- Weekly Outlook

- October 25, 2024

- 4 min read

Apple, Google, and Microsoft’s Earnings Reports and BoJ Interest Rate Decision

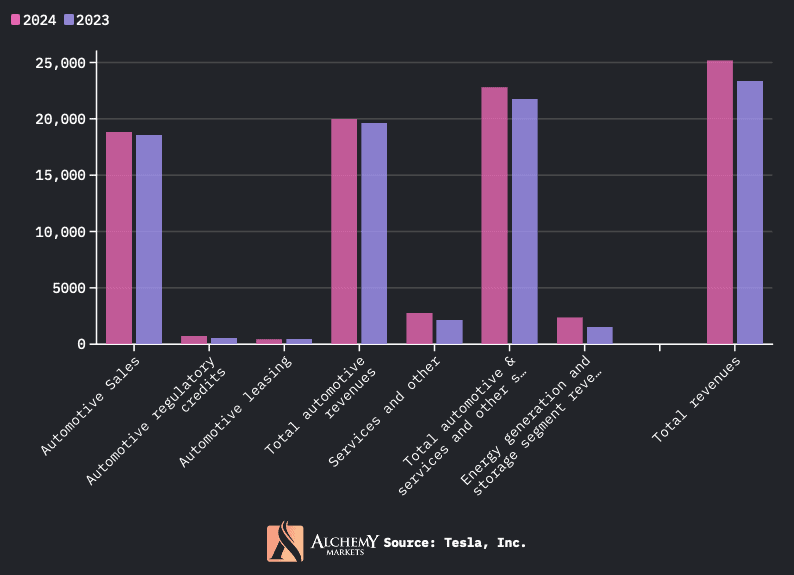

This week was marked by significant earnings reports and key central bank decisions. Tesla led the headlines, surpassing earnings expectations and providing positive forward-looking guidance that pushed its stock higher, indicating optimism around its future growth potential. On the other hand, Coca-Cola missed its earnings expectations, facing headwinds due to inflationary pressures on input costs and slower global demand.

On the monetary policy front, the Bank of Canada cut rates by 50 basis points to 3.75%, in line with market expectations. Governor Tiff Macklem emphasised that inflationary pressures are no longer broad-based, marking a shift toward stabilising growth to avoid a sharp slowdown. His comment about “sticking the landing” reflects the BoC’s delicate balance in managing inflation without derailing economic recovery.

Economic Calendar for Next Week:

Bank of Japan Interest Rate Decision: The Bank of Japan (BoJ) is scheduled to meet next week amid rising concerns about underlying inflation. Although recent data shows continued upward pressure on prices, the BoJ is expected to maintain its wait-and-see approach, leaving its policy unchanged for now. Markets will be particularly focused on the quarterly outlook report, which will reflect the central bank’s updated assessment of the domestic economy and external risks, particularly the U.S. economic situation and the weakening yen.

- Outlook: The BoJ might delay rate hikes to December, with a probability of over 50%, but much depends on external factors like U.S. elections and global market conditions. However, the BoJ is expected to raise its policy rate to 1.0% by the end of next year.

Non-Farm Payrolls (NFP) – Friday, November 3rd: The U.S. labor market is another area of focus next week, with non-farm payrolls (NFP) numbers due on Friday. Economists are predicting the U.S. economy will add 140,000 jobs, down from last month’s robust 254,000. This decline suggests a potential slowdown in job creation, signaling moderation in the labor market amidst rising interest rates and slowing demand.

- Insight: A weaker-than-expected NFP result could strengthen the case for the Federal Reserve to pause its rate hikes. On the other hand, stronger job growth could put renewed pressure on wages and inflation.

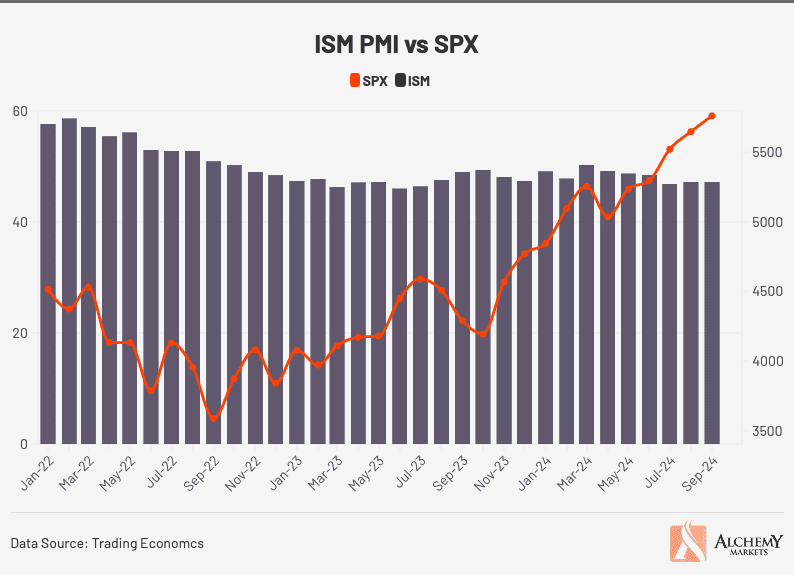

ISM Manufacturing PMI (Friday, November 3rd): Also due next Friday is the ISM Manufacturing PMI for October. Last month’s reading was 47.2, remaining below the key 50 mark that separates expansion from contraction. The market is expecting a slight increase to 47.6, which would still signal contraction but suggests that the negative sentiment is gradually improving.

- Outlook: A modest improvement in PMI could indicate that the U.S. economy is stabilising, which would be supportive of a steady GDP growth forecast in the coming quarters.

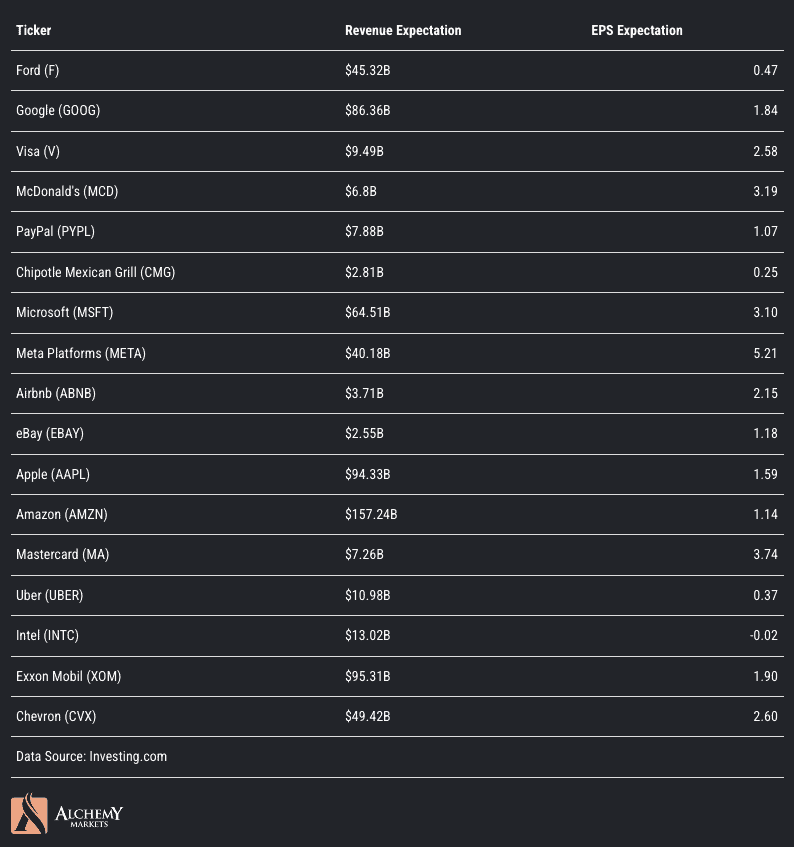

Earnings Calendar for Next Week:

Several major companies are set to report their quarterly earnings next week, across various sectors such as technology, finance, and consumer goods. Here’s a breakdown of some of the key earnings to watch:

Summary of This Week’s Earnings:

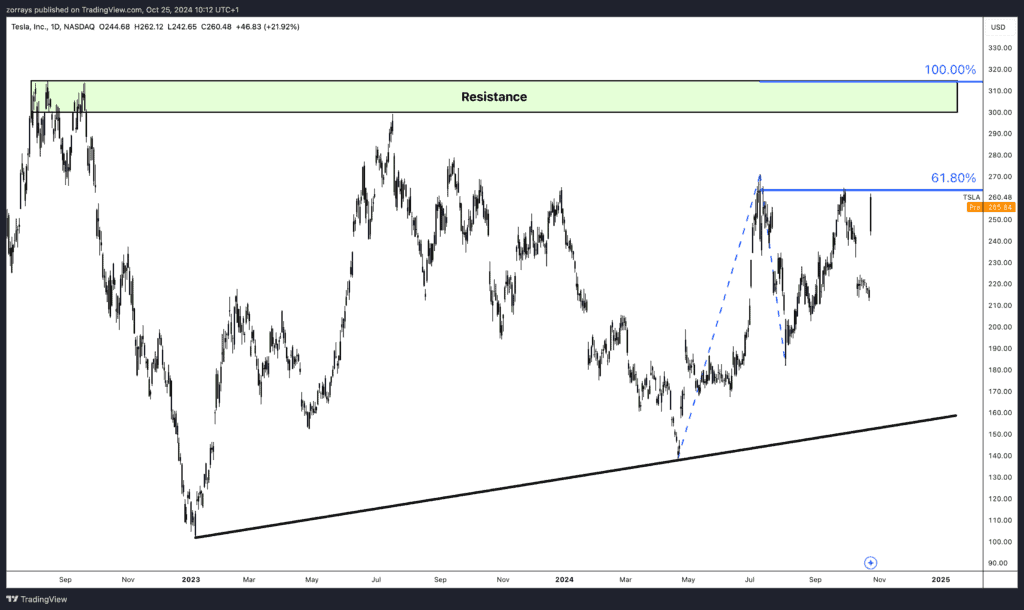

In addition to Tesla’s strong performance, other notable companies have also delivered earnings results. Tesla posted $25.18 billion in revenue, and its strong forward guidance has lifted market sentiment, with analysts setting a near-term price target of $310. On the other hand, Coca-Cola, facing inflationary headwinds, reported weaker-than-expected earnings.

As we move forward, the outlook for major tech names like Google, Microsoft, and Apple will set the tone for market sentiment in the coming weeks. Stay tuned for their reports and how they may affect broader market trends.

Conclusion:

Next week’s economic events and earnings reports will be crucial for understanding the trajectory of both the U.S. and global economy. As central banks, including the Bank of Japan, fine-tune their policies and major corporations release their financials, the market will be closely watching these events for direction.