- Opening Bell

- September 26, 2024

- 6min read

Powell’s Speech, GDP, and US Jobs Data: What to Expect Today

In the wake of the Federal Reserve’s surprising 50 basis point rate cut on September 18th, financial markets are on edge as they await critical economic data and Fed Chair Jerome Powell’s upcoming speech.

Today’s Final GDP report and Unemployment Claims will provide vital clues on the state of the economy, while Powell’s remarks are expected to shed light on the Fed’s future policy path.

Will the Fed’s aggressive cut be followed by further easing, or will stronger data signal a pause in rate cuts?

Final GDP q/q (UTC 12:30PM)

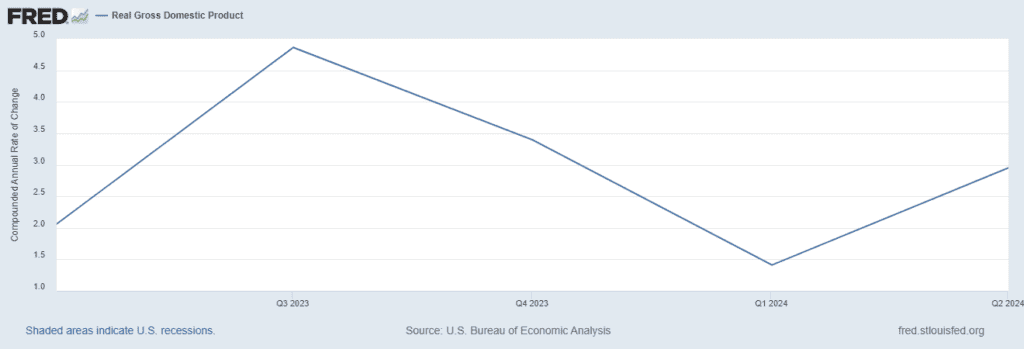

The Final GDP data is a lagged indicator that tells us about a country’s overall economic strength. With the recent 50bps rate cut on September 18th, the Fed has already signaled concerns about potential economic slowdowns, so today’s GDP report will be closely watched.

| Expectations / Forecast: 3.0% | Previous: 3.0% |

Since Q3 of 2023, the real GDP has shown a weakening trend, which puts pressure on the Federal Reserve to take a dovish stance in regards to monetary policy, favouring rate cuts. However, there has been an uptick from Q1 to Q2 for GDP, which is expected to keep growing with a forecast of 3.0% for today’s data.

Scenarios:

- The current expectation of the markets is for rate cuts to continue, as a 50bps is drastic and signals the Feds want to desperately address some economic stressors.

- If GDP comes in higher than expected (3.0%), the immediate need for further rate cuts is reduced. This may allow DXY and USD to regain some strength.

- If GDP comes in lower than expected (3.0%), this would signal that the economy is continuing to slow down, despite its uptick in Q2. This may create downward pressure on USD and the DXY.

Unemployment Claims (UTC 12:30PM)

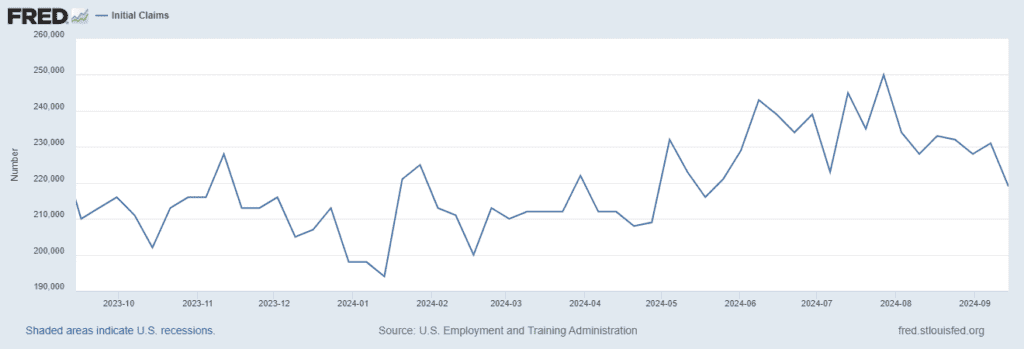

Historically, sharp increases in unemployment claims are often followed by aggressive rate cuts, such as the 50bps cuts seen in response to the 2001 recession, the 2008 recession, or the COVID-19 pandemic.

So if the statistics are able to meet or exceed expectations today, it should put some pressure on the Fed to continue their rate cuts.

| Expectations / Forecast: 224K | Previous: 219K |

While the claims can see a rise with today’s report, it’s important to take note that since August 2024, unemployment claims seems to be in a downtrend. Therefore, it’s important to watch for any surprises to the actual reading, as the market expects claims to come in higher than last month’s reading.

Scenarios:

- If unemployment claims comes in at 224K or higher, the immediate need for a rate cut increases. This may put downward pressure on the USD and DXY.

- If unemployment claims comes in lower than 224K, the immediate need for a rate cut decreases. This may provide some temporary strength for the USD and DXY.

- If unemployment claims comes in lower than 219K (previous reading), the downtrend is furthered on the FRED graph above and signal a stronger-than-expected labour market. This will shock the markets with temporary downward pressure, strengthen the dollar, and drastically reduce the expectation for immediate rate cuts.

Fed Chair Powell’s Speech (UTC 1:20PM)

Fed Chair Powell’s speech has historically been used as a signal for the future monetary policy. Given the recent 50bps rate cut, Powell’s speech today will be closely scrutinised for clues about the Fed’s future path. Markets will be particularly sensitive to his tone on the economic outlook, inflation, and forward guidance on further rate cuts.

The markets will be listening for hints of hawkish or dovish tone, which are respectively bearish and bullish for the general markets. If Powell is hawkish, this may mean imminent rate cuts may be on pause; while if Powell is dovish, continued easing would be expected.

Key Focus Areas in Powell’s Speech to Watch Today

❶ Explanation of the 50bps Rate Cut: If Powell explains the cut as a forward-looking, precautionary measure, it may reduce expectations of imminent further cuts, which could stabilise USD. If he expresses deeper concerns about the economy, markets may anticipate additional cuts, weakening the USD.

❷ Future Rate Cuts: If Powell signals that he Fed is in wait-and-see mode, this could suggest no immediate further cuts are planned, unless data worsens (See above). If he says economic data is continuing to deteriorate, it signals a potential additional 25bps or higher in coming months.

❸ Economic Outlook: If Powell is optimistic about the economy, citing the resilience of US consumer and labour markets, this could stabilise USD. If he says the economy is weakening, more easing of interest rates would be implied, signalling further cuts.

❹ Inflation Commentary: If Powell comments that inflation will rise due to the cut, this may reduce the need for immediate cuts. If he instead expresses that inflation remains a significant concern, markets may expect more rate cuts, weakening the USD.

As we approach Powell’s speech, it’s crucial to listen for hints about future rate cuts and how the Fed views current economic conditions. Key points to watch include his explanation of the 50bps cut and whether he suggests the Fed is in wait-and-see mode or leaning toward further easing.

| How does the Fed Pivot historical data play into these statistics? |

|---|

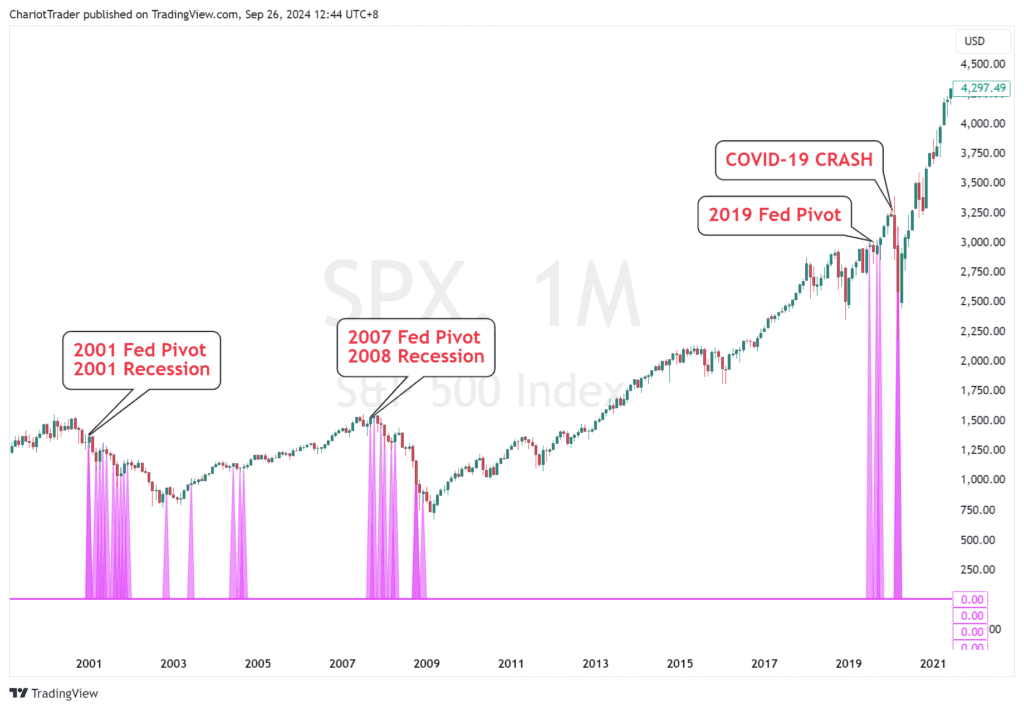

While rate cuts on the Dollar are fundamentally bullish for the general markets, the implementation of aggressive rate cuts, such as the 50bps, has often seen a drastic price decline of >30% on the S&P 500 not long after. Taking a look at the last three data points, we can see how a Fed Pivot often precedes a crash to the downside. This happened during the 2001 Recession, 2008 Recession, and also in the 2020 COVID crash. It’s important to remember that, despite these historical points of observation, that the price of S&P 500 can continue grinding up. For example, the Fed Pivot in 2019 did not result in a significant price decline, not until 7 months later due to the COVID-19 pandemic coming into full swing. Key Takeaway: Timing a Fed Pivot crash and jumping into short positions prematurely could be risky. It’s essential to keep observing market trends and indicators before making any hasty moves. |

Closing Thoughts

The overall market trend suggests expectations of further rate cuts for the USD, with investors pricing in continued easing by the Federal Reserve, especially after the recent 50 bps cut.

However, key data releases like Final GDP and Unemployment Claims today hold the potential to disrupt this outlook. If the readings come in stronger than expected, signalling robust economic growth or a healthier labour market, it could temporarily strengthen the USD and delay further rate cuts.

This would likely cause a temporary derailment of the overall bullish sentiment across many assets, particularly in risk-on markets like NZD/USD.

For deeper insights into how other markets are performing and what to expect next, refer to:

Nikkei Elliott Wave: More Dark Days for the Rising Sun?

NZD/USD Surge: Kiwi’s Turn to Emerge (Elliott Wave)