- Weekly Outlook

- November 15, 2024

- 5 min read

Chips and CPI: Crunching Numbers and NVIDIA’s Next Move

In October, U.S. inflation increased to 2.6% year-over-year from 2.4% in September, marking the first rise since March. This persistent inflation is complicating the Federal Reserve’s decision-making. Chair Jerome Powell highlighted caution, emphasizing the risk of premature rate cuts amid a robust economy. Markets are pricing in prolonged high rates, reflecting hesitancy to lower them quickly.

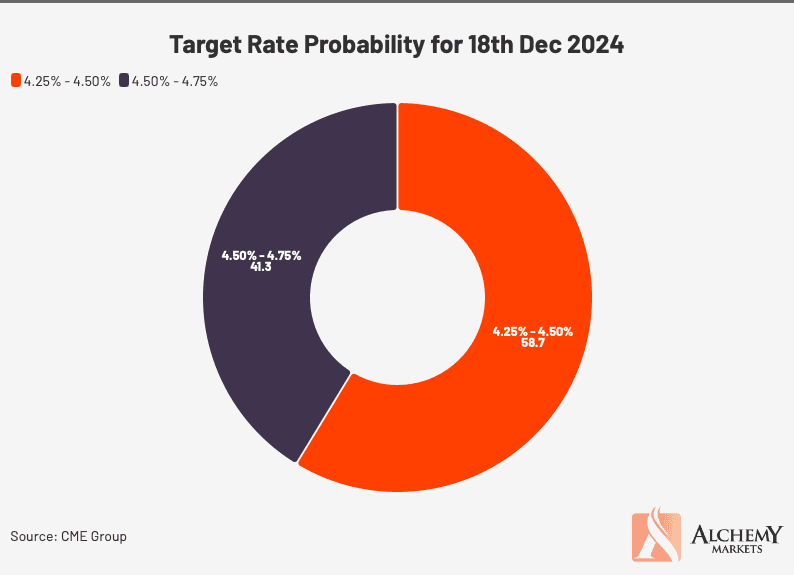

The SPX has stalled due to concerns that prolonged higher rates may slow economic growth and corporate earnings. This sentiment has added to market uncertainty, limiting strong equity momentum. According to the CME FedWatch Tool, there’s a 58.7% probability of a rate cut to 425-450 basis points in December 2024, while a 41.3% chance remains for the current 450-475 bps. This divergence underscores potential market volatility.

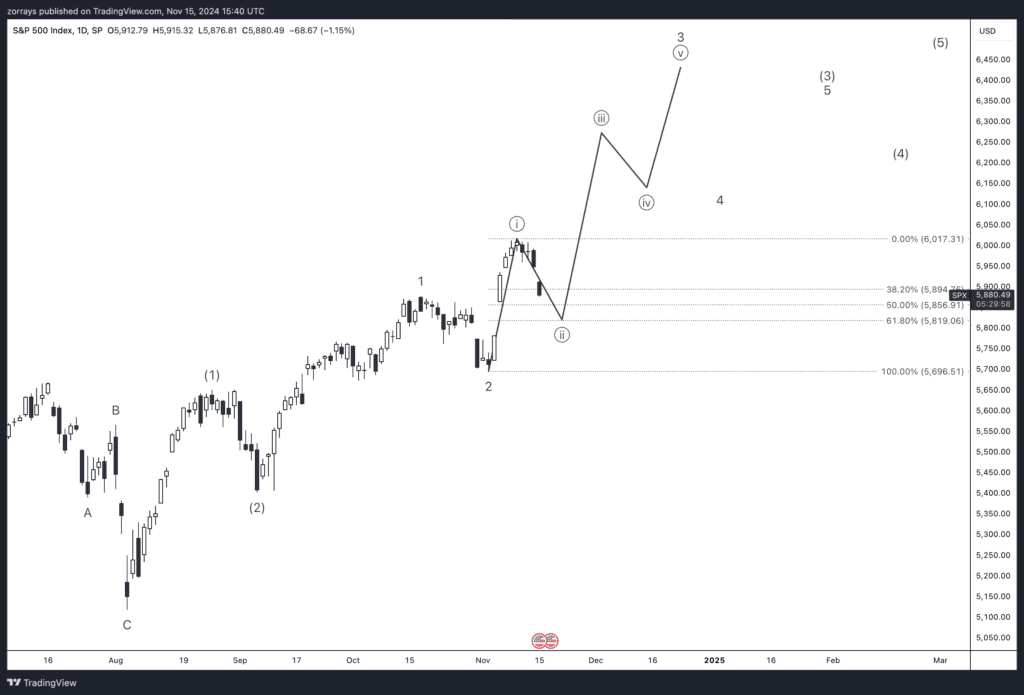

SPX Technical Perspective

The SPX is in a Wave 2 correction phase, with a critical retracement near the 61.8% Fibonacci level at approximately 5,819.06. A break below the 5,700 mark could negate bullish momentum, suggesting further downside risks. Near-term price action at 5,800 will be key in assessing recovery potential, though ongoing inflation concerns and Fed policy adjustments may sustain volatility.

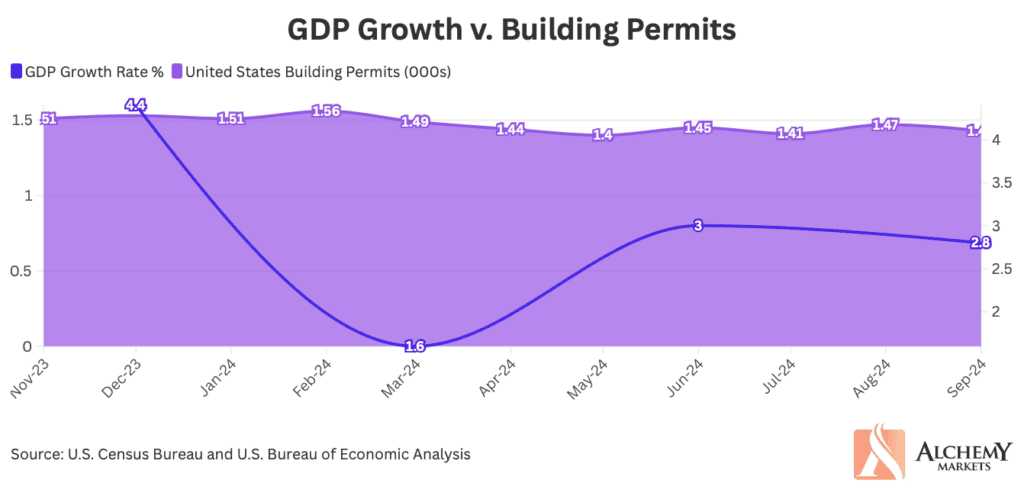

U.S. Economic Overview

Quiet Week Ahead

U.S. data releases are sparse, leaving markets speculative about December’s FOMC meeting. While initial expectations priced in a 20bp rate cut, Powell’s recent statements have reduced this to 15bp. Housing remains a key theme, but elevated mortgage rates and the bearish Treasury yield curve will likely keep affordability low.

Other notable releases include the leading index, which has been a poor predictor of economic growth. More critical data points—core PCE deflator and November’s jobs report—are scheduled in the coming weeks.

UK CPI Insights

On Wednesday, UK inflation is projected to inch above 2% due to a 10% increase in household energy costs in October. However, the Bank of England is more focused on services inflation, expected to rise to 5.0%. Stripping out non-essential categories, the “core services” metric may drop from 4.8% to 4.3%. This nuanced trend suggests that while December rate cuts are unlikely, the Bank may take a more aggressive approach to easing over the next two years than markets currently anticipate.

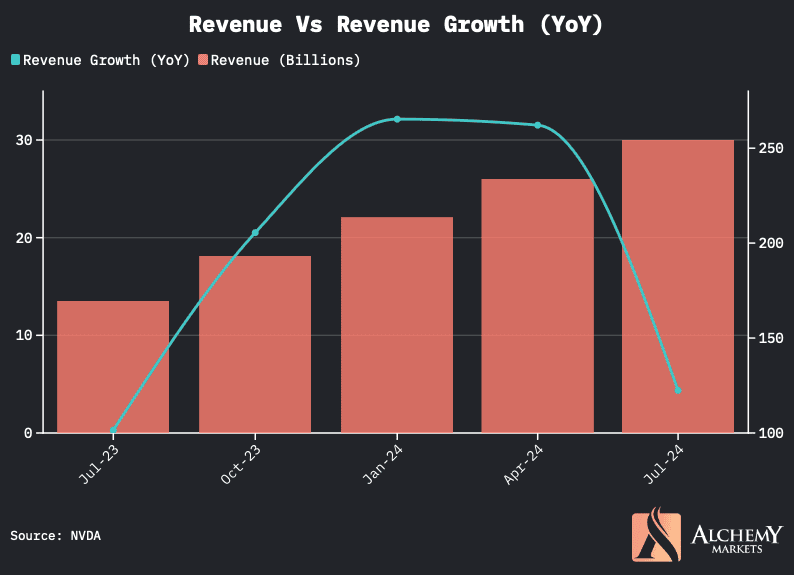

NVIDIA Q3 2024 Earnings Preview

Last Quarter Highlights

- Revenue & Profitability: NVIDIA reported $30.04 billion in revenue for the three months ending July 2024, a 122% year-over-year increase. Operating income surged to $18.64 billion from $6.8 billion.

- Key Drivers: Strong demand in Data Center and Compute segments fueled growth. The company expanded AI-focused offerings, including shipments of its Blackwell GPU samples.

- Challenges: Inventory provisions related to the Blackwell GPU impacted margins. NVIDIA highlighted ongoing global trade tensions and semiconductor supply complexities.

Outlook for Next Earnings Release

- Focus Areas: Traders should monitor NVIDIA’s updates on Blackwell architecture ramp-ups and its effect on operating margins. Data Center demand, particularly for AI products, will remain a key driver.

- Risks: Watch for commentary on U.S.-China trade restrictions and inventory management challenges.

- Market Implications: Continued strength in AI and Data Center markets could boost NVDA’s stock. However, any disruptions in product rollouts or geopolitical issues may create short-term volatility.

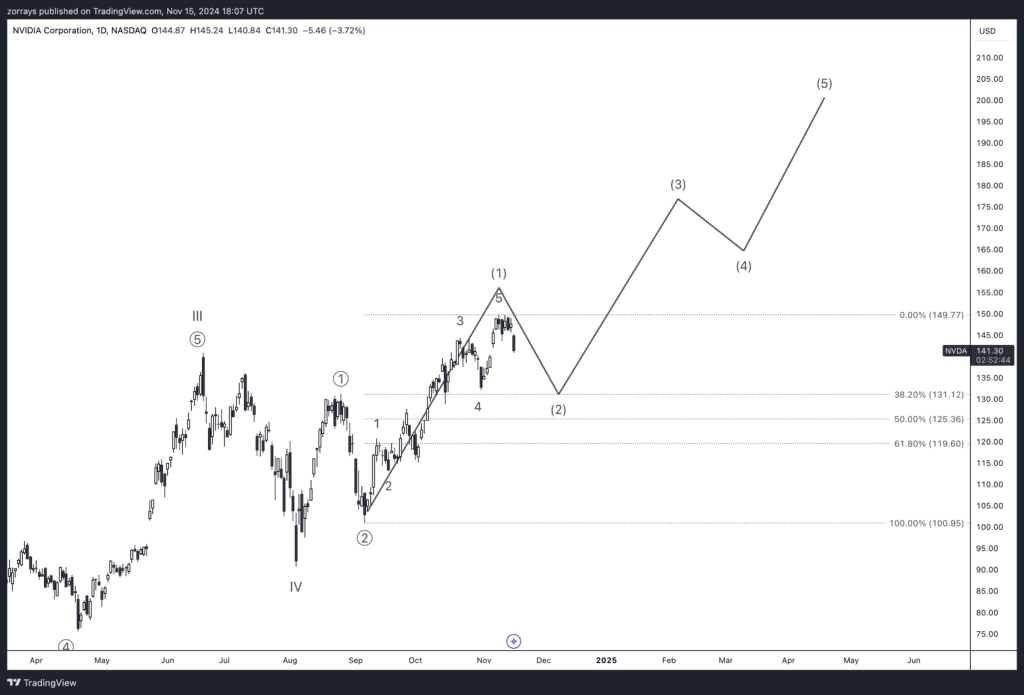

Technical Analysis: NVIDIA Wave Structure

Currently, NVIDIA appears to be in Wave (2) of the larger Wave ((3)), suggesting that the next move upward could be Wave (3) of ((3)). Typically, Wave 3 is known for its steep, strong momentum, especially within such a bullish setup. Given this positioning, we may not see a substantial retracement at this point; Wave 2s of Wave 3 structures are often quick and shallow.

The market’s reaction to upcoming headlines will be crucial, but in a classic Elliott Wave structure, this is generally a point where upward momentum builds quickly. All in all, the outlook remains bullish with more upside likely as the wave structure progresses.

Key Events to Watch This Week

| Event | Date | Relevance |

|---|---|---|

| U.S. Housing Data | 19th November 2024 | May influence market sentiment given rising mortgage rates. |

| UK CPI Release | 20th November 2024 | Key indicator for potential BOE rate changes and market reactions. |

| NVIDIA Q3 2024 Earnings | 20th November 2024 | Updates on AI and Data Center performance crucial for equity market trends. |

FAQs

Q1: Why has the SPX stalled?

Higher inflation and the Fed’s cautious stance on rate cuts have raised concerns about economic growth, limiting equity momentum.

Q2: What is driving UK CPI?

A rise in household energy bills and steady services inflation are the main contributors.

Q3: How has NVIDIA performed recently?

NVIDIA has delivered strong revenue growth driven by its AI and Data Center segments but faces challenges in inventory management and trade restrictions.

Q4: What should traders watch in NVIDIA’s earnings?

Key factors include AI product demand, Blackwell GPU updates, and any guidance adjustments.

Q5: Will U.S. housing data impact markets?

Yes, weak housing numbers amidst high mortgage rates could pressure market sentiment further.

Q6: Is the Bank of England likely to cut rates soon?

Not immediately, but trends in core services inflation suggest more aggressive cuts are likely in the medium term.