoin Season Index | Action | |

| Bitcoin to Altcoin Shift | When the index dips into “Bitcoin Season” but then rises back above 25, it suggests that altcoins are starting to outperform Bitcoin. | Shift focus from trading Bitcoin to Altcoin CFDs, including Ethereum |

| Altcoin to Bitcoin Shift | If the index enters “Altcoin Season” and then drops below 75, it often indicates that Bitcoin is holding its value better than altcoins during a market decline. | Continue trading Altcoins CFDs, with a bias to shorts |

| Extended Bitcoin Season | If the index remains in “Bitcoin Season” for an extended period, it suggests that Bitcoin is either outperforming altcoins in a downtrend or leading significant price moves ahead of altcoins. | Continue trading Bitcoin over Altcoin CFDs, with bias depending on BTC/USD’s trend |

| Extended Altcoin Season | If the index remains in “Altcoin Season” for an extended period, it suggests that the entire cryptocurrency market is in an uptrend, with Altcoins making more explosive uptrends. | Continue trading Altcoins CFDs, with a bias to longs |

This tool provides valuable insight into market cycles, helping traders determine whether to prioritise Bitcoin or altcoins in their portfolios.

Why Trade Ethereum CFDs with Alchemy Markets?

Trading CFDs on Ethereum with Alchemy Markets is different from purchasing it on crypto exchanges. Here is why CFDs might be more suited for your trading approach:

Wealth of Trading Resources

Alchemy Markets’ supported platforms offer a range of premium tools designed to enhance your trading experience, and give traders an edge in tackling the financial markets. These include real-time charting, various order types, technical indicators, VPS setup, algorithmic trading, and access to real-time analysis from analysts, among other benefits.

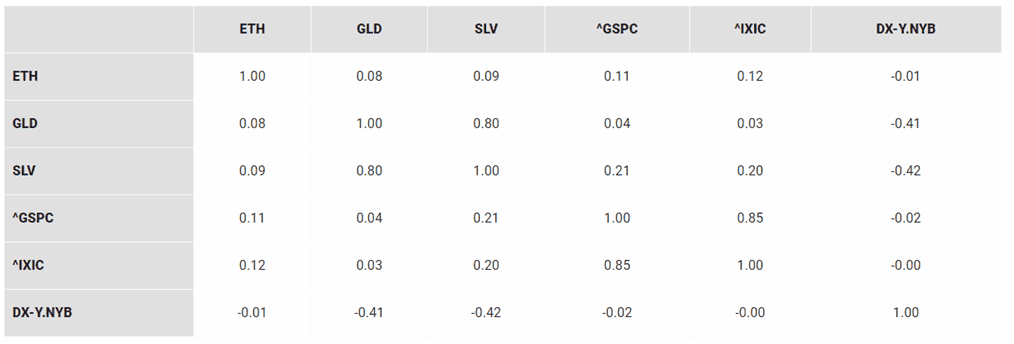

Diversification

Alchemy Markets also provides access to trade other traditional markets including forex pairs, stocks, and commodities. This enables you to diversify your trading portfolio and maximise the types of opportunities you would have, all in one place. This approach isn’t available on crypto exchanges as they commonly only list crypto related assets for trading.

Adding Ethereum CFDs into your trading can simultaneously reduce the risks associated with purely trading crypto, and also enhance potential returns. This is thanks to Ethereum’s high volatility and low correlation with traditional assets.

Ethereum’s lifetime correlation to gold, silver, the S&P 500, NASDAQ, and the USD Index is here.

Source: Coinhedge

Lower Costs

Alchemy Markets offers extremely low spreads on crypto CFDs, allowing traders to open multiple short-term positions simultaneously when trading this asset class.

The spread for Ethereum CFDs price can translate into a minimal commission of 0.01%, along with a standard commission fee of 0.35% for Classic Accounts. For comparison, trading fees on crypto exchanges can reach up to 0.6%.

Low fees are particularly attractive to active traders who frequently open and close positions throughout the day, such as scalpers and other intra-day traders.

No Physical Ownership

You can trade CFDs to eliminate the complexities associated with owning actual ETH. Buying it on centralised or decentralised exchanges requires secure storage in wallets that come in many forms, including:

- Custodial wallets – They are provided by crypto exchanges, where the exchange holds your private keys, exposing you to risks such as hacking or bankruptcy.

- Non-custodial wallets – They are more secure but require some expertise. Hardware wallets are the most secure option but can be costly, with prices ranging between $60 and $250 for a device.

Flexibility

Ethereum CFD trading offers greater flexibility than directly buying Ethereum.

You can profit during both bullish and bearish markets by going long or short. This allows for speculating on price movements under any market condition.

CFDs also offer quick entry and exit from trades, with access to multiple order types and risk management tools to customise your trading experience.

Competitive Spreads

To thrive in the competitive CFD industry, Alchemy Markets is interested in offering low spreads to attract users and increase its client base.

Though the spread for Ethereum CFDs might appear higher compared to forex pairs, it is relatively similar in percentage terms.

Accessibility

Unlike traditional assets, cryptocurrency markets operate 24/7. You can trade Ethereum CFDs price at any time using a laptop or mobile device with internet access.

Ethereum CFDs’ constant availability means that you don’t miss any price movements, unlike traditional assets that trade only during business days within specific hours. When traditional markets reopen, price gaps from unexpected events may lead to margin calls, especially after weekends and holidays.

Liquidity

Ethereum CFDs benefit from high liquidity, as Ethereum is the second-largest cryptocurrency by market cap after Bitcoin.

A large number of trades are executed continuously, ensuring fast execution at targeted prices. Nevertheless, it’s recommended to trade when the market is more active, which happens to be during trading hours of major traditional assets.

Ability to Go Long or Short

With Ethereum CFDs, you can open both long and short positions. Alchemy Markets allows Ethereum CFD traders to profit from price declines, a feat not possible when buying ETH on crypto exchanges.

Stability

Trading Ethereum CFDs price can offer more stability than buying Ethereum on crypto exchanges, as most CFD brokers, including Alchemy, provide extensive risk management tools like stop-loss orders.

Moreover, Alchemy operates under regulatory frameworks that ensure protection and oversight, which is often not the case with many unregulated crypto exchanges.

Margin and Leverage

Unlike buying on crypto exchanges, Ethereum CFDs allow traders to use leverage, enabling larger positions with only a partial initial investment. This can amplify potential gains but also increases the risk of losses. For example, using a 10:1 leverage allows you to control a $1,000 position with only $100.

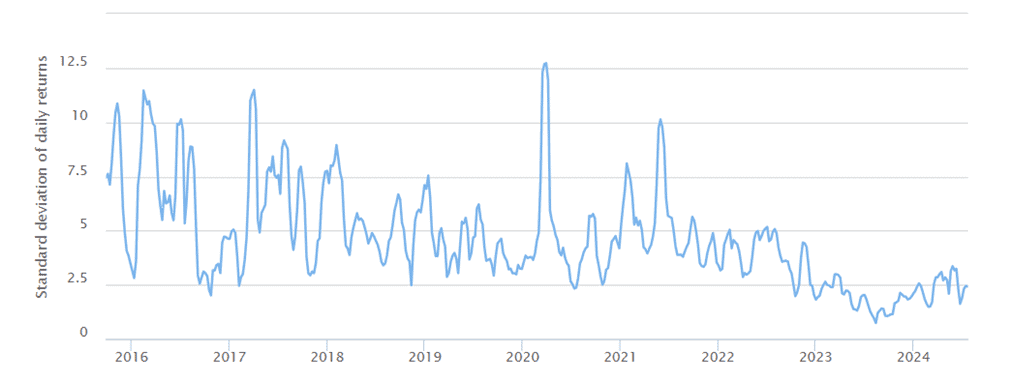

Volatility

Ethereum CFDs mirror the price of Ethereum and offer the same level of volatility. ETH’s volatility can present both opportunities and risks.

Although Ethereum’s 30-day volatility has stabilised over recent years, it remains high compared to forex pairs. Trading Ethereum CFDs price allows you to take advantage of these price swings without owning the cryptocurrency.

Source: Buy Bitcoin Worldwide Ethereum Volatility

No contract expiration date

Unlike futures or options, Ethereum CFDs do not have expiration dates. You can hold positions indefinitely, although some brokers may charge a fee for holding positions overnight.

This flexibility helps avoid the pressure associated with trading futures and options, where traders may make quick decisions as expiration dates approach.

Ethereum CFD Trading Example

Here is an example of an Ethereum CFD position:

In our case, the bid price for ETH/USD is $3,495, and the ask price is $3,500. A CFD of Ethereum represents the value of 1 ETH. If you think the price of Ethereum will increase, you can open a long position with $1,000 of your own capital at $3,500.

With 10:1 leverage, you would increase your buying power by ten times, opening a position of $10,000 with a 10% margin requirement.

If the price of ETH increases to $3,800 within a week, your position would gain approximately 8.57% to reach about $10,857. Closing it would mean that you secure a net profit of $857. Thanks to the used leverage, this represents an 85.7% return on your initial capital of $1,000.

Ethereum CFDs Trading Strategies

Ethereum CFD traders can employ various strategies based on their risk tolerance and objectives. Here are three of the most popular trading styles:

- Swing trading – Swing traders hold positions for several days or even weeks. They aim to capitalise on price swings by entering long or short positions based on the overall trend. Typically, swing traders would rely on technical indicators like moving averages or the Relative Strength Index (RSI), while also performing basic fundamental analysis.

- Day trading – Day traders open and close positions within the same day. They rely on technical indicators and chart patterns while monitoring major events that might influence market sentiment. Day traders typically use 1-minute, 5-minute, and 15-minute timeframes, keeping an eye on their positions.

- Scalping – Scalping is a short-term trading strategy that focuses on small price movements. Traders open and close positions within minutes or even seconds. Scalpers often use high leverage and short timeframes, targeting small gains that accumulate over the course of the day.

For All Trading Styles: Support and Resistance Trading

The most basic, yet flexible way to trade ETH/USD is to simply chart out the support and resistance levels on your preferred timeframe. Then, we will wait for a reaction at marked price zones and enter a trade. The principle here is to “Buy low, sell high”, which means we’ll look to buy at support, sell at resistance.

| Here’s how it works: 1. Mark out the previous pivot points – where price shifted directions dramatically with a clear lowest point or highest point. 2. Watch for a rejection at this area, entering in the direction of the reversal. For example, you would look for longs if the price was moving lower, and short if price was moving higher. 3. Stop loss placed a few pips away from the wick’s extreme. 4. Take profit placed at previous pivots, in the direction of the rejection. |

Ethereum Support and Resistance Example

In this 1-hour ETH/USD chart example, we see two major instances where our strategy would have given us a clear entry.

Marked in purple, this zone is important because it has previously acted as a support level, a consolidation zone, and eventually flips into powerful resistance for ETH/USD.

Zooming into the “Long Entry” area, let’s take a look at how we would have traded this price zone.

Notice how on the left, we have marked out a pivot low. Drawing a horizontal level from the wicks, we’ve now gotten a key level of interest to watch for a reaction, potentially giving us a long trade.

When the price returns to this pivot low, we are given three entry opportunities with a green candlestick close with a lower wick, similar to a hammer candlestick pattern. Entering here, we would target the previous pivot high as our take profit level. Alternatively, we can also target a 1:2 risk to reward ratio with this strategy, which sometimes can result in a greater return.

As you can see, even though our first two initial trades were stopped out, we ultimately nabbed a win on the third candlestick entry.

For Swing Trading: Using ETH/BTC to Enter Trades

Bitcoin and Ethereum usually move together—when Bitcoin rises, Ethereum tends to follow. Some traders use Bitcoin as a leading indicator for trading Ethereum and other altcoins.

However, there are times when this correlation breaks, with Bitcoin rising while Ethereum drops or vice versa. This is where the ETH/BTC chart becomes crucial, helping traders spot moments of divergence and avoid false signals from the BTC/USD pair that may not reflect the overall crypto market’s direction.

Here is an example of this playing out in early January 2024:

By watching the ETH/BTC chart, you could have identified a 19% rally in Ethereum while Bitcoin dropped 9%, profiting from a divergence play.

Although ETH/BTC is helpful for detecting market shifts, a valid trade setup on ETH/USD is still essential. ETH/BTC simply shows when Ethereum is outperforming Bitcoin, which can play out in different ways on ETH/USD.

Possible Scenarios on ETH/USD Based on ETH/BTC Rising:

Here are four scenarios that would explain why the ETH/BTC cross rate would rise.

- Scenario A: ETH/USD rises faster than Bitcoin, indicating increased volatility in ETH.

- Scenario B: ETH/USD stays flat, while Bitcoin declines, signalling higher volatility in BTC.

- Scenario C: ETH/USD drops more slowly than Bitcoin, pointing to increased volatility in BTC.

- Scenario D: ETH/USD rises while Bitcoin drops, signalling stronger volatility in ETH.

Example of Applying ETH/BTC Analysis with a Strategy

Zooming into the ETH/USD chart, we see that price found support at the 61.8% Fibonacci retracement level. Meanwhile, a trendline breakout on the ETH/BTC chart indicates Scenario D, where Bitcoin is declining while Ethereum forms a green candle.

This decorrelation signals a moment of increased volatility, allowing traders to enter a long position on ETH/USD. By placing a stop loss just below the green breakout candle, the trade hit the take profit target with a favourable 1:2 risk-to-reward ratio.

You can leverage the ETH/BTC pair alongside a valid trade setup on ETH/USD to uncover unique opportunities that others might overlook or be hesitant to take.

| Here’s how it works for bullish scenarios: 1. Identify a bullish breakout on ETH/BTC. 2. Confirm a bullish setup on ETH/USD. 3. Place a stop loss below the previous pivot low. 4. Set your take profit at 1:2 RRR, or at previous high or major resistance on ETH/USD or ETH/BTC. |

| Here’s how it works for bearish scenarios:1. Identify a bearish breakdown on ETH/BTC.2. Confirm a bearish setup on ETH/USD.3. Place a stop loss above the previous pivot high.4. Set your take profit at 1:2 RRR, or at a previous low or major support on ETH/USD or ETH/BTC. |

The key takeaway is that by using the ETH/BTC chart in combination with other strategies, you can refine your trade entries and enhance your overall trading approach.

Advantages of Ethereum CFDs

- Volatility – The high volatility of Ethereum CFDs ensures numerous trading opportunities due to frequent price fluctuations.

- Short selling – Unlike buying Ethereum on crypto exchanges, CFDs allow traders to profit from price declines.

- Leverage – Ethereum CFD traders can boost potential profits with leverage, which makes it possible to open larger positions with smaller initial investments.

- No need for digital wallets – Ethereum CFD traders avoid the complexity of setting up digital wallets and transferring Ethereum between multiple addresses.

- Regulated environment – Reputable CFD brokers like Alchemy are licensed and regulated in one or more jurisdictions, ensuring a level of oversight and protection.

- Advanced terminals – Alchemy offers advanced trading terminals like MT4. Additionally, it offers educational materials and trading tools like Trading Central.

Disadvantages of Ethereum CFDs

- Margin Risk – CFD trading comes with the risk of liquidations as positions are entered with leverage. This means risk management becomes of utmost importance when trading CFDs.

- Leverage – Ethereum CFDs are complex instruments. Using leverage comes with a high drawdown risk if not carefully implemented.

- Counterparty Risk – Although Ethereum itself is decentralised, trading Ethereum CFDs means relying on your broker to fulfil their obligations. Ensure your broker is regulated by a recognised authority to guarantee appropriate oversight.

- CFDs are illegal in some jurisdictions – A few countries, including the US, don’t allow CFD trading.

- Overnight fees – Some CFD brokers may charge fees for holding positions overnight because you are borrowing the funds to access leverage.

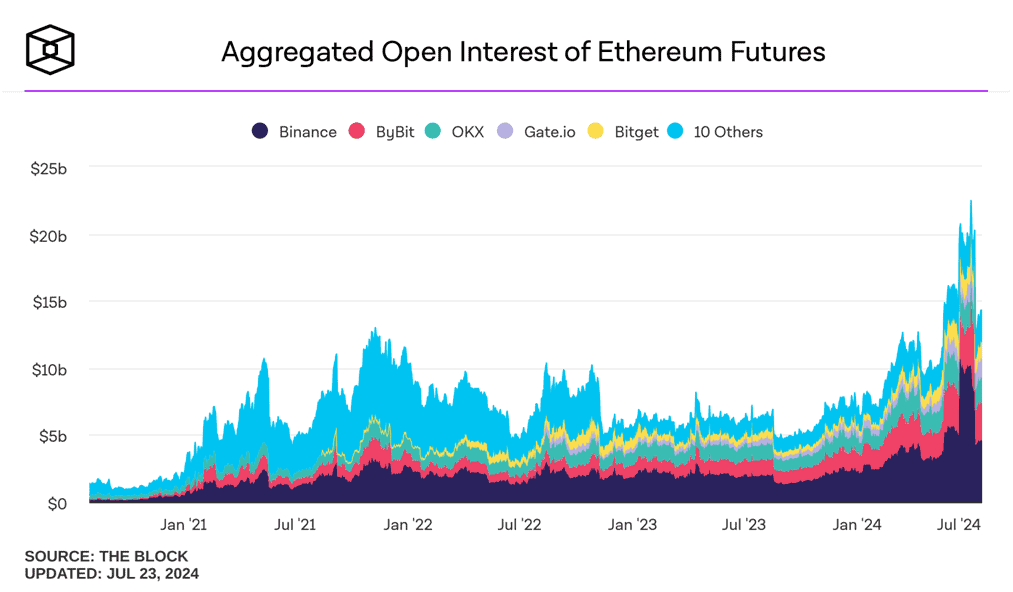

Ethereum CFD vs Ethereum Futures

Ethereum futures can be used as an alternative to CFDs, as they also enable traders to gain exposure to the cryptocurrency without holding it. However, the downside is that futures contracts have an expiry date that requires traders to settle at the predetermined price.

Ethereum futures are offered by crypto exchange platforms like Binance and OKX, as well as traditional futures trading venues like the Chicago-based CME exchange.

Futures are contracts to buy or sell the asset at a predetermined price for delivery at a specified time. Most Ethereum futures providers deliver the USD equivalent when the contract expires.

Both Ethereum CFDs and futures enable short selling.

The aggregated open interest in Ethereum futures hit a record high in July 2024 at over $22 billion.

Source: The Block

Ethereum CFD vs Ethereum ETF

Ethereum spot exchange-traded funds (ETF) are funds backed by actual ETH coins that can be traded in the form of shares listed on traditional stock exchanges, such as the New York Stock Exchange. Unlike CFDs, Ethereum spot ETF holders actually hold ETF shares.

In the US, Ethereum ETFs officially began trading on July 23, 2024, with the US Securities and Exchange Commission (SEC) finally giving its nod after years of review. The regulator approved 9 Ethereum ETFs, including the funds from BlackRock, Fidelity, Grayscale, and VanEck.

Short selling Ethereum ETFs is more complicated because they act like stocks.

Ethereum CFD vs Bitcoin CFD

There are a multitude of reasons why a trader may prefer trading the Ethereum CFD over the Bitcoin CFD, and vice versa.

The first and foremost reason would be Ethereum’s higher volatility compared to Bitcoin, due to its smaller market cap. However, it’s worth noting that Ethereum and Bitcoin both have their “seasons”, whereby one coin outshines the other in terms of bullish performance.

Crypto traders often monitor the Altcoin Season Index and the ETH/BTC chart to identify moments of increased volatility in either asset. By doing so, they can capitalise on the shifting dynamics between Ethereum and Bitcoin, making it an attractive strategy to trade both assets simultaneously.

| Quick tip: Since its creation in 2016, Ethereum has been in a monthly symmetrical triangle pattern against the Bitcoin price, which could offer range trading and breakout trade opportunities. |

Furthermore, Ethereum’s status as a Layer-1 blockchain with smart contract capabilities makes it a cornerstone of decentralised finance (DeFi) and the broader blockchain ecosystem. This fundamental strength drives both speculative and long-term interest, especially because Ethereum offers more functions as a widely adopted cryptocurrency – as opposed to Bitcoin, which is a store of value.

While Bitcoin remains a more stable and established asset, Ethereum CFDs offer traders a way to leverage the volatility and innovation within the broader cryptocurrency market. Whether it’s during altcoin season, significant technological advancements, or the booming NFT market, Ethereum CFDs can provide dynamic trading opportunities that complement Bitcoin CFDs.

Ethereum CFD vs Ethereum Classic CFD

Ethereum Classic (ETC) was created in July 2016 after a split in the Ethereum community. This split happened because of a disagreement over how to handle a major hack of Ethereum that resulted in the loss of a lot of funds. The original creators of Ethereum, including Vitalik Buterin, decided to create a new version of Ethereum that would undo the effects of the hack and return the stolen funds.

Thus, the new Ethereum (ETH) was born, while the original Ethereum blockchain became Ethereum Classic (ETC), which remains tradeable to this day. Despite being the “older” version, Ethereum Classic is still actively developed and maintained by a dedicated community of developers and supporters.

From 2023 to 2024, Ethereum Classic (ETC) has shown a pattern of slower price acceleration and quicker depreciation compared to Ethereum (ETH). This trend makes ETC a more suitable asset for short swing trades, as its volatility and faster downward movements can present smoother downtrends.

In contrast, Ethereum’s relatively steadier performance makes it a better asset to perform long trades on, as the downside volatility appears to be less on ETH than on ETC.

Ethereum CFD vs Solana CFD

Solana has emerged as a rapidly growing competitor to Ethereum. As a Layer-1 blockchain, Solana offers an alternative network for users to create dApps (Decentralised apps), Non-Fungible Tokens (NFTs), and cryptocurrencies on.

As of 2024, Solana has shown bigger price swings and sharper movements compared to Ethereum. Its lower market cap makes it potentially more profitable but also riskier. For these reasons, some traders prefer trading Solana CFDs rather than holding the coins directly.

Both Solana and Ethereum are actively developed, with Ethereum already having a spot ETF approval and Solana rumoured to be next. The combination of potential network upgrades, as well as financial institution involvement makes news-driven trades possible on Solana and/or Ethereum.

Ethereum CFD vs Cardano CFD

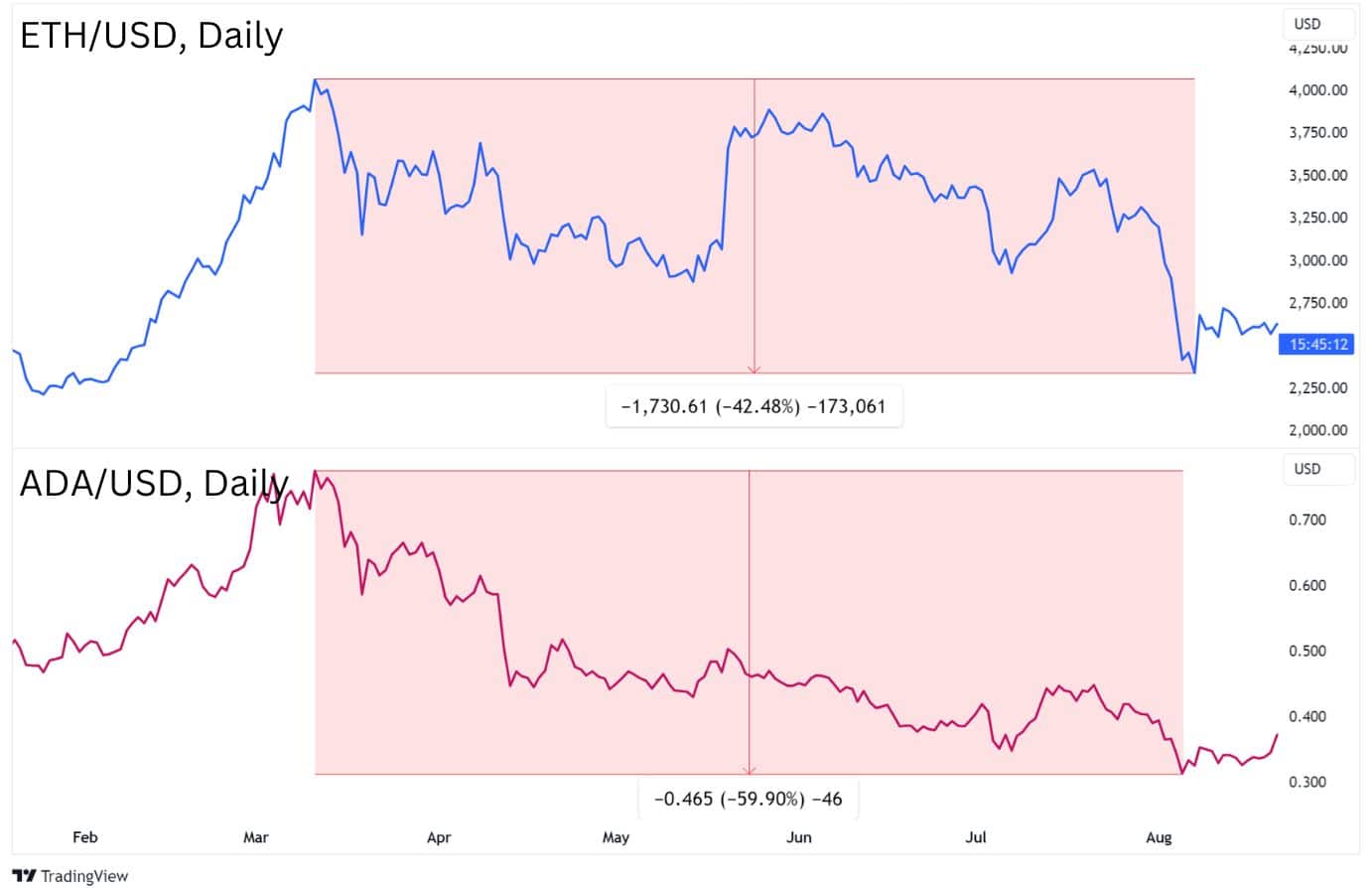

Cardano has positioned itself as a significant competitor to Ethereum and Solana, offering a Layer-1 blockchain that emphasises a research-driven approach for building dApps (decentralised apps), smart contracts, and cryptocurrencies.

Ethereum is far more stable by comparison, especially as of 2024. The chart below shows a comparison of their price fluctuations during the year, showing that ADA has fallen significantly without many pullbacks. While this may offer less swing trading opportunities on ADA compared to Ethereum, it also makes scalping Cardano less risky, as there are little sudden spikes in price movement.

Both Cardano and Ethereum are under active development, with Ethereum already having secured a spot ETF approval. Cardano, while not yet at that stage, continues to grow its ecosystem with a focus on sustainability and scalability.

The prospect of upcoming network advancements and increasing attention from institutional investors makes news-driven trading on Cardano and Ethereum an appealing opportunity.

FAQ

What are the best times to trade Ethereum CFDs?

Ethereum CFDs can be traded 24/7, but it’s recommended to trade during weekdays due to increased liquidity and more stable prices. The ideal chart timeframes for trading Ethereum CFDs vary based on the trader’s strategy. Scalpers might prefer 1-minute and 5-minute charts, while swing traders might use 30-minute, 1-hour, and daily charts.

How much capital do you need to trade Ethereum CFDs?

CFD brokers usually have minimum deposit requirements for trading Ethereum CFDs. At Alchemy Market, the minimum account deposit is $100. It’s recommended to start with an amount that matches your financial goals and risk tolerance.

What is the size of an Ethereum CFD Contract?

The size of an Ethereum CFD contract can vary depending on the broker, but it usually represents 1 ETH.

What are the fees in Ethereum CFD Trading?

CFD brokers incur commissions in the form of the spread, which can range between $3 and $5. This suggests that the size of the spread is about 0.01%.

Are Ethereum CFDs safe?

Investing in Ethereum CFDs carries significant risk due to Ethereum’s high volatility. Moreover, using leverage can further amplify this risk. While Ethereum CFDs can offer significant profits, they can also result in losses exceeding your initial investment. Make sure to trade with a reputable and licensed broker.

Is Ethereum a CFD?

Ethereum is a cryptocurrency that supports its own blockchain. However, traders can speculate on the price movements of Ethereum (Ether) by trading the cryptocurrency directly, via an ETF, options, or through a CFD.