- Weekly Outlook

- October 24, 2025

- 2min read

The Fed’s October Chill: Is the Dollar Index About to Get Spooked?

The U.S. Dollar Index (DXY) continues to tread cautiously as markets look ahead to the Federal Reserve’s October 29 meeting, where a second consecutive 25bps rate cut is widely expected. Despite inflation remaining above the Fed’s 2% target, the balance of risks is gradually shifting.

Chief Economist James Knightley notes that while the U.S. economy remains resilient, disinflationary pressures are building beneath the surface. Lower energy prices, softer wage growth, and moderating housing rents are helping ease inflation expectations. Meanwhile, cracks are emerging in the labor market, with multiple indicators pointing to potential job losses ahead — a development that could weigh on both growth and inflation in the medium term.

With these dynamics in play, the Fed’s gradual move toward a more neutral policy stance seems appropriate. The anticipated October rate cut reflects a preemptive effort to cushion the economy against a softening labor market without reigniting inflation.

However, the timing of key economic data remains uncertain. The release of the third-quarter GDP figure is in jeopardy due to the ongoing government shutdown, leaving investors with limited visibility into near-term growth momentum.

Technical Outlook

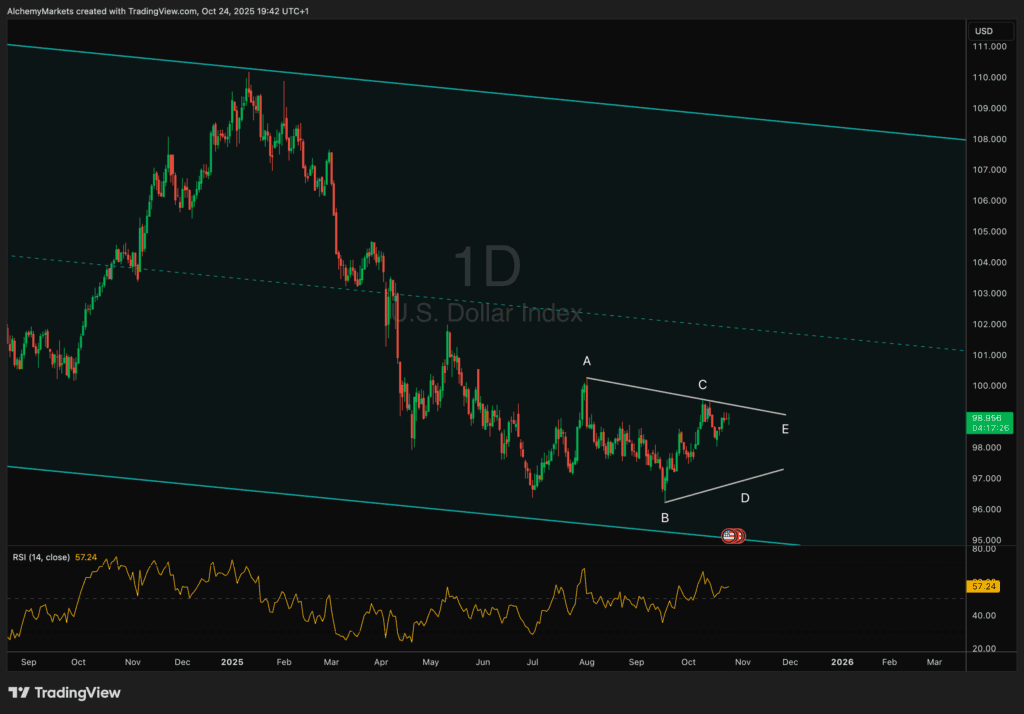

From a technical perspective, the DXY appears to be consolidating within a symmetrical triangle pattern, as shown in your chart. The market structure, labeled A–B–C–D–E, reflects a sideways correction phase, often signalling indecision before a breakout.

Currently, the index trades near 98.96, sitting midway within the triangle. The pattern’s upper boundary (around 99.50) represents near-term resistance, while the lower boundary (near 97.20–97.50) serves as key support.

Momentum indicators such as the RSI remain neutral, consistent with a corrective structure. The price action suggests that DXY may still have another push lower—possibly toward the lower trendline (point D)—before any decisive breakout occurs.

Given the current macro backdrop of an expected Fed rate cut and softening U.S. data, the bias leans slightly bearish over the coming weeks. Yet, as the pattern nears completion, volatility could increase sharply once the market finds directional conviction.