- Quarterly Forecast

- December 29, 2024

- 5 min read

A Balanced Q1 2025 Equity Market Outlook

As 2025 approaches, global equity markets are poised to navigate a landscape shaped by both promising fundamentals and emerging technical patterns. The U.S. stock market has enjoyed a remarkable two-year run, buoyed by robust economic indicators, corporate innovation, and policy shifts. However, with Q1 2025 on the horizon, a convergence of technical corrections and macroeconomic dynamics signals a pivotal phase for investors. From the S&P 500’s anticipated wave 2 retracement to the DAX’s test of upper channel resistance, a nuanced interplay of fundamentals and technicals will define the upcoming quarter.

In this report, we delve into key indices, integrating technical patterns with fundamental outlooks to provide a comprehensive perspective. While the U.S. indices like the S&P 500, Nasdaq 100, and Dow Jones Industrial Average reflect potential for bullish continuity amid corrective phases, European benchmarks such as the FTSE 100 and DAX grapple with unique regional factors that could shape their trajectories.

United States Markets: A Blend of Technical Corrections and Strong Fundamentals

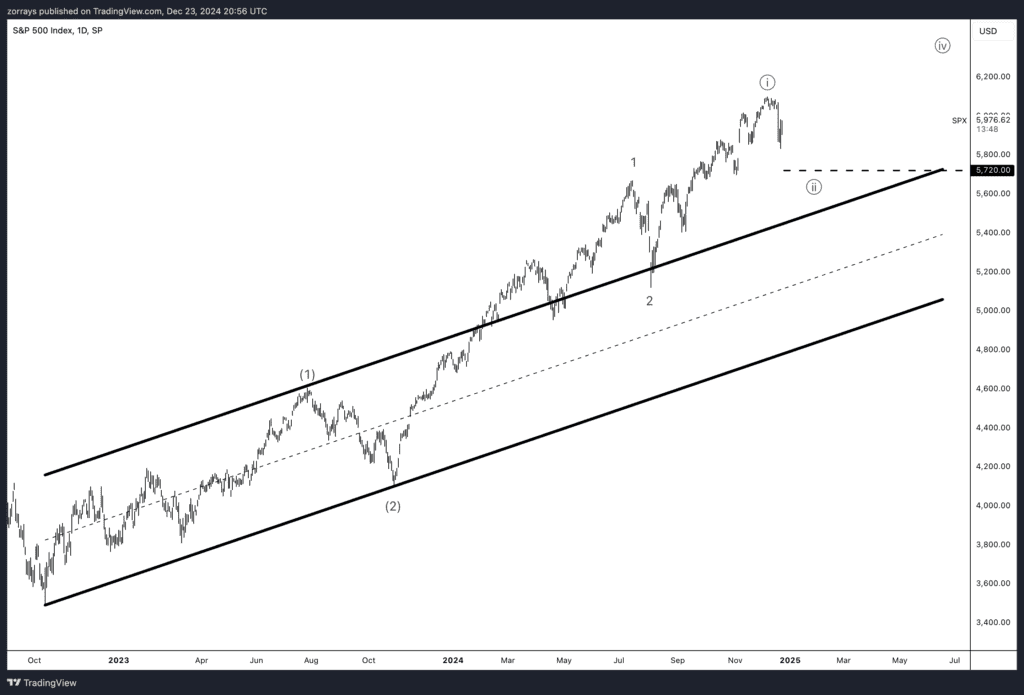

S&P 500 (SPX): Poised for a Healthy Wave 2 Correction

The S&P 500, having closed 2024 with one of its strongest performances in recent years, is positioned for a technical correction into Q1 2025. Elliott Wave analysis suggests a wave 2 retracement, targeting a key support level around 5,720. Despite this anticipated pullback, the broader fundamental landscape remains supportive:

- Macro Backdrop: A decisive U.S. election result and a “no-surprise” Federal Reserve rate cut have bolstered investor confidence. Additionally, potential tax cuts and deregulation in key industries could provide tailwinds into the new year.

- Market Breadth: The rotation from tech-heavy leadership to broader market participation in late 2024 highlights improving fundamentals across a wider array of sectors, enhancing the index’s resilience.

- Earnings Outlook: With a narrowing valuation gap between growth and value stocks, the S&P 500’s composition offers attractive opportunities for stock pickers, particularly in value-oriented sectors.

While the wave 2 correction may temper gains in the near term, the index’s technical structure remains bullish, with potential for a strong rebound later in 2025.

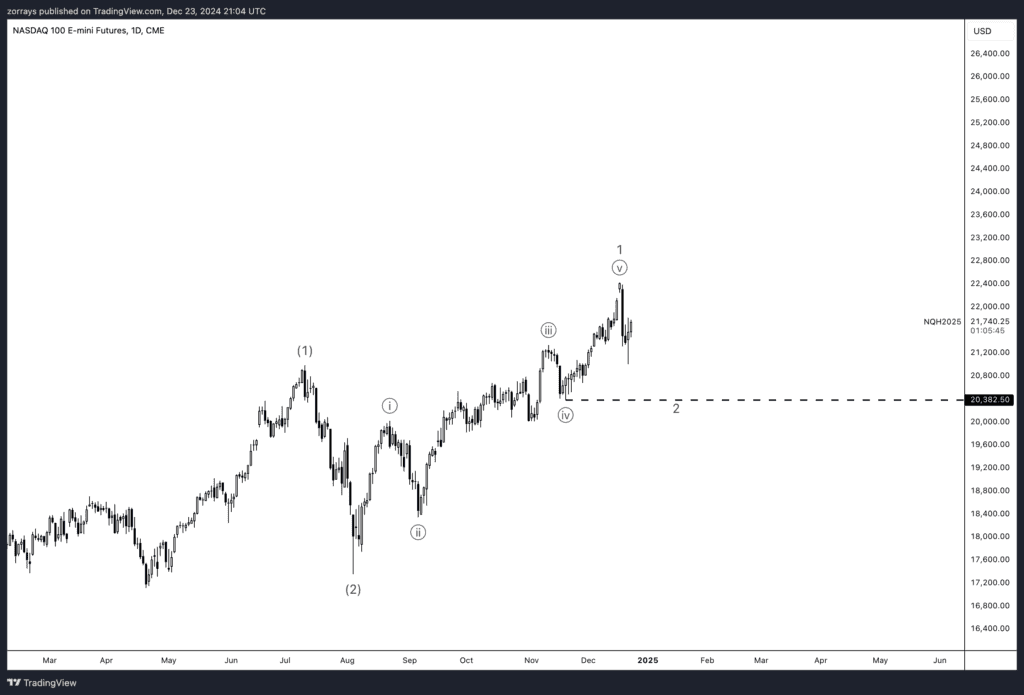

Nasdaq 100 (NQ): Awaiting a Reaction at Key Support

The Nasdaq 100 shares a similar technical outlook to the S&P 500, with a wave 2 correction likely to test support around 20,380. This aligns with a broader reassessment of growth prospects:

- AI and Tech Innovation: Continued advancements in artificial intelligence and related technologies underpin the index’s long-term growth potential. However, high valuations and rising competition may introduce short-term volatility.

- Economic Fundamentals: The U.S. economy’s resilience—characterised by low unemployment and strong consumer spending—provides a favorable backdrop for the tech-heavy index to stabilise and recover from corrective phases.

Investors should watch for a reaction at the 20,380 level, as it could mark the start of the next bullish leg, contingent on renewed optimism around technology sector earnings growth.

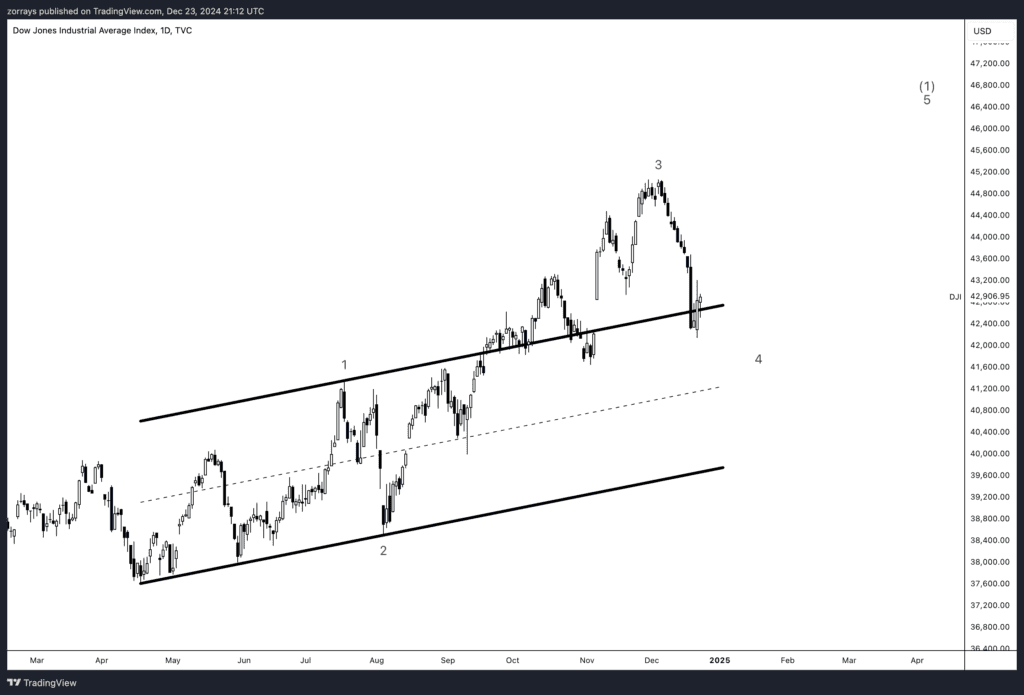

Dow Jones Industrial Average (DJI): Sideways Consolidation or Further Impulse?

The Dow Jones Industrial Average exhibits a more complex technical setup, with potential for either a wave 4 correction or a 1-2-1-2 structure that could lead to sideways movement or further bullish impulsion.

- Corporate Realignments: A surge in management changes and M&A activity among Dow constituents reflects a dynamic corporate landscape. These shifts, combined with supportive policies, could drive long-term growth.

- Sector Resilience: Industrial and financial sectors, key components of the Dow, stand to benefit from deregulation and infrastructure investments, providing a cushion against near-term corrections.

While the Dow’s path may be less linear than its counterparts, its technical and fundamental backdrop supports a cautiously optimistic outlook for Q1 2025.

European Markets: Regional Dynamics Meet Technical Patterns

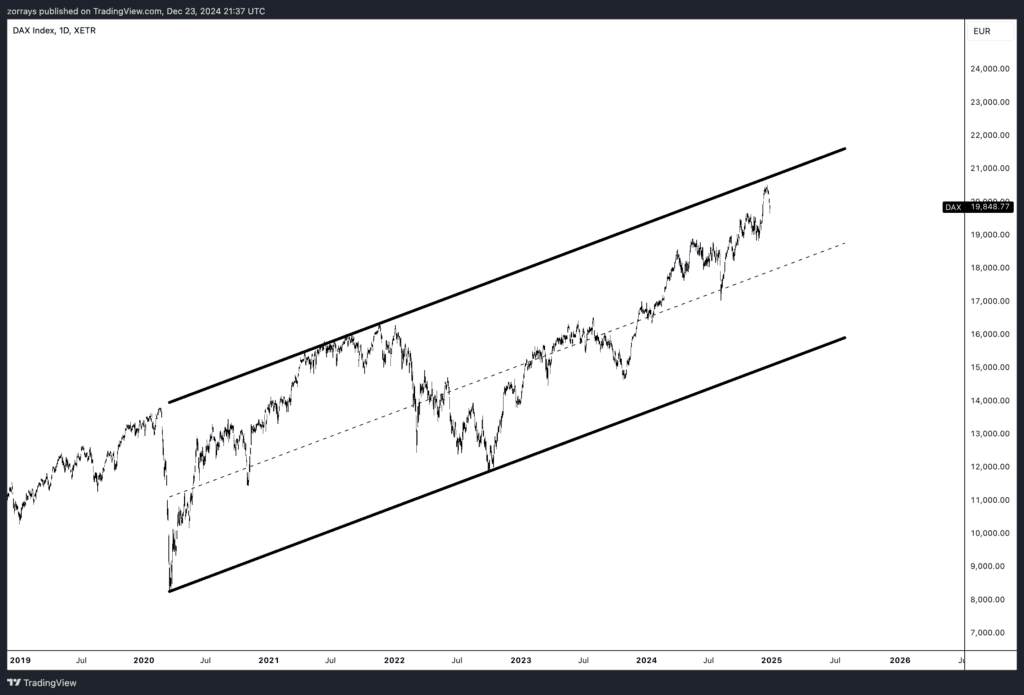

DAX (Germany): Testing Upper Channel Resistance

The DAX has been climbing within a well-defined ascending channel but now faces resistance at its upper boundary. This technical barrier coincides with a shifting macroeconomic environment:

- Economic Outlook: Germany’s manufacturing sector is showing signs of stabilisation, aided by government support for green energy initiatives and supply chain restructuring. However, slowing global demand poses a risk.

- Technical Implications: The upper channel resistance may prompt a short-term pullback, but the DAX’s overall trend remains bullish. A breakout could signal renewed momentum, while a rejection may lead to consolidation within the channel.

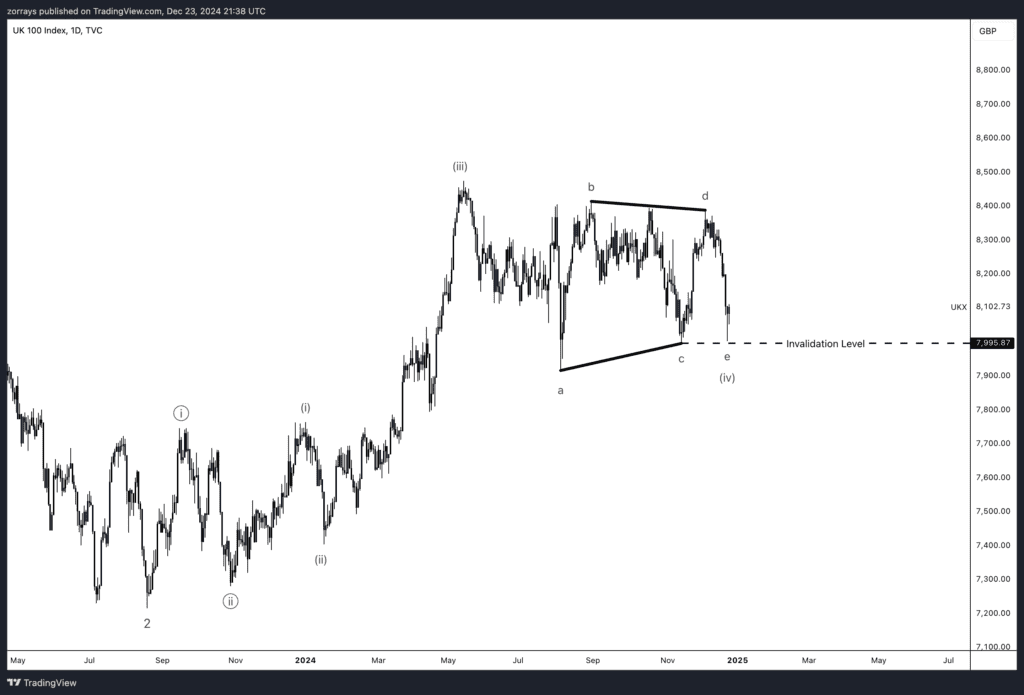

FTSE 100 (UKX): Triangular Resolution Amid Dovish Policy

The FTSE 100’s price action is consolidating within a symmetrical triangle, with completion expected soon. This aligns with the Bank of England’s dovish stance, which is likely to shape the index’s trajectory:

- Monetary Policy: The BoE’s cautious approach to rate hikes contrasts with global tightening trends, supporting economic growth and, by extension, equity performance.

- GDP Growth: Improved GDP projections for the UK, driven by resilient consumer spending and easing inflation pressures, provide a positive backdrop for the FTSE’s breakout potential.

A resolution of the triangle pattern, whether to the upside or downside, will depend on the interplay of these fundamental and technical factors.

Conclusion: A Pivotal Quarter Ahead

As Q1 2025 unfolds, equity markets face a delicate balancing act between technical corrections and favorable fundamentals. The U.S. indices, while poised for retracements, are underpinned by a resilient economy and sectoral dynamism. Meanwhile, European benchmarks navigate regional challenges and opportunities, with technical levels providing crucial decision points. Investors should remain vigilant, leveraging both technical insights and macroeconomic analysis to navigate the quarter’s complexities effectively.