- Weekly Outlook

- January 3, 2025

- 5 min read

Examining ISM Data and Key Events Ahead

Reflecting on Today’s ISM Manufacturing Data

After a prolonged slump over the past two years, the December ISM Manufacturing Index has offered a glimmer of hope with stronger-than-expected results. The index rose to 49.3, up from 48.4 in November and exceeding the consensus forecast of 48.2. While the reading still indicates contraction (below the 50.0 level), the improvement marks a critical step forward for a sector that has faced persistent headwinds.

The standout drivers were the production component, which surged to 50.3—its first expansionary reading since May—and new orders, which climbed to 52.5, marking two consecutive months in growth territory. These gains hint at a potential revival in manufacturing, likely aided by factors such as the return of Boeing workers following labor strikes. However, caution persists, as the employment component dropped to 45.3, signaling continued job losses in the sector. Additionally, the backlog of orders remains in contraction, reflecting lingering uncertainty about sustained demand.

Tariff concerns and international supply chain disruptions continue to weigh heavily, especially for exporters and firms reliant on global trade. Nevertheless, with parts of the West Coast showing stronger-than-expected activity (as evidenced by the absence of weak regional data west of the Rockies), there is hope for a more balanced recovery across geographies.

Key Events to Watch Next Week

ISM Services PMI (Wednesday, January 8, 2025)

The spotlight will shift to the ISM Services PMI, with the consensus expecting a rise to 53.5, up from 52.1 in December. Unlike manufacturing, the services sector has remained more resilient amid Federal Reserve tightening. A strong performance here would underscore the broader economy’s adaptability to higher interest rates. Key components to watch include business activity and employment, as these could offer early insights into the health of the labor market ahead of Friday’s non-farm payroll report.

Non-Farm Payrolls (Friday, January 10, 2025)

All eyes will be on the December non-farm payrolls, where the forecast stands at 150,000, a notable drop from the 227,000 jobs added in November. While the slowdown may indicate cooling labor demand, it could also reflect seasonal adjustments and shifts in hiring patterns during the holidays. The unemployment rate and average hourly earnings will be equally critical, as they provide deeper insights into wage pressures and consumer spending power—key factors for the Federal Reserve’s inflation outlook.

If the jobs data underwhelms expectations, it could bolster market sentiment that the Fed may pause further rate hikes sooner rather than later. Conversely, a stronger-than-expected reading could reinforce the central bank’s hawkish stance.

Technical Analysis: USD/JPY Outlook

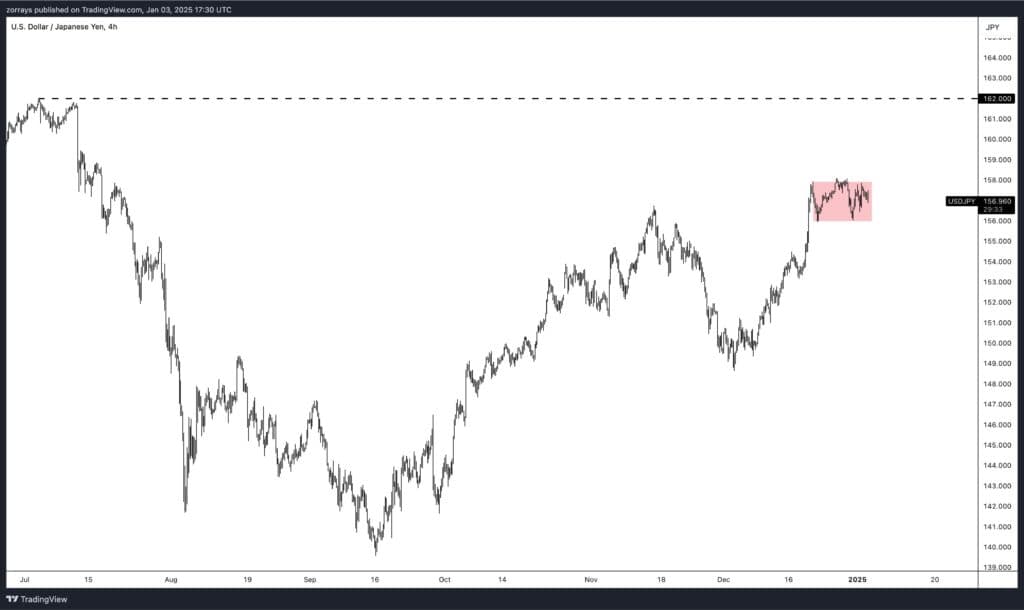

The USD/JPY pair has been consolidating in a sideways range over the past few trading sessions, with resistance near the 158.000 level and support around 156.500. A breakout above the upper boundary of this range could set the stage for a bullish move, targeting the next major resistance at 162.000.

The bullish bias is supported by improving risk sentiment, as evidenced by today’s stronger ISM manufacturing data. Additionally, an uptick in the ISM Services PMI next week could further fuel USD strength, particularly if coupled with resilient payroll numbers. On the downside, a break below 156.500 could signal bearish momentum, potentially opening the door to support near 154.000.

Key levels to watch:

- Resistance: 158.000 (current range top), 162.000 (next key level)

- Support: 156.500 (current range bottom), 154.000 (strong support zone)

Broader Market Implications

With manufacturing showing signs of life, services likely to post gains, and payrolls expected to moderate, the outlook for the U.S. economy remains cautiously optimistic. The Federal Reserve’s current monetary policy appears to be taming inflation without tipping the economy into a significant downturn. However, ongoing weakness in manufacturing employment and a potential deceleration in hiring across the broader economy warrant close monitoring.

For traders and investors, next week’s events will play a pivotal role in shaping market sentiment and the trajectory of the U.S. dollar. Strong data could push USD/JPY higher, while softer numbers might trigger a risk-off response, benefiting safe-haven assets like the Japanese yen and Treasuries.

FAQs

1. What does the ISM Manufacturing Index tell us about the economy?

The ISM Manufacturing Index provides insights into the health of the manufacturing sector by measuring new orders, production, employment, and supplier deliveries. A reading above 50 indicates expansion, while below 50 signals contraction.

2. Why is the ISM Services PMI important?

The ISM Services PMI gauges the performance of the services sector, which constitutes the majority of U.S. economic activity. It’s a critical indicator of business sentiment and consumer demand.

3. How could December’s non-farm payrolls affect USD/JPY?

Stronger-than-expected payrolls could boost the U.S. dollar, driving USD/JPY higher. Conversely, weaker data might prompt a sell-off in the dollar, benefiting the yen.

4. What is driving USD/JPY’s recent price action?

USD/JPY has been consolidating amid mixed economic data. A breakout above the current range could signal bullish momentum, while a breakdown could suggest renewed yen strength.

5. How do tariffs and global supply chains impact U.S. manufacturing?

Tariffs and supply chain disruptions create uncertainties for manufacturers by increasing costs and complicating operations, especially for exporters and firms reliant on global trade.

6. What could the Federal Reserve do next based on upcoming data?

The Fed’s decision will hinge on economic resilience. Strong ISM and payrolls data could justify additional rate hikes, while weaker readings might prompt the Fed to pause or ease monetary tightening.

Conclusion

This week’s ISM manufacturing report has provided some optimism for the U.S. economy, but caution remains warranted. As we look to next week’s ISM Services PMI and non-farm payrolls, market participants should prepare for potential volatility in the U.S. dollar, particularly against the yen. The USD/JPY pair, in particular, is primed for a significant move, with the technical setup suggesting a bullish breakout on strong economic data.