- Chart of the Day

- May 12, 2025

- 3 min read

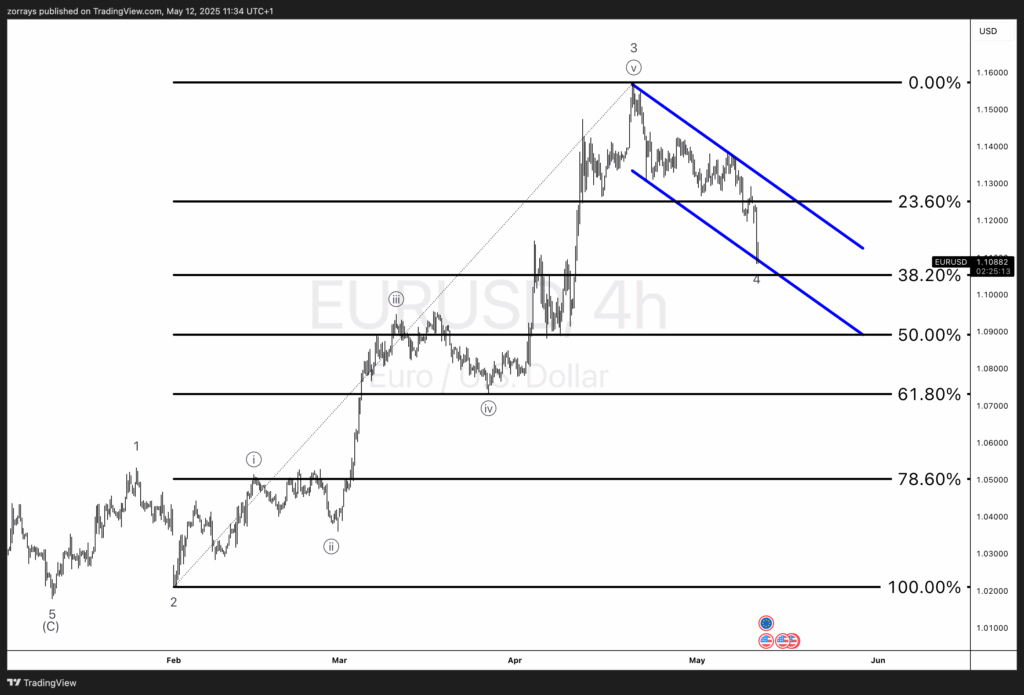

EUR/USD at Make-or-Break Levels – 38.2% Fib Test and Overvaluation Signals a Key Turning Point

Fundamentals – The Euro’s Shaky Ground

EUR/USD Briefly Breaks 1.1200 – Why the Drop Matters

In early trading today, EUR/USD slipped just below the 1.1200 support level, signaling a test of critical psychological and technical thresholds. While the pair has pulled back around 3% from its April 21 peak, it’s still trading about 3% overvalued according to short-term fair value models. This mispricing becomes even more apparent when juxtaposed against the two-year EUR/USD swap spread, currently sitting at -170 basis points—a differential historically consistent with prices closer to 1.0600.

Dollar Dominance Still in Play

Even though rate spreads aren’t the sole driver of FX markets in the current climate, they remain a key anchor for medium-term direction. Dollar support persists due to resilient US consumer data and a still-hawkish Fed tone. If upcoming trade war rhetoric softens or if US-China tensions ease, the greenback could see reduced risk premiums. However, that doesn’t necessarily translate into euro strength—it might only slow the decline.

Eyes on Bessent and Geopolitics

Markets are paying close attention to Bessent’s update on US-China negotiations. Should he strike a constructive tone, risk assets may rally, and the EUR/USD could find short-term support near 1.1200. On the geopolitical front, the Russia-Ukraine narrative is still fluid. Talks of a 30-day ceasefire proposed by Trump and Turkey’s mediation efforts with Putin and Zelenskyy offer some hope, but markets have grown skeptical of peace breakthroughs. Even a positive announcement may prompt only a muted reaction unless it’s seen as durable and enforceable.

Eurozone Macro – Still a Passenger, Not the Driver

The eurozone’s influence on EUR/USD remains muted. Tomorrow’s ZEW sentiment surveys may stir minor moves, but US factors continue to lead the charge. This week, macro data from Europe is unlikely to alter the broader trend unless significantly divergent from expectations.

Technicals – All Eyes on the 38.2% Fibonacci and Channel Support

Wave 4 in Progress – Correction Meets Critical Support

From a pure Elliott Wave perspective, EUR/USD appears to be undergoing a Wave 4 correction within a broader impulsive rally. Price action has now crept into the 38.2% Fibonacci retracement, a textbook support zone for fourth-wave pullbacks. Historically, Wave 4 corrections tend to find strong bids around this level, aligning with the 1.1090–1.1100 region.

Confluence at the Lower Channel Boundary

What’s particularly compelling is the confluence of technical supports—not only is EUR/USD at the 38.2% retracement, but it’s also brushing against the lower bound of the descending parallel channel that’s governed price action since the peak near 1.1600 (Wave 3). This double-layered structure sets up a clear make-or-break scenario.

- A bullish bounce from this area would support the idea that Wave 4 has completed, potentially launching Wave 5 toward retesting or even exceeding April highs.

- A decisive break below 1.1090, especially on daily closes, opens the door to deeper retracements toward the 50.0% level near 1.0900, and possibly even 61.8% at 1.0700, should momentum persist.

Bearish Momentum Intact but Waning

The steepness of the recent decline within the channel suggests strong short-term bearish momentum. However, the lack of acceleration through support implies sellers may be losing steam, especially ahead of today’s fundamental catalysts.