- Chart of the Day

- January 13, 2025

- 2 min read

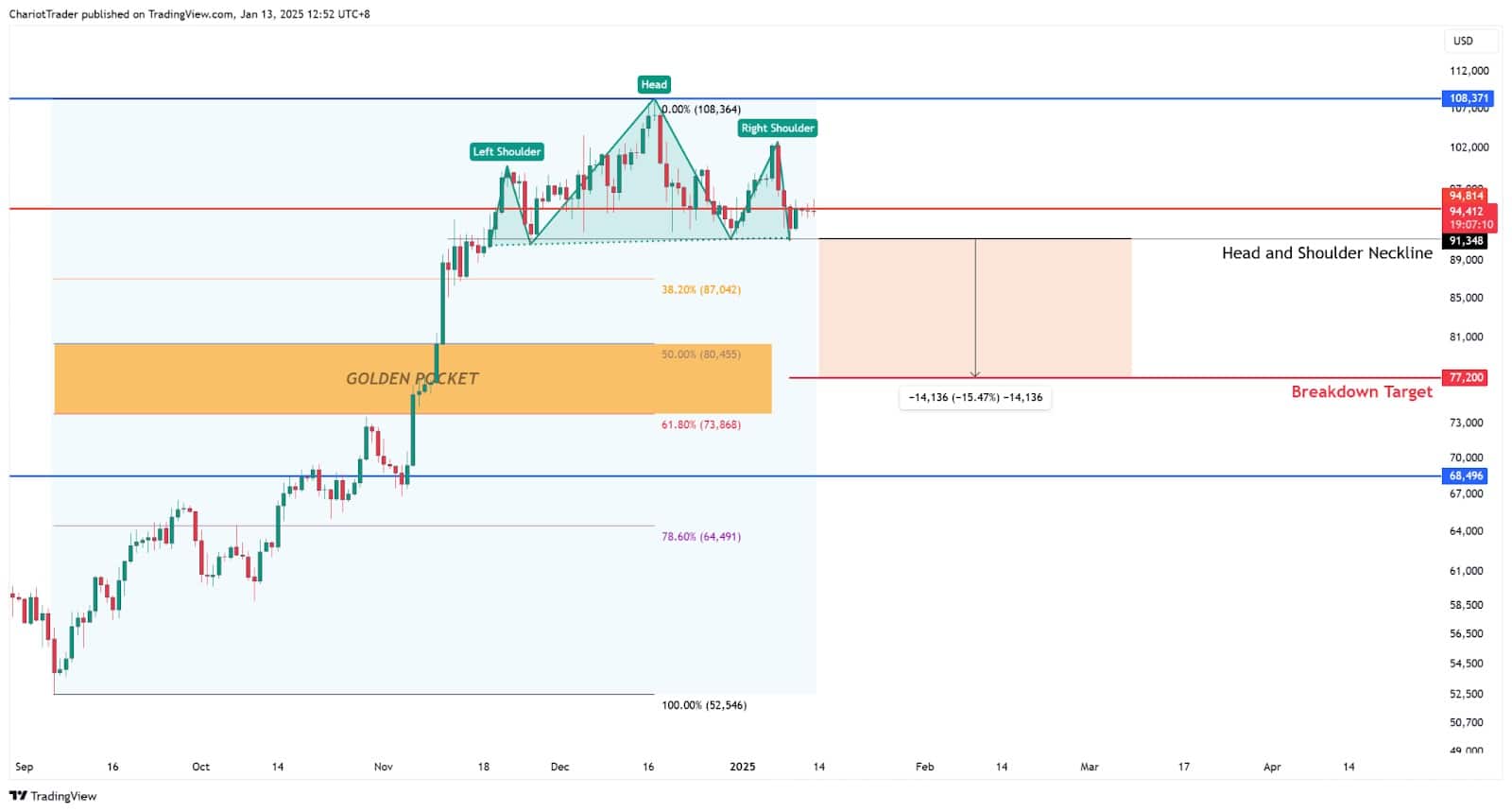

Warning on Bitcoin: $77,000 in Sight with Head and Shoulders

Bitcoin is currently forming a daily head-and-shoulders pattern with a neckline at approximately $91,348 — which if broken, could bring prices to around $77,000. Additionally, BTC/USD is currently struggling with a point of control level at $94,814 — the price level with the highest traded volume since Bitcoin’s impulsive rise in September 2024.

Scenarios & Key Levels to Watch

In the short term, there are two scenarios to consider on Bitcoin – a bullish and bearish case.

| Bullish Scenario: Bitcoin closes daily above the Point of Control at $94,814. and the 38.20% Fibonacci Retracement at 95,556. In this scenario, a possible uptrend may occur up to the 50% and 61.80% retracement zones, from $96,932 to $98,307. If a short squeeze ensures, we may even see $100,266 or higher. |

| Bearish Case: Bitcoin closes daily below the Point of Control and 38.2 Fib. In this scenario, the probability for a continued downtrend is greatly increased, at least towards the head and shoulders measured move target $77000. Additionally the Golden Pickot – though huge in its range, is between $73,868 and $80,4K – aligning with the measured move target. |

Keep in mind that the FOMC is happening this month, which could drastically impact the price of Bitcoin. The Fed Fund Decision, and the FOMC Meeting will take place on January 29th.

You may also be interested in:

DISCLAIMER: For educational purposes only. Trading comes with substantial risk, leading to possible loss of your capital.

Traders are advised to do their own due diligence before investing.