- Weekly Outlook

- July 26, 2024

- 5 min read

Rate Rumble: BoJ, Fed, and BoE’s Decisions

This week is filled with significant economic events and data releases that could influence global markets. Key highlights include GDP data from the Euro Zone, interest rate decisions from major central banks, and critical inflation and employment figures.

Global Economic Overview

A focus on central bank policies and key economic indicators from the Euro Zone, Australia, Switzerland, and the United States.

Central Bank Policies

Bank of Japan (BoJ) Interest Rate Decision

- Date: July 30, 2024

- Current Rate: 0.10%

- Expected Decision: The BoJ recently ended its negative interest rate policy, raising rates to 0-0.1%. This move marks a cautious shift towards normalisation. Further rate increases are unlikely in the near term, with the BoJ focusing on maintaining accommodative conditions while monitoring inflation trends and economic recovery.

Federal Reserve (Fed) Interest Rate Decision

- Date: July 31, 2024

- Current Rate: 5.25%-5.50%

- Expected Decision: The Fed is expected to maintain its current rate, prioritising inflation control. Any future adjustments will depend on continued improvements in inflation data, with rate cuts potentially being considered later in the year if inflation stabilises.

Bank of England (BoE) Base Rate Decision

- Date: August 1, 2024

- Current Rate: 5.25%

- Expected Decision: The BoE is likely to cut its base rate to 5.00%, responding to easing inflationary pressures. The bank remains cautious due to persistent inflation in the services sector and wage growth, influencing its decision-making process.

Inflation and Growth Data

GDP QoQ (Q2) – Euro Zone

Source: Eurostats

- Date: Tuesday

- Overview: The Euro Zone’s GDP for Q2 is expected to show a modest growth of 0.2%, down from 0.3% in the previous quarter. This data will offer insights into the region’s economic recovery, highlighting the challenges and progress post-pandemic.

CPI (QoQ) (Q2) – Australia

Source: ABS

- Date: Wednesday

- Overview: Australia’s quarterly CPI is forecasted to rise by 0.7%, a decrease from the previous 1% increase. This slowdown indicates a potential easing in inflationary pressures, supporting a more dovish stance from the Reserve Bank of Australia moving forward.

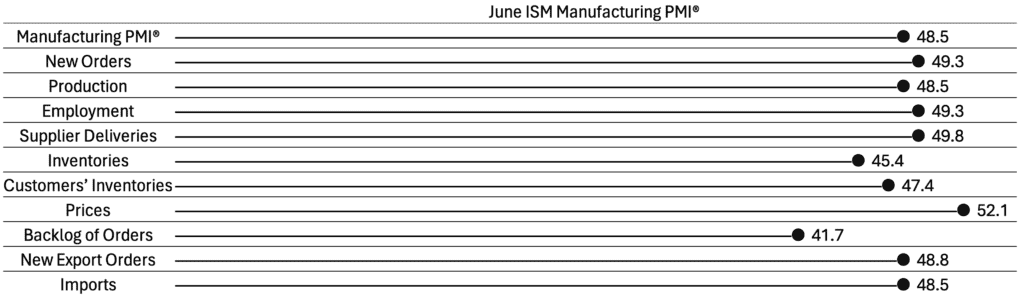

ISM Manufacturing PMI (July) – United States

Source: ISM

- Date: Thursday

- Overview: The ISM Manufacturing PMI is anticipated to slightly increase to 48.8 from 48.5, reflecting a gradual recovery in the manufacturing sector. Despite this improvement, the PMI remains below the neutral 50 mark, suggesting continued contraction and influencing the Federal Reserve’s cautious outlook on rate cuts later this year.

CPI (MoM) (July) – Switzerland

- Date: Friday

- Overview: Switzerland’s monthly CPI data will be crucial for assessing inflation trends. A stable or declining CPI could reinforce the Swiss National Bank’s recent rate cuts, aimed at stimulating economic growth while managing inflationary expectations.

Quarterly PPI Figures – Australia

- Date: Friday

- Overview: Australia’s Producer Price Index (PPI) will provide key insights into cost-push inflation within the supply chain. Stable or lower-than-expected PPI figures may signal easing inflationary pressures, further supporting a dovish outlook from the Reserve Bank of Australia.

Employment Trends

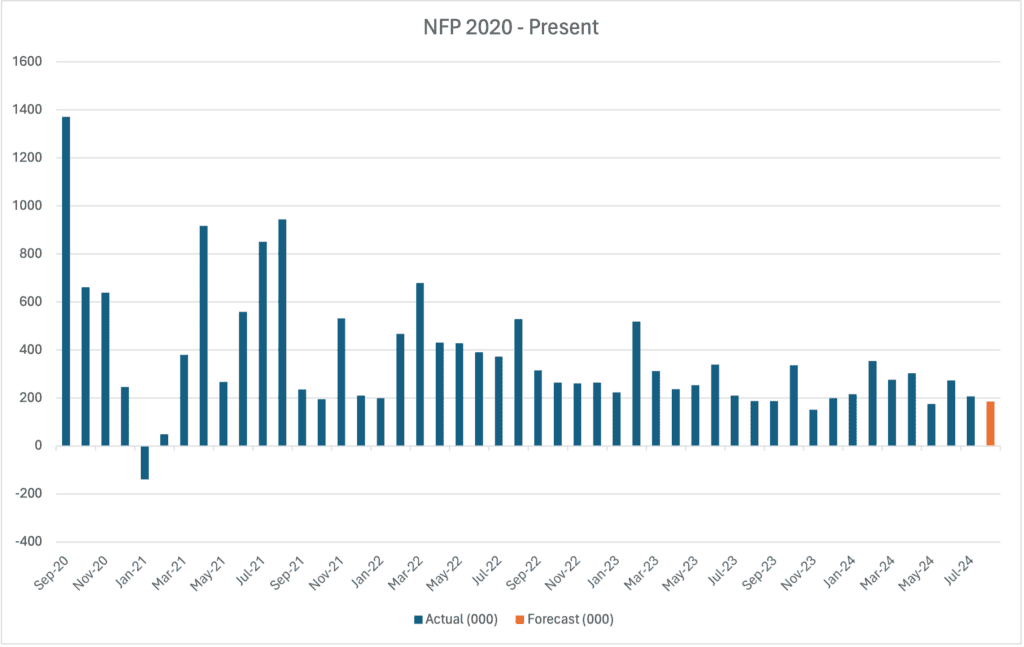

Non-Farm Payrolls (NFP) – United States

- Date: Friday

- Overview: The upcoming Non-Farm Payrolls (NFP) report is crucial for assessing the U.S. labour market’s health. Analysts expect an increase of approximately 180,000 to 190,000 jobs for the month, down from previous figures. The unemployment rate is forecasted to remain around 3.8%. This data will provide key insights into the Fed’s next policy moves, as employment trends are a significant factor in determining monetary policy direction. A stronger-than-expected job report could reinforce the Fed’s cautious stance on future rate cuts.

Technical Analysis

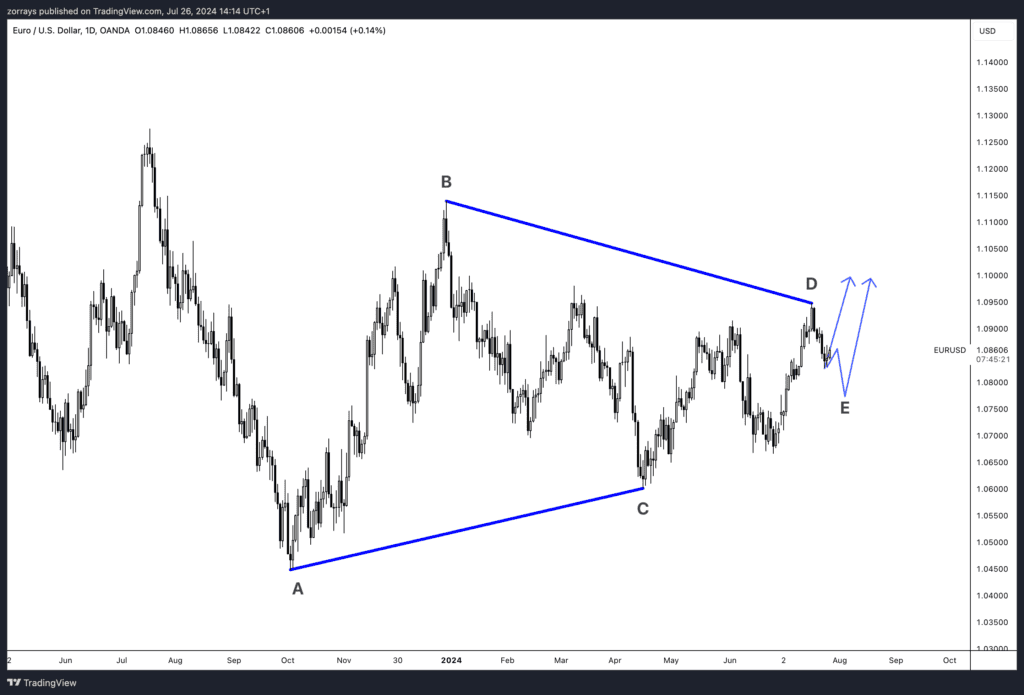

EURO

Upward Arrow (Bullish Scenario)

The bullish scenario for the EUR/USD pair hinges largely on the potential for weaker U.S. economic data, particularly the upcoming Non-Farm Payrolls (NFP) report. Should the NFP numbers fall short of expectations, it would signal a cooling U.S. labor market, which might prompt the Federal Reserve to delay or even consider cutting interest rates sooner than anticipated. A dovish shift by the Fed, characterized by lower interest rates, tends to weaken the U.S. dollar, thereby making the euro relatively stronger. This dynamic could propel the EUR/USD pair upwards as investors seek higher returns in other currencies.

Additionally, stronger-than-expected economic data from the Euro Zone could bolster the euro. For instance, if Q2 GDP data shows robust growth or if CPI figures indicate rising inflation, it might compel the European Central Bank (ECB) to adopt a more hawkish monetary policy stance. A stronger economic outlook and potential for tighter monetary policy would likely attract investment into the euro, further supporting the upward movement of the EUR/USD pair.

Downward Arrow (Bearish Scenario)

Conversely, a bearish scenario could unfold if the U.S. NFP report shows stronger-than-expected job growth, indicating a resilient labor market. Such data could support the Federal Reserve’s current policy trajectory or even encourage a more hawkish stance, where the Fed may continue raising interest rates to curb inflation. Higher U.S. interest rates typically strengthen the U.S. dollar, as investors seek better returns, thereby exerting downward pressure on the EUR/USD pair.

On the other hand, weaker economic performance in the Euro Zone could also lead to a bearish outlook for the EUR/USD. If the region’s GDP growth rate is lower than expected or if inflation remains subdued, the ECB might maintain or even enhance its accommodative monetary policies. This could weaken the euro, making it less attractive to investors and pushing the EUR/USD pair lower.

In summary, the EUR/USD pair’s direction will likely depend on the relative strength of economic data from both the U.S. and Euro Zone, and the subsequent monetary policy responses from the Federal Reserve and ECB.