- Opening Bell

- March 18, 2025

- 2 min read

US Data Weakens the Dollar as Markets Stay Fragile

The US dollar is struggling, falling against all major G10 currencies except the Japanese yen. Recent economic data has disappointed investors, adding to concerns about the strength of the US economy.

Weak Retail Sales and Manufacturing Data Hurt the Dollar

February retail sales increased by just 0.2% month-on-month, far below the expected 0.6% rise. This follows a sharp decline in January, signaling weaker consumer spending. Meanwhile, the Empire Manufacturing Index dropped to its lowest level in over a year, reflecting a slowdown in industrial activity.

These disappointing figures have fueled concerns that the US economy may be losing momentum. As a result, investors have pulled back from the dollar, seeking stronger currencies.

Stock Market Remains Fragile Despite Gains

Despite the weak economic data, US stock markets had a positive trading session. However, uncertainty remains high. The US administration has hinted that a mild recession might be an acceptable cost in the push for trade reforms.

Adding to the uncertainty, the Federal Reserve is set to announce its latest interest rate decision soon. While markets hope for rate cuts, rising inflation expectations suggest the Fed may remain cautious. This could limit any potential relief for investors.

Key Events to Watch: Industrial Data and the Trump-Putin Call

There’s no major economic data set to influence the dollar today. However, investors will be keeping an eye on:

- Industrial production figures for February

- Housing starts data

Additionally, markets are watching an important phone call between former President Trump and Russian President Putin regarding Ukraine. If Russia shows willingness to accept a US-Ukraine ceasefire plan, the dollar and yen—both considered safe-haven currencies—could face further pressure.

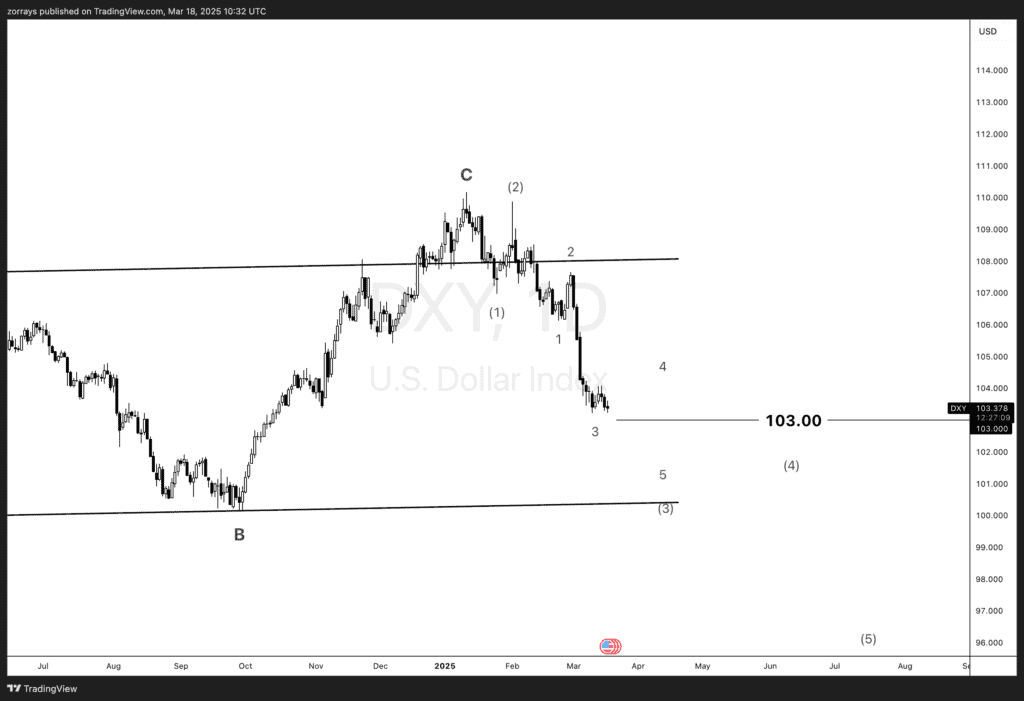

Dollar Index (DXY) Could Drop Further

The US Dollar Index (DXY) is already slipping and may test 103.0 before the Federal Open Market Committee (FOMC) meeting. If the Fed takes a cautious approach, the dollar could find some support. However, further weakness remains a possibility.

Conclusion

The dollar continues to face headwinds from weak economic data, trade policy uncertainty, and global geopolitical events. While stock markets are holding up for now, risks remain. With the Fed’s decision looming, investors will be watching closely to see if the central bank offers any relief.