- Elliott Wave

- February 12, 2025

- 2 min read

DAX Elliott Wave: Bulls on a Mission

Executive Summary

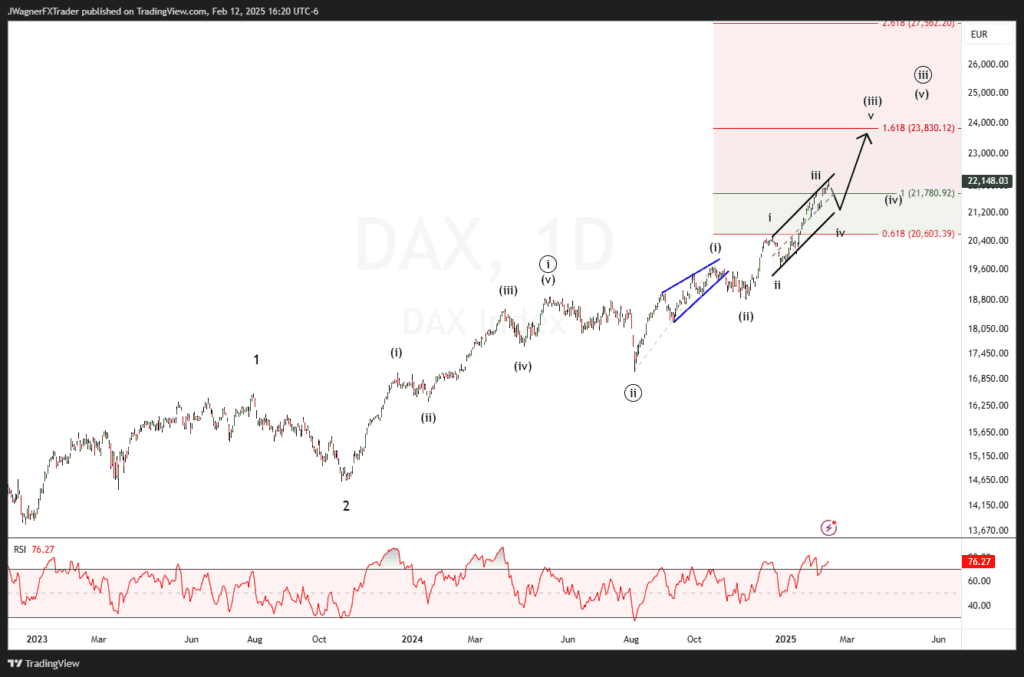

- Bullish Continuation: The DAX is in an impulsive wave (iii) projecting higher towards 23,830.

- Key Support Levels: The bullish trend remains in place so long as prices remain above wave i high of 20,522.

- Near-Term Outlook: A minor correction (wave iv) may cause prices to dip but leads to wave v to new highs.

Current Elliott Wave Analysis

The DAX continues its impressive rally outperforming the US equities markets since Trump was elected back in November. The current Elliott wave analysis shows DAX is in the later stages of wave (iii) of ((iii)). After a small dip in wave iv, wave v of (iii) could rally to 23,830.

23,830 is important as that yields a wave relationship where wave (iii) is the Fibonacci extension of 1.618 times the length of wave (i).

In the meantime, a minor dip in wave iv of (iii) may offer an opportunity to reset for another rally. The bullish forecast remains viable so long as prices don’t press below the wave i of (iii) high of 20,522.

Bottom Line

The DAX uptrend remains intact, with Elliott Wave structure points towards further upside. Traders should watch for a minor wave iv correction before wave v of (iii) possible extends towards 23,830. The bullish bias remains valid as long as the index holds above 20,522.

You Might Be Interested In: