- Opening Bell

- October 27, 2025

- 6min read

Megacap Moment Arrives: Wallstreet Brace for MAG7 Earnings Blitz

Markets enter one of their most pivotal weeks of the year. Five of the Magnificent Seven — Microsoft, Alphabet, Meta, Apple, and Amazon — are set to report results that could dictate the tone of the final stretch of 2025. Together, they make up nearly a quarter of the S&P 500’s total weight, a concentration that makes their earnings as much a macro event as a corporate one.

The setup is unusual. The Federal Reserve’s upcoming rate decision lands in the same week, and futures markets are already pricing in what could be the first cut of the cycle. Investors are looking for confirmation that growth remains intact, inflation is contained, and corporate earnings can still justify record valuations.

The question is not whether these giants will make money but whether they can make enough to sustain a market priced for perfection.

Quick Hits: MAG7 Bias for the Week

Earnings on Wednesday, October 29, 2025

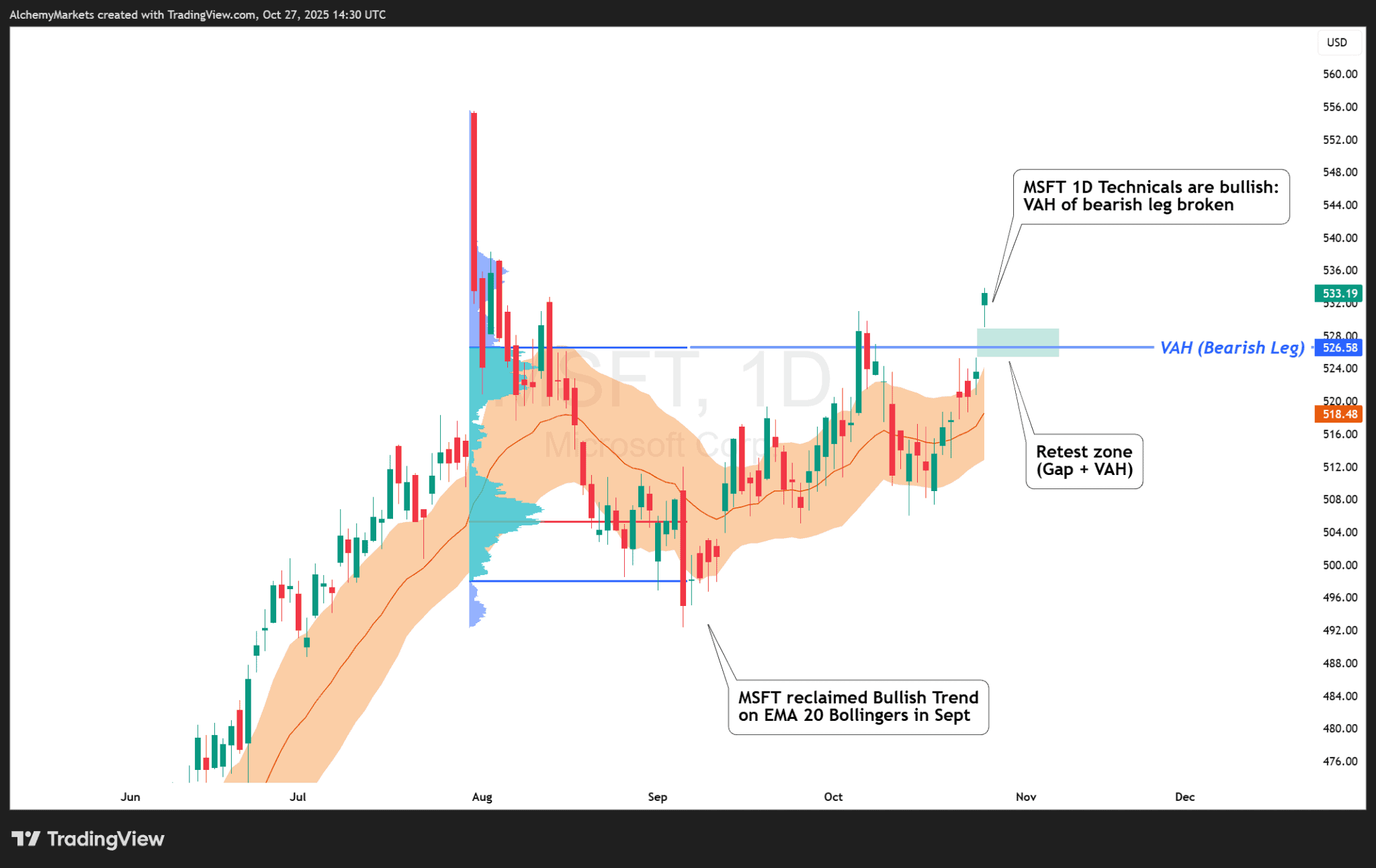

Microsoft (MSFT): Neutral to slightly bullish. Cloud and AI guidance will decide direction.

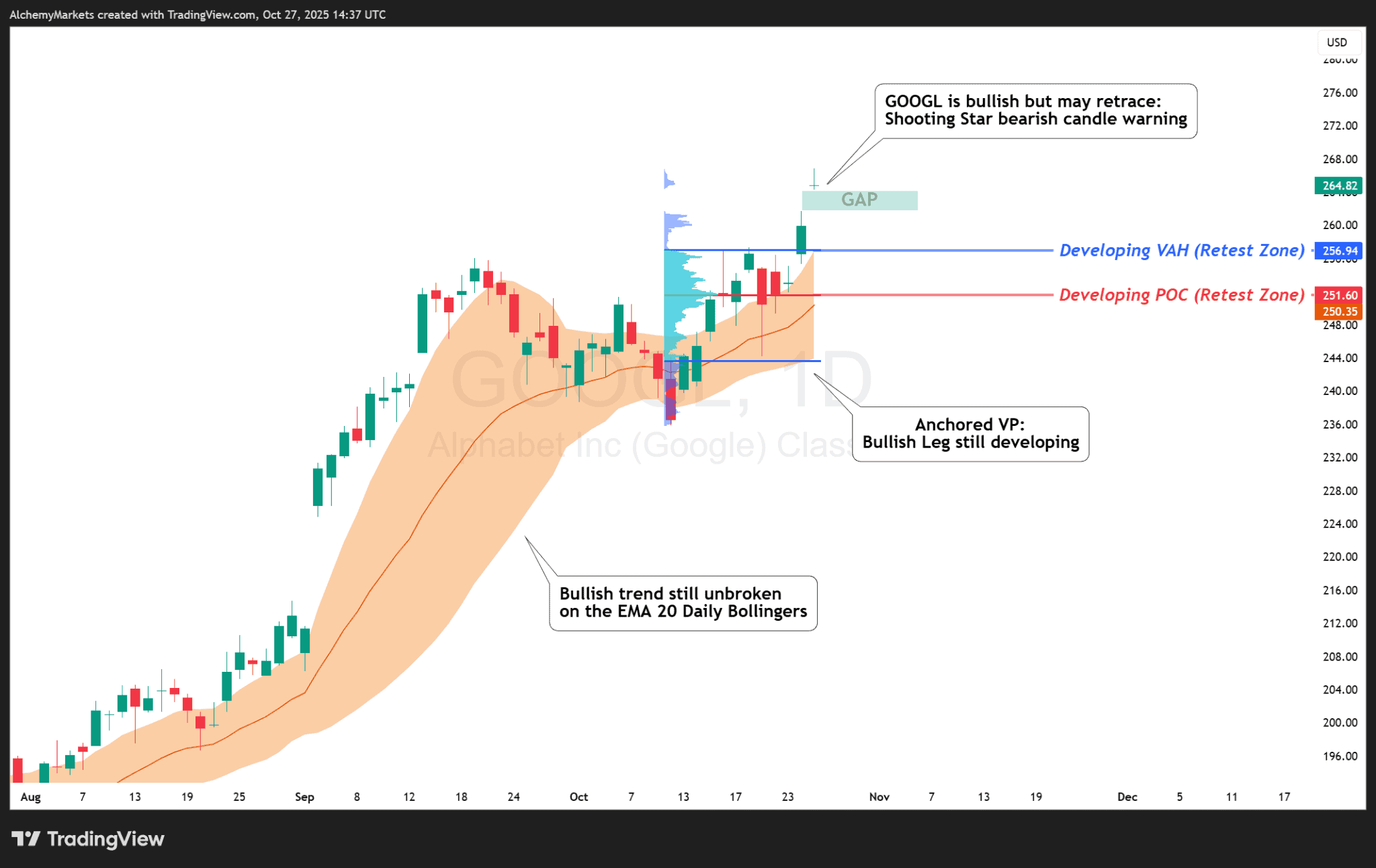

Alphabet (GOOGL): Neutral. Advertising and Cloud growth must stay resilient.

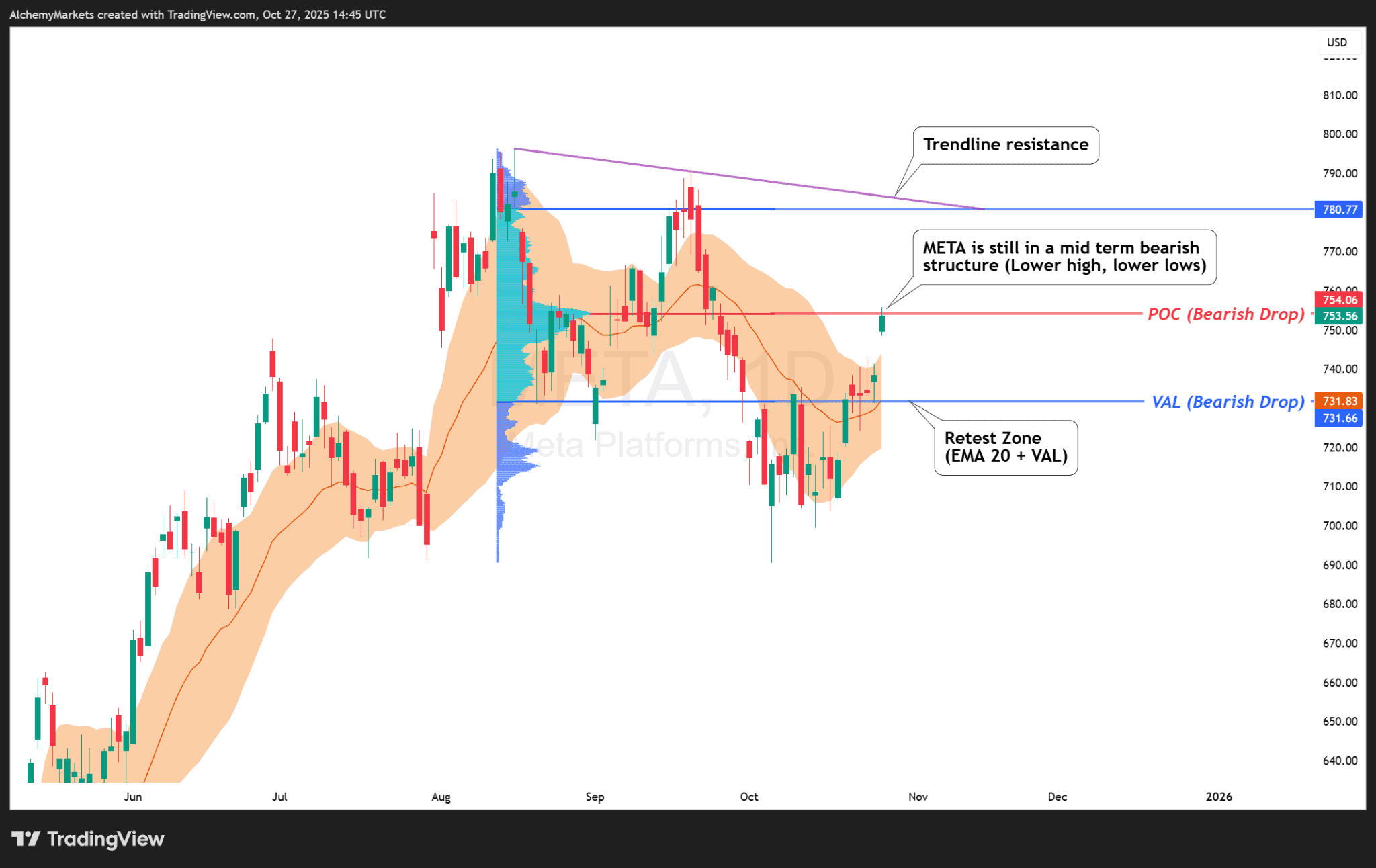

Meta (META): Slightly bullish. Efficiency tailwinds and stable ad demand support upside.

Earnings on Thursday, October 30, 2025

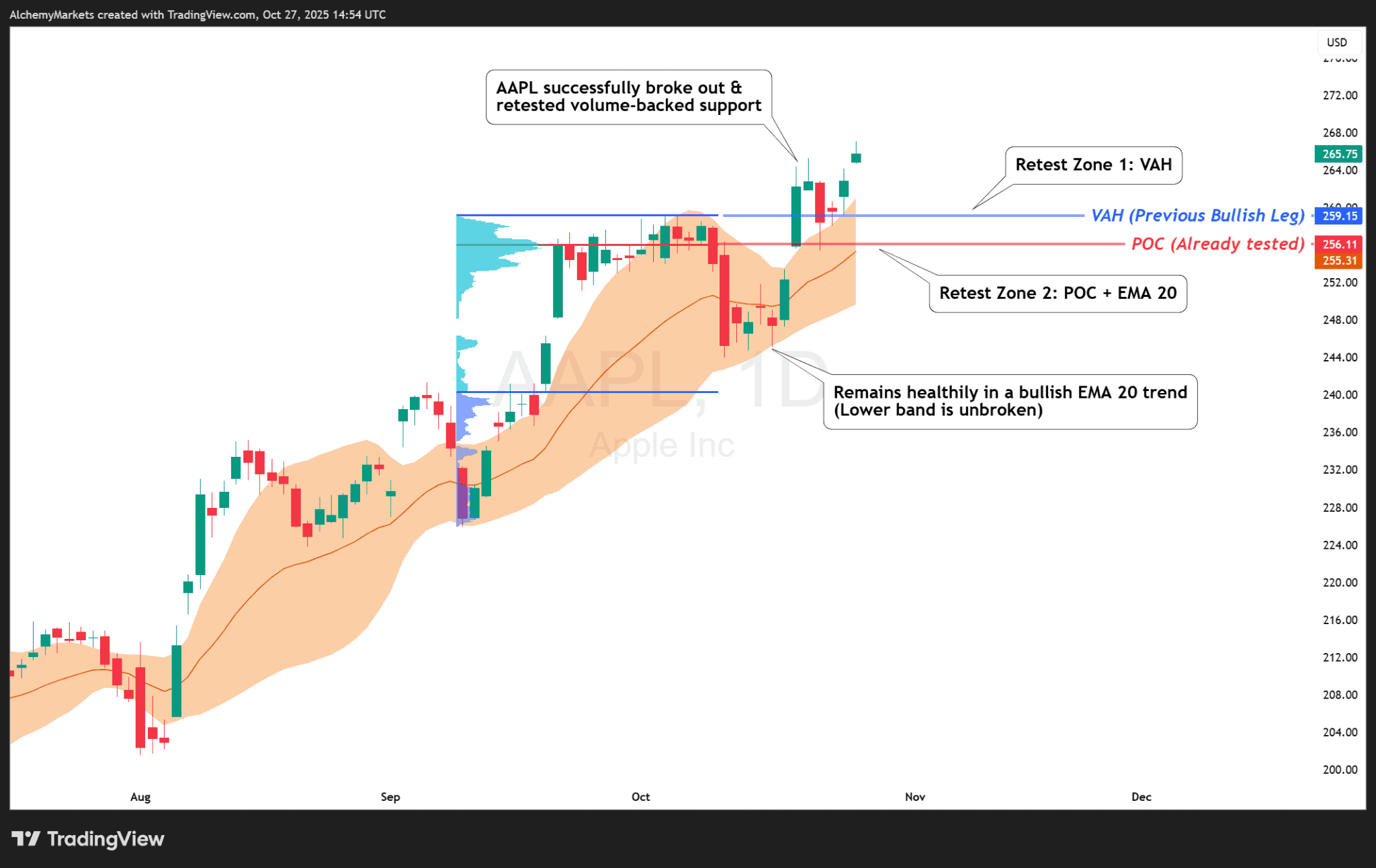

Apple (AAPL): Neutral to slightly bearish. Services earnings are solid, but the hardware cycle is maturing.

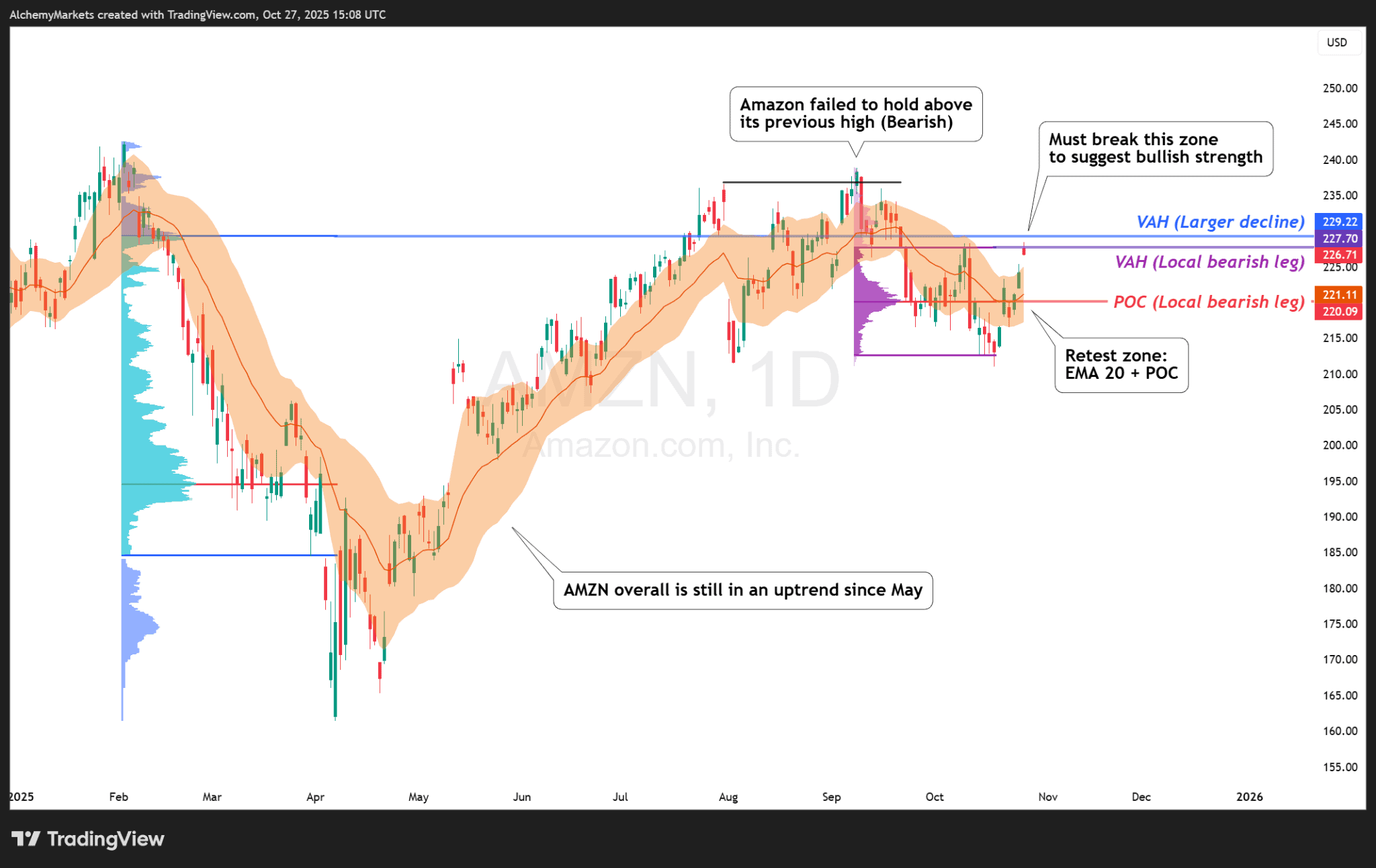

Amazon (AMZN): Neutral to bullish. AWS and retail margins remain key strengths.

Expectations and Valuations

Across Wall Street, expectations are firm but cautious.

| 💠 Microsoft (MSFT) | Forecasted to deliver around $3.67 EPS on revenue of $75 billion, with Azure’s growth and Copilot’s adoption under scrutiny. |

| 📊 Alphabet (GOOGL) | Expected to post roughly $2.27 EPS and $100 billion in revenue, while attention centres on its ad margins and Cloud division profitability. |

| ♾️ Meta (META) | May see EPS near $6.7 and revenue close to $49 billion, testing whether its heavy AI and data-centre investments are beginning to translate into operational leverage. |

| 🍏 Apple (AAPL) | Projected at $1.77 EPS on $102 billion in revenue, as traders watch iPhone 16 demand and the performance of its high-margin services segment. |

| 📦 Amazon (AMZN) | Estimated at $1.57 EPS on $178 billion in revenue, with AWS growth and retail margins expected to guide market sentiment. |

These are healthy numbers, but the real story lies in how they stack against expectations already inflated by this year’s rally. The S&P 500’s forward price-to-earnings ratio now sits near 23.28, well above its five- and ten-year averages. The Nasdaq’s is even higher, around 27.5 times forward earnings.

What Matters Most: Guidance

This week’s real catalyst will not be the reported numbers but the guidance that follows. After several quarters of strong beats, markets are demanding evidence that momentum will continue into 2026.

| 💠 Microsoft (MSFT) | Cloud margins and AI monetisation are in focus. Azure’s growth remains steady, but investors want proof that Copilot is driving incremental revenue rather than just adoption headlines. |

| 📊 Alphabet (GOOGL) | Cloud and YouTube performance will be key. Cost discipline impressed last quarter, but competition for ad budgets from Amazon Ads and TikTok remains intense. |

| ♾️ Meta (META) | Efficiency gains have restored confidence, yet its heavy AI and data-centre spending raises concerns about near-term cost discipline and returns on investment. |

| 🍏 Apple (AAPL) | Navigating a maturing product cycle. iPhone 16 demand looks stable but unspectacular, while its services division may offset softer hardware sales. |

| 📦 Amazon (AMZN) | Positioned to benefit from cloud adoption and stronger logistics margins. Any signs of weaker e-commerce activity could weigh on consumer sentiment. |

The challenge for these companies is not delivering strong numbers — it’s convincing investors that growth rates can remain high in a slowing economy. If even two of them issue cautious guidance, it could be enough to shift the entire market’s tone.

Sentiment and Positioning

Institutional and retail sentiment remain divided.

Recent fund manager surveys show portfolio allocations to equities at their highest since early 2024, signalling optimism among large institutions. But this confidence is tempered by caution — more than 60 percent of managers still view equities as overvalued, and many consider the AI-driven rally a potential bubble.

On the retail side, sentiment is far less enthusiastic. The latest AAII poll shows that roughly 36 percent of individual investors are bullish, while over 40 percent remain bearish. This gap between retail caution and institutional optimism has defined much of 2025’s rally. For professional investors, it implies more room for upside if retail flows return; for traders, it means the market is vulnerable to volatility if big money starts trimming exposure.

Short interest remains low in megacap names but elevated in mid-cap tech. That divergence suggests funds are hedging broader sector exposure without directly betting against the leaders. It also explains why sharp rallies in the smaller AI or semiconductor names often spill over into the major; short covering fuels risk appetite across the board.

Macro Crosscurrents

Beyond earnings, the macro backdrop complicates the picture.

The Federal Reserve is expected to signal a mild rate cut this week, possibly the first step in a gradual easing cycle. Inflation has cooled, but policymakers remain wary of reigniting price pressures.

If the Fed’s tone is dovish, it could amplify any positive earnings surprises, giving equities a tailwind through November. Conversely, if the Fed stays cautious, it may cap enthusiasm even if the Mag 7 numbers are strong.

At the same time, global growth has shown resilience. U.S. GDP data remains firm, with consumer demand steady and corporate balance sheets generally healthy. Yet higher valuations have compressed the market’s risk premium — investors are being paid less to take on the same risk. That’s why this week’s results matter more than usual: they will test whether fundamentals can still support stretched multiples.

Outlook: Balancing Hope and Tension

This week’s lineup is less about individual companies and more about what they collectively represent — the engine of U.S. market growth. The Mag 7 have carried global equities for nearly two years.

Their earnings this week will determine whether that leadership continues or starts to fracture. If results come in broadly positive and guidance remains upbeat, tech could lead another leg higher into year-end, especially if the Fed confirms an easing bias. But if guidance turns cautious or AI spending is framed as a near-term drag, investors may finally start rotating toward value and cyclicals.

Either way, volatility is likely. Options markets are pricing 2.5 to 5 percent swings for each megacap post-earnings, signalling that traders expect big moves. Those moves will ripple across indices, ETFs, and sectors tied to tech.

Final Take

The market stands at a crossroad where valuation, policy, and performance intersect. The Mag 7 are no longer just companies; they are the pulse of the market itself.

Their collective message this week will determine whether investors keep believing in the earnings story or start questioning the price they are paying for it.

At these levels, optimism is a crowded trade. The next few days will reveal whether it still has room to run.