- Elliott Wave

- Gennaio 14, 2026

- 2 min di lettura

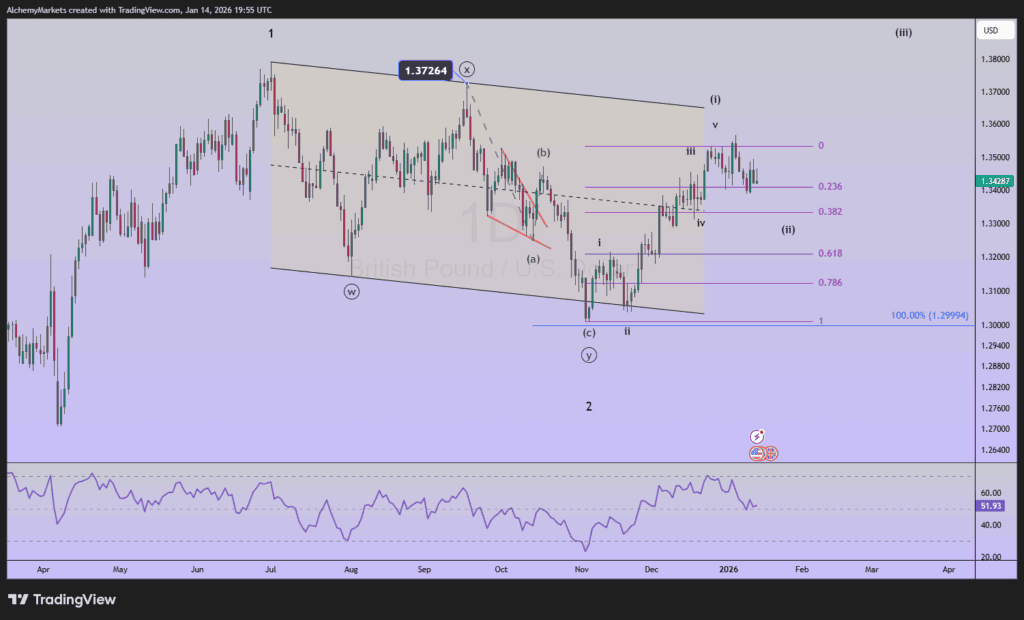

GBP/USD Elliott Wave: Chopping Lower In Temporary Decline

Executive Summary

- GBPUSD finished the first wave of a larger third wave.

- Current decline is viewed as wave (ii) of ((i)) of 3.

- The forecast is bullish while holding above 1.3010.

Back on November 13, while trading at 1.3190, we forecasted a major low and large rally for GBP/USD that may extend to 1.48. Cable, so far, has reached a high of 1.3567 and the pattern we are following appears incomplete.

GBPUSD Elliott Wave Count

GBPUSD appears to have completed wave 2 at the 1.3010 low on November 5. We know from our Elliott wave studies that this suggests a wave 3 rally. Wave 3 tends to have a similar size or Fibonacci proportions to the wave 1, or 2025 rally.

Using the Fibonacci extension tool, this projects a 100% wave 3 rally at 1.48.

But first, GBPUSD appears to be correcting lower within a smaller degree wave (ii). This wave (ii) decline has met the minimum expectations at the 23.6% Fibonacci retracement level. However, more commonly, wave (ii) tends to retrace between 38.2% and 78.6%. This would yield a lower decline to 1.3125 – 1.3333.

Then, once wave (ii) is in place, GBPUSD would need to break above the price channel resistance near 1.3650.

Bottom Line

GBPUSD appears to be correcting lower in a smaller degree wave (ii). We suspect this decline may halt near 1.3125 – 1.3333 and lead to a large wave 3 rally that possibly reaches 1.48.

If the 1.3010 support low is broken, then wave ‘2’ is extending lower.