- Weekly Outlook

- November 22, 2024

- 5 min read

Global Markets on Edge: Key Inflation and GDP Data to Shape the Week Ahead

The global economy is entering a pivotal week, with key data releases poised to influence market sentiment and shape monetary policy expectations. Major events include inflation updates from the United States and the Eurozone, along with crucial GDP figures from Canada. Here’s a detailed look at the economic calendar and what’s at stake in the days ahead.

United States: Inflation Report (Wednesday)

The focus next week will be on the core Personal Consumer Expenditure (PCE) deflator, a favoured inflation gauge for the Federal Reserve. This data will play a critical role in shaping the Fed’s next move. Markets remain evenly split on whether the Fed will cut rates by 25 basis points (bps) in December or hold off until January.

The core PCE deflator reflects contributions from both the Consumer Price Index (CPI) and the Producer Price Index (PPI). Current forecasts suggest a monthly increase of 0.3%, a rate that’s still too high for the Fed to achieve its 2% annual inflation target. To hit this target, the monthly inflation rate needs to average 0.17% over time, making the upcoming data pivotal.

For a rate cut on December 18 to materialise, additional supportive data will be required:

- A soft jobs report on December 6.

- Subdued core CPI and PPI readings on December 11 and 12, respectively.

While these outcomes are possible, the market should remain cautious as they are far from guaranteed. Traders should monitor any shifts in Fed commentary and broader market sentiment leading up to Wednesday’s release.

Eurozone: November Inflation & Economic Sentiment (Friday)

The Eurozone’s November inflation report is due on Friday, and the data is expected to trend upward, driven primarily by base effects. While rising inflation may raise eyebrows, the broader economic picture is becoming more complex.

At the October press conference, ECB President Christine Lagarde painted a downbeat picture of the economy. However, recent mild growth surprises and evolving inflation dynamics suggest that the narrative could be shifting.

Two critical points for traders to note:

- Demand-Driven Inflation: While demand pressures appear to be easing, any surprises in inflation data could influence debates over the ECB’s future rate-cutting cycle.

- Economic Sentiment Survey: The European Commission’s sentiment survey, also releasing this week, will offer deeper insights into business perspectives, hiring intentions, and pricing strategies.

These data points will give traders a clearer understanding of the Eurozone’s economic trajectory and how it may influence the ECB’s policy outlook in December.

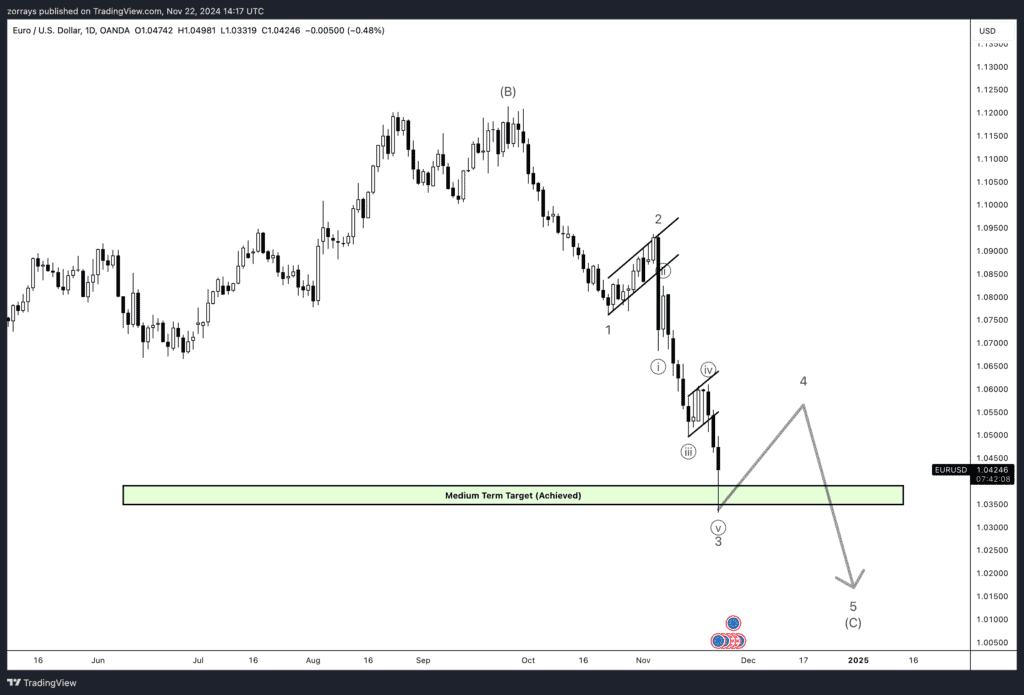

Technical Analysis

On the daily chart, EUR/USD has completed its wave 3 downtrend, achieving the medium-term target as indicated by Elliott Wave analysis. A corrective move into wave 4 appears likely in the short term, which could bring EUR/USD higher toward the 1.0550–1.0650 zone.

This correction, however, is expected to be short-lived. The bearish structure remains intact, and once the wave 4 retracement is complete, EUR/USD could resume its downtrend toward a potential new low near 1.0200.

Key Levels to Watch:

- Resistance (Wave 4 Target): 1.0550–1.0650

- Support (Wave 5 Target): 1.0200

Summary for EUR/USD: The Euro is in for a corrective wave 4 bounce before likely breaking to new lows, fuelled by dollar strength from potentially strong U.S. inflation data.

Canada: Q3 GDP (Friday)

Canada’s economy takes center stage on Friday with the release of third-quarter GDP data. After an annualized growth rate of 2.1% in Q2, the market anticipates a notable slowdown, with forecasts predicting a soft 0.9% gain.

Our expectation is slightly weaker at 0.8%, and any figure below this threshold could fuel speculation that the Bank of Canada (BoC) might deliver further rate cuts. Markets currently price in 30 bps of cuts at the BoC’s December 11 meeting, but softer-than-expected GDP data could tilt expectations toward a more aggressive 50 bps cut.

Retail traders should watch for how GDP data impacts the Canadian dollar (CAD) and commodities closely tied to the Canadian economy, such as oil.

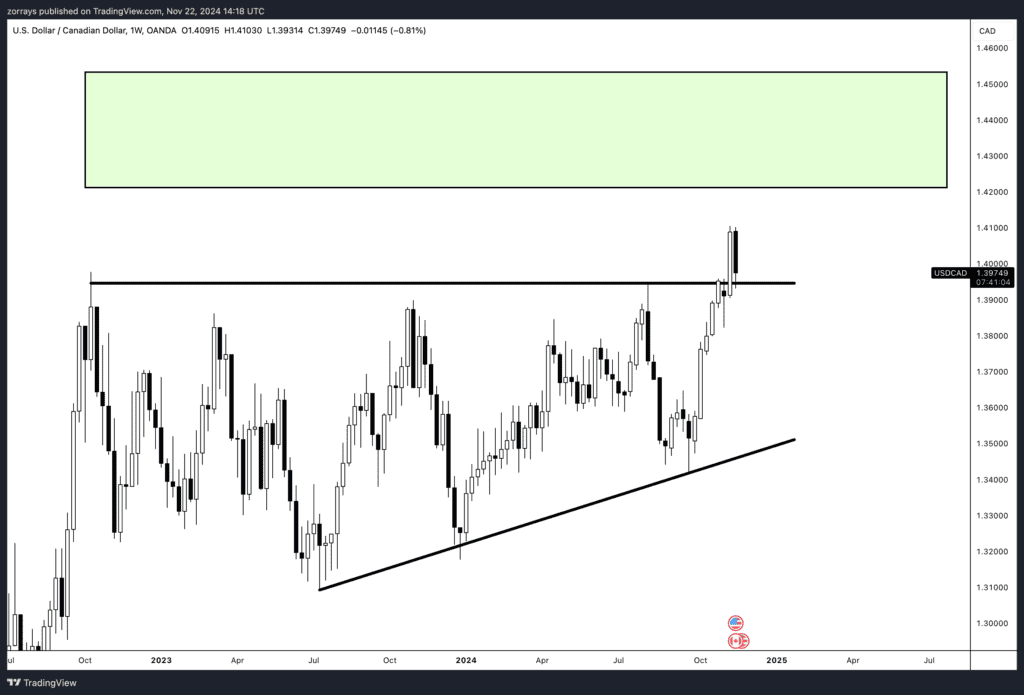

Technical Analysis

The weekly chart for USD/CAD showcases a clean ascending triangle breakout, with the pair currently retesting the breakout level around 1.3900–1.4000. This retest is critical, and if the level holds, USD/CAD is likely to climb toward the next major resistance zone around 1.4300–1.4500 (highlighted in the yellow box).

With fundamentals supporting CAD weakness, the breakout retest aligns with the technical outlook for further upside.

Key Levels to Watch:

- Support (Retest Zone): 1.3900–1.4000

- Resistance (Target Zone): 1.4300–1.4500

Summary for USD/CAD: USD/CAD is likely to bounce off its ascending triangle retest, with the next target zone around 1.4300–1.4500, driven by Canadian GDP concerns and U.S. dollar strength.

Key Takeaways for Traders

- Inflation in Focus: Both the U.S. and Eurozone inflation data could provide directional cues for currencies and indices.

- Interest Rate Speculation: This week’s data will heavily influence rate-cut probabilities for the Federal Reserve, ECB, and Bank of Canada.

- Currency Volatility: Pay close attention to the USD, EUR, and CAD, as data surprises could drive volatility in these markets.

As always, stay informed, manage your risks, and be prepared to act on significant market movements.