Like a firehose extinguishing last week’s bullish spark, today’s US Flash Manufacturing and Services PMIs came in STRONG – with a capital S.

Now, as analyzed earlier today in my opening bell piece: Negative Economic News for Eurozone Ruffles the Markets, the only saving grace for GBPUSD and assets across the board would be a negative US Flash PMI announcement.

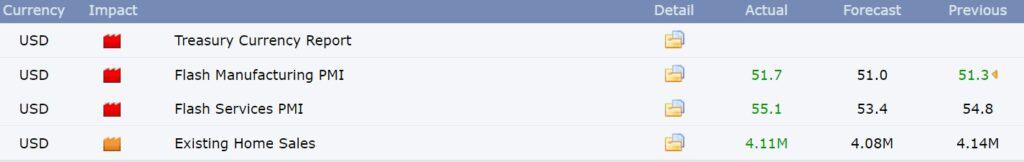

Unfortunately, that did not turn out to be the case. Flash PMI data came out to be way better than forecasted, at 51.7 (Manufacturing), and 55.1 (Services).

This comes as both a surprise and devastating blow to the markets, as the implications of this data would go against the narrative of rate cuts in 2024.

An improvement in the PMI data acts as a leading indicator for an increase in inflation. Businesses can afford to amp up the costs of production, which should logically lead to a price increase for consumer goods.

So, circling back to GBPUSD, what does this mean for traders?

Technically, GBPUSD is consolidating within a weekly symmetrical triangle pattern with a looming bearish stochastics RSI cross in play.

With the stronger economic outlook for the US, personally, I am leaning towards a bearish break or at least a test of this lower trendline at $1.24091.

If broken, then GBPUSD would have a bearish target at approximately the 0.618 Fibonnaci retracement level at $1.14192.

What to expect in the coming weeks for GBPUSD

As the economy appears to be performing robustly, the Federal Reserve may be less inclined to cut interest rates. Higher interest rates or even the anticipation of maintaining current rates generally support a stronger USD, exerting downward pressure on GBPUSD.

Additionally, recent economic data from the UK has not been particularly encouraging. The UK’s inflation rate, although still elevated, has shown signs of cooling slightly, which might deter the Bank of England from raising interest rates aggressively. This contrast in monetary policy expectations between the US and the UK further strengthens the bearish outlook for GBPUSD.

In summary, the combination of stronger-than-expected US economic data, subdued UK economic performance, and geopolitical uncertainties all point towards a bearish outlook for GBPUSD.

Traders should watch for a break below the $1.24091 level, which could pave the way for a move towards the 0.618 Fibonacci retracement target at $1.14192.

You may also be interested in: Stochastic Oscillator Indicator Explained