- Weekly Outlook

- August 30, 2024

- 5 min read

The Rollercoaster of Global Markets – Buckle Up!

As we approach another week in the thrilling world of global economics, it’s time to prepare for a ride that promises a mix of excitement, mild turbulence, and a few surprises along the way. So, strap in and let’s take a tour of what’s on the economic calendar.

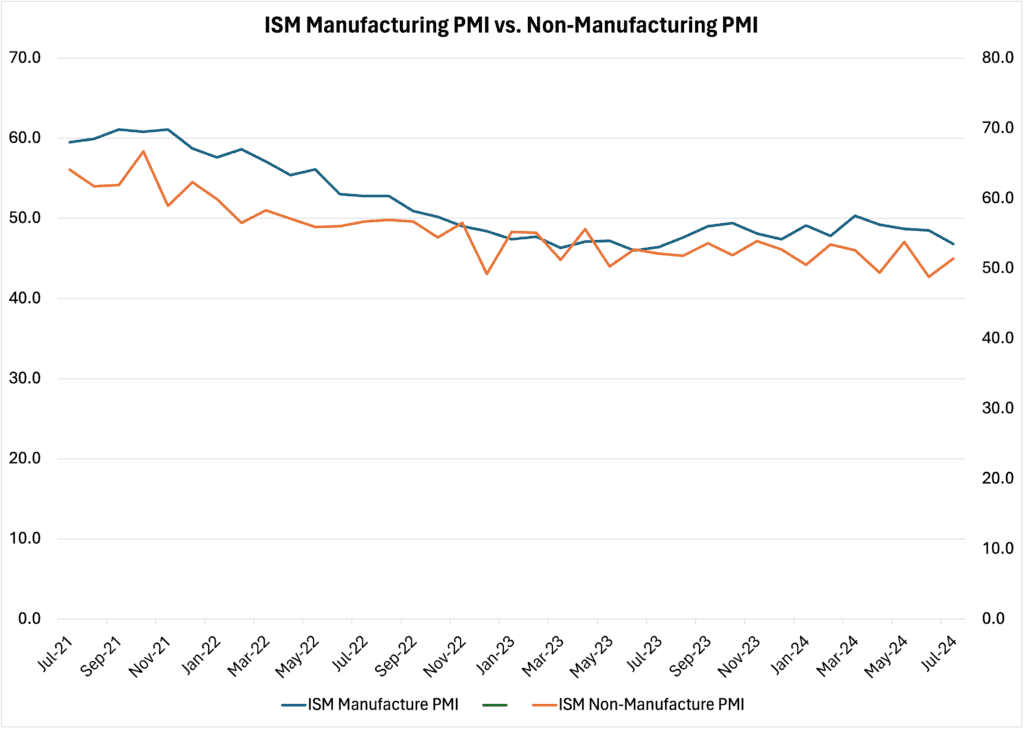

USA: ISM PMI – Measuring the Pulse of American Industry

ISM Manufacturing PMI: Last month, the index sat at a rather sluggish 46.7. However, this month’s consensus is a slight uptick to 47.8. It’s like giving the economy a small shot of espresso—still below the growth threshold of 50, but at least we’re not flatlining! A rise in this index indicates that manufacturing is trying to stir from its slumber, though it’s more of a stretch and a yawn rather than a full leap out of bed.

ISM Non-Manufacturing PMI: Previously at 51.4, and no change is expected this month. It’s a bit like treading water—you’re not sinking, but you’re not exactly swimming to shore with vigour either. The steady figure above 50 suggests that while services are holding their own, the growth is more tortoise than hare. GDP, it seems, is inching forward, but don’t expect it to break any land speed records.

To better understand the divergence between these sectors, the chart above compares the ISM Manufacturing PMI with the ISM Non-Manufacturing PMI over the past year. Notice how the services sector remains just above the growth threshold, while manufacturing is still struggling to regain its momentum.

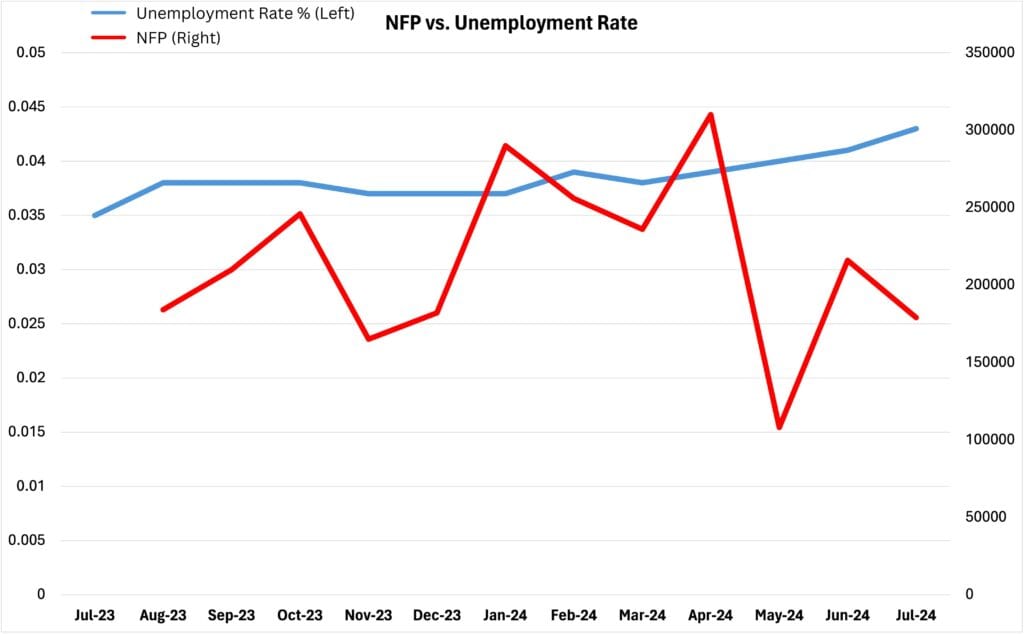

USA: Non-Farm Payrolls (NFP) – Job Market Jitters

The job market has been the centre of attention lately, and for good reason. Last month’s NFP was a decent 114k, but this month the consensus is a more robust 163k. It’s as if the job market is giving a little wave to say, “Hey, I’m still here!” No alarms are ringing yet, and while it’s not a parade, there’s certainly a sense of stability in the air.

To put this into perspective, the chart above juxtaposes the Non-Farm Payrolls data with the US unemployment rate, illustrating how job creation has correlated with unemployment trends in recent months. This visual reinforces the idea that, despite some fluctuations, the job market remains resilient.

Canada: BoC Interest Rate Decision – A Slice of Maple-Flavoured Caution

The Bank of Canada (BoC) is all set to make headlines again, and not for their poutine recipes. The central bank is widely expected to cut the overnight rate for the third consecutive meeting, with the goal of bringing it down to a more neutral level quickly. The expectation is for rates to drop to 3% by Q2 2025, like a cautious driver easing off the gas as they approach a bend in the road.

The BoC started this easing cycle on June 5th, buoyed by data that inspired confidence in inflation trending towards the 2% target. A follow-up cut on July 24th was backed by further evidence of “broad price pressures continuing to ease,” with excess supply keeping inflation at bay.

Since then, things have only cooled more. Business surveys show further softening, employment has dipped for the second month in a row, and headline inflation has relaxed to 2.5%, sitting comfortably within the BoC’s target range. It’s like the Canadian economy is bundling up for winter, preparing for a period of slower growth and reduced inflation.

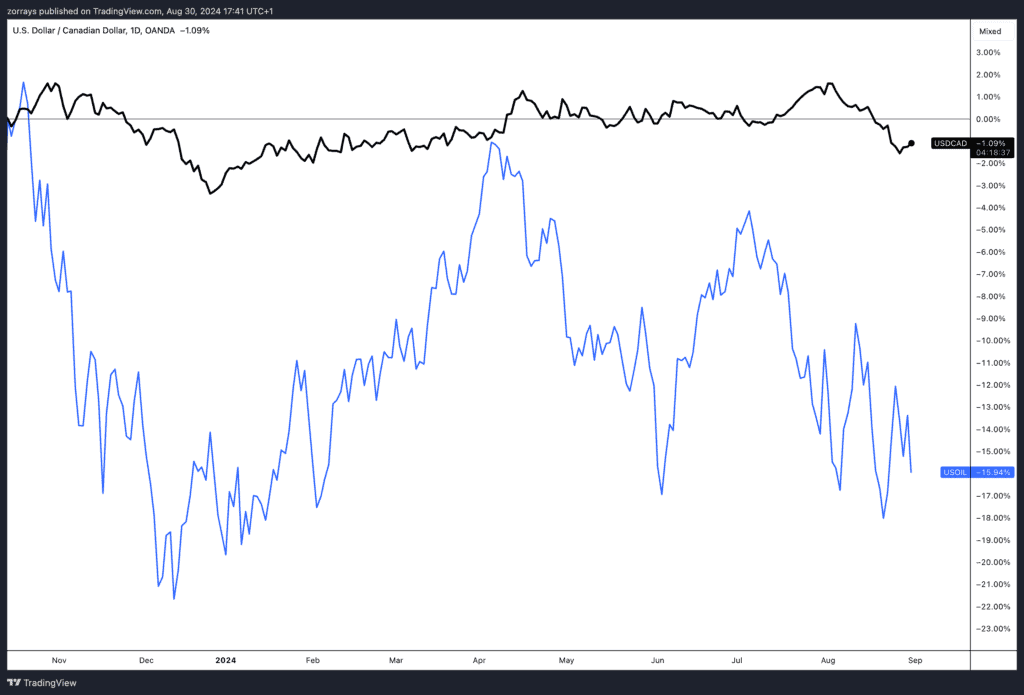

Given these conditions, we foresee further rate cuts. We’re in agreement with the market’s pricing of another 25 basis point cut on September 4th, with the overnight rate likely to settle around 3% by mid-2025. For the Canadian dollar (CAD), this isn’t particularly great news. With the BoC likely to cut rates three more times this year, CAD might struggle to outshine other pro-cyclical currencies like the AUD and NZD. Even as the USD shows a softer month, the CAD is unlikely to steal the spotlight.

For further context, the chart above tracks the relationship between the USDCAD exchange rate and crude oil prices. The Canadian dollar’s performance is closely tied to oil prices, and as we see oil prices shift, CAD tends to follow suit, providing insight into potential future movements.

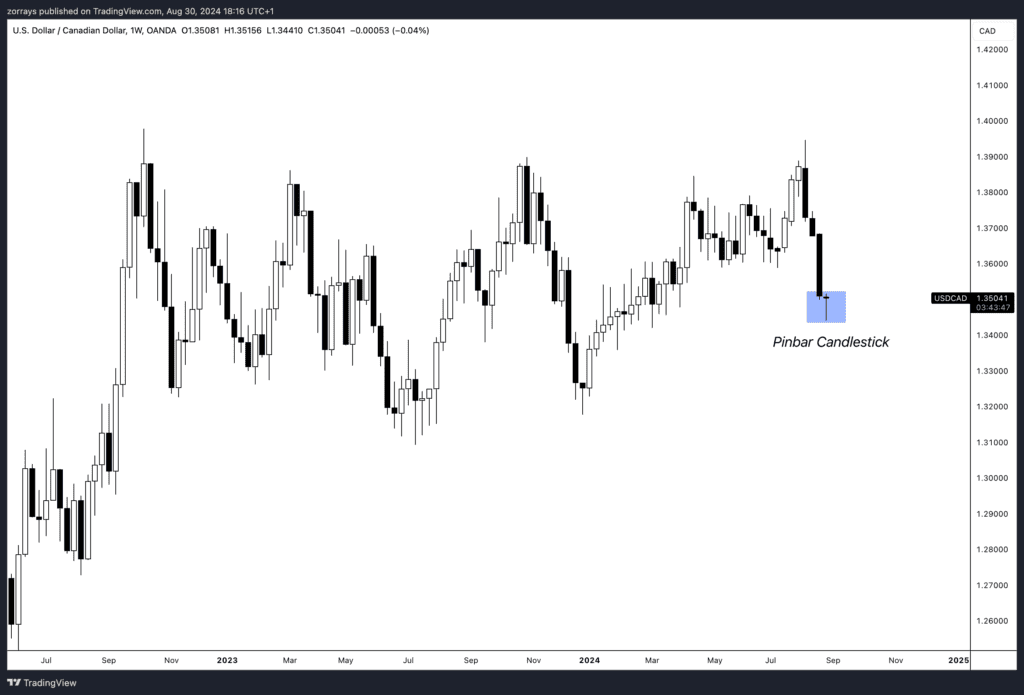

Technical Analysis: USDCAD – The Loonie Takes a Backseat

In the FX markets, the USDCAD might find some support, but don’t expect fireworks. As the BoC continues to trim rates, CAD’s appeal will likely diminish, especially against more attractive options like AUD and NZD. It’s a bit like turning up to a party where everyone else is in a snazzy outfit, and you’re in yesterday’s jeans—comfortable, but not exactly the life of the party.

Adding to the current outlook, we’re also seeing a pin bar candlestick formation on the weekly timeframe, signalling a potential turnaround. This suggests that while the USD has shown some recent softness, the market could be poised for a correction, making the upcoming weeks crucial for determining the direction of this pair.