- Opening Bell

- November 27, 2024

- 4 min read

Rates, Rallies, and Resolutions in the Last 24 Hours

The past 24 hours have been a whirlwind for global markets, with pivotal developments across monetary policy, inflation data, and geopolitical affairs. From the Federal Reserve’s nuanced stance on rate adjustments to the Reserve Bank of New Zealand’s surprise cut, central banks have dominated headlines. Meanwhile, Australia’s inflation story took an intriguing turn, and the Middle East brought a glimmer of hope with a critical ceasefire agreement. As energy markets and currencies react, we’re diving into these events to untangle their implications for the dollar, oil prices, and global growth. Here’s your concise guide to the market-shaping events of the day.

1. FOMC Meeting Minutes

The Federal Open Market Committee (FOMC) decided to lower the federal funds target range to 4.5%–4.75%, citing easing labor market conditions and moderate progress toward its 2% inflation goal. The Fed emphasized uncertainty in the economic outlook and its readiness to adjust policy as needed. The balance of risks between employment and inflation appears stable, though vigilance remains high regarding financial and international developments.

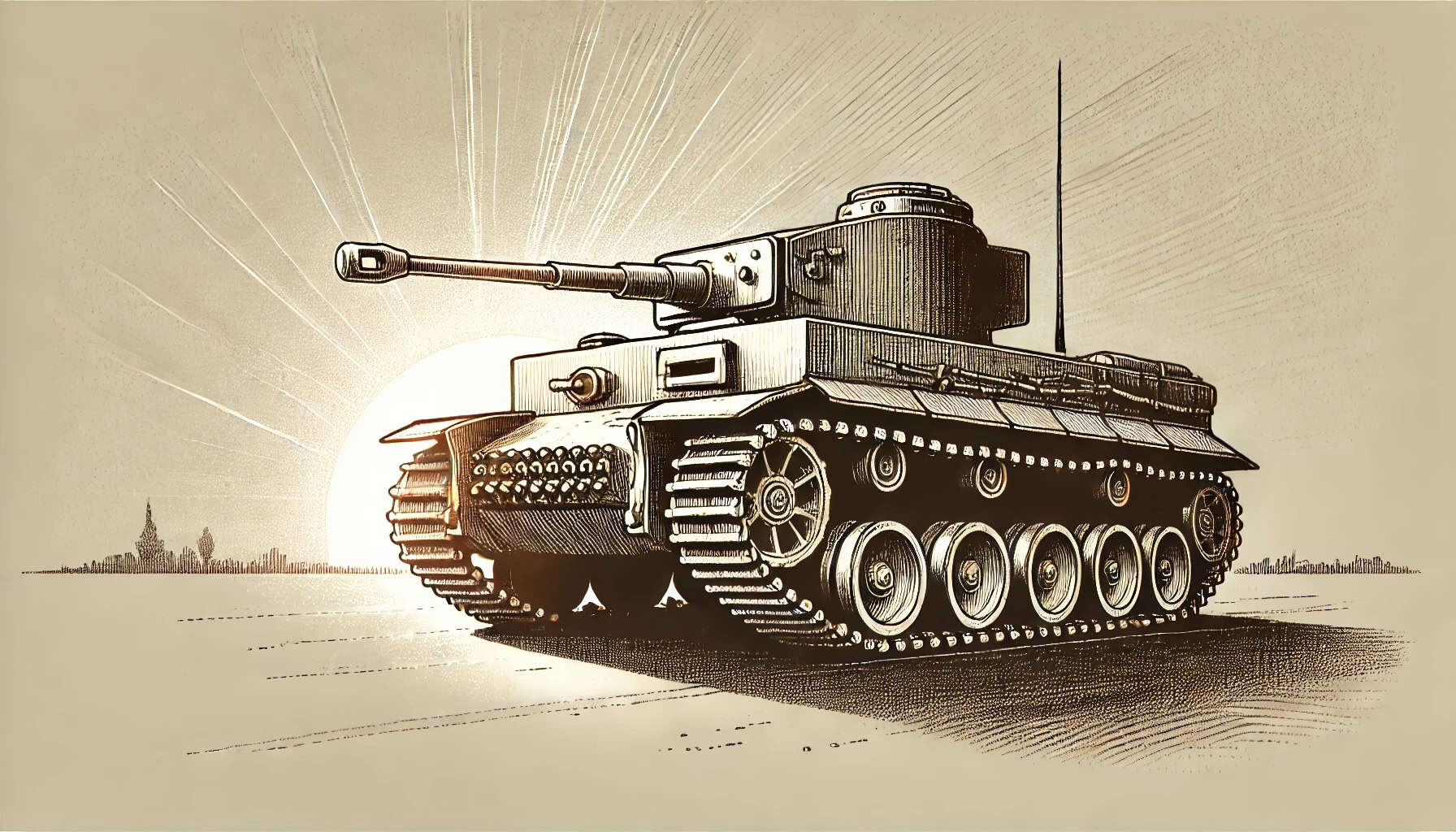

U.S. Dollar Index – Daily Timeframe

The dovish tone suggests a cautious stance as the Fed approaches the terminal rate for this cycle. This could keep the U.S. dollar under pressure in the short term, especially if other central banks remain aggressive. Equity markets may find relief in the slower pace of tightening, potentially encouraging risk-on sentiment, but the broader uncertainty might limit gains.

2. Reserve Bank of New Zealand (RBNZ) Rate Cut

The RBNZ lowered its Official Cash Rate (OCR) by 50 basis points to 4.25%, with inflation now near the midpoint of its 1%–3% target band. The easing reflects subdued economic activity, spare productive capacity, and expectations of weak employment growth through 2025.

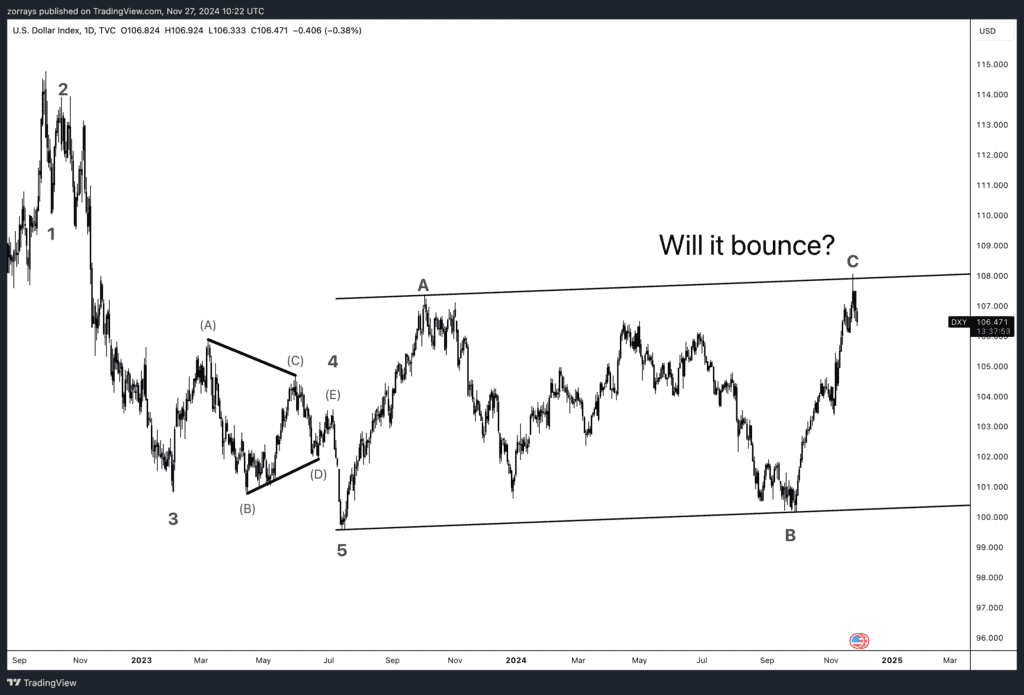

NZD/USD – Daily Timeframe

The rate cut reflects New Zealand’s challenges in reigniting growth amidst global and domestic headwinds. For the New Zealand dollar (NZD), the reduction could exert downward pressure, particularly against peers like the Australian dollar or U.S. dollar. However, expectations of further easing in early 2025 may have already been priced in, limiting immediate volatility.

3. Australia’s Inflation Data

October’s inflation rate stood at 2.1% YoY, within the Reserve Bank of Australia (RBA)’s target range but heavily influenced by temporary government measures like electricity subsidies. Core inflation remains stubborn, rising to 3.5%, which underscores underlying price pressures despite the headline figure’s stability.

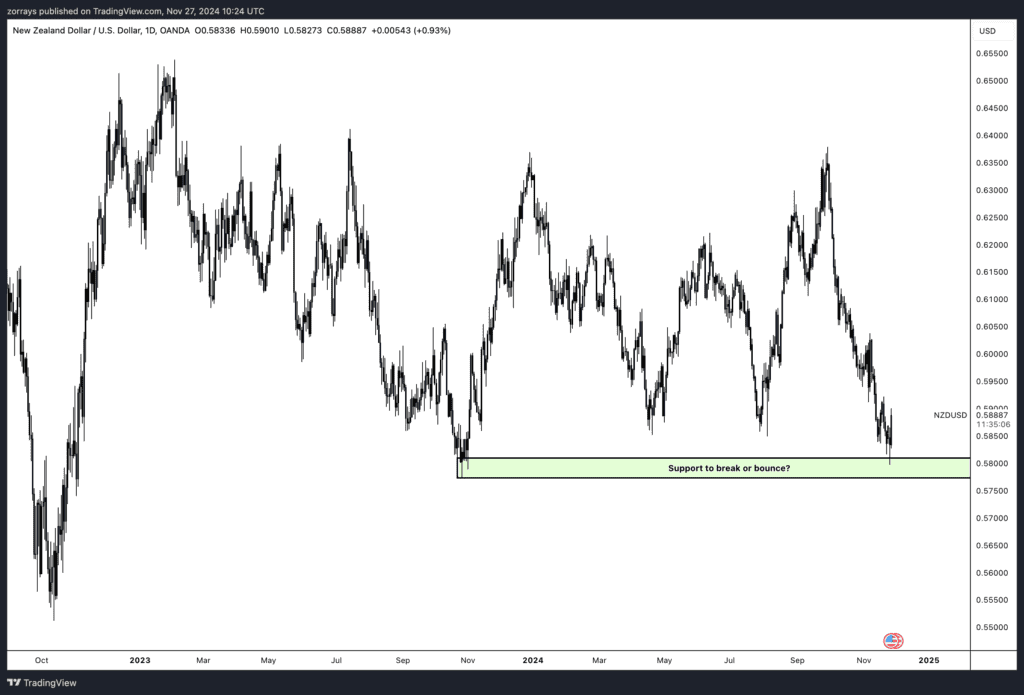

AUD/USD – Daily Timeframe

The Australian dollar (AUD) remained largely unaffected by the data, as markets focus on core inflation and the likelihood of an RBA rate cut remains distant. Stability in the AUD reflects broader macroeconomic resilience, but prolonged inflation concerns could affect future monetary policy expectations.

4. Energy Markets: Ceasefire in the Middle East

Israel and Hezbollah agreed to a 60-day ceasefire, reducing tensions and allowing time for peace talks. Meanwhile, U.S. crude oil inventories fell by 5.9 million barrels, but refined product stocks rose. ICE Brent remains flat after Monday’s sharp decline, reflecting cautious optimism. Additionally, the upcoming OPEC+ meeting is likely to see a delay in planned production increases due to demand concerns.

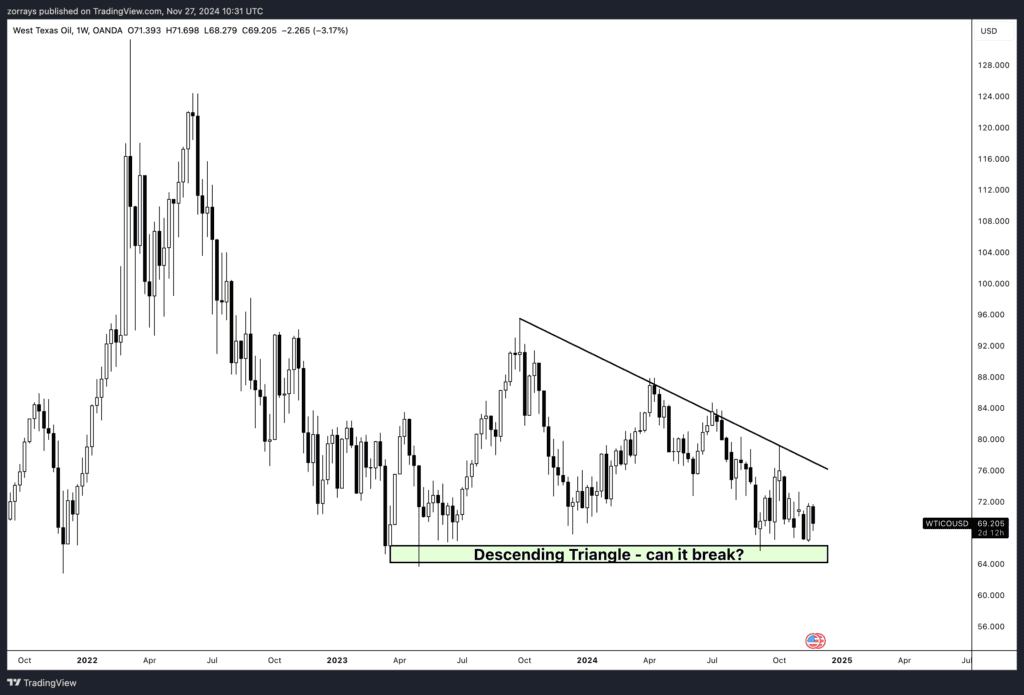

U.S Oil – Weekly Timeframe

The ceasefire reduces immediate geopolitical risks in the Middle East, a key factor for crude price stability. However, OPEC+ decisions and U.S. inventory data will heavily influence near-term oil prices. Crude may struggle to break above $75/barrel, with oversupply risks capping gains.

The crude oil chart highlights a descending triangle pattern, with consistent lower highs and a horizontal support level near $68. A break below this key support could signal further downside momentum, potentially targeting lower price levels. However, if buyers step in and push prices above the descending trendline, it may invalidate the bearish setup and suggest a potential reversal.

This mix of monetary policy adjustments, inflation dynamics, and energy market developments offers a nuanced outlook. Markets are poised for cautious trading, with monetary easing measures providing some support while inflation and geopolitical risks linger.