- Elliott Wave

- July 22, 2025

- 2 min read

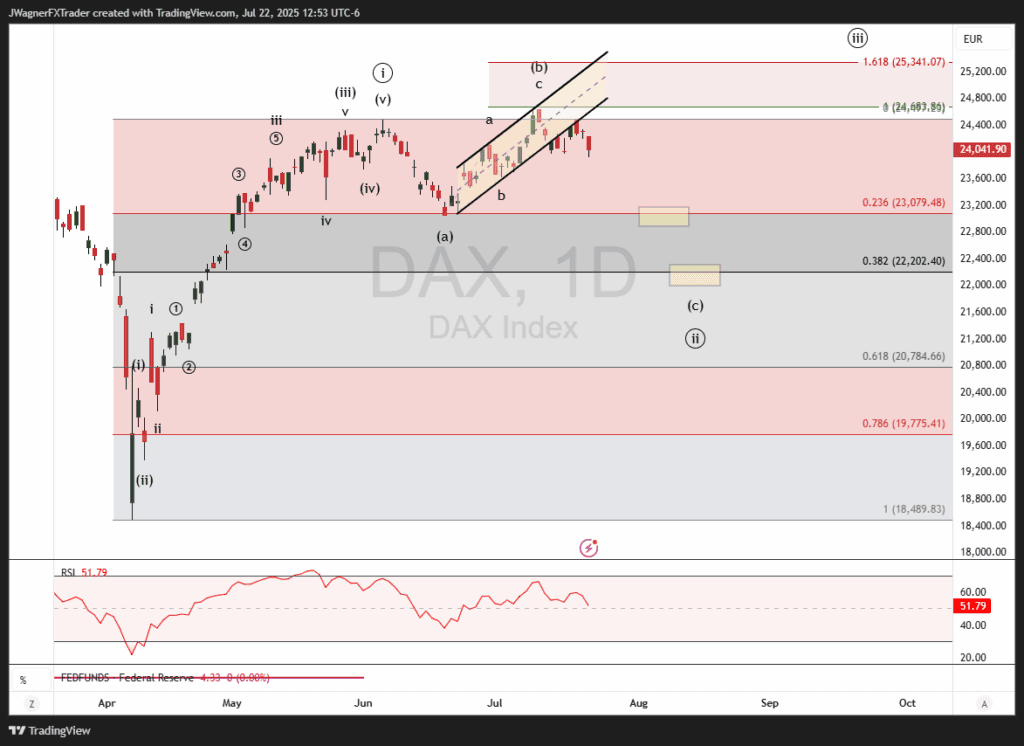

DAX Elliott Wave: German Engine Rallies Again

Executive Summary

- Bullish Bias: The DAX has completed wave ((i)) from the April low and wave ((ii)) is now unfolding as a three-wave correction.

- Key Fib Levels: Expect the (c)\-wave of ((ii)) to target the .236 Fibonacci retracement at 23,080 or .382 retracement at 22,200 before the next impulsive leg up.

- Invalidation Level: A break above the July 10 high of 24,639 suggests the wave ((iii)) rally has already begun.

Current Elliott Wave Analysis

The rally off the April 7 low at 18,489 has subdivided into a complete Elliott wave impulse pattern. Since June 5, DAX has been working sideways in an (a)-(b)-(c) flat pattern.

This flat pattern makes up wave ((ii)).

Within wave ((ii)), we see:

- Wave (a): 24,479 → 23,051 (completed)

- Wave (b): 23,051 → 24,639 (channelled zigzag)

- Wave (c): 24,639 → ? (in progress)

Wave (b) is a big clue that a decline to retest the 23.6% Fibonacci retracement is a higher likelihood. Wave (b) channeled higher in an a-b-c zigzag pattern, a corrective wave. This suggests the entire rally may become fully retraced or mostly retraced.

Once lower levels are achieved, then we’ll anticipate another powerful rally.

Look for wave (c) of (ii)) to finish up near 23,080 0r 22,200.

Bottom Line

The DAX remains in an overall uptrend after completing wave ((i)). Look for wave ((ii))’s (c)-leg to finish near 22,200–23,080.

If 24,639 is broken to the upside, then we will consider wave ((ii)) already complete and a wave ((iii)) rally in progress.