- Weekly Outlook

- October 11, 2024

- 6 min read

ECB Rate Cut Showdown: Inflation Dives, Markets Brace for Impact – GBP/USD Eyes Reversal

Next week is shaping up to be pivotal for the financial markets, with a major focus on the European Central Bank’s (ECB) highly anticipated interest rate decision. The release of important inflation data for both the Eurozone and the UK will also be closely watched, as central banks weigh up their next monetary policy moves.

ECB Rate Decision – Thursday, October 17, 2024

The key event next week is the ECB’s monetary policy meeting on Thursday, where financial markets are widely expecting another rate cut. Recent economic data, including weaker sentiment indicators and headline inflation dipping below 2% for the first time in more than three years, have fueled market speculation that the ECB will opt for an immediate cut.

Market Sentiment & ECB’s Stance:

While markets have priced in a rate cut, this decision is expected to be more controversial than it appears. During the ECB’s September meeting, officials signaled a preference for a gradual and measured pace of reducing monetary policy restrictiveness. This implies that the ECB was not in a hurry to cut rates, preferring to wait until the December meeting, when it would have more updated macroeconomic projections to support its decision. The October meeting, therefore, may be seen as too early to adjust its strategy based solely on recent data.

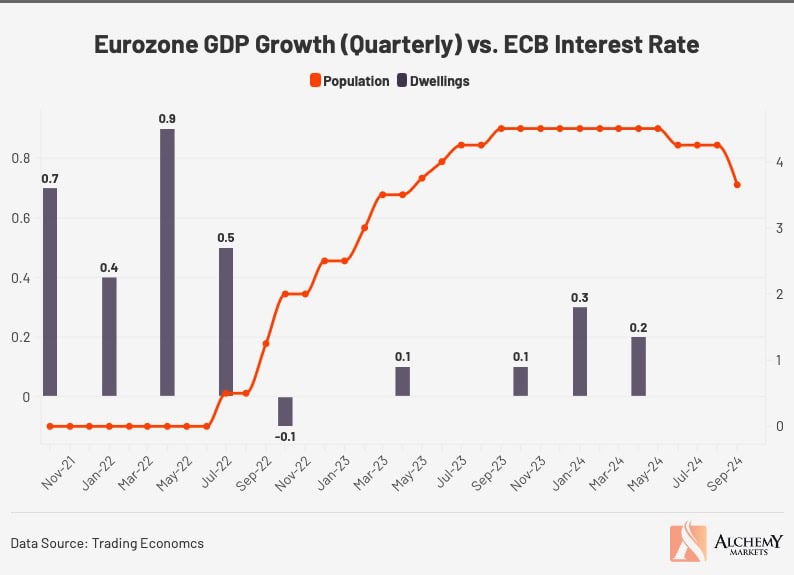

However, the case for a cut is becoming stronger. Economic sentiment across the Eurozone has worsened since June, with all indicators pointing to slower growth in Q3. The ECB had already forecasted a slowdown in its September projections, but risks are now clearly tilted to the downside. September’s inflation decline, while primarily driven by lower energy prices, has prompted renewed discussions within the ECB, particularly among dovish members.

Key Arguments For and Against a Rate Cut:

- For a Rate Cut: Economic sentiment has continued to deteriorate, and recent disinflationary data indicates the ECB’s inflation outlook might undershoot rather than overshoot its target. Additionally, with energy prices falling over the last several months, headline inflation is likely to remain subdued, and the ECB may choose to act now to prevent a more severe downturn in growth.

- Against a Rate Cut: There has been little hard macro data since the September meeting to justify an immediate cut. Recent weak sentiment data had already been factored into the ECB’s September projections, and a sudden shift in monetary policy could signal panic rather than a strategic move.

Market Influence on ECB’s Decision:

While markets often influence central bank decisions, particularly during tightening cycles, the situation is different in an easing cycle. With inflation still below target, the ECB may feel less pressure to meet market expectations immediately and may prefer to wait for more robust data. Nonetheless, if the ECB does cut rates next week, it could signify a shift toward a more aggressive easing stance, likely leading to a meeting-by-meeting approach to rate decisions.

Eurozone & UK CPI Data – A Close Watch on Inflation Trends

Alongside the ECB meeting, the release of key inflation data from both the Eurozone and the UK will further shape market expectations.

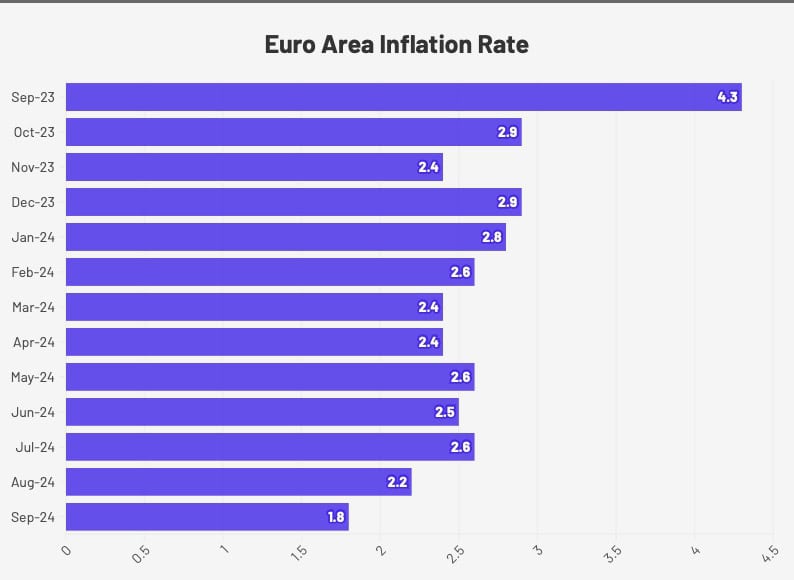

Eurozone CPI (YoY) – Monday, October 14, 2024

Data Source: Trading Economics

The Eurozone’s inflation print for September is expected to come in at 1.8%, down from 2.2% in August. This decline is in line with market expectations and reflects the weakening growth outlook across the region. The slowdown in inflation has been largely attributed to the fall in energy prices over recent months, though core inflation, particularly in services, remains stubbornly high.

With inflation dropping below the ECB’s target, this data will only add to the argument for a rate cut. The continued softness in energy prices, alongside lower growth prospects, will keep inflationary pressures subdued, which could make the ECB more inclined to ease policy further.

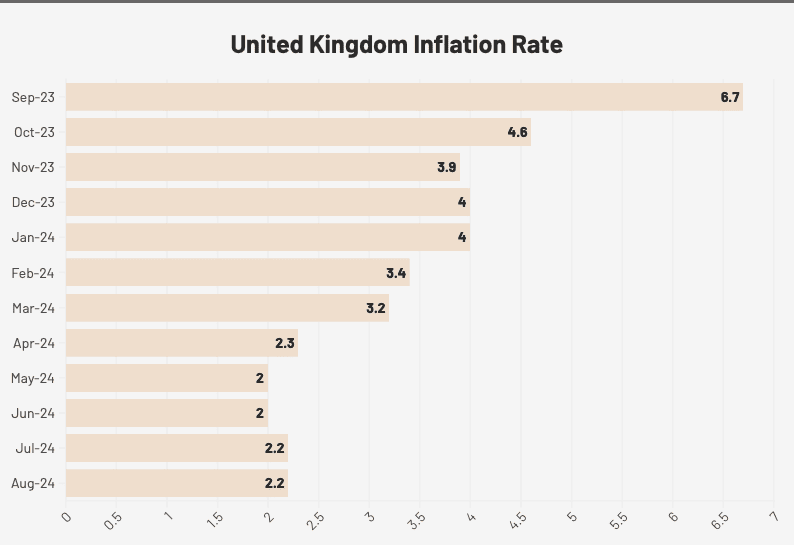

UK CPI (YoY) – Wednesday, October 16, 2024

Data Source: Trading Economics

The UK will also report its inflation data next week, with headline CPI expected to edge down to 2.1% from 2.2% in August, according to consensus forecasts. Core inflation, which strips out more volatile components like food and energy, is projected to dip slightly to 3.5% from 3.6% in the previous month.

The recent trend in UK inflation suggests a stabilization near the Bank of England’s (BoE) 2% target, though policymakers remain cautious about core inflation persistence. This will be the last inflation print before the BoE’s Nov. 7 meeting, where it is expected to cut interest rates from 5% to 4.75%. With inflation still above the target and uncertainty surrounding energy prices due to the Middle East tensions, the BoE is likely to remain cautious about cutting rates too quickly.

Corporate Earnings Season – Q3 2024 Focus

Next week also marks the height of the Q3 earnings season, with multiple large corporations set to release their earnings results. Investors will be closely monitoring earnings reports for any signs of how rising interest rates, inflation, and slowing growth are impacting corporate profits. This will provide further insight into the broader economic environment, which, in turn, will shape market sentiment going forward.

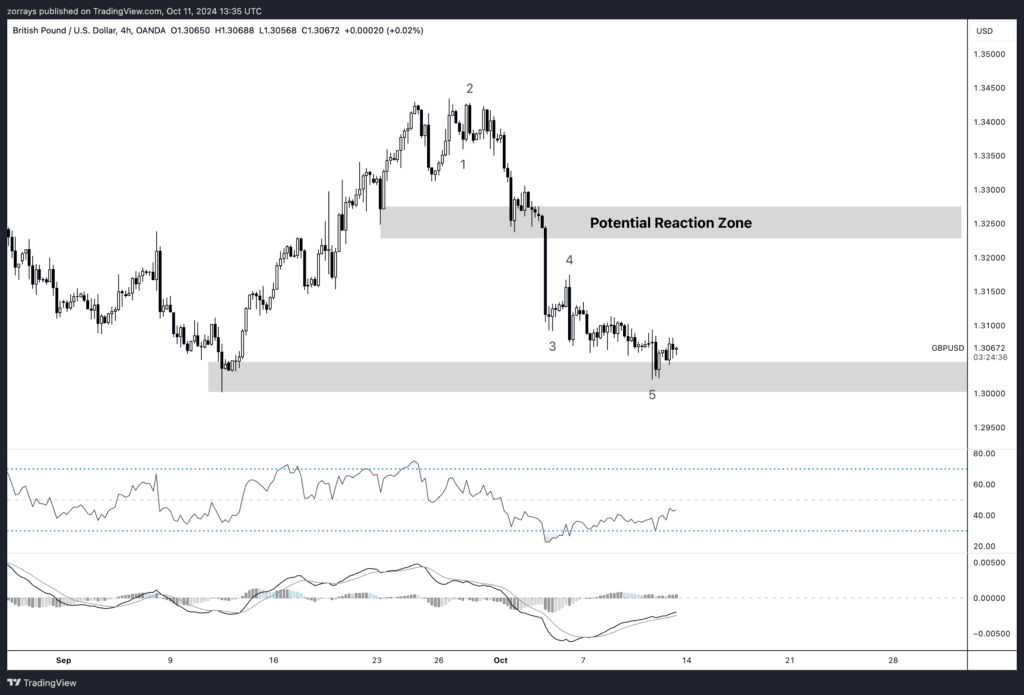

Technical Analysis: GBP/USD Outlook

Turning to the technical picture, GBP/USD is currently trading around the 1.3067 level, sitting on a strong support zone. This coincides with the completion of a five-wave impulse pattern to the downside, suggesting the possibility of a corrective wave higher in the short term. Supporting this outlook are bullish divergences visible on both the Relative Strength Index (RSI) and the Moving Average Convergence Divergence (MACD), indicating that momentum is slowing and a reversal may be imminent.

However, any short-term correction could be capped by renewed USD strength, especially after the recent U.S. CPI print, which came in below market expectations, reinforcing the case for a temporary bullish outlook on the dollar. If the corrective wave materializes, it may offer a short-term buying opportunity before the overall bearish trend resumes, driven by the broader macroeconomic environment, including potential hawkish surprises from the Federal Reserve.

Conclusion

Next week promises to be eventful, with the ECB rate decision and key inflation data from the Eurozone and UK taking center stage. While markets are leaning towards a rate cut from the ECB, the decision remains finely balanced, with arguments both for and against. Meanwhile, inflation data from both regions will provide important clues as to the next moves from their respective central banks. For GBP/USD, a corrective move higher seems possible in the short term, though the broader trend remains bearish as the dollar continues to benefit from favourable economic conditions.