- Weekly Outlook

- September 6, 2024

- 7 min read

Inflation Eases, Rate Cuts Loom, Growth Slows

This past week, we’ve seen a mix of signals from the economy, and the data released highlights just how complex and nuanced the landscape is right now. Understanding these developments is key to staying ahead, whether you’re an investor, a trader, or someone closely watching global markets.

Mixed Signals from the U.S. Labor Market Raise Doubts Ahead of Fed’s Next Move

The latest Non-Farm Payrolls (NFP) report showed slower-than-expected job growth, with downward revisions casting doubt on the labor market’s strength. While the unemployment rate dipped slightly, weakness in key sectors like manufacturing and retail persists. Growth remains concentrated in lower-paying, less secure jobs, reinforcing concerns about a softening labor market. With inflation easing, the Federal Reserve faces growing pressure to cut rates, potentially by 50bps, to get ahead of further labor market weakness.

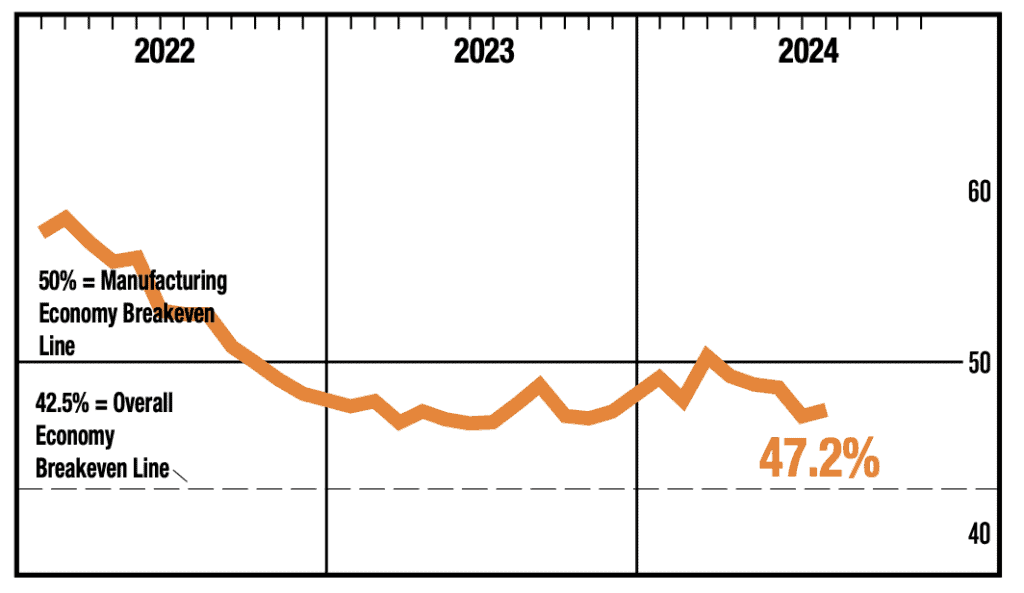

Let’s start with the ISM Manufacturing PMI

Source: ISM World

It wasn’t the best news. The PMI came in below expectations at 47.2, falling further below the 50-point threshold that separates expansion from contraction. What’s more, new orders have slowed down significantly, dropping by -2.8%, signalling that growth is tapering off. This is a key metric because it suggests businesses are becoming cautious, likely in response to softening demand.

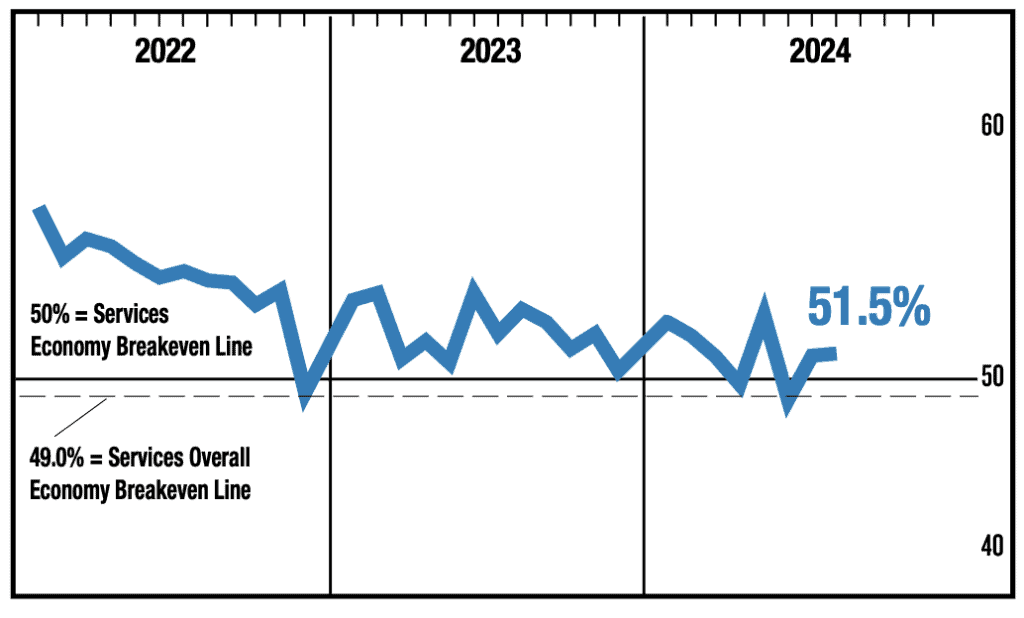

ISM Services PMI

Source: ISM World

Contrast that with the ISM Services PMI, which delivered a bit more optimism. The Services PMI came out slightly above expectations at 51.5, showing that this sector still has some resilience. It’s not a huge increase, just 0.1%, but the fact that it’s holding above 50 indicates that the service sector—often a bellwether for consumer spending—remains in positive territory.

This paints a somewhat conflicting picture. Manufacturing is clearly slowing, while services are still holding on, albeit by a thread. What does this tell us? It’s a reflection of broader economic trends where goods demand is cooling, but services, which consumers can’t cut back on as easily, are faring better.

On to the Bank of Canada (BoC)

The BoC’s stance continues to lean dovish, as expected. This past week, they cut their benchmark rate by 25 basis points, bringing it down from 4.5% to 4.25%. This move wasn’t a surprise to many, but what’s key here is the BoC’s growing concern about inflation potentially dropping below their target of 2%. With that in mind, expect more cuts ahead—forecasts suggest we could see the rate hit 3.75% by the end of the year.

Why does this matter? Because rate cuts are generally a sign that the central bank is trying to prevent the economy from cooling too much, especially when inflation is no longer the biggest concern. But, in doing so, the BoC is walking a fine line, balancing between supporting growth and avoiding an inflationary spiral.

Looking ahead to next week, we’re all eyes on the U.S. inflation data

Data Source: Investing

The CPI (Consumer Price Index) is expected to show a decline from 2.9% to 2.6%. This would align well with the Federal Reserve’s ongoing dovish approach, which has been shifting from fighting inflation to managing a soft landing for the economy. In my view, this drop in inflation will provide the Fed with more justification to keep rates steady or even consider cuts later in the year. The slowdown is a sign that inflationary pressures are indeed easing, but it also speaks to a potential slowdown in broader economic activity—something that could weigh on markets.

Also on the horizon is the Michigan Consumer Sentiment Index, with a preliminary read for September expected to tick up from 67.9 to 68. It’s not a massive increase, but it’s a positive signal nonetheless. Why does it matter? Because consumer sentiment is a leading indicator—when confidence rises, it usually translates into higher spending, which in turn supports GDP growth. A small increase like this suggests that U.S. economic activity might remain stable for the near term, even with the inflationary slowdown.

And then there’s the European Central Bank (ECB)

The ECB is also facing some tough decisions. Economists are predicting that they’ll cut their rate from 4.25% to 4% in an effort to stimulate growth. The Eurozone isn’t technically in a recession, but let’s not sugarcoat it—the economy is crawling forward at a snail’s pace. The fading inflationary pressures are the ECB’s strongest argument for cutting rates. However, wage growth remains high, and there are still significant expectations for selling price increases. This means that the inflation fight isn’t quite over, and further cuts beyond September might be a tough sell.

Here’s my take: while inflation is coming down, it’s not disappearing overnight. The ECB, like the Fed and the BoC, will likely tread carefully. We shouldn’t expect any major forward guidance from next week’s ECB meeting. The central bank will likely stick with its data-dependent narrative, letting the numbers guide their moves. It’s worked so far, so why change?

Technical Analysis

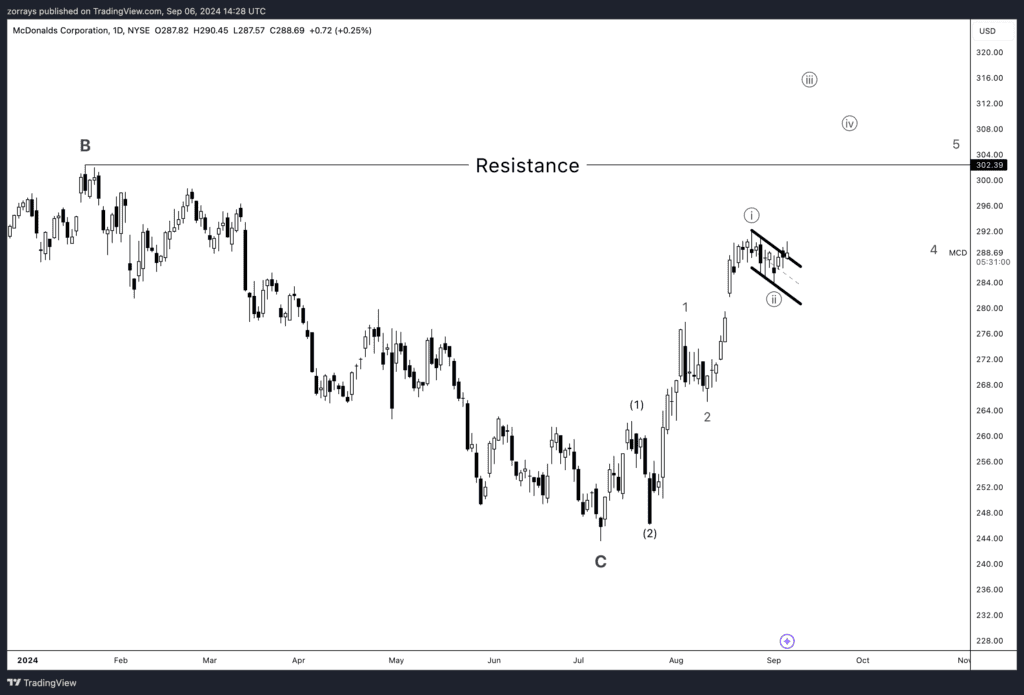

I’ve been bullish on both McDonald’s (MCD) and EUR/USD, and recent price action is confirming that bias with a series of 1-2, 1-2 waves unfolding on both charts. This pattern is typically a precursor to a significant impulse move to the upside, signaling that the bullish momentum is likely to continue.

McDonald’s (MCD)

For McDonald’s, the price has rallied strongly off the lows and is now forming a series of 1-2 patterns, indicating that the bullish trend remains intact. However, we are now approaching a critical resistance level around 302.39. This level has historically acted as a strong barrier, and we want to see the price break above it to confirm further upside potential. If McDonald’s can decisively push through this resistance, it opens the door for a move towards the next higher targets, potentially above 320. Until then, the resistance could pose a short-term hurdle.

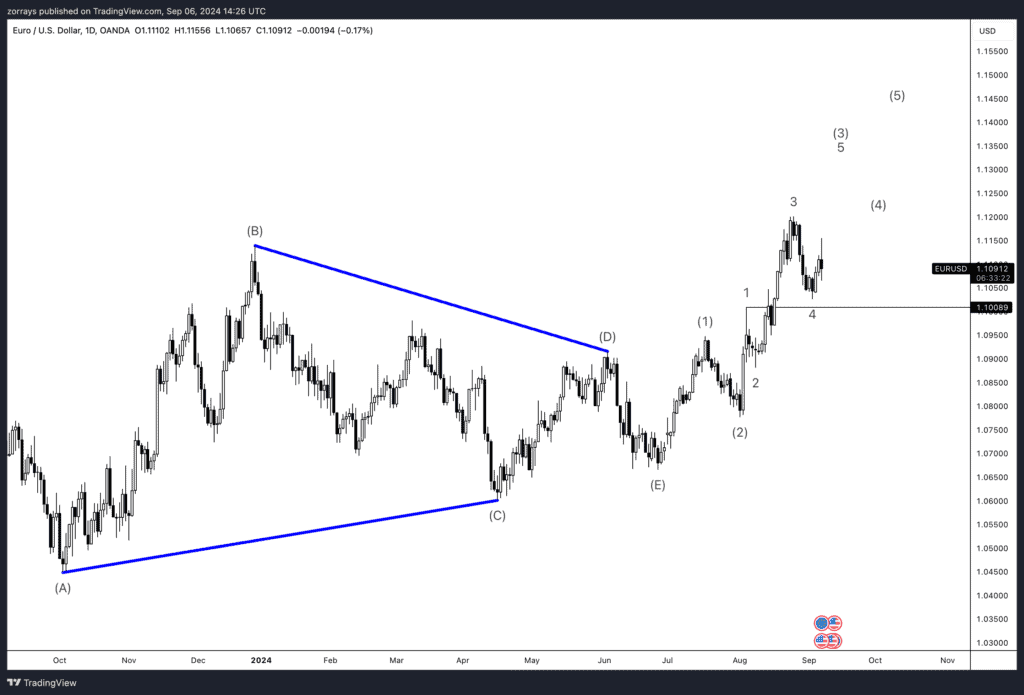

EUR/USD

Similarly, EUR/USD has also been unfolding a series of 1-2, 1-2 waves, which suggests the bullish trend is far from over. The recent breakout from the triangle pattern indicates that the pair has more room to rally. We’re currently seeing a minor correction, but this is likely just a consolidation phase before the next impulsive move higher. As long as the price stays above key support at 1.10089, I remain confident in the bullish outlook, targeting further gains towards 1.1350 and beyond.

In both cases, the 1-2, 1-2 structure is a powerful bullish signal, and I expect continued strength in the near term, provided that key resistance levels are cleared and supports hold firm.

Final Thoughts on What’s to Come

The big takeaway here is that we’re in a period of economic transition. Central banks are shifting gears from aggressive rate hikes aimed at curbing inflation to a more nuanced approach aimed at sustaining growth without reigniting inflationary pressures.

In the U.S., inflation is coming down, and while that’s a good thing for consumers, it’s also a signal that growth may be slowing. Canada’s central bank is already cutting rates, and Europe is on the cusp of doing the same. The balance between inflation and growth will be delicate in the coming months.

Next week’s inflation numbers and consumer sentiment data will be critical to watch. While markets have priced in a lot of this already, surprises could still sway sentiment. Keep an eye on how these numbers shape central bank policies moving forward.