Opening bell

- October 30, 2024

- 6min read

Q3 2024 Earnings Insights for AMD, Alphabet, Microsoft, and Meta

As we approach another highly anticipated earnings report cycle, market participants are closely watching key players in the tech industry. This morning, AMD and Alphabet (Google’s parent company) already reported their Q3 2024 earnings, with substantial results that have stirred market interest. Microsoft and Meta are set to release their reports after the market closes, providing critical insights into their performance, especially in light of recent market volatility and sector-specific developments.

Below, we delve into the Q3 2024 performance and future expectations for AMD and Google, followed by a preview of what to watch in Microsoft’s and Meta’s upcoming reports.

Yesterday’s Earnings

Alphabet Inc. (GOOGL)

Q3 2024 Earnings Summary

Source: Stock Analysis

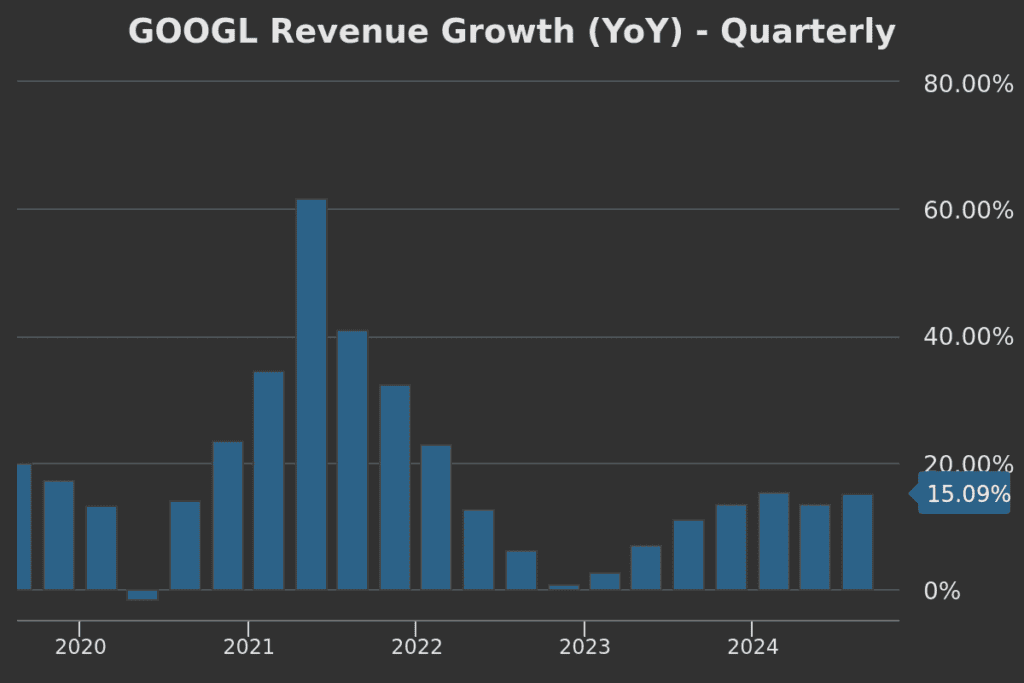

Alphabet reported strong Q3 2024 results, with revenue climbing 15% year-over-year (16% in constant currency) to $88.3 billion. Google Services saw steady growth, with a 13% increase driven by Google Search, YouTube ads, and other subscription-based platforms. Additionally, Google Cloud reported an impressive 35% revenue surge, underpinned by accelerated growth in AI infrastructure and generative AI solutions.

Forward Guidance and Outlook Looking ahead, Alphabet has positioned itself to benefit from continuous AI-driven innovation across its core business sectors. CEO Sundar Pichai highlighted the expanding application of AI in Google’s product ecosystem, particularly in search capabilities and cloud services. Investors should watch for further AI-related developments as Alphabet scales its generative AI solutions to capture more market share in the cloud space.

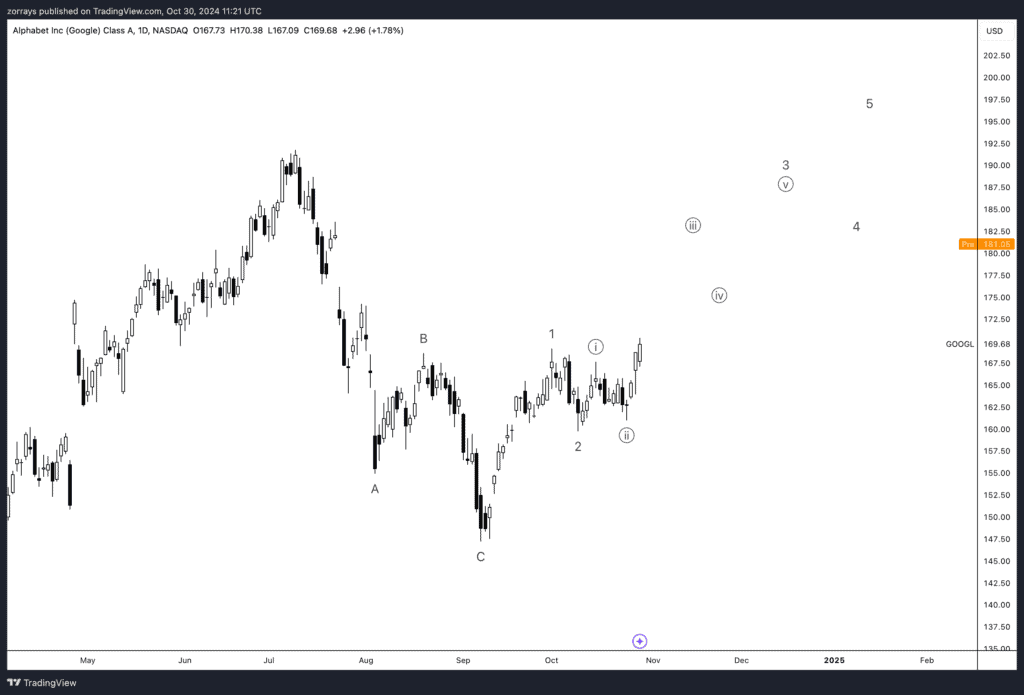

Technical Analysis

Alphabet’s stock appears to be in a robust upward move, labeled as wave 3 of a broader Elliott Wave structure. With a sharp 7% pre-market gap up, Alphabet is positioned for potential continuation within this wave, which is commonly one of the strongest in terms of price momentum. Market participants should watch for potential resistance around the 3rd and 5th wave target levels shown in the chart.

Advanced Micro Devices Inc. (AMD)

Q3 2024 Earnings Summary

Source: Stock Analysis

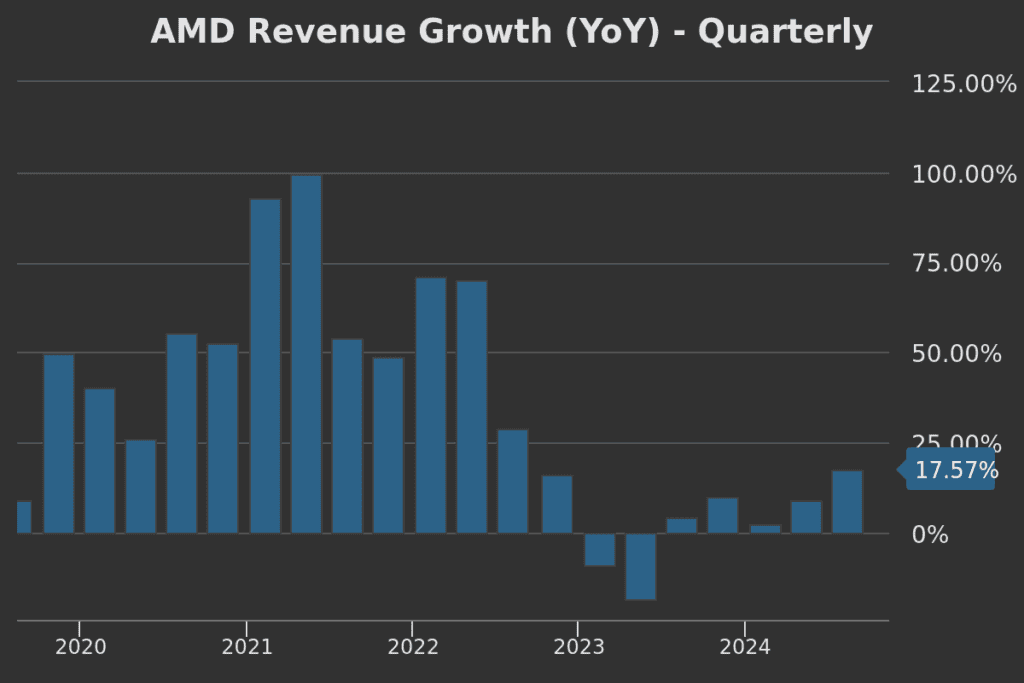

AMD posted Q3 revenue of $6.8 billion, marking an 18% year-over-year increase, driven by high demand for EPYC and Instinct data center products and strong Ryzen processor sales. The Data Center segment achieved record revenue of $3.5 billion, up 122% year-over-year, highlighting the sector’s robust demand for high-performance computing solutions. AMD projects Q4 revenue of approximately $7.5 billion, reflecting a potential 22% year-over-year growth.

Forward Guidance and Outlook For Q4, AMD’s forecasted revenue growth is anchored in continued demand across the data center and client segments. With ongoing product releases and partnerships, including AI advancements and the expansion of its embedded and networking solutions, AMD is set to capture additional market share in the high-performance computing space.

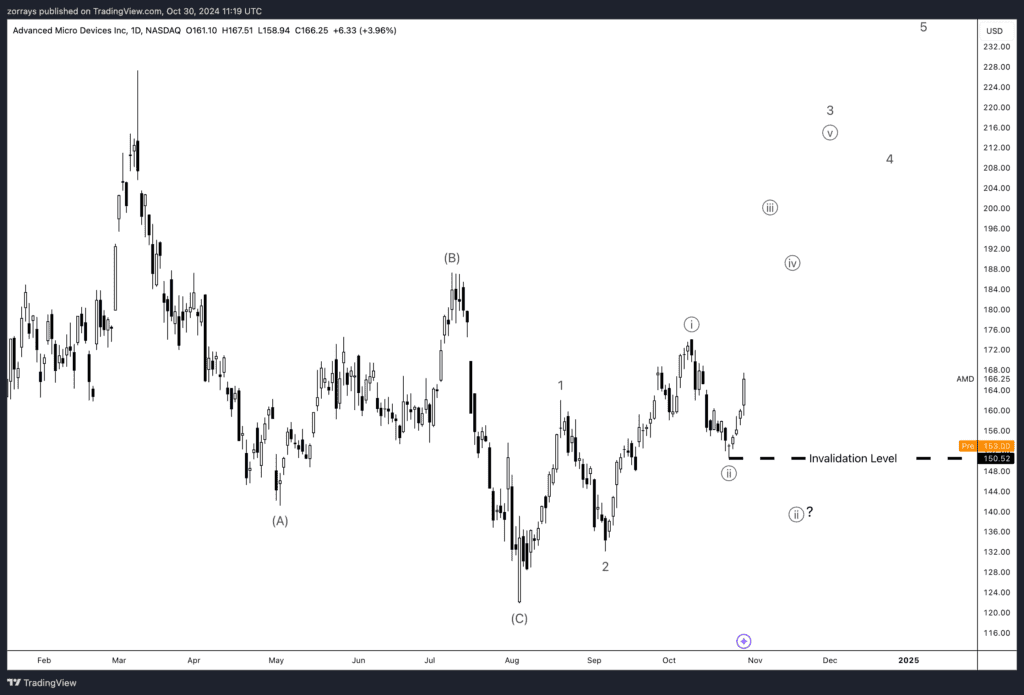

Technical Analysis

AMD opened with a gap down, showing hesitation as it hovers near the critical invalidation level. This could signal a potential deeper correction if prices breach this level, casting doubt on the viability of the current wave ((ii)) scenario. Investors should be cautious and monitor this level, as breaking below it might indicate the stock is headed for a more pronounced pullback, potentially due to concerns around valuation.

Today’s Earnings

Microsoft Corp. (MSFT)

Q2 2024 Recap and Q3 2024 Preview

Source: Stock Analysis

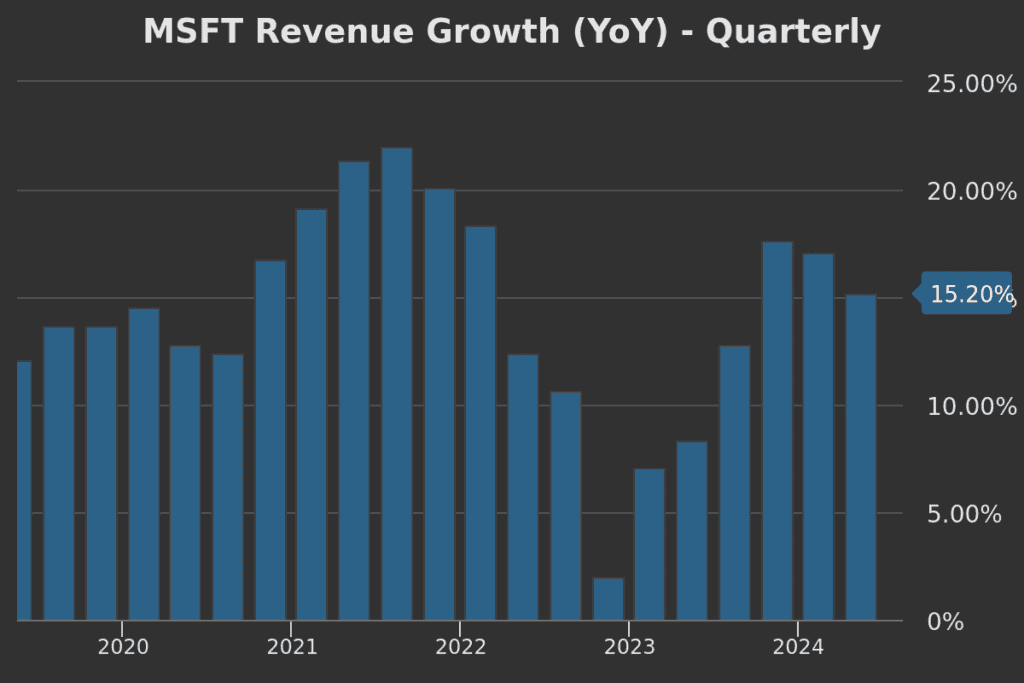

Microsoft’s Q2 2024 report showcased a solid 18% revenue increase in its Intelligent Cloud division, led by Azure’s 26% growth in constant currency. Overall revenue rose to $61.9 billion, a reflection of strong performance across its cloud services and productivity software suites.

What to Watch in Q3 2024 Investors should focus on Azure’s performance as Microsoft deepens its integration of generative AI features across its software ecosystem. New product offerings such as Copilot in Microsoft 365 and other AI-driven enhancements may drive incremental revenue growth in the Productivity and Business Processes segment. Additionally, watch for updates on Microsoft’s recent acquisitions and its outlook on AI investments, which are essential components of the company’s growth strategy.

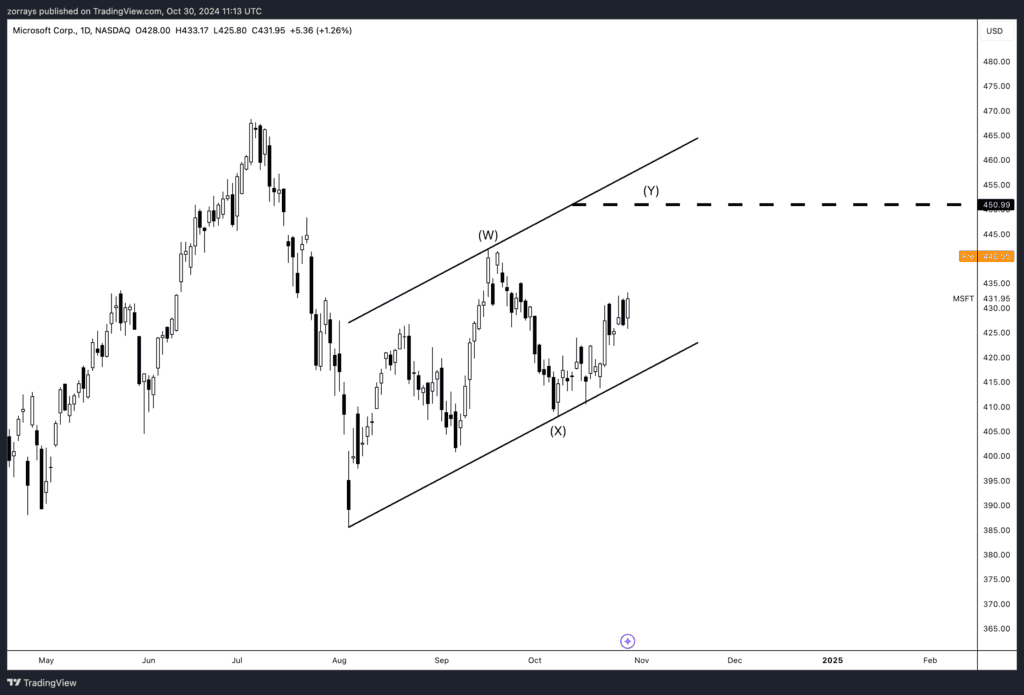

Technical Analysis

Microsoft’s chart displays two possible trajectories: a near-term bullish wave that could bring prices to the top of the channel, or a bearish count indicating a potential reversal from this resistance. A breakout from the channel top could signal the start of a new bullish cycle, but a failure to surpass this level might suggest an unfolding leading diagonal structure and subsequent decline.

Meta Platforms, Inc. (META)

Q2 2024 Recap and Q3 2024 Preview

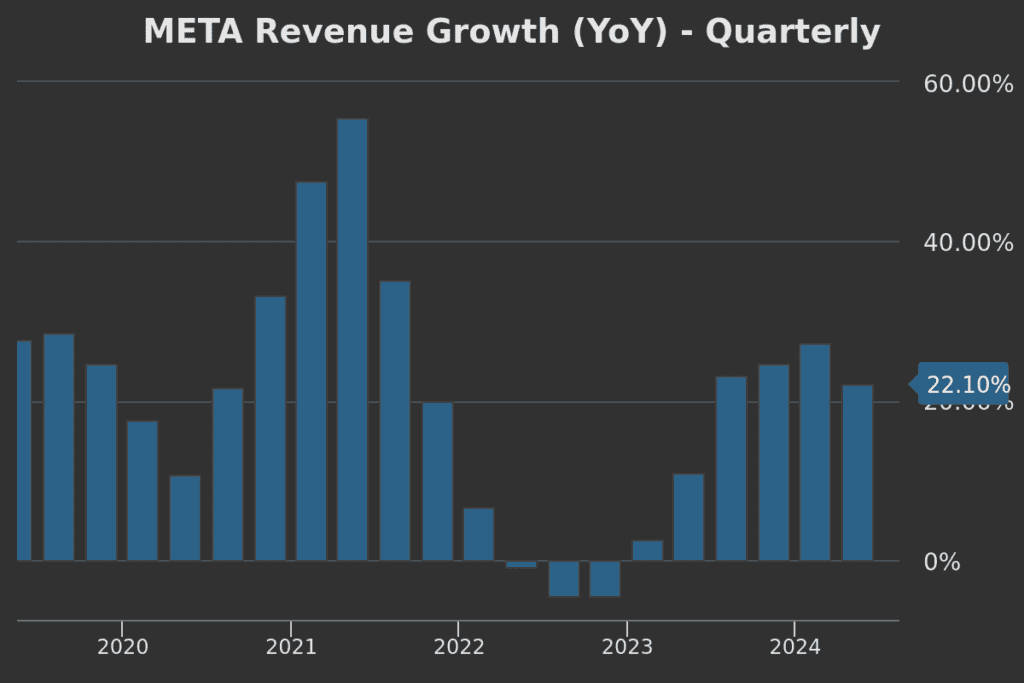

In Q2, Meta reported a 22% year-over-year increase in revenue to $39.07 billion, driven by strong ad impressions and a 10% increase in average ad prices. Meta’s ongoing investments in AI and its Reality Labs segment are integral to its long-term vision, despite regulatory challenges and cost pressures.

What to Watch in Q3 2024 Key areas to monitor include Meta’s ad revenue growth trajectory, engagement metrics across its platforms, and any updates on its ambitious AI and metaverse initiatives. The financial impact of Reality Labs will also be scrutinized, given that this segment has been a substantial expense for Meta. Further, investors will be keen on updates regarding Meta’s strategy to counteract regulatory headwinds in key markets.

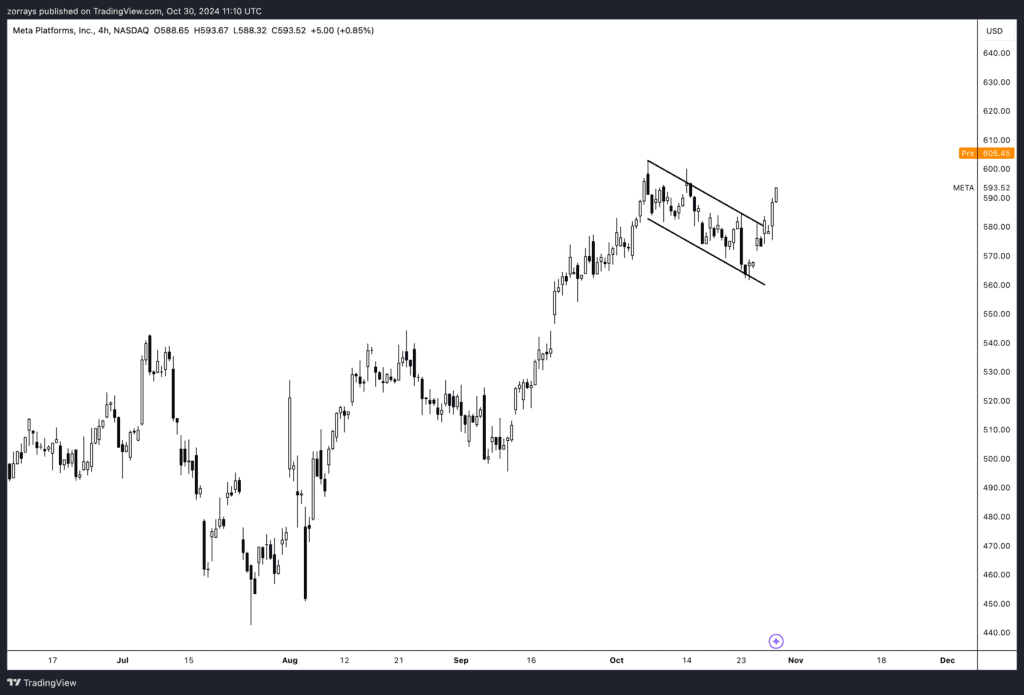

Technical Analysis

Meta’s stock has broken out of a bullish flag pattern with a gap up into what appears to be a less defined zone on the chart, often referred to as “no man’s land.” This breakout could potentially lead to continuation as the flag breakout pattern aligns with bullish momentum. However, price stability and sustained volume will be crucial for confirming the strength of this move.

Conclusion

The Q3 2024 earnings season reveals pivotal insights into the performance and strategies of major tech firms. Alphabet and AMD have already reported strong results, showcasing robust growth in cloud, AI, and data center segments. As Microsoft and Meta prepare to release their reports, investors should be attuned to developments in AI applications, regulatory impacts, and each company’s strategic initiatives to stay competitive.

Frequently Asked Questions (FAQ)

1. Why did Alphabet’s stock surge after its Q3 2024 earnings? Alphabet’s stock saw an uptick due to strong revenue growth, especially in Google Cloud and advertising segments, as well as continued innovation in AI, which has strengthened its market position.

2. What are the main growth drivers for AMD? AMD’s growth is fueled by increasing demand for its data center and client products, specifically EPYC and Instinct processors, as well as new AI collaborations across the tech industry.

3. What should investors look for in Microsoft’s Q3 earnings? Key metrics to watch in Microsoft’s earnings include Azure’s growth, AI integration in Microsoft 365, and any updates on cloud and productivity segments, which are central to Microsoft’s growth strategy.

4. How is Meta dealing with regulatory challenges? Meta faces regulatory headwinds, particularly in the EU and U.S. However, the company continues to invest in AI and its metaverse initiatives, aiming to stay competitive and mitigate these challenges through innovation and platform growth.

5. Why is AMD’s technical setup showing potential weakness? AMD’s price action indicates a possible breach of its invalidation level, which may suggest a deeper correction. This can be attributed to valuation concerns or investor caution amidst broader market volatility.

6. Is Microsoft expected to outperform this quarter? Microsoft’s performance will largely depend on Azure’s growth and the integration of AI across its offerings. With strong cloud fundamentals, Microsoft is well-positioned but will need to exceed expectations in these areas to drive a significant rally.