- Chart of the Day

- October 21, 2024

- 2 min read

China Cuts Rates: Potential Bounce on Hang Seng Index

On October 21st, the People’s Bank of China announced a 0.25% cut on their 1Y Loan Prime Rate, and a 0.05% cut on the 5Y Loan Prime Rate. These cuts in the short term interest rates are meant to bolster the Chinese economy and give businesses more funds to sustain themselves.

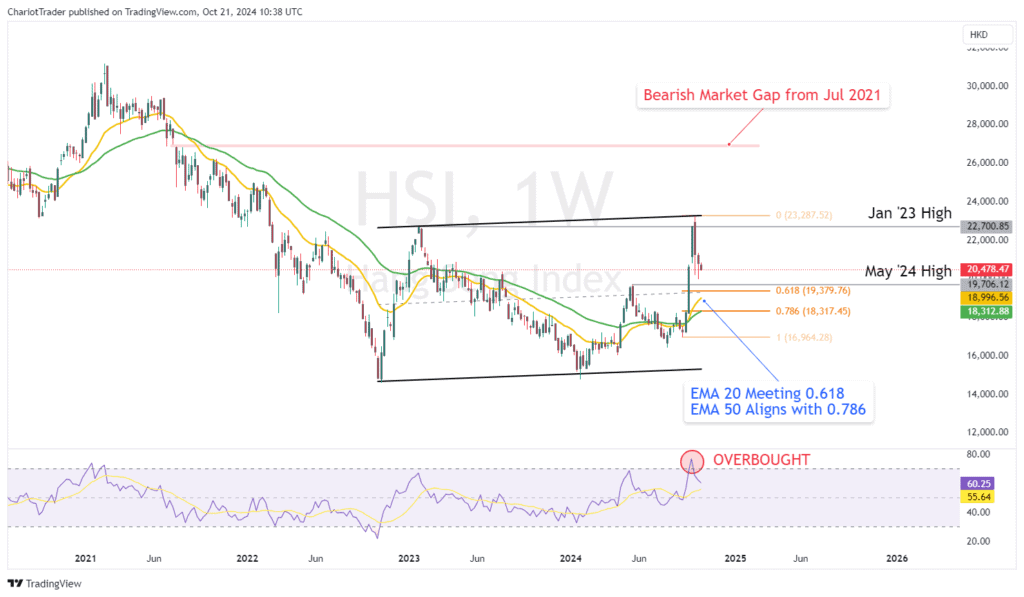

With this in mind, the Hang Seng Index is technically overbought, and could see a retracement to lower levels at approximately $19,706 HKD.

But, fundamentally, the HSI should be bullish due to these rate cuts – so, in the event that HSI will bounce; where will the targets be?

Technical Analysis on the Hang Seng Index

The HSI could potentially be in a rising parallel channel on the weekly timeframe. As the price is retracing, traders should be mindful of the pivot high formed during May 2024, and the 0.618 Fibonacci level.

Additionally, a quick glance at the weekly EMA 20 and EMA 50 tells us that a definitive EMA Cross has occurred – which hints at a bullish trend emerging. That being said, a bullish close above the January 2023 Highs at $22,700.85 HKD is absolutely required for the HSI to convincingly flip bullish.

If the price does retrace, here are the levels to view:

- May 2024 High at $19,706.12

- 0.618 Fibonacci Retracement at $19,379.76, aligns closely with Weekly EMA 20

- 0.786 Fibonacci Retracement at $18,317.45, aligns with Weekly EMA 50

- Bottom of the Parallel Channel at approximately $15,500 to $14,800 HKD

If the price of HSI does rise from here, or bounce at the aforementioned levels, we should be mindful of various resistances above:

- January 2023 High at $22,700.85 (Could create a double top)

- Top of Parallel Channel at approximately $23,500 HKD

- 0.618 Fibonacci Retracement at $24,922 HKD

- Bearish Market Gap from July 2021 from approx. $26,750 to $27,000 HKD

- 0.786 Fibonacci Retracement at $27,676 HKD

Event of Collapse – Global Implications

In the event the HSI does collapse, it could indicate that despite the rate cuts, the confidence in the Chinese economy is simply too weak.

This would send ripples throughout the global economy, affecting the S&P 500, Nasdaq, and potentially oil and metal prices – as the Chinese economy is a huge consumer of these natural resources.

You may also be interested in: