- Weekly Outlook

- November 21, 2025

- 5 min read

The U.S. Dollar at a Crossroads: Why DXY at 100.000 Marks a Critical Turning Point for Global Markets

Understanding the Macro Backdrop: Data Delays and Fed Uncertainty

The U.S. Dollar Index (DXY) is hovering around a pivotal resistance level near 100.000, and it’s happening in one of the most uncertain macro environments in years.

The U.S. government shutdown has disrupted the collection and release of key economic data — including payrolls, CPI, and GDP revisions. With these reports delayed, the Federal Reserve will face its December meeting without the crucial insights that normally guide its decisions.

This creates a “blind spot” in policy-making. Without fresh inflation or employment numbers, policymakers are effectively flying blind, which makes a December rate cut extremely unlikely. The Fed tends to avoid acting without sufficient data, especially after the FOMC minutes showed members leaning against premature easing.

In other words, the near-term story is “delay, not cancellation.” Markets may still expect rate cuts by mid-2026, but the first move now looks postponed.

The Fed’s Dilemma: Flying Blind into December

When central banks lack data, they rely more heavily on anecdotal evidence like the Beige Book — qualitative reports from businesses across the U.S. economy. While useful, these are not market movers.

The practical outcome?

The Fed will likely keep its policy rate unchanged in December, waiting for clarity. This “wait-and-see” stance supports the U.S. dollar in the short term, as rate differentials remain favorable relative to other major economies.

Market Reactions: Volatility Without Direction

With CPI, jobs, and GDP data off the table, traders are forced to react to secondary indicators — ADP employment, ISM PMIs, and credit spreads. This reduces trend clarity but increases intraday volatility.

Risk assets — particularly high-duration tech stocks — tend to struggle in this type of environment. Without definitive macro signals, markets trade on narratives and sentiment, not hard data.

Expect choppy, range-bound price action across equities, while the dollar remains supported by cautious Fed rhetoric.

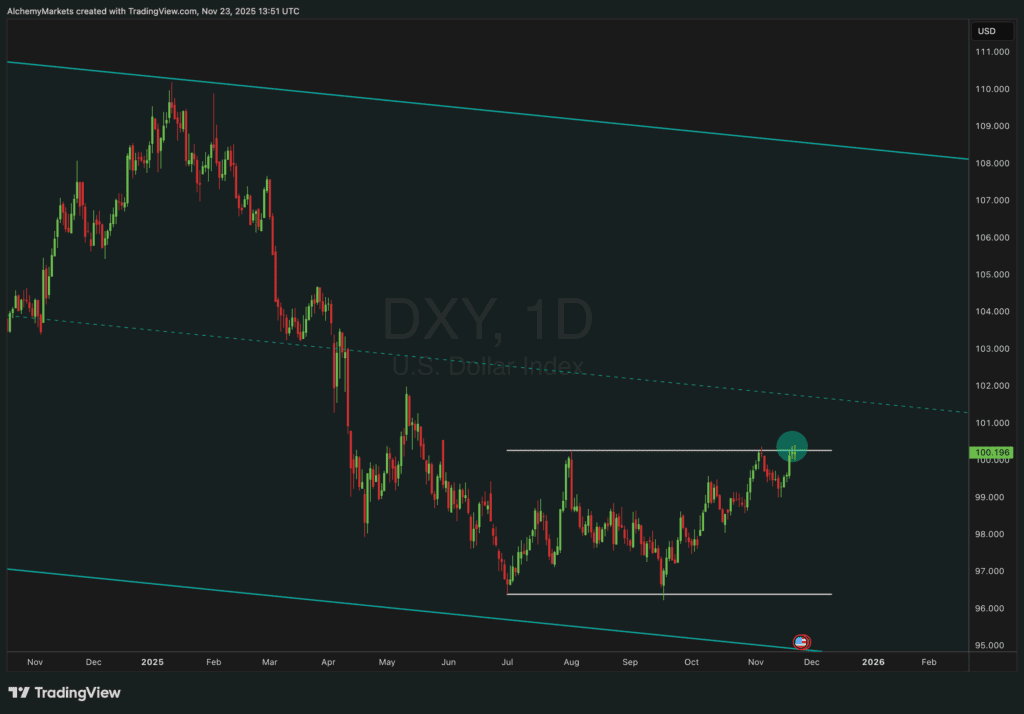

Technical Analysis: DXY’s Battle at 100.000 Resistance

The DXY daily chart (see below) reveals a clean technical setup. After months of range-bound movement between 96.000 and 100.000, the index now sits precisely at the upper boundary — a key inflection point.

Chart Overview and Key Levels

- Resistance: 100.000

- Immediate Support: 98.000

- Major Range: 96.000 – 100.000

- Medium-Term Trend: Downward channel (since early 2024)

The recent rally has brought DXY right into overhead resistance, where sellers previously dominated in August and October. The reaction here will determine whether the current rally evolves into a trend reversal or another failed breakout.

Bounce or Break? The Two Scenarios in Play

Bullish Breakout: Path to 102.00–103.00

If the dollar breaks and holds above 100.000, it would confirm renewed momentum, likely targeting 102.00–103.00 — aligning with the next descending trendline in the broader channel.

This scenario would suggest that markets are pricing in “higher-for-longer” U.S. rates, especially if global growth data weakens relative to the U.S.

Bearish Rejection: Retest Toward 98.00 Support

Conversely, if DXY fails to clear resistance, expect a swift rejection toward 98.00, and possibly the lower boundary near 96.000.

A rejection here would align with renewed risk-on sentiment — potentially driven by dovish rhetoric from the Fed or an easing of U.S. financial conditions.

Broader Implications: What DXY’s Next Move Means for Risk Assets

USD and Real Yields: The Case for Continued Strength

A stable or stronger dollar typically coincides with elevated real yields. That dynamic pressures gold and emerging market currencies, while benefiting sectors like defensive equities (utilities, healthcare).

Impacts on Equities, Bonds, and Commodities

- Equities: Tech underperforms; defensives outperform.

- Bonds: Front-end yields remain anchored; curve flattens.

- Commodities: Gold softens; oil reacts more to supply-side dynamics.

The UK Angle: Fiscal Tightening and GBP Sensitivity

Across the Atlantic, the UK faces its own macro crossroads. The government’s £30bn annual fiscal gap forces Chancellor Rachel Reeves to choose between tax hikes or higher borrowing.

Markets expect a combination of both, effectively tightening financial conditions.

For sterling, this means short-term support from fiscal credibility but longer-term headwinds if growth slows.

Gilts could rally if issuance expectations fall, but UK domestic equities — particularly retailers and housebuilders — may underperform if tax increases reduce disposable income.

FAQs

1. What is the DXY and why does it matter?

The DXY (U.S. Dollar Index) measures the dollar’s value against a basket of major currencies. It’s a key barometer of global financial conditions.

2. Why is the 100.000 level significant?

It marks a major resistance level, previously rejected multiple times. A break above would signal a potential trend reversal.

3. How do Fed decisions affect the dollar index?

Rate hikes or delayed cuts support the dollar by maintaining higher yields relative to other currencies.

4. What happens if the U.S. data delays continue?

Volatility rises as traders rely on incomplete information, and the Fed becomes more cautious with policy changes.

5. How does the UK budget influence global FX markets?

Fiscal credibility in the UK can stabilize GBP and influence cross-asset flows, especially into gilts.

6. What trading strategies work best in this environment?

Relative value and range-trading setups tend to outperform, as clear directional trends remain elusive.

Conclusion: Preparing for DXY’s Next Big Move

The U.S. Dollar Index (DXY) is at a make-or-break level around 100.000, coinciding with one of the most uncertain macro backdrops in recent memory.

Whether it breaks higher toward 102.00 or rejects back to 98.00, the move will set the tone for global markets into year-end.

With the Fed flying blind and data delayed, the dollar’s resilience may persist — at least until hard numbers return.

For now, traders should respect the range, monitor positioning closely, and prepare for volatility spikes as narratives shift faster than fundamentals.