- Weekly Outlook

- July 18, 2025

- 4 min read

Housing Slump and a Silent Fed – Closer Look At the Euro-Yield

Global Tensions, Steady Growth: What’s the Disconnect?

Trade wars and tariffs usually scare businesses into pulling back. They delay investments, cut hiring, and often scale down expansion. That’s the usual pattern. But this time around? Things are playing out differently.

Global trade policy uncertainty remains high, especially in light of potential new U.S. tariffs. But despite this, economic momentum hasn’t dipped much. According to market analyst Briggs, this is largely due to easier financial conditions—think low interest rates and accommodating central banks.

“Companies might see little need to alter their behavior when the market is telling them that the outlook is okay,” Briggs says.

In specific pockets—like the construction of new factories in emerging markets—there’s been some hesitation. But overall, businesses seem unfazed by the noise. Briggs expects the real drag on growth to come from the actual impact of tariffs later in the year, not from the threat of them.

U.S. Outlook: Housing Slump and a Silent Fed

Next week is relatively quiet on the U.S. economic front as the Federal Reserve enters its pre-meeting blackout period. No official commentary will be made ahead of the July 30 FOMC meeting.

Key Events to Watch:

- Thursday – New and Existing Home Sales (June)

Mortgage rates are creeping up again, straining affordability and weakening demand. The National Association of Home Builders reported this week that buyer interest is at historic lows—only the 2008 crisis and COVID lockdowns had worse traffic. - Friday – Durable Goods Orders (June)

Expect a significant drop due to wild fluctuations in Boeing aircraft orders. However, if we strip out defense and aircraft, the core data still shows a sluggish business investment trend.

Eurozone: ECB Likely to Sit Tight

The European Central Bank will hold its latest policy meeting on Thursday. Though pressure is building—especially with looming U.S. tariffs—the ECB is expected to keep rates unchanged.

Why? Two reasons:

- No escalation yet – The next round of tariffs isn’t expected until August 1. The ECB typically reacts to policies once they are enacted, not preemptively.

- Euro strength is moderate – The currency has strengthened slightly since the last meeting, but not enough to warrant action.

Even with growing risks to European growth, most ECB policymakers appear set on a wait-and-see strategy, likely debating a cut in September instead.

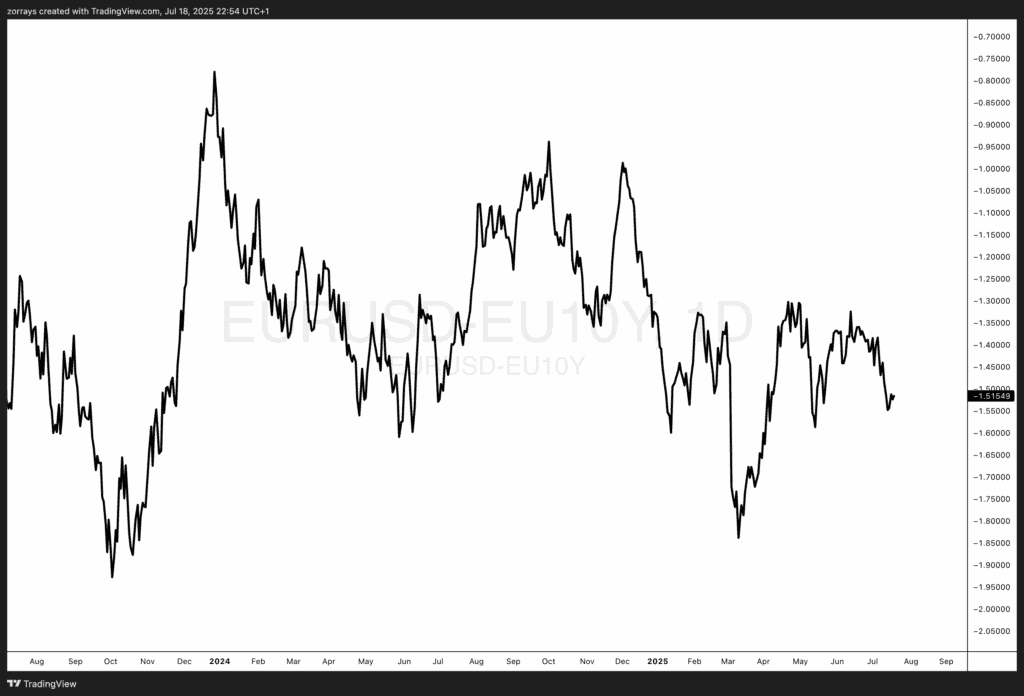

Euro-Yield Ratio

To better understand the eurozone’s current monetary landscape, we can look at a ratio chart comparing the EUR/USD exchange rate to the Eurozone 10-year government bond yield (EU10Y). This Euro-Yield Ratio provides a deeper macro view by showing how the euro’s value is performing relative to domestic interest rates. When yields rise, the euro typically strengthens—since higher returns attract capital. However, this chart shows the ratio is dropping steadily, meaning the euro is underperforming relative to bond yields.

From an educational standpoint, this divergence is important. It tells us that despite firm or even rising yields—normally a bullish signal for a currency—the euro is losing ground. That suggests investors may lack confidence in the eurozone’s growth outlook or are prioritising safer havens like the U.S. dollar. It aligns with the view expressed earlier in this article: the ECB is likely to remain cautious, not because rates are too high, but because the underlying economic sentiment is fragile. This chart adds nuance to the policy outlook—it’s not just about where yields are, but whether those yields are translating into investor confidence. Right now, the answer appears to be: not quite.

Market Highlights: What to Watch (July 21–25)

| Date | Region | Event |

|---|---|---|

| Mon July 21 | U.S. | Leading Indicators (Jun) |

| Tue July 22 | U.S. | Richmond Fed Manufacturing Index (Jul) |

| Wed July 23 | U.S. | Existing Home Sales (Jun); Japan: Machine Tool Orders |

| Thu July 24 | U.S./Eurozone/Canada | U.S.: New Home Sales; Eurozone: ECB Meeting; Canada: Retail Sales |

| Fri July 25 | U.S./Japan/UK | Durable Goods Orders (Jun); Japan: Indicators; UK: Retail Sales |

The Fed’s Dilemma: Waller Pushes for a Cut

While the Fed remains in its quiet period, the policy debate is intensifying behind closed doors. Fed Governor Christopher Waller has voiced support for a 25-basis-point rate cut at this month’s meeting, citing:

- Slowing job market momentum

- Downside risks to growth

- Confidence that tariff-related inflation is temporary

Yet, many of his colleagues seem more cautious. With inflation still above target and the economy proving resilient, they prefer to wait for more data before making a move.