- Opening Bell

- August 8, 2024

- 3 min read

What’s Next for USD, EUR, and the Fed?

USD Stability Amidst Economic Data and Fed Actions

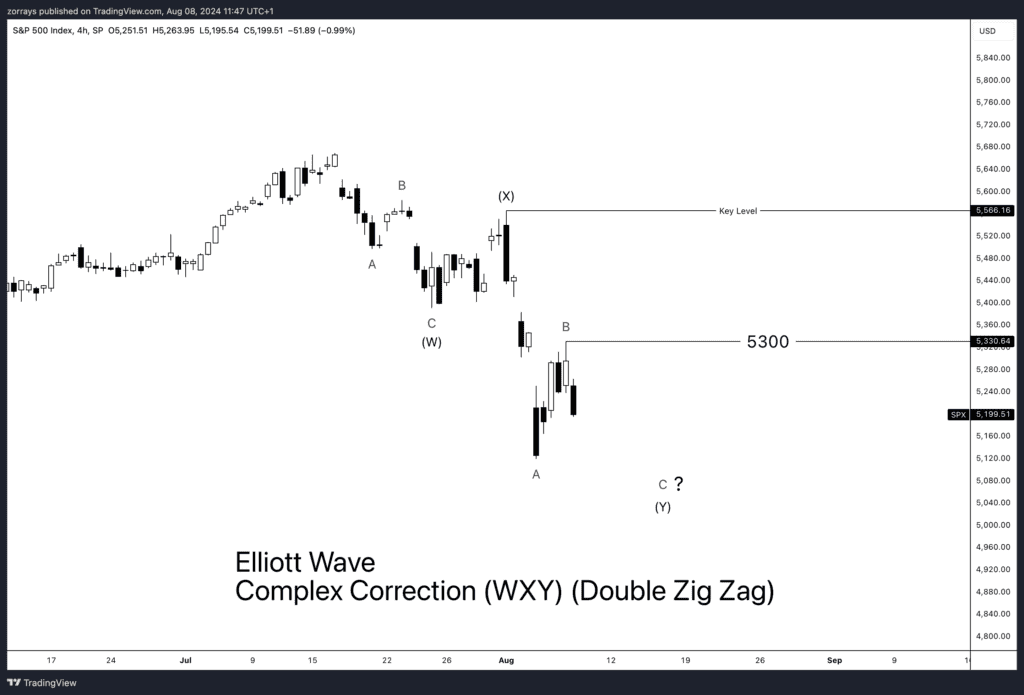

S&P 500 Index

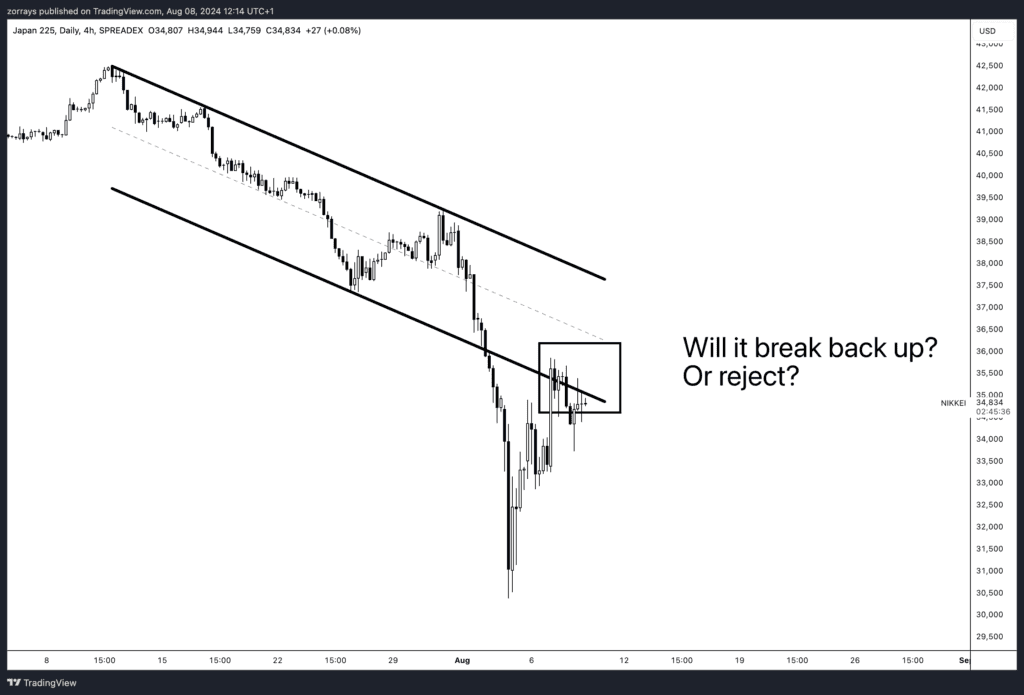

Nikkei 225

Recent sessions have shown a semblance of stability in risk assets, with equity markets rebounding and market interest rates rising from panicked levels. This recovery has helped some risk currencies recoup some of their losses. However, major equity indices like the S&P 500, stuck around the 5300 mark, and the Nikkei 225, hovering near 36,000, have hit key technical resistance levels. We believe that closing above these levels is crucial to signal the end of the current corrective phase.

Data source: Trading Economics

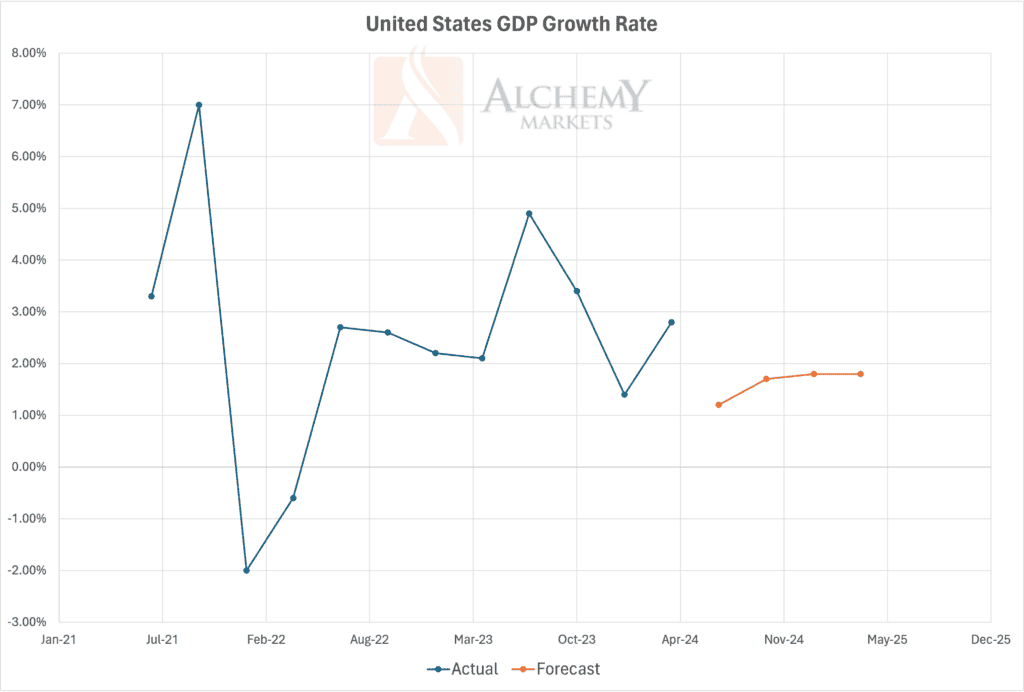

The direction of equity corrections largely depends on upcoming US economic data and Federal Reserve communications. The critical question is whether the US economy is heading toward a recession and how the Fed will respond. A recession without Fed intervention due to persistent inflation could lead to a flatter or inverted yield curve, significant equity losses, and a stronger dollar.

Conversely, softer US data prompting a Fed response—potentially hinted at the upcoming Jackson Hole symposium—could result in a steeper yield curve, more stable risk assets, and a weaker dollar. We lean toward the latter scenario, expecting the dollar to soften in the coming months.

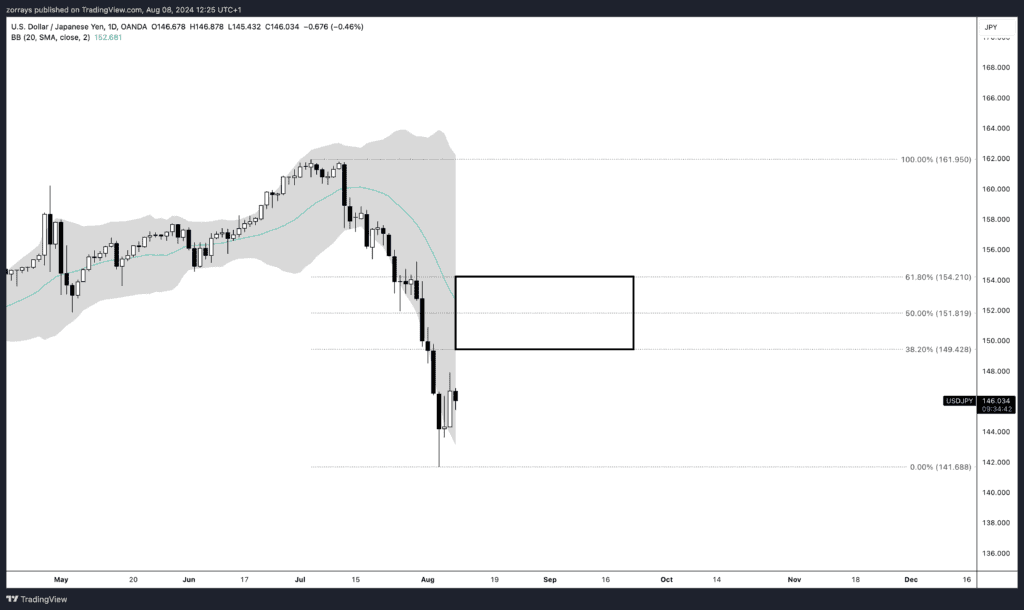

Yen Carry Trade and USD/JPY Dynamics

Attention is also on the yen carry trade and its potential to drive USD/JPY below 140, causing cross-market volatility. We have previously noted that speculators in yen futures markets may have nearly flattened their positions. The deeper layers of the yen carry trade are harder to gauge, and any claims about significant unwinding should be viewed cautiously.

Currently, it seems USD/JPY may remain in the 145/155 range, unlikely to sustain a move above 155/160 as it heads towards the middle bound of the Bollinger Band, with a softer US rate environment possibly pulling it back to the 138/140 area.

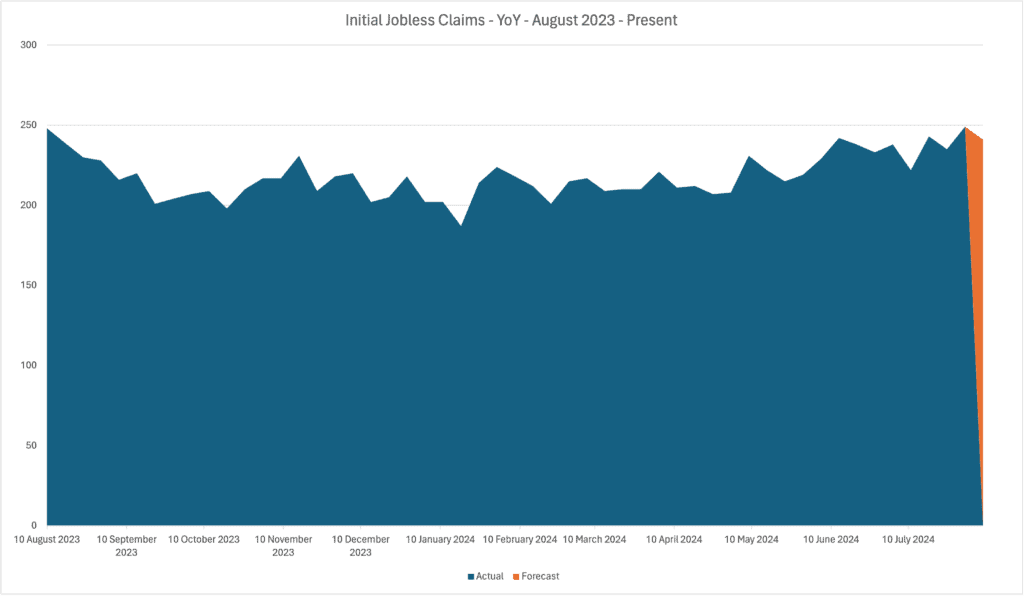

Initial Jobless Claims

Data Source: Department of Labor

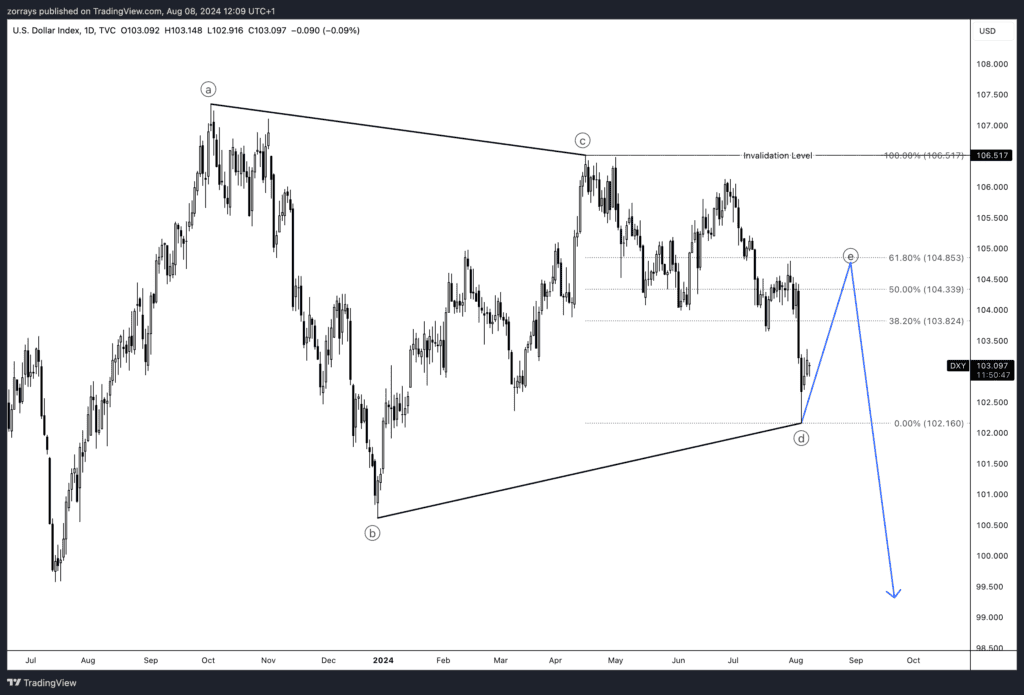

For today, keep an eye on initial jobless claims. A higher number could increase fears of rising unemployment and prompt a Fed response, negatively impacting the dollar. The DXY index might be capped at 104/105 region during rallies, with a possibility of it moving down breaching the 102 mark in the coming weeks.

U.S. Dollar Index

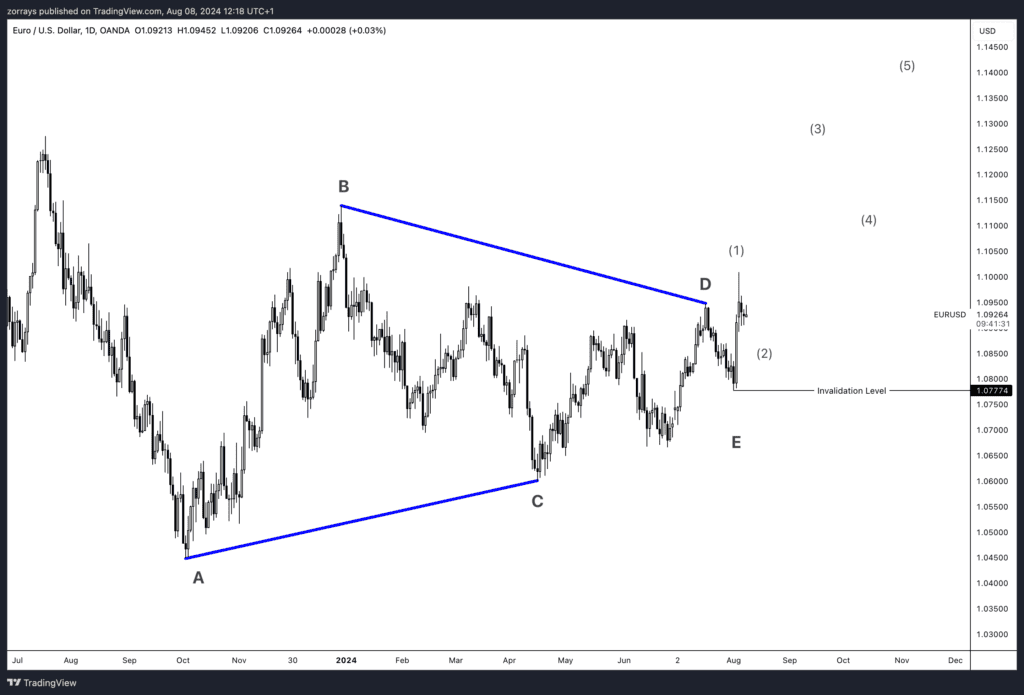

EUR/USD Prospects Amid Market Settling

Should equity markets stabilise, EUR/USD has the potential to rise, reconnecting with the narrowing eurozone-US interest rate differentials and possibly trading above 1.10 in the coming months. Short-dated EUR rates, currently priced at 81bp of European Central Bank easing this year, seem overly aggressive. Our forecast suggests only 50bp of further easing. We anticipate EUR/USD to maintain support at 1.07774, and a higher-than-expected US initial claims figure today could see EUR/USD challenge 1.10.

Conclusion

The coming weeks will be pivotal for both the USD and EUR, with economic data and Federal Reserve actions playing crucial roles. Monitoring initial jobless claims, Fed communications, and key technical levels in equity markets will provide insights into the future direction of these currencies.