- Chart of the Day

- November 1, 2024

- 1 min read

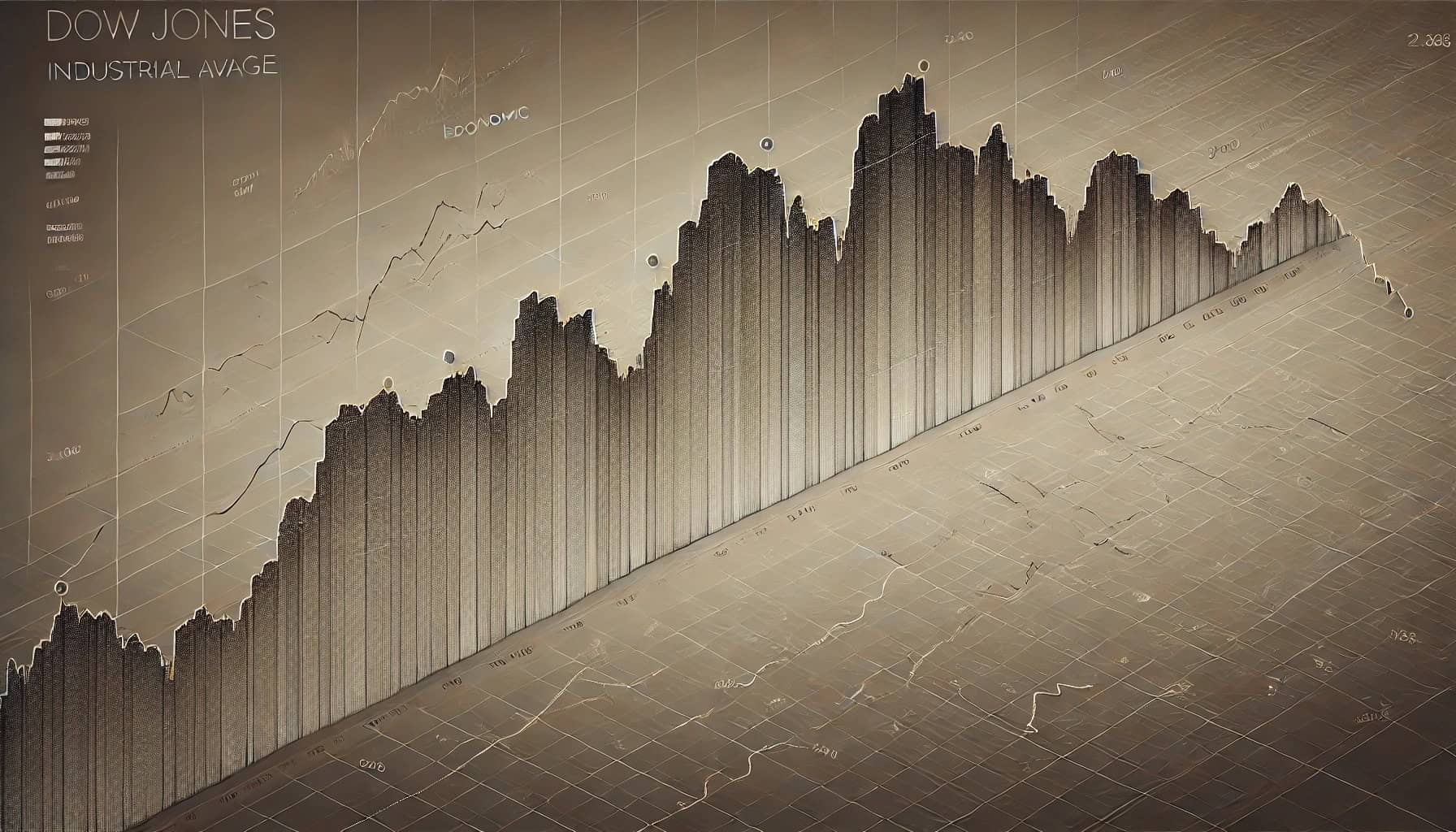

DJ30 First Red Monthly Close in 6 Months

With election day drawing close, we finally saw a red month in the Dow Jones Industrial Average for the first time in 6 months.

From the October opening price, the index pushed up by an impressive 1,065.35 pips (2.51%), reaching new highs at $48,387.35. However, following a harsh rejection, the Dow Jones fell by 1,647.85 pips (3.80%), closing at $41,739.50.

With this monthly close, we now have a bearishness injected into the index with a bearish Shooting Star candlestick pattern. Though a bearish reversal is not confirmed, it is now a possibility worth considering.

The weekly EMA 100, visualised as a blue line, on the DJ30 is a somewhat respected exponential moving average, which could potentially provide support for the asset.

However, it currently sits at approximately 4,500 pips (10%) away, and is not worth considering as a support until the April High and September Low level at approximately $40,056.35 breaks.

As we move into the US Election Day on November 5th, 2024, the DJ30 may see some extreme volatility during this week.

Traders are advised to tread cautiously.

You may also be interested in: