- Weekly Outlook

- August 22, 2025

- 4min read

After Jackson Hole: Can Markets Hold Their Nerve Before Payrolls & PCE?

Markets head into the weekend with Powell’s Jackson Hole address front and centre.

The symposium’s theme — “Labour Markets in Transition” — goes straight to the heart of the Fed’s current dilemma: softening growth signals on one side, still-sticky inflation risks on the other.

With Powell due to speak later today, traders are reluctant to show their hand. Next week becomes the first real test of how his message lands, and whether markets lean into September rate cut bets or pull back.

What Is the Market Expecting Going In?

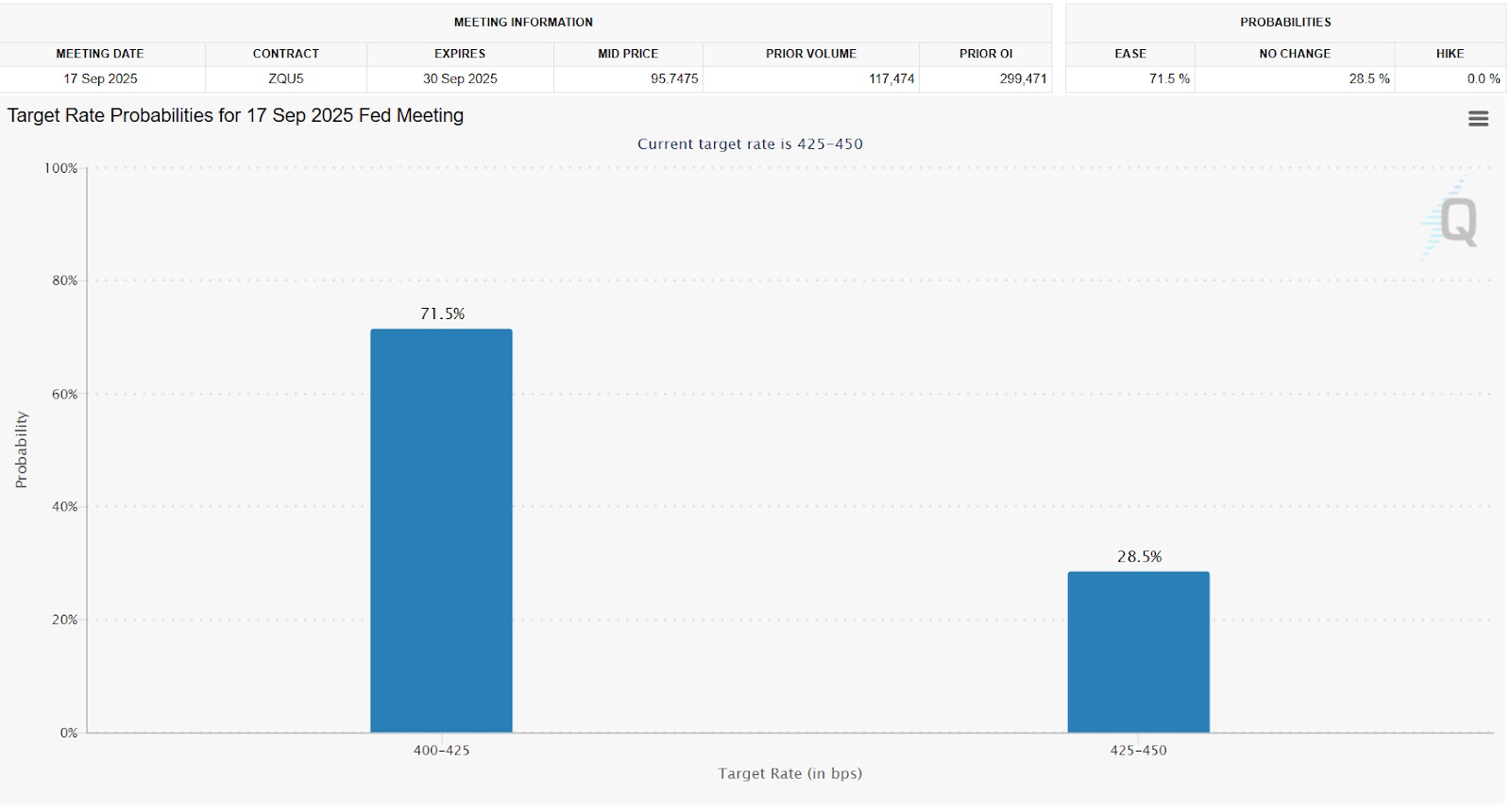

CME FedWatch Tool shows around 70% odds of a September cut — a drastically more cautious expectation compared to just a week ago (84%). Fed officials have remained cautious, reminding markets that one more jobs report (Sept 6) and CPI release (Sept 10) are still to come. The reaction to Powell’s tone today will likely steer early-week flows, but without fresh data, conviction may stay low.

5 Key Themes to Watch Next Week

1. Powell’s Message and the Fed Chorus

The first test will be whether Powell’s remarks lean dovish enough to keep risk assets buoyant, or cautious enough to put a floor under the US dollar. Equally important is the Fed chorus that follows: commentary from officials next week could either amplify his line or temper it, depending on how markets react today.

2. The RBNZ’s Ripple and Central Bank Watch

Last week’s surprise cut from the RBNZ to 3.00% still weighs on the kiwi, and attention shifts to whether the RBA or BoC hint at joining the dovish tilt. Any sign of sympathy could ripple through AUD and CAD pairs.

3. UK Inflation and Services Strength

CPI stuck at 3.8% year-on-year and robust services PMIs leave the Bank of England facing a split economy. Sterling traders will be on alert to see if the BoE acknowledges this divergence, or if patience remains the official line.

4. Eurozone Divergence

Germany’s composite PMI edged into expansion at 50.9, but services activity slipped to contraction. For the euro, sentiment may hinge less on domestic data and more on whether Powell’s tone today gives the ECB space to pause without losing credibility.

5. US Manufacturing vs Services

Flash PMIs showed manufacturing at a 39-month high of 53.3, while services cooled. This divergence may shape equity rotation in the week ahead, with cyclicals and industrials supported, but tech and growth potentially more cautious.

SPX Technical Analysis – Consolidation or Trap?

The S&P 500 continues to drift inside its August channel, stalling near 6,480 resistance. Price now hovers around 6,370, with Fibonacci retracements aligning to key volume zones.

- Bullish case: Holding above $6,347 (50% retracement + volume cluster) could set up another run at $6,480 highs.

- Bearish case: Holding above $6,270 (78.6% retracement + Point of Control) could set up a dead cat bounce of sorts.

Momentum is neutral for now, with post-Jackson Hole interpretation likely to decide direction.

What to Watch Next Week

The immediate focus is on how markets digest Powell’s Jackson Hole remarks today. His tone will set the stage, but traders will also look toward China’s official PMIs at month-end, Eurozone inflation flash estimates, and any follow-up commentary from the RBA or BoC after the RBNZ’s surprise cut. Corporate earnings guidance from global tech and retail names may also influence broader risk sentiment.

Global Central Bank Watch

If Powell leans dovish, the ECB and BoE may find some room to pause, though inflation challenges remain unresolved in both regions. The RBA will come under sharper scrutiny after the RBNZ’s easing, while the BoJ is expected to stay firmly dovish — leaving the yen highly sensitive to global yield spreads.

Positioning Into September Data

Options flows suggest traders are hedging equity exposure into September. With US payrolls on September 6 as the next major test, markets may stay cautious and range-bound until Powell’s message is fully absorbed.