- Weekly Outlook

- August 2, 2024

- 5min read

RBA: Will They or Won’t They and SPX in Trouble

Today, the market (SPX) experienced a significant downturn with the VIX up by 50%. This volatility was driven by worse-than-expected ISM manufacturing data and disappointing employment figures, more on this below. As we look ahead to next week, two key events could further influence market dynamics: the Reserve Bank of Australia’s (RBA) interest rate decision on Tuesday and the ISM Non-Manufacturing PMI (Jul) report. Both events are pivotal for understanding economic trends in Australia and the United States. If the ISM Non-Manufacturing PMI data also comes out worse than expected, we can anticipate another volatile period in the market.

Australia: RBA Interest Rate Decision

Data Source: ABS

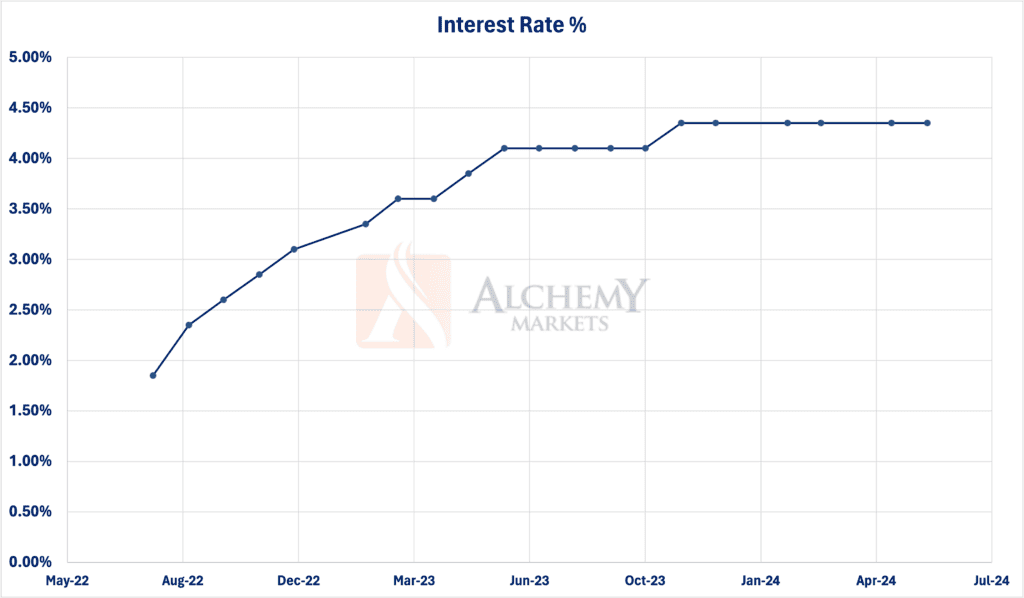

The Reserve Bank of Australia (RBA) is scheduled to announce its interest rate decision on August 6, 2024. Recent analyses suggest that the RBA is likely to hold the interest rate steady at 4.35%. The trimmed mean inflation, a preferred measure by the RBA, has shown signs of easing, dropping to 3.9% in June from 4.0% in March. Despite this, the overall inflation rate remains higher than desired, keeping the possibility of a rate change under careful consideration.

Inflation Data and Its Impact

Data Source: ABS

June’s inflation data revealed a mixed picture. The core trimmed-mean CPI rose by 0.8% quarter-on-quarter, which was lower than expected, indicating a potential slowdown in inflationary pressures. However, the headline inflation remained high at 3.8% year-on-year for the second quarter. These figures suggest that while there is some progress in controlling inflation, it is not sufficient to rule out further rate hikes entirely.

Market Reactions and Economic Implications

The market’s initial reaction to the latest inflation data saw the Australian dollar weaken, reflecting uncertainties around the RBA’s next move. Although some analysts argue for a pause to give the economy more time to adjust, the consensus leans towards maintaining the current rate. Should the RBA decide to hold rates, it might stabilise the AUD/USD pair, especially given the dovish tone from the U.S. Federal Reserve.

United States: ISM Non-Manufacturing PMI (Jul)

Data source: ISM

Recent Performance and Expectations

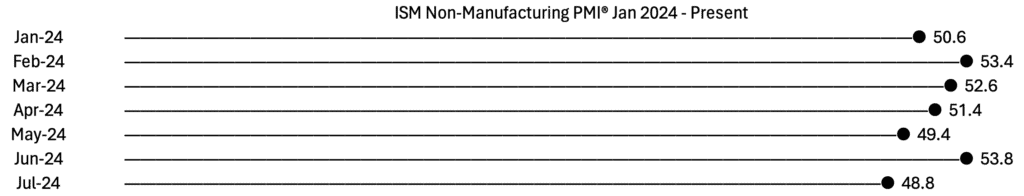

The ISM Non-Manufacturing PMI for July is another critical event, scheduled for release next week. Last month, the PMI disappointed with a headline figure of 48.8, signaling a contraction in the service sector. This followed a trend of declining performance in the manufacturing sector, which has remained below the 50 mark for four consecutive months.

Expected Data and Market Impact

For July, analysts expect the ISM Non-Manufacturing PMI to rebound slightly to 51.0, indicating modest expansion. This figure is crucial as it reflects the health of the service sector, which constitutes a significant portion of the U.S. economy. A better-than-expected PMI could bolster confidence in the U.S. economic outlook, supporting GDP growth projections.

Implications for the Fed and Financial Markets

The ISM data is forward-looking and closely watched by the Federal Reserve. Given the recent cooling in economic activity, a positive surprise in the PMI could reduce the likelihood of further rate cuts in the immediate future. Conversely, if the PMI falls short of expectations, it might signal ongoing economic struggles, potentially leading to a more dovish stance by the Fed.

Technical Analysis

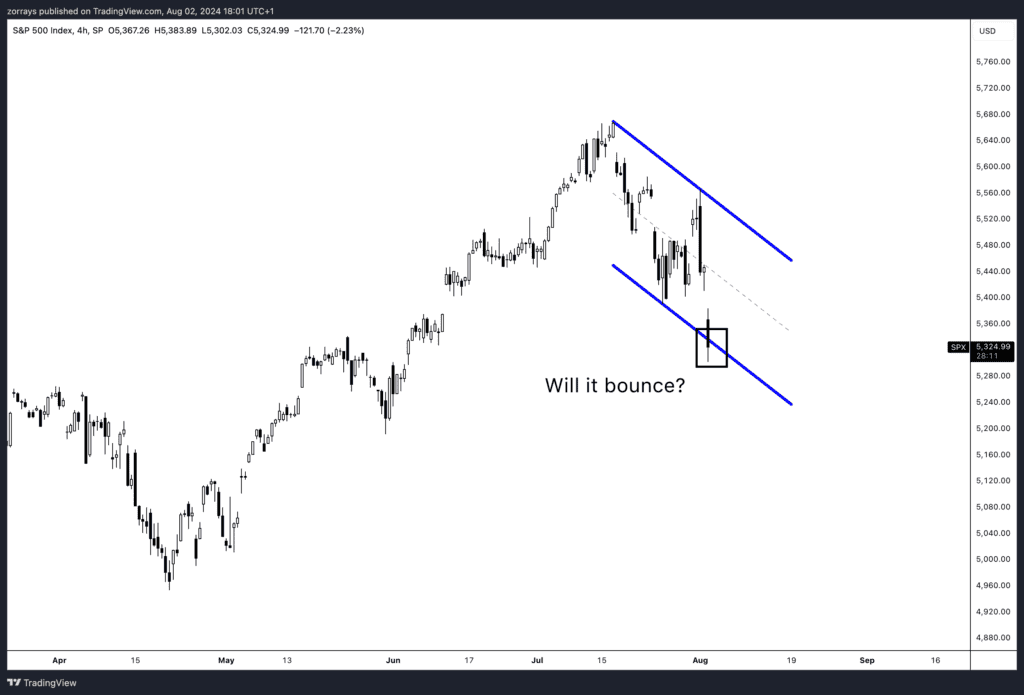

SPX – 4 hour timeframe

The chart provided shows the S&P 500 Index on a daily timeframe, illustrating a recent downtrend within a defined bullish flag pattern. The index closed at 5,327.58, down 2.19% for the day.

Key Observations:

- Bull Flag Pattern: The index is currently trading within a downward-sloping channel, often referred to as a bull flag. This pattern typically indicates a continuation of the prior uptrend once the consolidation phase within the flag concludes.

- Lower Bound Interaction: The index has recently touched the lower bound of this channel, which might act as a support level.

- Negative Employment Data: Today’s market decline can be attributed to worse-than-expected employment data. Poor employment figures suggest potential economic slowdowns, leading to bearish sentiment in the market.

- Potential Bounce: Given the historical tendency for bull flags to resolve to the upside, there is potential for the S&P 500 to bounce off the lower bound of this channel. If the index respects this support level, we could see a reversal and continuation of the previous bullish trend.

VIX – UP 50% today

Conclusion

Next week’s economic calendar is set to provide critical insights into the future monetary policy direction of both Australia and the United States. The RBA’s interest rate decision will be closely watched for its impact on inflation and economic stability, while the ISM Non-Manufacturing PMI will offer a glimpse into the health of the U.S. service sector. Investors and analysts alike will be keenly observing these events to adjust their strategies accordingly.

FAQs

What is the current interest rate set by the RBA? The current interest rate set by the RBA is 4.35%.

Why is the ISM Non-Manufacturing PMI important? The ISM Non-Manufacturing PMI is important because it provides insight into the health of the U.S. service sector, which is a significant component of the overall economy.

What are analysts expecting for the RBA’s interest rate decision? Most analysts expect the RBA to hold the interest rate steady at 4.35% due to mixed inflation signals.

What was the previous ISM Non-Manufacturing PMI figure? The previous ISM Non-Manufacturing PMI figure was 48.8, indicating a contraction in the service sector.

What is the significance of a PMI reading above 50? A PMI reading above 50 indicates expansion in the sector, while a reading below 50 signals contraction.

How might the ISM Non-Manufacturing PMI affect the Federal Reserve’s decisions? A stronger-than-expected PMI could reduce the likelihood of further rate cuts, while a weaker PMI might prompt a more dovish stance from the Fed.