- Weekly Outlook

- September 20, 2024

- 6 min read

Central Banks Playing Limbo – How Low Will They Go?

The Federal Reserve made waves this past week slashing interest rates by 50 basis points (bps), signalling a dramatic shift toward a looser monetary policy. Meanwhile, the Bank of England (BoE), which started easing earlier than the Fed, held its rate steady at 5%, indicating a more cautious approach.

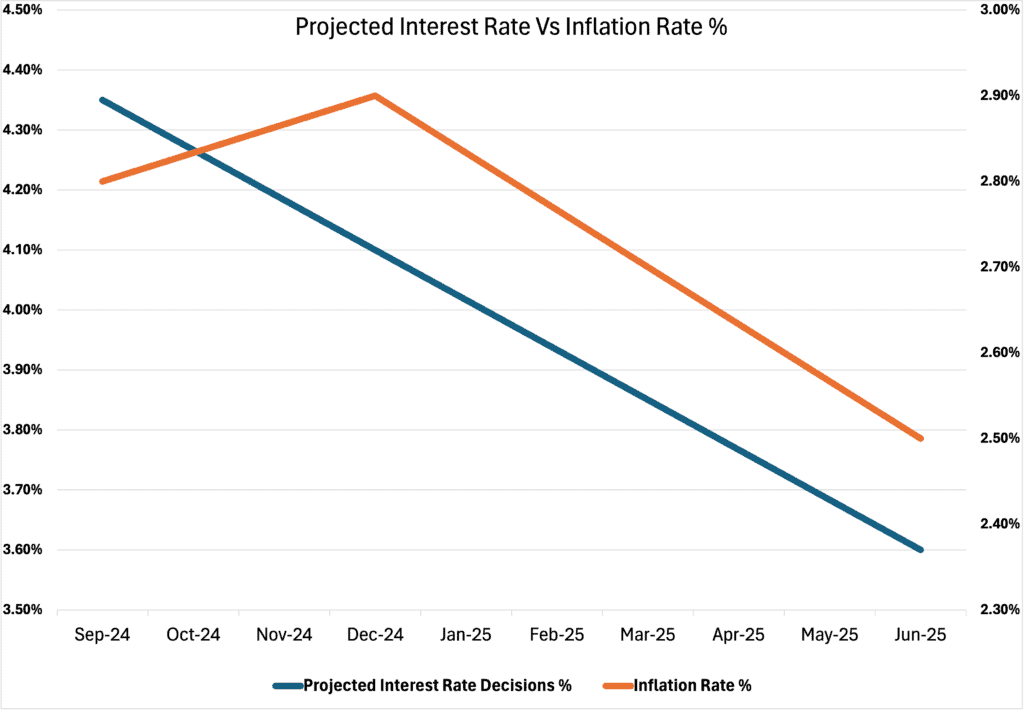

Australia (RBA Interest Rate Decision – Tuesday)

Data Source: Trading Economics

- Event: Reserve Bank of Australia (RBA) Interest Rate Decision

- Date: Tuesday

- Current Rate: 4.35%

- Inflation Rate: 3.8%

The RBA is expected to maintain its current rate at 4.35% as it carefully navigates persistent inflation, which stands at 3.8%. Despite inflationary pressures, the central bank is exercising caution, waiting to see if inflation eases without stalling the broader economy.

This decision is critical because a steady rate could indicate the RBA’s confidence in managing inflation without harming growth, setting a measured tone for the months ahead.

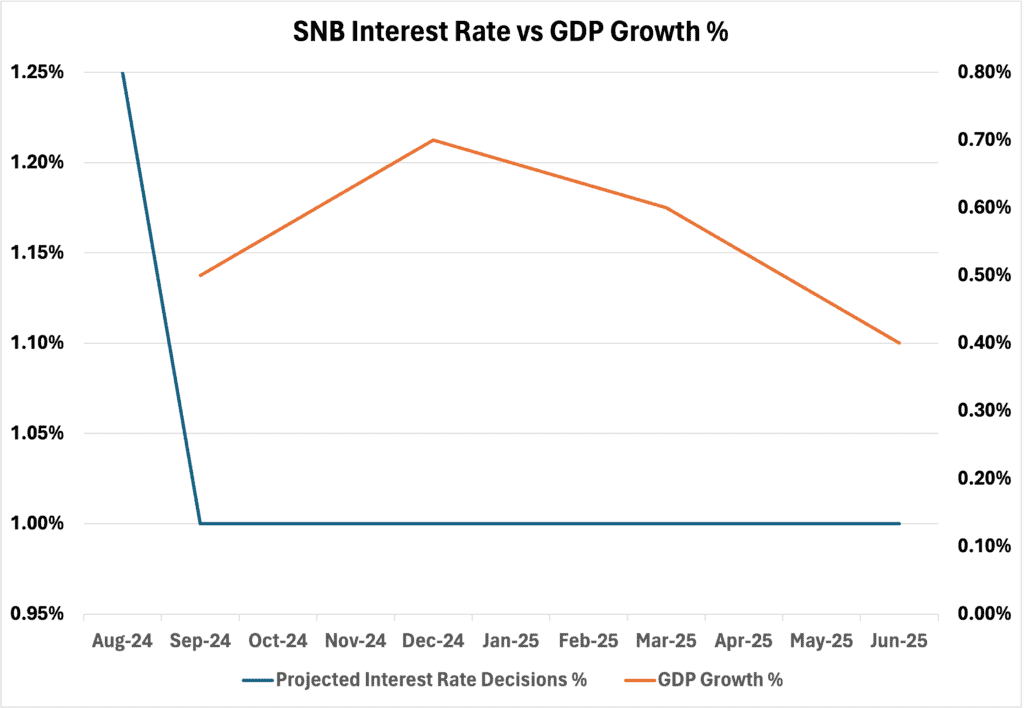

Switzerland (SNB Interest Rate Decision – Thursday)

- Event: Swiss National Bank (SNB) Interest Rate Decision

- Date: Thursday

- Current Rate: 1.75%

Switzerland’s SNB is expected to loosen its monetary policy further, likely reducing interest rates. The country’s economic outlook appears weak, with low inflation and a negative GDP forecast prompting the need for policy support to boost growth.

A rate cut here could signal the SNB’s focus on reviving economic activity as they shift priorities from inflation control to ensuring economic stability through stimulative measures.

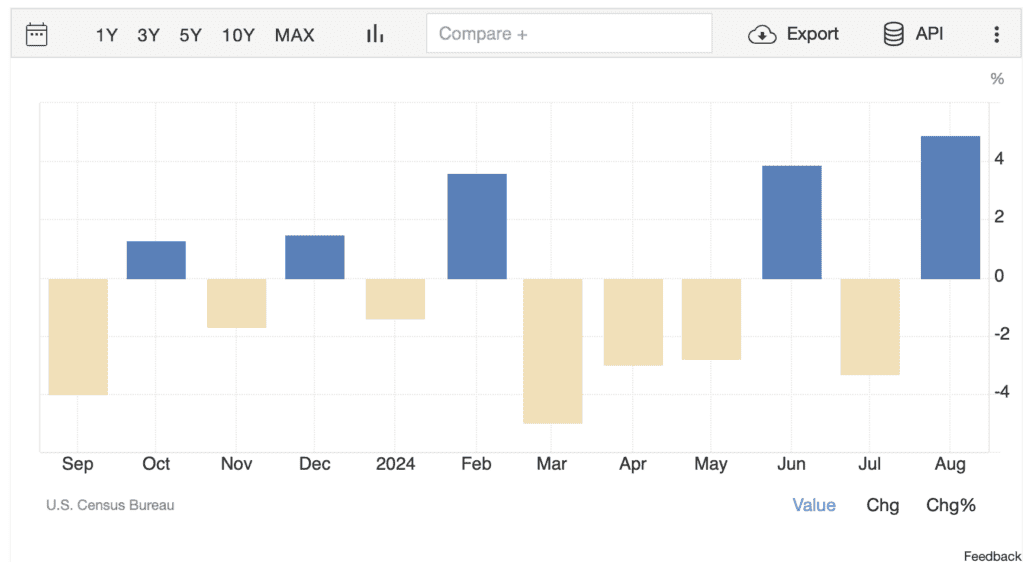

United States (Building Permits – Wednesday)

- Event: Building Permits (August Data)

- Date: Wednesday

- Previous: 1.406 million (July)

- Forecast: 1.475 million (August)

Building permits are expected to rise in August to 1.475 million from July’s 1.406 million, signaling strength in the housing sector. This increase would suggest sustained demand in the construction industry, a positive sign for economic activity in the near future.

A rise in permits is significant because it’s a key leading indicator for GDP growth, offering a glimpse into how the economy might perform in the coming quarters as housing demand often reflects broader economic health.

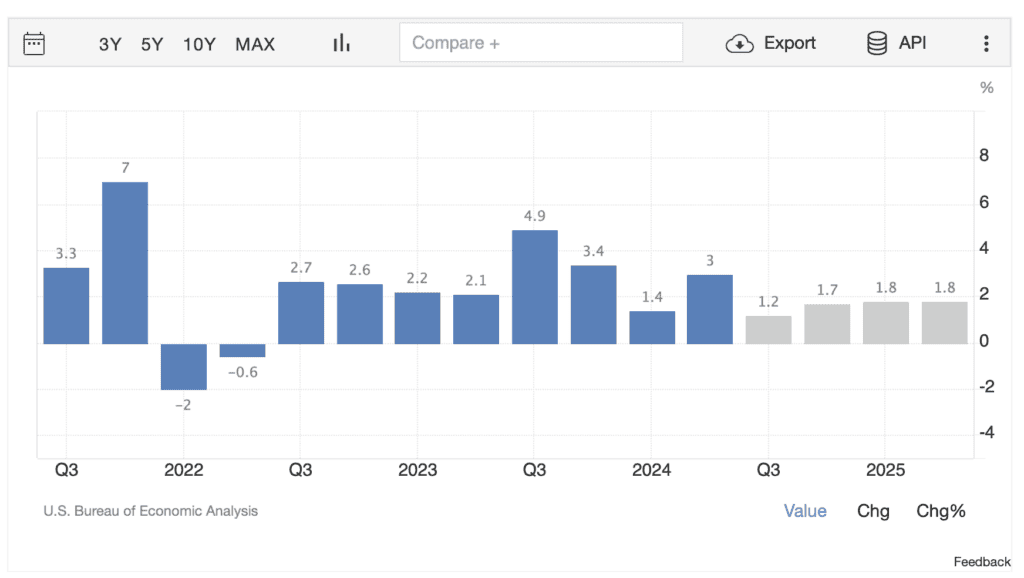

United States (GDP QoQ – Thursday)

- Event: GDP Growth Rate (Q2)

- Date: Thursday

- Previous: 1.4% (Q1)

- Forecast: 3% (Q2)

The second-quarter GDP is forecasted to show significant growth at 3%, up from 1.4% in the first quarter. This suggests that the U.S. economy is gaining momentum despite global economic uncertainties and rising borrowing costs.

This strong GDP growth reflects the economy’s resilience, indicating that the Fed’s policy decisions might have successfully avoided a recession while maintaining solid economic performance.

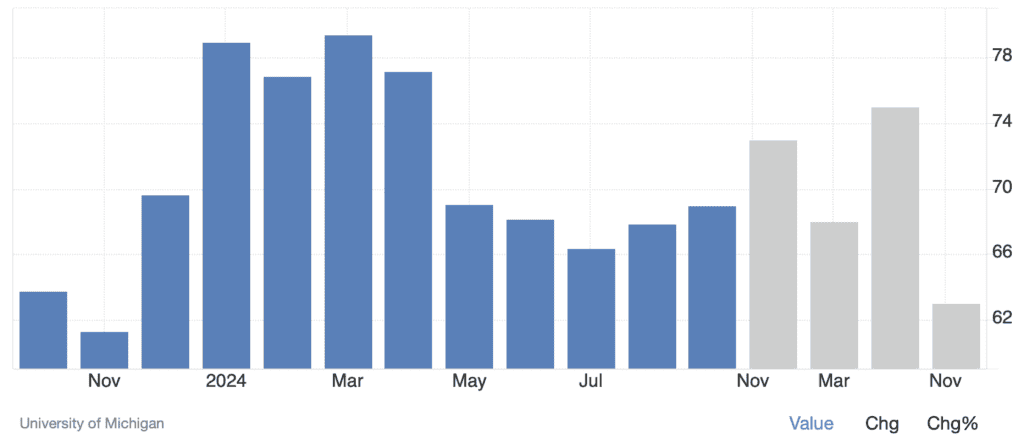

United States (Michigan Consumer Sentiment Survey – Friday)

- Event: Michigan Consumer Expectations and Sentiment Survey

- Date: Friday

- Previous: Expectations – 72.1, Sentiment – 67.9

- Forecast: Expectations – 73, Sentiment – 69

Consumer expectations are projected to rise from 72.1 to 73, while sentiment is expected to increase from 67.9 to 69. Both measures show improving consumer confidence, which is crucial for predicting future consumer spending patterns.

Higher sentiment and expectations indicate that consumers feel more optimistic about their financial situation, potentially driving higher spending and supporting future economic growth.

Technical Analysis: Breaking Bull Flags and Dollar Weakness

Let’s dive into the technical analysis of GBP/USD, EUR/USD, and AUD/USD, all of which show key breakouts of bullish patterns. These breakouts align with the broader narrative of a weakening U.S. dollar, which has been anticipated due to the Federal Reserve’s recent dovish stance and rate cuts.

These technical signals reinforce the macroeconomic backdrop of dollar weakness, driven by the Fed’s looser monetary policy. Let’s break down each pair and discuss how they align with this outlook.

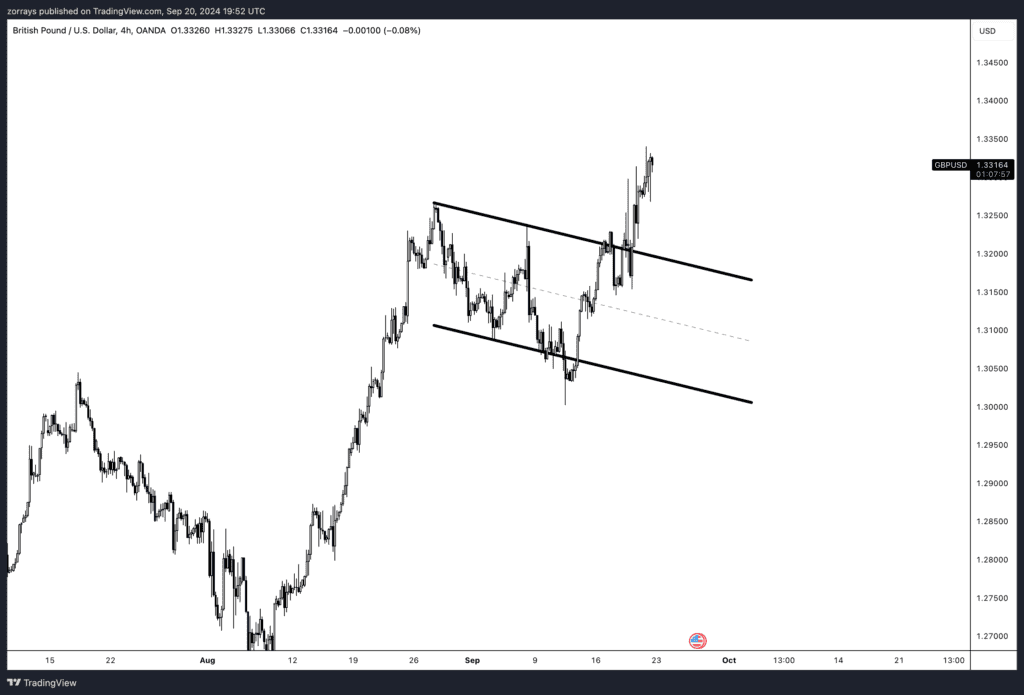

GBP/USD – Bull Flag Breakout and Momentum Shift

In the first chart of GBP/USD, we can clearly see a bull flag formation that has recently been broken to the upside. This is a classic continuation pattern that often suggests further bullish momentum. After a period of consolidation between two parallel trendlines, GBP/USD has made a decisive breakout, suggesting that upward momentum is likely to continue.

- Breakout Confirmation: The breakout above the upper trendline confirms bullish sentiment for GBP/USD, which supports the broader dollar weakness narrative. The pound’s recent strength ties into expectations that the BoE may maintain a more hawkish tone relative to the Fed’s dovish pivot.

- Next Resistance Levels: Watch for the pair to test levels around 1.3400 and beyond, as the breakout suggests that further gains could be on the horizon.

This breakout complements the dovish Fed narrative, where weakening U.S. dollar strength is giving currencies like GBP room to run higher, especially after clearing technical resistance.

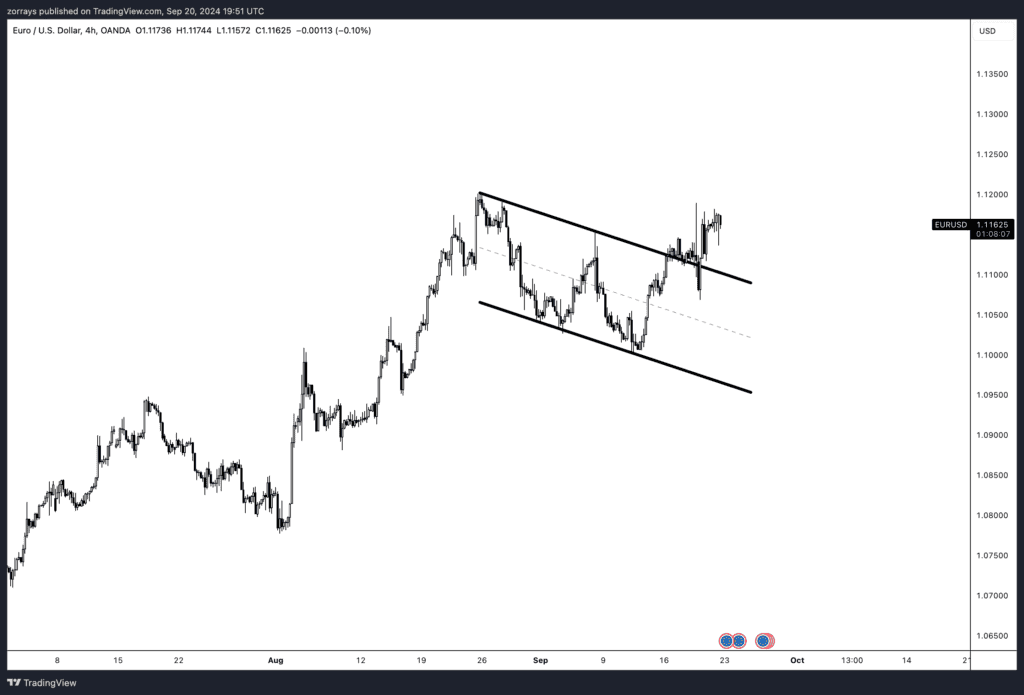

EUR/USD – Another Bull Flag Breakout

The EUR/USD chart shows a similar pattern, with a textbook bull flag breakout above its upper resistance line. The euro’s recent strength versus the dollar aligns with expectations of prolonged U.S. dollar weakness, as the Fed loosens its grip on monetary policy.

- Strong Breakout: The break above the flag suggests continued upward pressure on EUR/USD. The pair is now trading well above the trendline resistance, confirming the bullish outlook.

- Target Levels: Post-breakout, we could see EUR/USD pushing towards the 1.1250 level and potentially higher if dollar weakness persists.

With the Fed’s dovish policy, the euro is gaining traction, and the technical breakout further supports this bullish scenario. As Europe’s economic outlook stabilizes, the euro could continue to strengthen against the U.S. dollar.

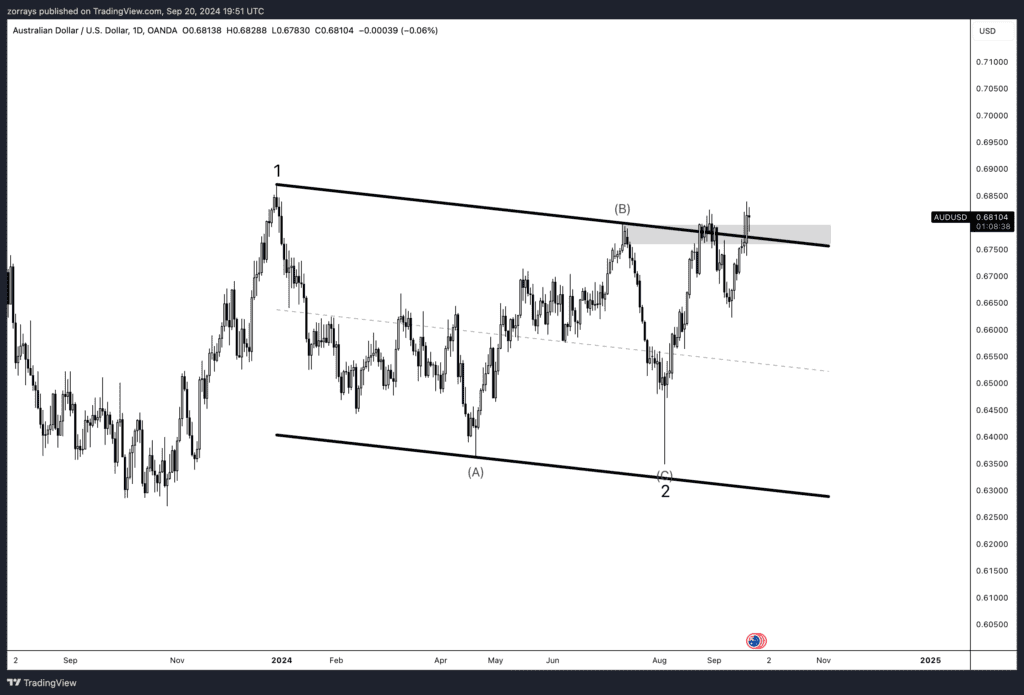

AUD/USD – Converging Pattern and Breakout

The AUD/USD chart showcases a longer-term descending channel, where the pair is currently breaking out above a key resistance trendline. The Australian dollar has shown resilience despite ongoing challenges with inflation, and this technical breakout is significant in light of the upcoming RBA decision, where rates are expected to remain steady.

- Channel Break: AUD/USD has pushed above the channel’s upper boundary, indicating a potential shift in trend. This breakout signals that further gains are likely, especially if the Fed’s dovish stance weakens the dollar as expected.

- Next Targets: The breakout above 0.6800 could open the door for a test of higher levels, around 0.6900 and beyond.

The Australian dollar’s strength could be seen as part of a broader global trend of dollar weakness. With the Fed easing, high-beta currencies like the Aussie tend to benefit, especially when breaking above key resistance levels.

Conclusion: Dollar Weakness Driving Bullish Breakouts

All three pairs—GBP/USD, EUR/USD, and AUD/USD—are breaking bullish technical patterns, reflecting a common theme: U.S. dollar weakness. This aligns perfectly with what we’ve discussed regarding the Fed’s dovish pivot, which is driving investors to seek opportunities in other currencies.

The bull flag breakouts across the board are confirming that sentiment is turning against the dollar, suggesting that more upside is likely for these currencies in the near term. As central banks like the BoE remain more hawkish compared to the Fed, and with the RBA holding steady, this technical picture could continue to develop, providing further upside momentum.