- Opening Bell

- November 21, 2024

- 3 min read

NVDA: Riding the AI Wave to Unprecedented Highs

Earnings Snapshot: Strong Beat on EPS and Revenue

NVIDIA (NASDAQ: NVDA) delivered another quarter of exceptional financial performance for period ending in 27th October 2024 (Q3 FY2025), exceeding both revenue and earnings expectations. Earnings per share (EPS) surged past estimates, beating projections by 8.66%, while revenue also posted a solid beat at 5.96% above expectations. The company’s robust execution in its data center and AI-driven platforms continues to dominate headlines as it benefits from surging demand for accelerated computing and artificial intelligence solutions.

Q3 Highlights:

- Revenue: $35.08 billion, up a staggering 93.5% year-over-year, driven largely by its Compute & Networking segment.

- Net Income: $19.3 billion, more than doubling from $9.24 billion in the prior year’s quarter.

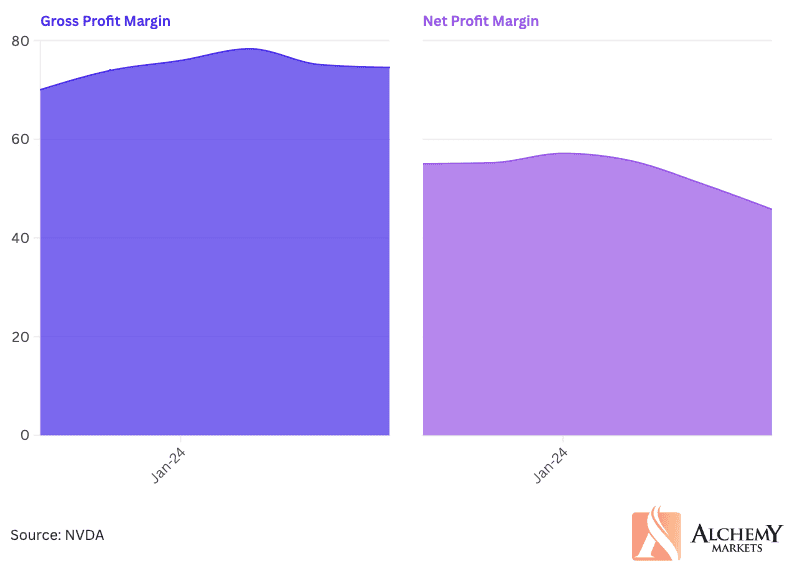

- Gross Profit Margin: Improved to 74.6%, showcasing NVIDIA’s pricing power and operational efficiencies.

Fundamental Overview: Momentum or Saturation Ahead?

NVIDIA’s performance highlights sustained demand for AI-based solutions across data centres, gaming, and professional visualisation platforms. The Compute & Networking segment continues to be a growth engine, accounting for 88% of total Q3 revenues at $31 billion. The Hopper and Blackwell architectures are fuelling this success, and the transition to new product generations is expected to contribute further to NVIDIA’s growth trajectory.

However, there are potential headwinds to consider:

- Demand-Supply Dynamics: Although demand remains robust, supply constraints for high-performance AI chips could limit upside potential in the near term.

- Geopolitical Risks: U.S. export controls to China and other regions pose risks to long-term growth, with regulatory uncertainties potentially dampening international demand.

- Valuation Concerns: As NVIDIA scales rapidly, the market is questioning whether growth rates are sustainable at current levels.

Technical Analysis: Impulse Wave (3) on the Horizon?

From a technical perspective, NVIDIA appears to be approaching a critical juncture. The stock is likely in the process of completing wave (2), a corrective phase, and may soon transition into the next impulsive wave (3). With earnings momentum and robust AI demand supporting a bullish long-term thesis, a rally targeting new highs could unfold.

That said, alternative counts exist: if growth deceleration or supply chain challenges weigh on sentiment, NVIDIA may struggle to hold key support levels. A failure to sustain higher highs in the next wave would signal diminishing momentum.

Key Levels to Watch:

- Support: $132–$136 range (wave (2) correction zone).

- Upside Targets: $160+ for wave (3) progression.

Outlook: AI and Data Center Growth Dominate the Narrative

NVIDIA is firing on all cylinders as AI adoption scales globally, but challenges like supply constraints and regulatory risks loom on the horizon. While the immediate future appears bright with strong momentum, cautious optimism is warranted as valuation concerns and macroeconomic factors could weigh on performance.

Investors should closely monitor product transitions, regulatory updates, and demand trends in key markets as NVIDIA’s story continues to evolve.