- Weekly Outlook

- July 12, 2025

- 6 min read

Are Central Banks Overreacting? What the Copper/Gold Ratio Tells Us

All Eyes on CPI

Markets are bracing for this Tuesday’s release of the U.S. Consumer Price Index (CPI), a key economic indicator that could shape monetary policy for the rest of the year. With inflation appearing subdued in recent months—registering 0.1% in April and 0.2% in May—investors are wondering if the tide is truly turning. However, the next few CPI readings, starting with this week’s, may reveal something different.

Tuesday’s report marks the beginning of a new phase in inflation monitoring. This is when the effects of tariffs imposed earlier this year are expected to surface. While the previous data suggested stability, core CPI is likely to accelerate in the upcoming release, and that could trigger a renewed debate over rate cuts and inflation control strategies.

What’s on the Calendar This Week

The most anticipated item is the U.S. CPI report, due Tuesday, July 15, at 08:30 AM ET. Core inflation—excluding volatile food and energy prices—is expected to rise, reflecting the lagging effects of import tariffs imposed in the spring.

Economists suggest that the months of July, August, and September will be pivotal. These will likely capture the full impact of rising import costs, especially for goods sourced from tariff-affected regions. As these figures roll in, they will influence not only the Federal Reserve’s rate decisions but also broader market sentiment.

Why Central Banks May Be Overreacting

Despite the potential uptick in CPI, there is a growing school of thought that central banks are overestimating the inflation threat. We argue that the structural conditions necessary for persistent inflation simply aren’t in place.

Tariffs Cause One-Off Price Increases

While the Federal Reserve and other central banks are concerned about the inflationary impact of tariffs, history suggests these shocks are typically one-time adjustments. The notion that tariffs will ignite a sustained inflation wave assumes firms will continually pass on these costs and that consumers will keep absorbing them—conditions that are not guaranteed in today’s economy.

Context Matters More Than Catalysts

Past inflationary spikes—such as the post-Covid surge—were not solely caused by supply shocks but were also fueled by extraordinary fiscal and labor market conditions. Government stimulus checks and a tight labor market enabled both businesses and households to sustain higher prices. Those conditions no longer apply. Today’s labor market has cooled significantly, and government stimulus has dried up.

Services Inflation: Still Sticky, But Easing

Central banks are particularly focused on services inflation, which tends to be more persistent. However, factors like declining rent growth and weakening consumer demand are expected to ease this component as the year progresses. In the U.S., falling shelter costs may start to make a noticeable dent in core services prices in the second half of 2025.

Haunted by the Last Inflation Wave

There’s also a psychological factor at play. Central banks, still reeling from their failure to predict the last inflation surge, may now be prone to overcorrecting. Policymakers are increasingly viewing inflation through the lens of behavioral economics—fearing that once prices rise, they’ll stay elevated simply because people expect them to. But inflation is not purely a sentiment-driven phenomenon; it also depends on whether businesses and consumers can sustain those price levels.

The Market’s Dilemma: Rate Cut or Inflation Scare?

The markets currently anticipate a potential Fed rate cut in September, a scenario built on the expectation that inflation will remain subdued. But if Tuesday’s CPI comes in hotter than expected, especially in core components, those expectations may be quickly revised.

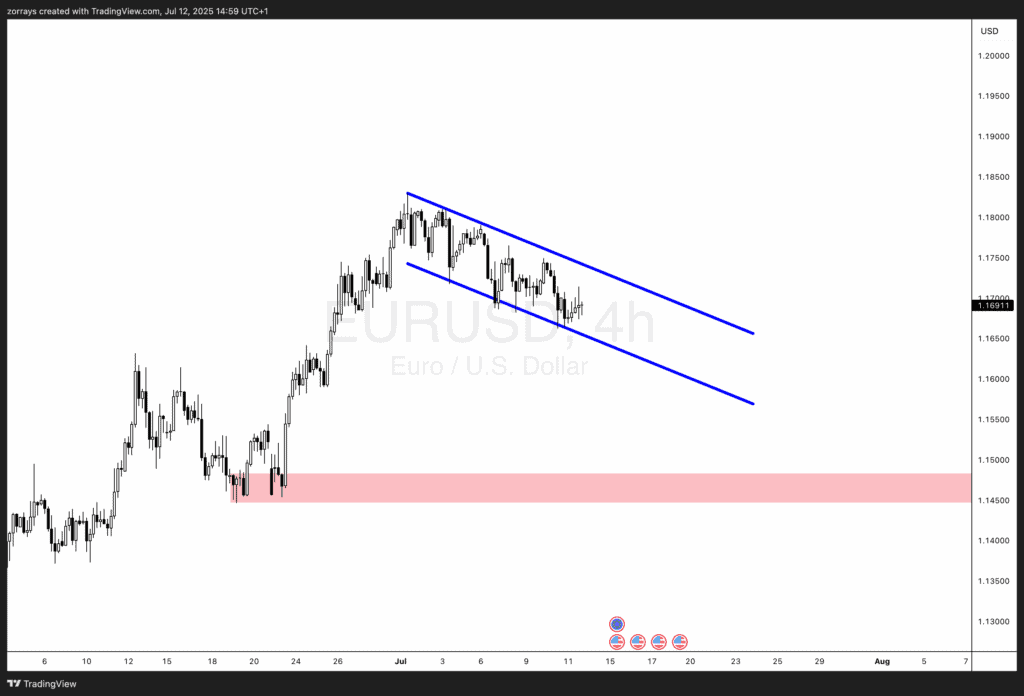

A significant surprise could push the U.S. 10-year Treasury yield toward 4.75%. Simultaneously, expectations for a September cut could evaporate, temporarily strengthening the U.S. dollar and pressuring equity markets. This could bring the EUR/USD exchange rate down toward 1.15, though any such move may be short-lived.

What Happens Next?

If Tuesday’s CPI confirms a rise in core inflation, the coming months will be under even tighter scrutiny. Here’s what to watch:

- July and August CPI: These will help determine whether the tariff impact is truly transitory.

- Labour Market Reports: Signs of slowing wage growth or reduced job openings will bolster the case for easing inflation.

- Central Bank Communication: How the Fed interprets the data will influence bond yields, currency valuations, and equity markets.

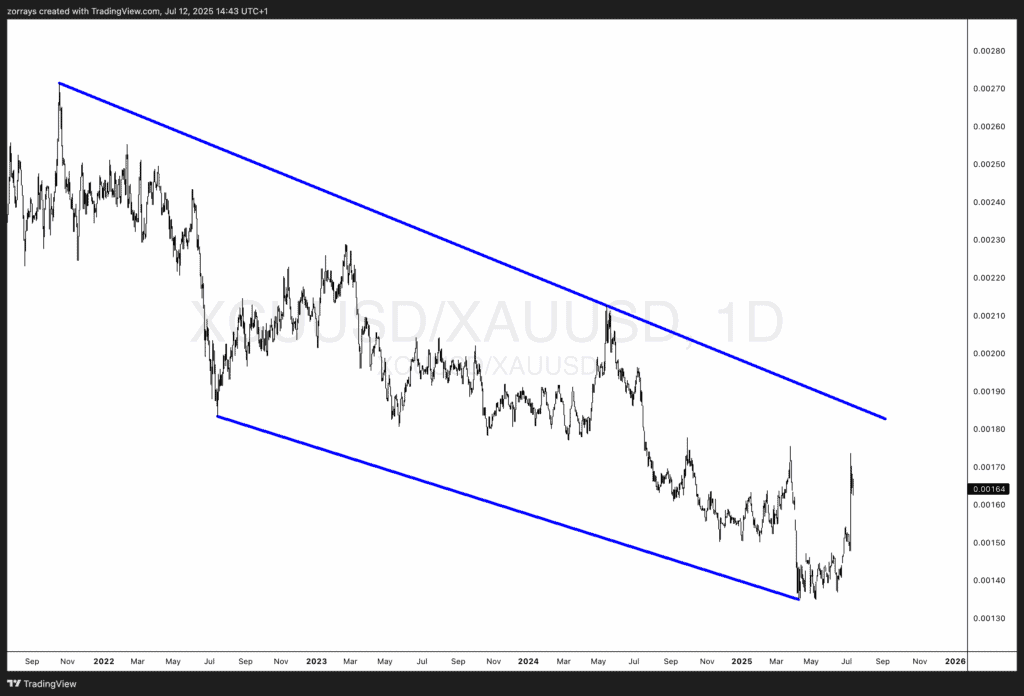

Copper/Gold Ratio Chart Testing a Key Trendline

The Copper/Gold ratio—a long-trusted gauge of macroeconomic sentiment—is approaching a major downward trendline that’s held firm since mid-2022. After a prolonged period of decline, this recent bounce marks the ratio’s most aggressive push higher in nearly two years. While it hasn’t broken out yet, it’s now pressing against a structurally important resistance level that could reshape how we think about inflation risk going forward.

So, what does this mean?

At its core, this ratio pits Dr. Copper, the industrial metal closely tied to real economic activity, against Gold, the go-to hedge for uncertainty and disinflation. When Copper outperforms Gold—as it’s attempting to now—it often reflects rising growth expectations, a pickup in risk appetite, or even the early stages of a reflationary backdrop.

This move toward the trendline is meaningful because it comes right as CPI data is due, and just as markets are wrestling with whether recent inflation will prove sticky or fade out. If this ratio breaks through the trendline, it may signal a shift in market psyche—from pricing in soft landings and Fed cuts to anticipating firmer growth or higher inflation pressure later this year.

In short, this chart serves as a real-time referendum on the inflation debate. If the ratio breaks out, central banks may not be wrong to stay cautious. If it gets rejected here, that would validate the view that inflation fears are overdone and the Fed still has room to ease without overheating the economy.

Conclusion: Inflation Might Rise—But Temporarily

Yes, Tuesday’s CPI may show an uptick in core prices, validating central banks’ short-term concerns. But the broader economic landscape doesn’t support the idea of a long-lasting inflation resurgence. The absence of robust fiscal stimulus, a cooling labor market, and softening consumer demand all suggest any inflation bump will be short-lived.

Rather than overreact, policymakers may need to stay patient. Services inflation is still elevated but showing signs of easing. Without the structural ingredients for runaway inflation, the Fed and other central banks should feel more confident in resuming rate cuts once the current noise fades.