- Chart of the Day

- April 15, 2025

- 2 min read

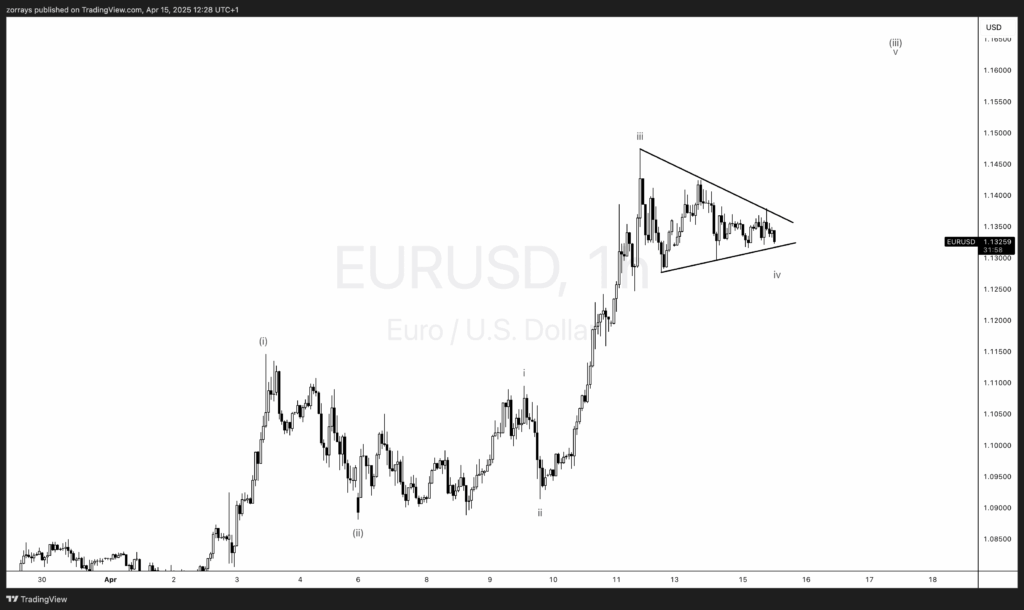

EUR/USD Coils in Wave iv Triangle, Eyes Breakout in Wave v

EUR/USD Consolidates Within Classic Elliott Wave Structure

EUR/USD is setting up for a potential bullish breakout as the pair carves out a textbook Wave iv triangle formation. The pair currently trades near 1.1325, having cooled off from its impulsive Wave iii high, and now compresses in a symmetrical triangle—typical of a fourth wave consolidation.

Wave Count Breakdown (1H Chart)

- Wave (i) and (ii) completed earlier this month, forming the base structure.

- The impulsive surge from April 10–12 forms a clear Wave iii, characterized by strong momentum and large-range candles.

- The current price action is confined within converging trendlines—a contracting triangle—labelled as Wave iv.

- A clean breakout above triangle resistance (~1.1380) would likely confirm the beginning of Wave v, targeting new highs possibly near 1.1550–1.1600, where higher-degree Wave (iii) may complete.

Key Technical Levels

| Support | Resistance | Wave Invalidation |

|---|---|---|

| 1.1300 | 1.1380 | Below 1.1250 (Wave i territory) |

- As per Elliott Wave guidelines, Wave iv must not overlap Wave i, keeping 1.1250 as the invalidation level for this bullish scenario.

Outlook

A breakout from the current consolidation would mark the start of Wave v, completing the five-wave sequence of Minute Wave (iii). The pattern favors the bulls, but confirmation is key.

Watch for:

- A decisive breakout above triangle resistance with volume

- Retest and hold of 1.1300 as support if the triangle resolves upward

Until the pattern resolves, patience remains the best approach.

DISCLAIMER:

For educational purposes only. Trading comes with substantial risk, leading to possible loss of your capital.

Traders are advised to do their own due diligence before investing.