- Opening Bell

- July 30, 2024

- 3 min read

USD Climbs Ahead of Key JOLTS and Consumer Confidence Reports

The U.S. dollar experienced a modest uptick across various currencies yesterday, though the precise cause remains uncertain. This movement might be attributed to the month-end flows. However, the more significant focus for the foreign exchange markets is whether the broad, cross-market correction observed around mid-July has concluded. The outcome of upcoming key events will be pivotal in determining this.

One of the primary factors influencing market sentiment is the potential 15 basis point rate hike by the Bank of Japan, anticipated by some analysts. Such a move could strengthen the yen independently, extending the corrective phase. However, the likelihood of a rate hike is not assured, with a majority in Japan considering it premature. If the Bank of Japan refrains from hiking rates, the USD/JPY could rise to around the 157 mark, prompting investors to reenter high-yield/activity currencies that suffered losses earlier in July.

Another crucial event on the horizon is the Federal Open Market Committee (FOMC) meeting. The FOMC’s stance could prove risk-positive and dollar-negative if it prepares markets for a potential rate hike in September. This meeting will significantly influence the dollar’s trajectory in the near term.

Focus on US Economic Releases

Today, market participants are keenly awaiting two critical U.S. economic data releases, both scheduled for 16:00 CET. The Job Openings and Labor Turnover Survey (JOLTS) data is expected to adjust back to around 8 million openings, following an unexpected spike to 8.14 million last month. The JOLTS figures have been indicative of excess labor demand, and a decline would support the Federal Reserve’s view that the labor market is rebalancing.

Also under scrutiny is the July consumer confidence report, anticipated to show a decline. Recent trends, bolstered by second-quarter earnings reports, suggest that the U.S. consumer might be weakening. A lower consumer confidence reading would reinforce expectations that the Federal Reserve might opt for a rate cut in September to sustain economic growth.

The U.S. Dollar Index (DXY) performed well yesterday, but these gains could be reversed if today’s data disappoints or if European data—such as France’s unexpectedly strong second-quarter GDP—buoys the euro.

EUR: Potential Boost from Better GDP Data

This morning, France reported better-than-expected second-quarter GDP growth. Similar GDP updates are expected from Germany, Italy, Spain, and the broader eurozone later today. A positive surprise in the eurozone’s GDP, forecasted at 0.2% quarter-over-quarter, could lift the euro by challenging the current market narrative of downside growth risks. It could also temper expectations for further European Central Bank (ECB) rate cuts this year.

Today’s schedule also includes national releases of July Consumer Price Index (CPI) data, ahead of the eurozone’s release tomorrow. The consensus currently expects the core CPI to retreat to around 2.8% year-over-year, unlikely to significantly alter ECB policy expectations.

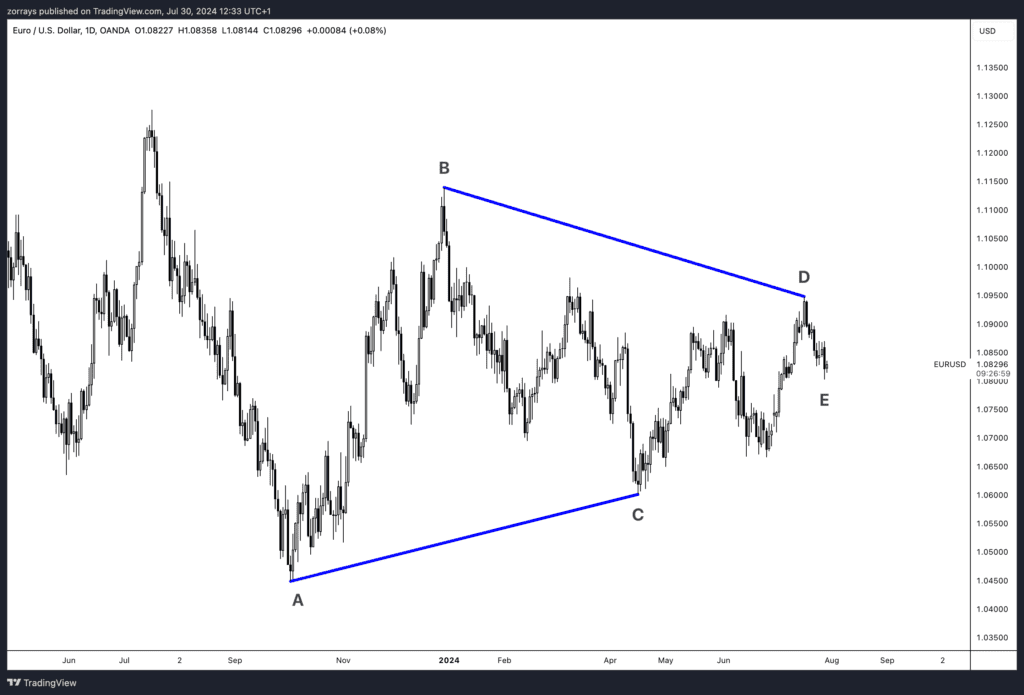

The EUR/USD pair had a soft start to the week but may find support from today’s GDP data. The pair could rise further if the Federal Reserve adopts a more dovish tone tomorrow evening, potentially setting 1.0800 as a support level for the week.