- Weekly Outlook

- October 4, 2024

- 5 min read

Global Markets on Edge: Middle East Tensions and New Zealand’s Rate Cut Shake Up Outlook

This week has been marked by a strong bullish run for the US dollar, bolstered by a hectic combination of central bank news and ongoing geopolitical concerns. Federal Reserve Chair Jerome Powell made headlines early in the week by pushing back against the idea of a 50-basis-point (bp) rate cut by year-end, an unusually firm stance that injected some volatility into currency markets. On the geopolitical front, Israel’s ground offensive in Lebanon added to market uncertainties. Typically, such a combination would spur a rally in the dollar; however, market sensitivity to both Fed signals and Middle Eastern conflicts appears to have diminished in recent sessions.

On the Fed front, Powell’s comments on Monday gave markets specific guidance, revealing that the central bank’s base case is for two 25bp hikes by year-end. His explicit remarks aimed to temper market expectations, which had become increasingly dovish since September’s unexpected 50bp cut. Despite Powell’s guidance, the Fed Funds Futures market is still factoring in 70bp of cuts by December, reflecting a broader sentiment that softer economic data could once again push the Fed into action. This divergence between Powell’s hawkish stance and market expectations suggests that near-term risks are skewed to the upside for the dollar, especially if upcoming data strengthens the case for continued tightening.

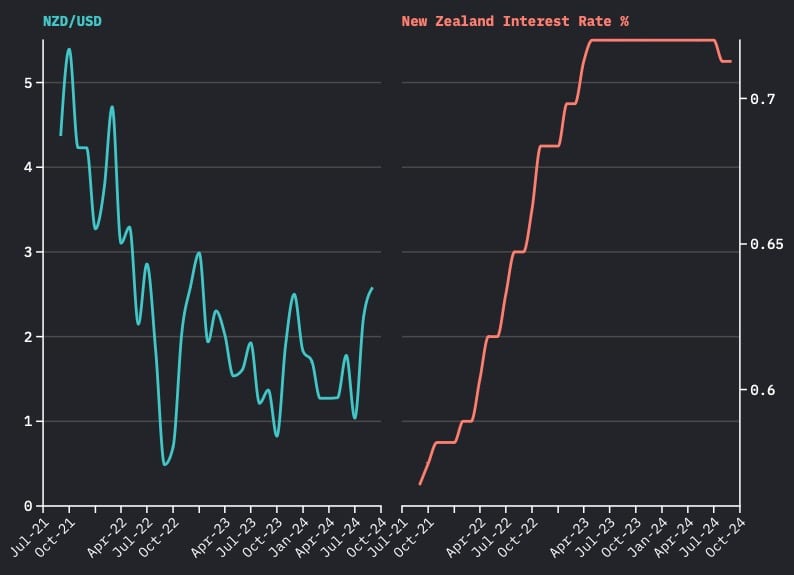

New Zealand Set for Rate Cut on 9th October

Data Source: Trading Economics and Yahoo Finance

Looking ahead, attention will turn to the Reserve Bank of New Zealand (RBNZ), which is expected to follow the Fed’s lead on 9th October with a 50bp rate cut, bringing the cash rate from 5.25% to 4.75%. The case for such a move is clear: a slowing economy, negative growth in Q2, and easing inflationary pressures are prompting calls for more aggressive easing to stimulate growth. In Q2, New Zealand’s GDP shrank by 0.2%, translating into a -0.5% year-on-year drop. While this was not as severe as some had expected, it nonetheless highlights the loss of economic momentum and strengthens the case for faster rate cuts.

The last CPI report, published in July, showed inflation slowing to 3.3%, lower than market expectations. Still, non-tradable inflation—typically stickier and harder to reduce—remained elevated at 5.4%. As the RBNZ hasn’t received updated inflation data since, its decision will likely rest on optimism around the broader disinflationary trend.

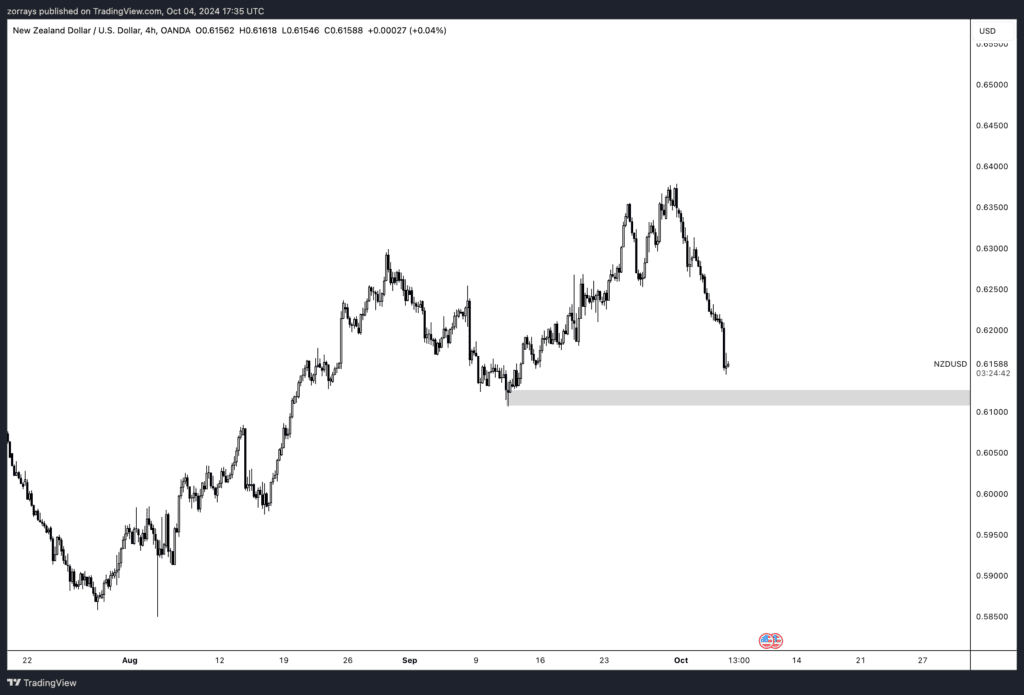

Market Expectations and FX Impact

Market pricing for the October RBNZ meeting reflects expectations of a 50bp cut, with a further 50bp reduction expected by November. While this dovish stance could be scaled back depending on incoming US data, particularly after stronger-than-expected US payrolls, the New Zealand dollar (NZD) will likely remain under pressure. A 50bp cut will leave the RBNZ more aligned with market expectations, and unless there is clear communication ruling out further aggressive cuts, the NZD is unlikely to recover significantly in the near term. We expect NZD/USD to trade close to 0.6100 before the US elections, particularly if global risk sentiment remains fragile due to ongoing Middle East tensions.

US CPI Data Set to Drop

Next week will also see the release of the latest US Consumer Price Index (CPI) data, which is expected to show a decline from 2.5% to 2.3%. This would bring inflation closer to the Fed’s target and could provide additional clues about the future path of interest rates. However, much of this outcome appears to have already been priced in by the market, reducing the likelihood of significant dollar volatility unless the data diverges sharply from expectations.

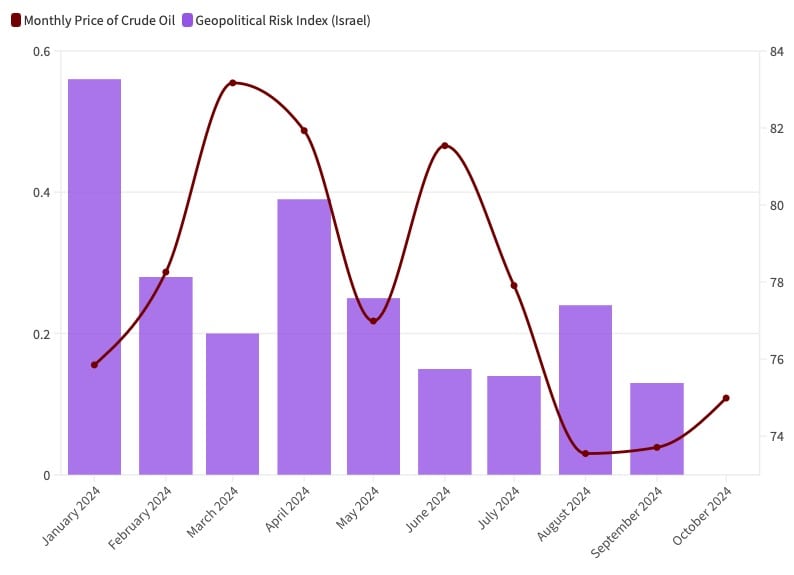

Middle Eastern Tensions and Oil Prices

Data Source: Yahoo Finance and MacroMicro

Oil prices have surged more than 8% amid escalating tensions following Iran’s missile attack on Israel, with further increases possible if the situation worsens. President Biden’s comment on supporting an Israeli strike on Iranian oil infrastructure has heightened concerns over potential disruptions in Persian Gulf oil flows, including through the Strait of Hormuz, a critical chokepoint for nearly a third of global seaborne oil trade. A loss of Iranian oil exports, particularly if midstream or upstream assets are hit, could remove up to 1.7 million barrels per day from the market, pushing oil prices higher and increasing the risk of a supply deficit through 2025. Additionally, disruptions to LNG flows from Qatar could severely impact global gas markets, especially during the high-demand winter months.

While strategic reserves may offer some relief, the risk of escalation remains, especially if the Strait of Hormuz is affected. With much of OPEC’s spare production capacity concentrated in the Gulf, any blockade could limit the group’s ability to counterbalance supply losses, potentially driving prices to new record highs.

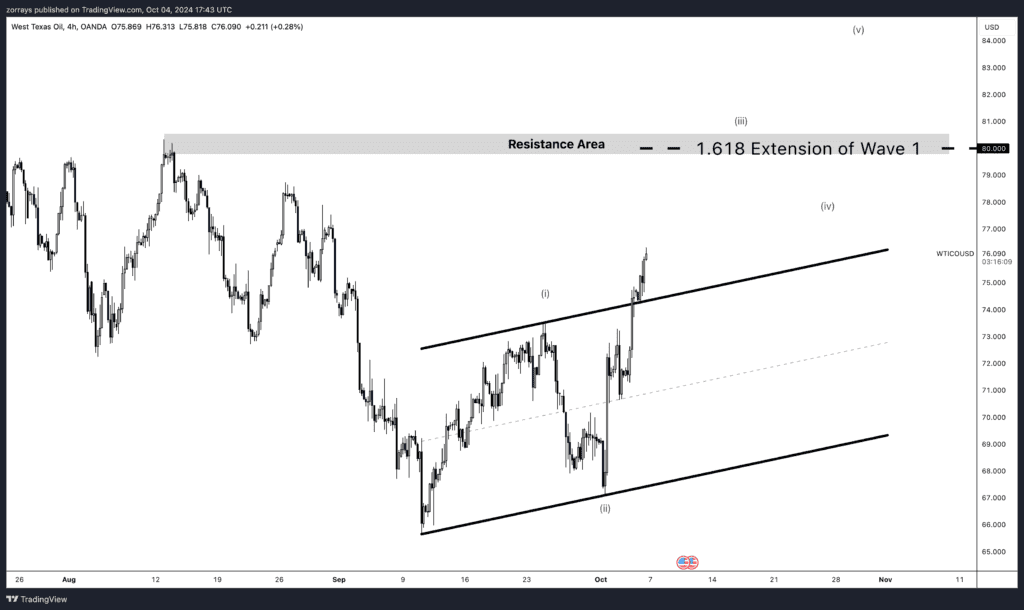

U.S Oil Medium Term Projections

This is my medium-term projection for oil prices, especially considering the potential for Israel’s retaliation to reduce supply. I expect prices to reach the $80 resistance area, which aligns with the 1.618% extension of wave 1 and could play into a larger wave 3 formation. While there’s a chance of a bounce from this resistance, leading to a corrective move downward, my current outlook is bullish for oil in the coming weeks. The geopolitical situation will be key in determining the next steps for the market.

Conclusion

As we look ahead to next week, the global economic outlook remains heavily influenced by both central bank actions and geopolitical developments. The Fed’s hawkish stance, coupled with market pricing for dovish outcomes, suggests that the dollar could remain strong in the near term, especially if economic data supports further tightening. Meanwhile, the RBNZ’s anticipated rate cut highlights the diverging policy paths of global central banks as they grapple with slowing growth and disinflationary pressures. Finally, with ongoing geopolitical risks in the Middle East, particularly around oil supply disruptions, market volatility is likely to remain elevated, leaving investors to navigate a complex and rapidly changing environment.