- Opening Bell

- August 1, 2024

- 6 min read

Rate Cuts Showdown: The Fed and BoE Set the Stage

As global economies navigate turbulent waters, central banks play a pivotal role in steering monetary policy. The Federal Reserve’s recent decision, coupled with the Bank of England’s (BoE) anticipated move today, has set the stage for significant shifts in interest rates. Additionally, the ISM Manufacturing PMI data provides crucial insights into economic activity. Let’s dive into the details of these events and their implications for markets and currencies.

Fed Holds Steady, Hints at September Cut

The Federal Reserve’s Stance on Inflation and Employment

The Federal Reserve left its monetary policy unchanged, as widely expected. However, subtle changes in the language of the press release indicate a shift in focus. The removal of the word “modest” from the description of progress towards the inflation goal suggests increasing confidence among officials that inflation is trending towards the 2% target. Moreover, there is a new emphasis on risks to both inflation and employment, highlighting concerns about rising unemployment rates.

Chair Powell’s Dovish Signals

Fed Chair Jerome Powell provided a cautiously dovish outlook, signaling potential rate cuts if data continues to align with expectations. Powell highlighted a “normalising” economy, with cooling inflation across goods and services. However, he stressed that more data is needed to confirm the trajectory, particularly regarding the labor market. The market’s response was lukewarm, as it hoped for a more explicit commitment to rate cuts.

Anticipating the Jackson Hole Conference

The Jackson Hole Conference at the end of August could be a critical moment for signaling the Fed’s next moves. With the unemployment rate exceeding forecasts and inflation moderating, the stage is set for potential cuts in September, November, and December. The Fed’s long-standing goal of a “soft landing” seems achievable, provided the data supports it.

Yield Movements and Market Reactions

Post-FOMC, the yield on 2-year and 10-year Treasuries nudged higher, reflecting anticipation of rate cuts. The 2-year yield is trending towards 4%, with the 10-year not far behind. This flattening of the yield curve suggests market readiness for the Fed’s easing cycle. However, liquidity conditions, influenced by the Fed’s quantitative tightening, remain a point of interest.

The Dollar’s Response

The dollar showed initial strength post-announcement but softened as Powell’s dovish tones set in. The prospect of a September rate cut could keep the dollar on the defensive, especially with the Fed’s renewed focus on its dual mandate. This shift in short-term rates has already seen some movement in the forex markets, with the yen and Swiss franc gaining ground.

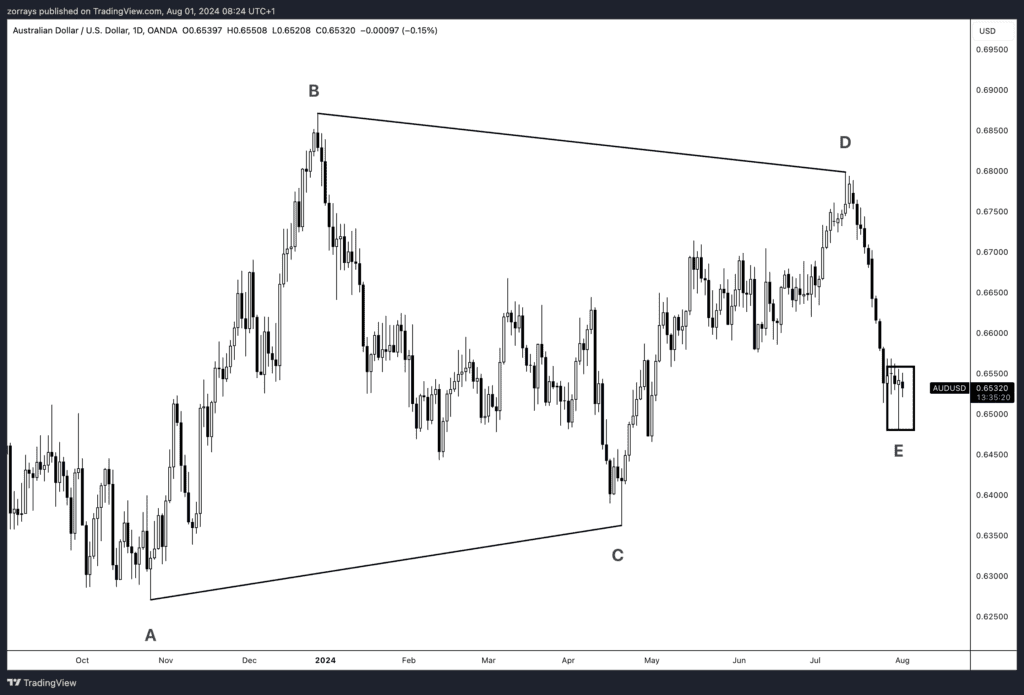

AUD/USD

The AUD/USD pair is experiencing significant market dynamics due to contrasting monetary policies between the U.S. and Australia. Here’s a quick breakdown:

- U.S. Federal Reserve: Holding rates at 5.50%, with a potential cut in September if inflation moderates, leading to a softer U.S. dollar.

- Australian Reserve Bank (RBA): Cash rate currently at 4.35%. Speculation exists about future rate cuts, but no clear direction yet, leaving room for possible hikes if inflation persists.

- Market Impact: This divergence has led to the AUD/USD being trapped in a sideways Elliott Wave triangle. The pattern’s Wave E ended with a Pinbar candlestick, suggesting potential reversal or continuation, depending on upcoming economic indicators and central bank actions.

This situation is closely watched by carry traders, who take advantage of interest rate differentials by borrowing in currencies with lower rates to invest in higher-yielding ones. The next steps from the Fed and RBA will be crucial in determining the pair’s future direction.

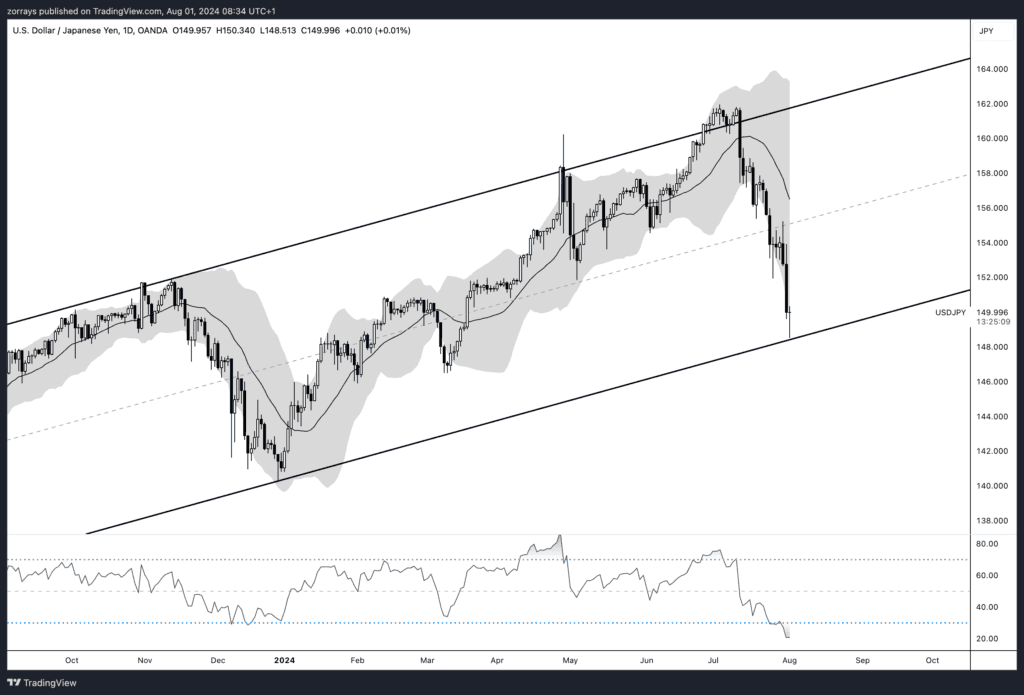

USDJPY

he USD/JPY pair recently dropped to the lower bound of its ascending channel and touched the lower Bollinger Band, indicating potential “oversold” conditions. This movement is influenced by the Bank of Japan’s (BOJ) potential intervention to prevent excessive yen weakness and the dovish signals from the U.S. Federal Reserve.

Key points:

- BOJ Intervention: Speculation around BOJ intervention has supported the yen, contributing to the recent drop in USD/JPY.

- Dovish Fed: The Federal Reserve’s dovish outlook, suggesting possible rate cuts, has added downward pressure on the dollar.

- Technical Indicators: The pair is showing oversold signals both from the RSI and the lower Bollinger Band, indicating a potential correction or consolidation.

- Channel Support: The price has reached the lower bound of the ascending channel, which may provide short-term support.

These factors suggest that while the pair may experience a short-term correction, the broader trend could depend on the evolving monetary policies of the BOJ and the Fed.

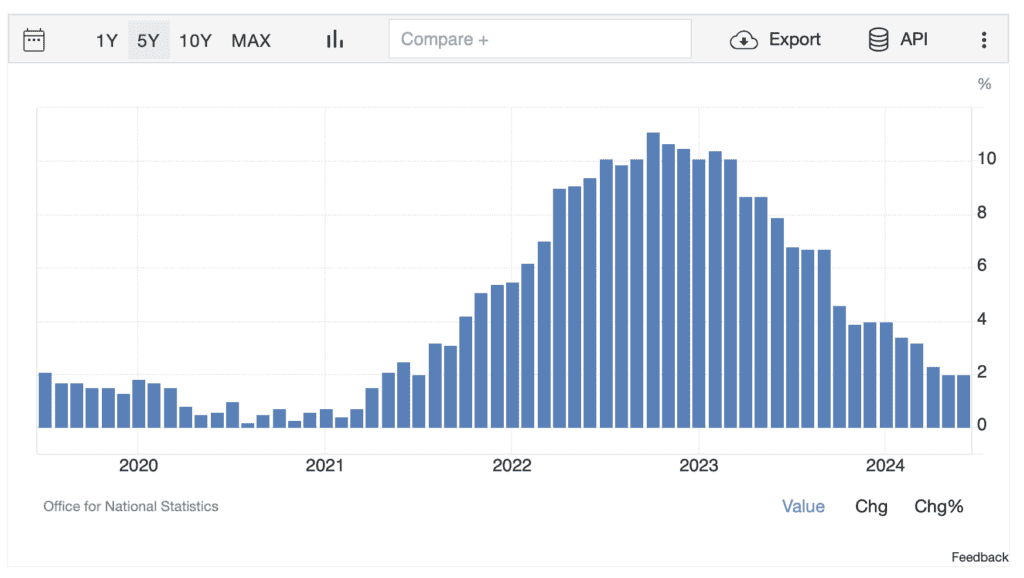

BoE’s Rate Decision: To Cut or Not to Cut?

United Kingdom’s Inflation Rate: 2%

Today’s Bank of England meeting is crucial for the GBP/USD pair and UK economic outlook. With the market slightly leaning towards a rate cut, the BoE’s decision could have a significant impact on sterling. The rationale for a cut centers around declining services inflation and weakening pricing power, as reflected in recent surveys. A cut could lead to a drop in Gilt yields and pressure on the pound, especially if the BoE refrains from providing forward guidance.

ISM Manufacturing PMI: A Key Economic Indicator

The ISM Manufacturing PMI data, set to release later today, will provide further insights into the health of the U.S. manufacturing sector. This indicator is critical for assessing economic activity and can influence the Fed’s policy decisions. A soft reading could reinforce expectations for a dovish stance, further impacting market dynamics and the dollar.

Conclusion

As we navigate through these pivotal economic events, the focus remains on central banks’ responses to evolving data. The Fed’s cautious approach, the BoE’s potential rate cut, and the ISM Manufacturing PMI will all play crucial roles in shaping market sentiment and currency movements. Investors and policymakers alike will be watching closely as the narrative unfolds, with significant implications for global markets.

FAQs

- What did the Fed decide in its recent meeting?

- The Federal Reserve left interest rates unchanged but hinted at potential rate cuts if data supports a soft landing.

- How did the market react to the Fed’s announcement?

- The market showed initial disappointment with the lack of explicit commitment to rate cuts, leading to a softening of the dollar.

- What is expected from the Bank of England’s decision today?

- The BoE is anticipated to cut rates, potentially leading to a drop in Gilt yields and pressure on the pound.

- How does the ISM Manufacturing PMI impact economic outlooks?

- The ISM Manufacturing PMI provides insights into the manufacturing sector’s health, influencing monetary policy decisions.

- What is the significance of the Jackson Hole Conference?

- The Jackson Hole Conference is a platform where central banks often signal future policy directions, with this year’s focus potentially on rate cuts.

- Why is the yield curve flattening important?

- A flattening yield curve suggests market anticipation of rate cuts, influencing investment decisions and economic forecasts.