- Opening Bell

- May 31, 2024

- 2 min read

All Eyes on U.S Core PCE Today, Gold Could Drop to $2,300

With the Core PCE data scheduled for release today, the markets have been fairly quiet throughout the week – largely cooling off from their rallies.

Overall trading volume this week was low, implying that most market participants are sitting out in anticipation of the Core PCE data.

Key Takeaways:

- High Impact News at 12:30 UTC – U.S Core PCE Data

- Core PCE is forecasted at 0.3%, if it is higher, then it could imply Fed Rates stay high for longer.

- The implications could drive Gold lower towards $2,300 and potentially $2,200.

| New York Time (GMT-4) | London Time (GMT+1) | Asia Time (GMT+8) |

| 8:30AM | 1:30PM | 8:30PM |

Core PCE News

Source: Forex Factory

The Core PCE (Price Consumption Expenditure) m/m data is interesting to many traders, as it reveals how effective the Federal Reserve has been in controlling inflation.

If the month-over-month data comes in higher than the expected 0.3%, this could cause some temporary volatility for Gold – where the general direction is bearish.

Gold Technicals

Source: TradingView

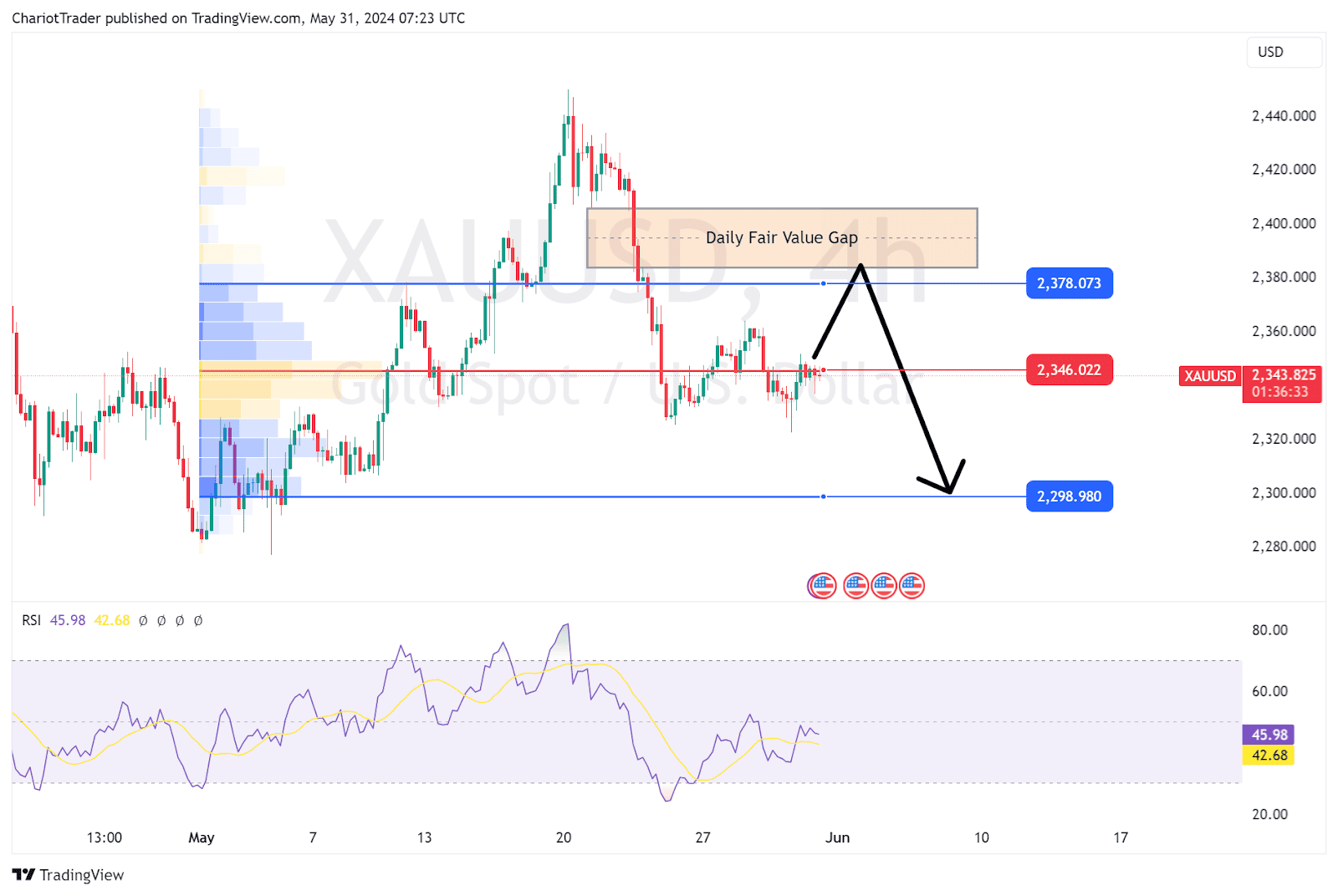

The Gold (XAUUSD) 4H chart is particularly interesting, as we have several resistances stacking at the topside. First, we can identify a Fair Value Gap at approximately $2,400, which is also present on the daily time frame.

By drawing an Anchored Volume Profile from the beginning of May, we reveal three key points of interest.

- Value Area High: $2,378.073

- Point of Control (Highest Traded Volume): $2,346.022

- Value Area Low: $2,298.980

If Gold manages to push higher, I would keep an eye on the Value Area High, the Daily Fair Value Gap, and the RSI for a potential bearish divergence on the 4H time frame.

On the flip side, we can trail lower from here as the price is currently testing the Point of Control as resistance. In which case, I would watch the Value Area Low at approximately $2,300 as a support zone. If that manages to break, Gold could tumble down to the next major support level at $2,200.