- Chart of the Day

- November 25, 2024

- 3 min read

EUR/JPY in the Spotlight: Is a Slide to 151 on the Cards?

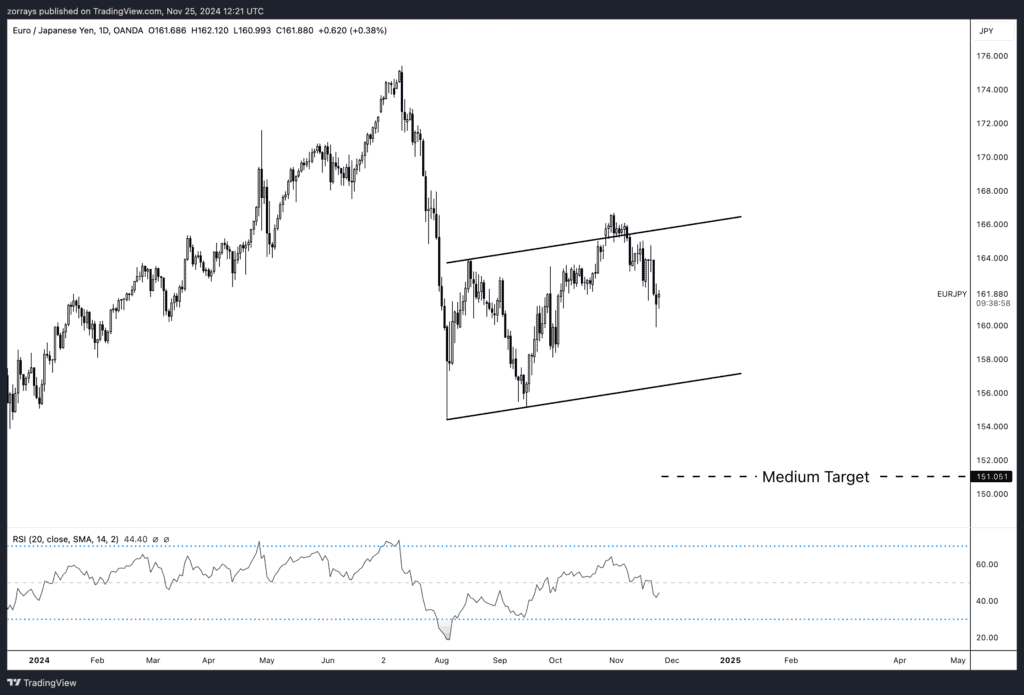

The EUR/JPY pair continues to show weakness, reflecting a supportive shift in Japan’s fiscal and monetary policy mix. This chart illustrates the technical and macroeconomic landscape driving this move, highlighting potential targets for traders monitoring the pair.

Policy Developments Supporting Yen Strength

Recent political and economic developments in Japan are starting to weigh heavily on the EUR/JPY. The inclusion of the Democratic Party for the People (DPP) in Japan’s governing coalition has brought new fiscal policies to the table. The DPP’s demands for higher income tax thresholds, combined with other measures, have culminated in a $250 billion fiscal stimulus package.

This stimulus aligns with expectations that the Bank of Japan (BoJ) will hike rates in December, with the market pricing in nearly 15 basis points (bp) of a 25bp hike. The balance of a looser fiscal stance and a tighter monetary policy typically strengthens a currency, a dynamic likely to favor the Japanese yen.

Meanwhile, Europe offers no comparable fiscal measures. Germany, the largest economy in the eurozone, has no stimulus on the horizon, especially with federal elections not due until late February. This divergence between Japan’s proactive fiscal policies and Europe’s lack of fiscal support adds further downward pressure on EUR/JPY.

Technical Outlook: EUR/JPY Testing Key Levels

The attached daily EUR/JPY chart provides a clear picture of the ongoing bearish trend. Here’s a breakdown of the technical structure:

- Ascending Channel Breakdown

The pair has been trading within a rising channel since late August, but recent price action shows a clear rejection at the upper boundary, followed by a sharp descent. This indicates a weakening bullish momentum. - Support and Resistance Zones

- Resistance: 166.00 – The upper trendline has capped gains and now serves as a strong resistance level.

- Support: 156.00 – The lower channel boundary aligns with a critical support zone.

- Medium-Term Target

The chart highlights a medium target at 151.05, reflecting bearish sentiment and the potential for further downside. This level aligns with key historical support levels from earlier in 2024, reinforcing its importance as a potential stopping point for this move. - Indicators

- Momentum indicators (e.g., RSI) are pointing downward but not yet oversold, suggesting room for additional declines.

Key Takeaways for Traders

- Bearish Fundamentals: The divergence between Japan’s fiscal-monetary policy mix and Europe’s more muted approach is tilting the scales in favor of yen strength.

- Bearish Technicals: The EUR/JPY pair is firmly in a descending trajectory, with a break below 156 potentially opening the door to 151.05.

- Upcoming Catalysts:

- Bank of Japan’s December meeting, where a 25bp rate hike is anticipated.

- Ongoing developments in Japan’s fiscal policy and Germany’s lack of a fiscal package.

Trading Strategy

For traders looking to capitalize on the EUR/JPY’s bearish momentum:

- Short Positions:

- Entry: Near 164.00 resistance (if retested).

- Stop Loss: Above 166.00.

- Target 1: 156.00.

- Target 2: 151.05 (medium-term target).

- Alternative Setup: Wait for a decisive breakdown below 156.00 to confirm further downside, with 151.05 as the next target.

This chart perfectly encapsulates the convergence of macroeconomic and technical factors driving EUR/JPY. Traders should remain vigilant as we approach the BoJ’s pivotal December meeting and keep an eye on whether Germany’s fiscal stance shifts heading into February elections.