- Chart of the Day

- November 3, 2025

- 3 min read

Bitcoin Support Incoming: Watch $105K and $115K as Targets

Last month’s crypto rejection came as a surprise to many, but not to our analysts at Alchemy Markets. Our TradingView idea posted on October 26th was perfectly respected.

Bitcoin cleanly rejected from $115,500 (July’s POC), and now sees itself trading at $107K levels. The real question now is — will we bounce soon? Or does this decline have way more room to go?

Bitcoin — Is the Support Coming in?

Major support could be just around the corner, and the reason we say this is because of 3 uniting factors:

- A trendline support since June 2025.

- A high volume node (support with high volume) is at $105,000, aligning with the trendline.

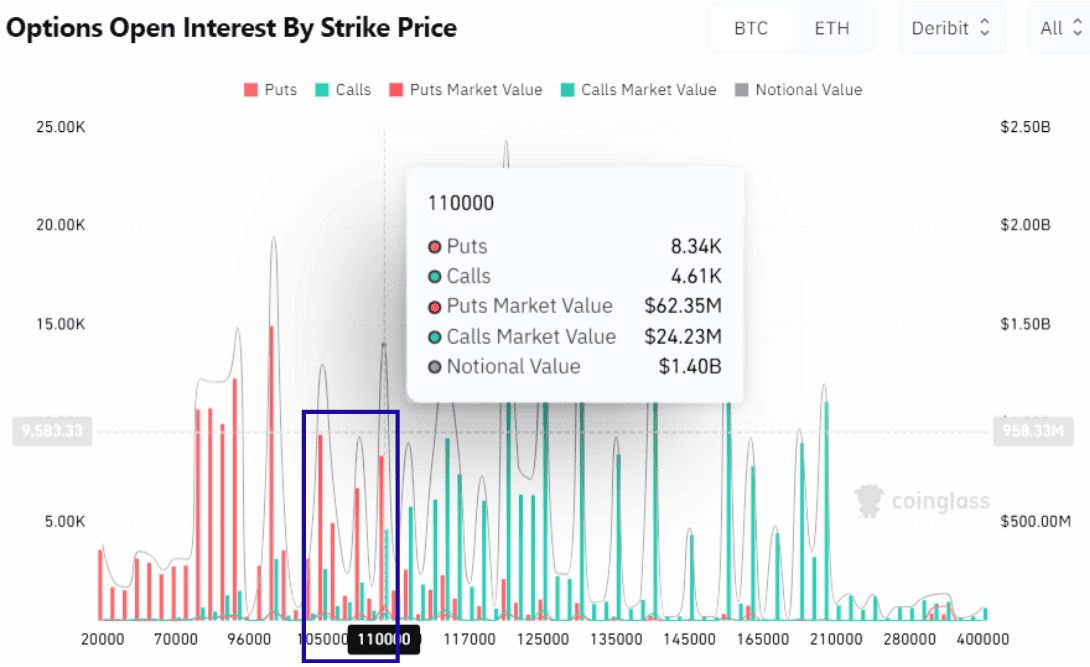

- Significant options open interest has been found at $105,000 to $110,000.

These three zones are screaming that $105,000 could be the low Bitcoin bulls are looking for, and that relief is just around the corner.

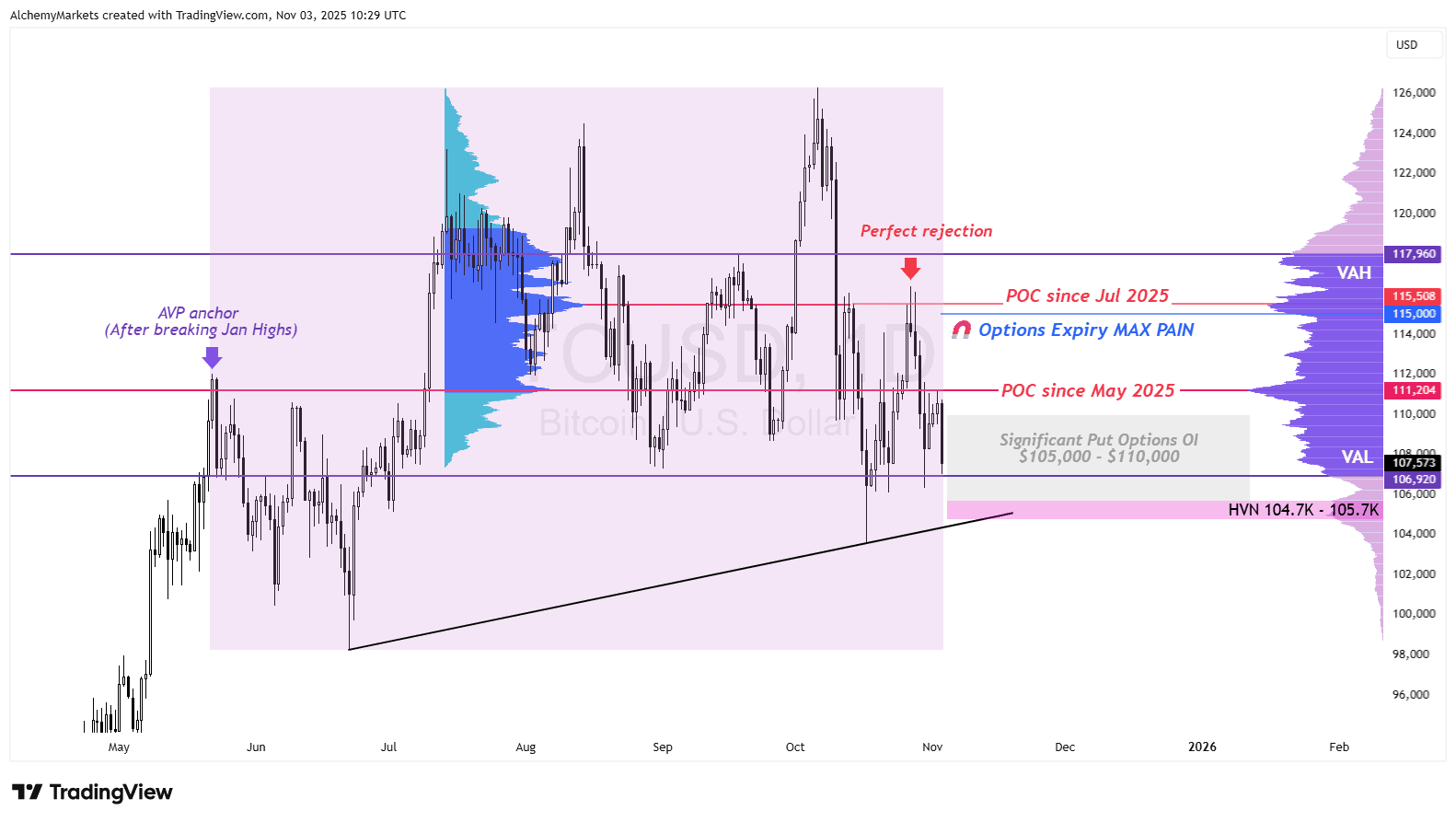

Bitcoin Technical Chart (Daily Timeframe)

As we predicted, Bitcoin rejection at the July 2025 POC — the price level with the most concentrated trading since July — and now the cryptocurrency has slid into the $107,000’s for trading.

This level is significant as it is the Value Area Low (VAL) of the entire range since May 2025. This is represented by the purple Anchored volume profile on our chart, with the range encapsulated in purple.

Currently, Bitcoin has shown respect more than three times at the VAL, but this decline towards the same zone marks the fourth retest, making a successful retest less likely (though, not impossible).

In such a scenario, the $104,700 to $105,700 high volume node (HVN) is a zone to watch. Not only does this align with a rising trendline support, but also, there is a large collection of put options gathered.

According to this Coinglass data, Bitcoin has approximately 136.73M in Put Options Open Interest in the $105,000 to $110,000 zone. This aligns perfectly with the HVN and trendline. It is in the best interest of option sellers to keep prices above this zone, so the put options do not come into profit.

However, if Bitcoin does manage to close below this zone at the end of the month (when these options expire), downside risks are then accelerated → Options come into play, puts adds more selling pressure.

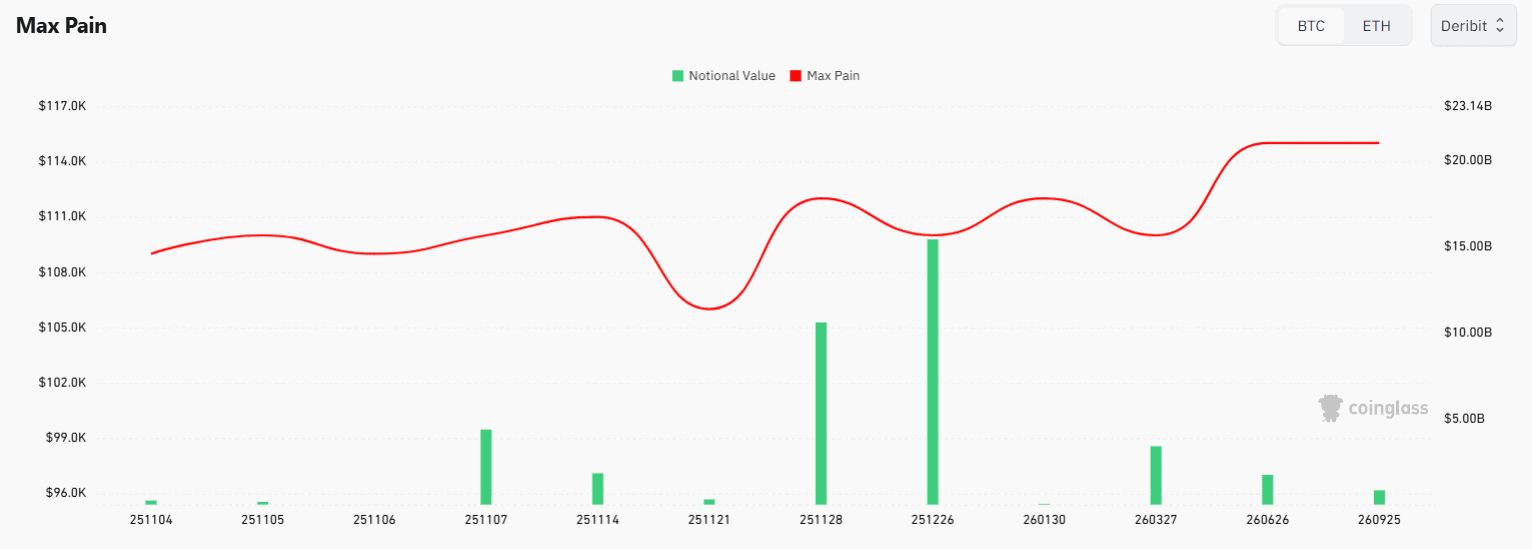

Max Pain and Potential Bitcoin Closing Target: $115,000

While downside risk is defined by the put cluster at $105K–$110K, the upside remains capped near the monthly max-pain zone. That upside target sits at $115,000 — the max pain point of this month’s major options expiry.

If Bitcoin manages to close around this area by November end, options sellers will walk away with maximum profit, making $115,000 the most likely expiry target unless volatility spikes.

Don’t get it twisted though, until we see a clean break above $115,000, it remains a strong resistance level. Bitcoin was rejected from this exact zone on October 28th, which triggered the current move lower.