- Weekly Outlook

- December 6, 2024

- 5 min read

Central Banks Shape Markets Ahead

The coming week is set to be pivotal for global financial markets, with key central bank meetings and critical economic data releases likely to drive volatility. Traders and investors will closely monitor rate decisions from the Federal Reserve, European Central Bank (ECB), and Bank of Canada (BoC), as well as inflation data from the United States. Here’s what to watch and what it could mean for the markets.

United States: All Eyes on the Federal Reserve’s Rate Decision

Event: Federal Open Market Committee (FOMC) Meeting

Date: Dec 18, 2024

The Federal Reserve’s FOMC meeting is shaping up to be a 50:50 decision on whether policymakers will cut the federal funds rate by 25 basis points (bp) or hold steady. Economic indicators suggest monetary policy remains in restrictive territory, but recent data points to a need to ease closer to neutral.

Key Factors to Watch:

- Core CPI (Consumer Price Index): Expectations for a 0.3% month-on-month (MoM) increase suggest inflationary pressures are moderating but remain sticky. This keeps the Fed walking a tightrope between over-tightening and easing too soon.

- Market Sentiment: A growing consensus supports a 25bp rate cut in December, followed by a pause in January. The Fed will likely weigh this move against its broader objective of sustaining economic stability without reigniting inflation.

Market Impact:

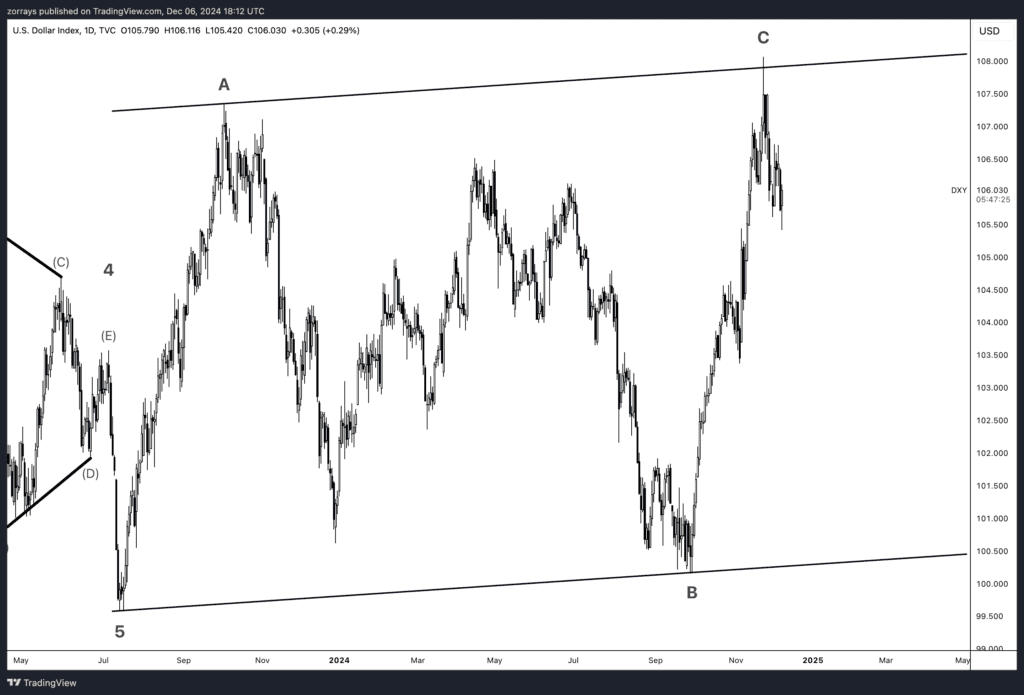

The U.S. Dollar Index (DXY) is showing signs of bouncing off its upper resistance boundary, reflecting heightened anticipation of a dovish Fed. Traders are already positioning for a rate cut, and a dovish outcome could signal further downside for the dollar.

Eurozone: ECB Rate Cut Expected Amid Signs of Easing

Event: European Central Bank Rate Decision

Date: Dec 12, 2024

The ECB appears ready to deliver a dovish message alongside a 25bp rate cut next week. With inflation under control and growth slowing, the ECB is seeking to align policy with neutral levels while signaling its openness to deeper cuts if necessary.

Key Points to Note:

- Inflation: Subdued price pressures leave room for the ECB to act decisively to support the slowing economy.

- Forward Guidance: Policymakers are expected to emphasize their commitment to rate cuts and maintaining liquidity in the financial system.

Market Impact:

A dovish ECB could weigh on the euro in the short term, especially if accompanied by explicit forward guidance hinting at further easing. This could widen interest rate differentials with the U.S., keeping EUR/USD under pressure.

Canada: Bank of Canada Eyes Aggressive Rate Cuts

Event: Bank of Canada Rate Decision

Date: Dec 11, 2024

The Bank of Canada has already slashed its policy rate by 125bp since June, and markets are pricing in a second consecutive 50bp cut next week. This would bring the benchmark rate to 3.25% as policymakers respond to weak growth and a benign inflation backdrop.

Key Dynamics at Play:

- Debt Levels: Elevated household debt and the structure of Canada’s mortgage market have necessitated swift action to prevent economic fragility.

- External Risks: Tariff threats from the U.S. under a potential Trump administration are also weighing on sentiment, increasing the urgency for proactive policy adjustments.

Market Impact:

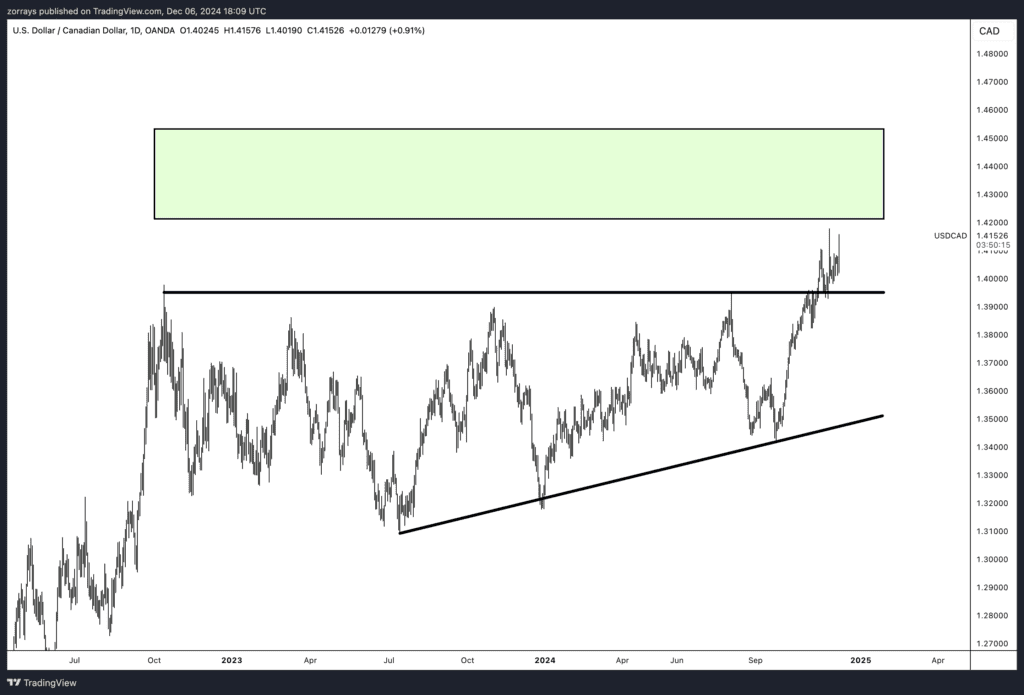

USD/CAD remains firmly bullish as it inches toward its projected target. The pair broke above key resistance levels last week, supported by strong U.S. dollar momentum and expectations of further BoC easing. As rate cuts reduce the appeal of the Canadian dollar, we expect the pair to extend its gains into the green zone above 1.4400.

Technical Outlook: Key FX Levels to Watch

DXY (U.S. Dollar Index)

- Resistance: 106.50

- Support: 105.00

The DXY has bounced off its upper trendline, suggesting potential consolidation ahead of the Fed meeting. A dovish outcome could push the index lower toward support at 105.00.

USD/CAD

- Key Resistance: 1.4200

- Target Zone: 1.4400–1.4500

The pair has broken out of a long-term consolidation pattern, confirming a bullish continuation. Traders should watch for further upside as the BoC’s dovish stance weighs on the Canadian dollar.

Key Themes and Takeaways

- Fed’s Balancing Act: The Fed’s December decision could set the tone for markets heading into 2025. A dovish pivot would reinforce expectations of an extended pause.

- ECB’s Commitment to Easing: The ECB is likely to signal a longer-term dovish stance, which could weigh on the euro and support broader risk-on sentiment.

- BoC’s Aggressive Cuts: Canada’s economic challenges necessitate urgent policy action, keeping USD/CAD well-supported.

FAQs on the Upcoming Economic Events

1. What is the likelihood of the Fed cutting rates in December?

The probability is evenly split at 50:50. While inflation data supports a cut, policymakers remain cautious about moving too quickly.

2. How will the ECB’s decision affect the euro?

A dovish stance, combined with a rate cut, could lead to short-term euro weakness as markets price in extended easing.

3. Why is the Bank of Canada cutting rates aggressively?

Canada faces a unique combination of high household debt, a fragile housing market, and external risks, prompting swift action to prevent economic instability.

4. What does the technical outlook suggest for the U.S. Dollar Index?

The DXY is testing resistance at 106.50, with a dovish Fed decision likely to trigger a pullback toward support at 105.00.

5. What is driving the bullish outlook for USD/CAD?

The pair’s breakout above resistance reflects strong dollar momentum and expectations of further BoC easing.

6. How will these events impact global markets?

Expect heightened volatility across currency pairs, equities, and commodities as central bank actions set the tone for economic policy into 2025.

Conclusion

Next week promises to be a critical juncture for global markets, with key central bank decisions shaping the outlook for the dollar, euro, and Canadian dollar. Stay tuned for market developments as the Fed, ECB, and BoC unveil their policy stances and set the stage for 2025.