- Weekly Outlook

- May 9, 2025

- 4min read

DXY Breakdown Adds Pressure as Markets Brace for US CPI, Retail Sales, and UK Jobs Data

Economic data over the coming week will provide a crucial pulse check on the health of the US and UK economies. With growth slowing but not collapsing, markets are cautiously optimistic—but downside risks remain. US retail sales and inflation figures will offer clarity on the strength of consumer demand and price pressures, while the UK will release critical updates on employment and GDP. These events will shape not just near-term forecasts, but also the trajectory of monetary policy decisions on both sides of the Atlantic.

US Inflation – Tuesday, May 14

The April CPI report will be a key moment for markets, as inflation remains the primary obstacle preventing the Federal Reserve from easing policy. While overall CPI is expected to remain above 4%, some categories—like rents—may start to cool. That said, businesses facing tariffs may have begun preemptively raising prices, potentially making this month’s data sticky. If inflation proves resilient, rate cut expectations for July could be pushed back even further.

US Retail Sales – Thursday, May 16

March’s retail sales were boosted by consumers accelerating purchases in anticipation of tariff-driven price hikes, especially in autos. April may show continued strength in specific categories, but overall spending could begin to soften. With consumer confidence dipping and household wealth taking a hit, discretionary purchases might waver. However, stock market gains continue to support upper-income spending, suggesting a two-speed consumer economy that’s holding up—for now.

US Consumer Sentiment & Industrial Production – Friday, May 17

Preliminary University of Michigan consumer sentiment and industrial production data will round out the week’s US releases. Sentiment is expected to remain subdued as inflation, job uncertainty, and political noise weigh on households. Meanwhile, industrial production may show further stagnation as firms deal with uneven demand and lingering supply chain complications. Both data points could reinforce caution about the near-term economic outlook.

UK Labour Market Report – Tuesday, May 14

The UK’s jobs data will be scrutinized for signs of resilience or softening. While recent tax hikes have hit employers hard, redundancies have stayed low. Unemployment is likely to rise modestly, though measurement inconsistencies mean results can be noisy. Most importantly, wage growth is expected to slow—an outcome that may influence the Bank of England’s future rate decisions. Staff shortages, particularly in services, remain a structural challenge that could limit the pace of cooling.

UK Q1 GDP – Thursday, May 16

First-quarter UK GDP is projected to post solid growth, buoyed by a surprisingly strong February. Even if March data shows some reversion, the quarterly outcome should look positive. However, much of the momentum stems from volatile manufacturing swings and government spending, not underlying private sector strength. With household budgets under strain and inflation still elevated, the second quarter could paint a much flatter picture of the UK economy.

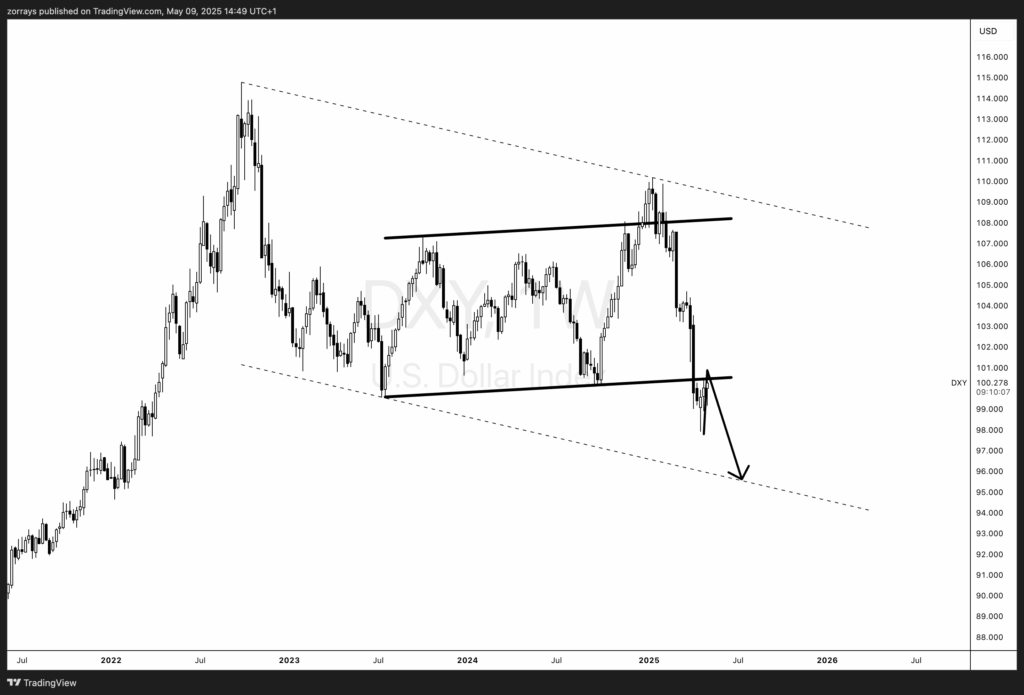

Chart of the Week: US Dollar Index (DXY)

This DXY chart has sparked a lot of discussion among peers lately—and rightly so. Strip away the noise, and a clear structure reveals itself: impulse – correction – impulse. The index broke lower from a broad consolidation pattern that had held for much of 2023 and early 2024.

What followed was textbook: a strong initial push down, followed by a choppy, directionless corrective phase, and now signs of another impulsive move lower beginning to unfold. From a technical perspective, price is likely to remain confined within the larger descending channel (marked by dotted trendlines). The recent rejection at horizontal support-turned-resistance only reinforces the bearish outlook.

Until we see a clean breakout above 102–103, the path of least resistance appears downward. Expect the dollar to remain weak into the next quarter, especially if inflation data allows the Fed to begin talking cuts more openly.