- Chart of the Day

- October 21, 2025

- 3 min read

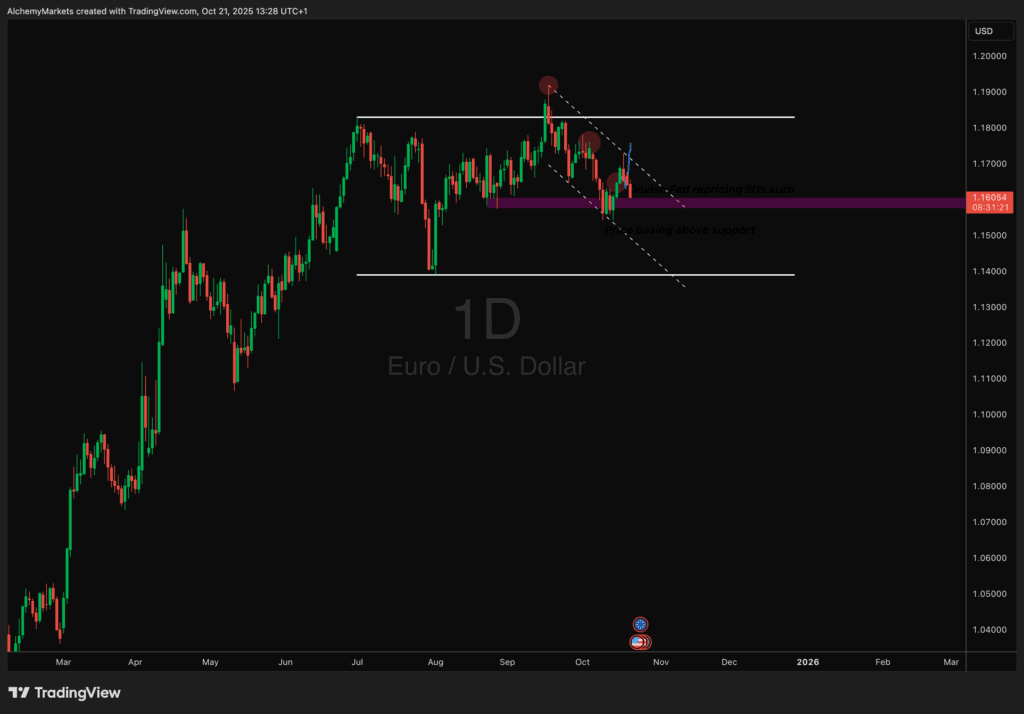

USD Holds the Line at 1.60 — Key Support or Next Leg Down?

Market Snapshot

FX volatility has cooled as the new week kicks off, with US equities extending their rebound on the back of eased credit market concerns. The risk mood has steadied, helped in part by Zions Bank’s solid earnings report—though the fraud-related losses kept market watchers alert for any lingering signs of credit stress across the system.

Amid this calmer tone, the US dollar has regained its footing, now sitting only 0.7% below its October 10 high. The move highlights how quickly investors have shaken off last week’s banking jitters, especially as the USD OIS curve has turned more hawkish, with two-year rates climbing 7 basis points yesterday.

Technical Focus: The 1.60 Level — A Line in the Sand

Our Chart of the Day zooms in on the price action as we arrive at 1.60, a level that coincides with the lower bound of the descending channel that has defined the recent correction.

- Support Zone: 1.60 marks the lower edge of this multi-week descending pattern, where buyers have previously stepped in to defend.

- Momentum Signals: Oscillators suggest short-term downside pressure is fading, hinting at possible stabilisation here.

- Key Risk: If 1.60 breaks decisively, it could open the door for a deeper retracement, potentially accelerating toward the next psychological pivot near 1.57.

In contrast, a rebound from this level—especially on a day where USD sentiment is turning more constructive—could signal the start of a technical base within the broader downtrend.

Macro Undercurrents: Hawkish USD, Muted China Risk

Fundamentally, the greenback’s tone continues to track shifts in Fed easing expectations. With the market repricing toward a slower pace of rate cuts, the short end of the curve is providing a sturdy foundation for the dollar.

Meanwhile, geopolitical risks are sitting quietly in the background. Not much has changed on the US-China trade frontahead of the scheduled Trump–Xi meeting later this month. Still, the US-Australia rare earths deal offers Washington a subtle edge in upcoming negotiations—a reminder that strategic positioning in commodities continues to shape longer-term FX narratives.

Bottom Line:

FX traders are watching 1.60 as the key battleground. The technical setup suggests the descending channel’s lower bound may act as a short-term cushion, but a clean break below would shift the bias decisively bearish.

With volatility subsiding and the USD buoyed by a hawkish repricing in front-end rates, the next move hinges on whether this support holds firm—or gives way to renewed downside momentum.