- Opening Bell

- May 16, 2024

- 3min read

USD Dips, Markets Rally With Bullish U.S. CPI Data. What’s next?

Going into 2024, investors approached the markets with a “risk-off” sentiment in the first quarter due to expectations of multiple aggressive rate hikes from the US Federal Reserve.

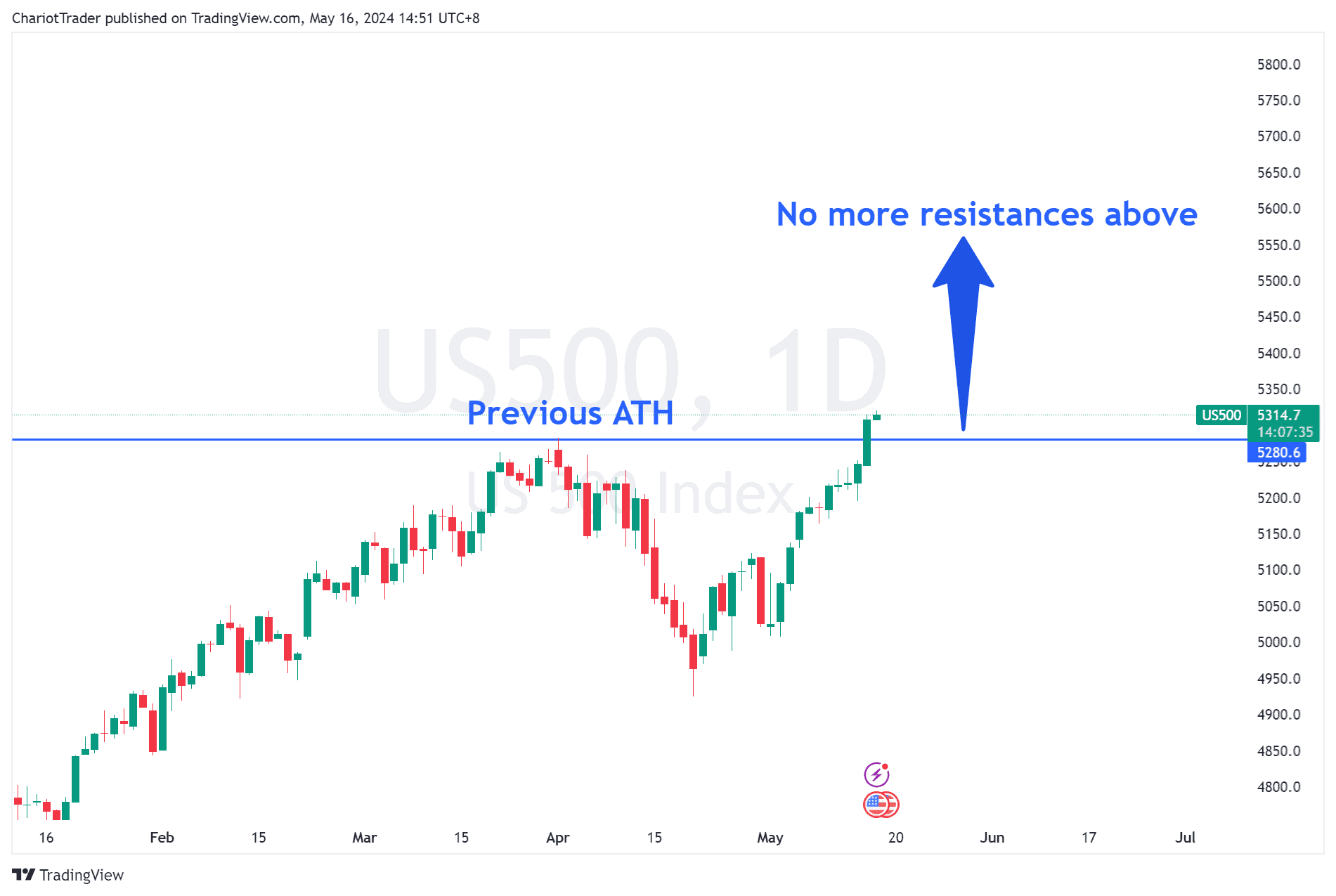

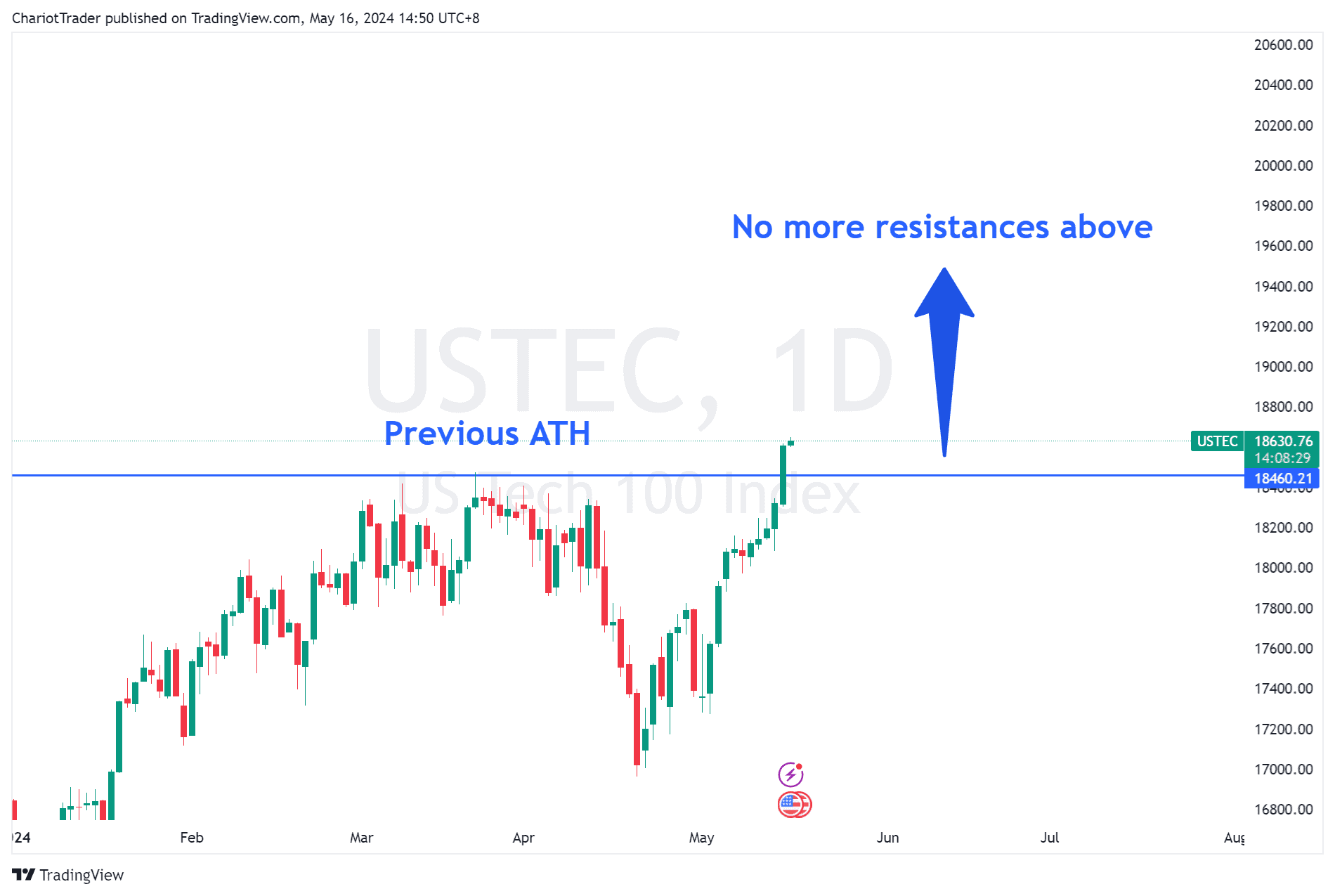

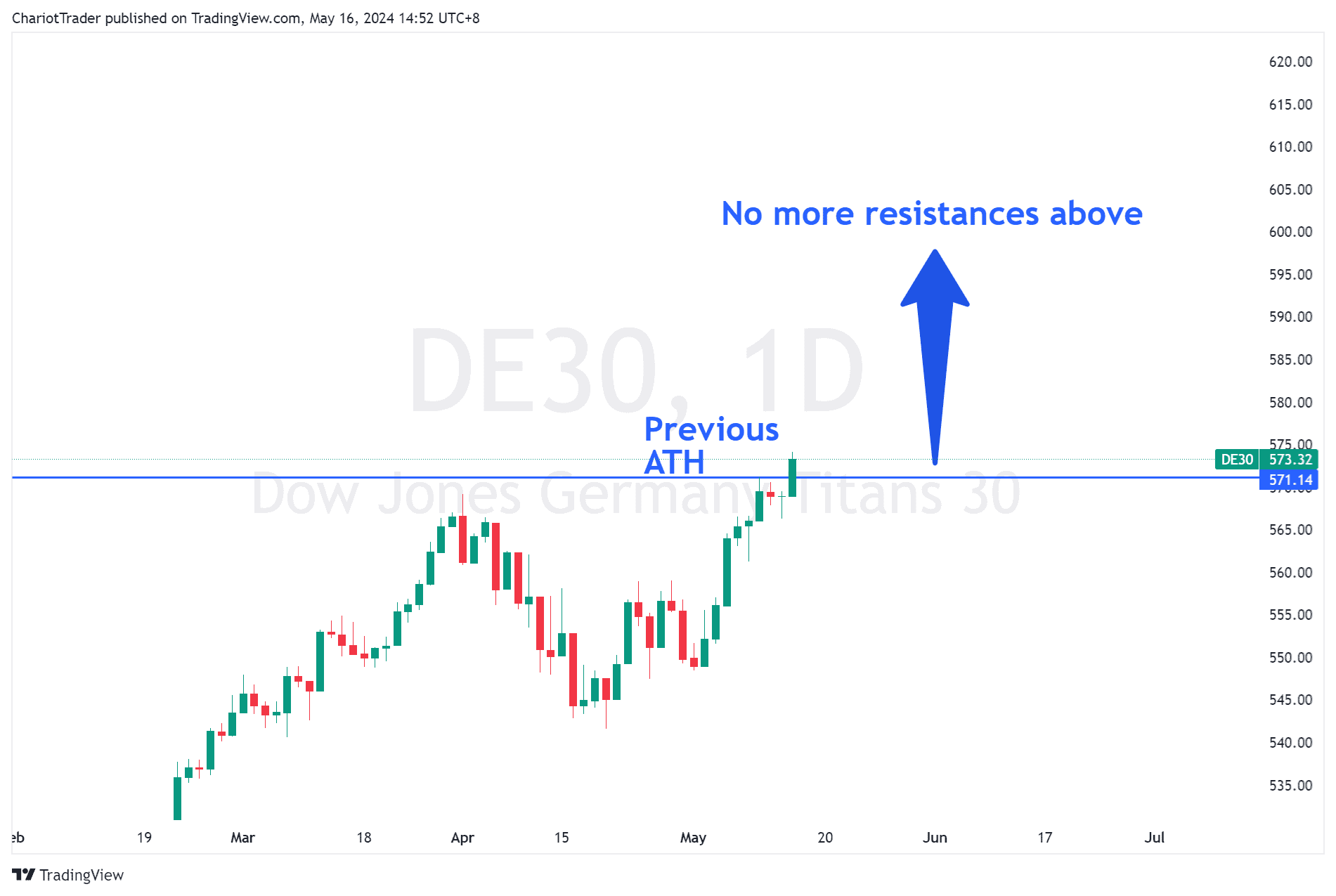

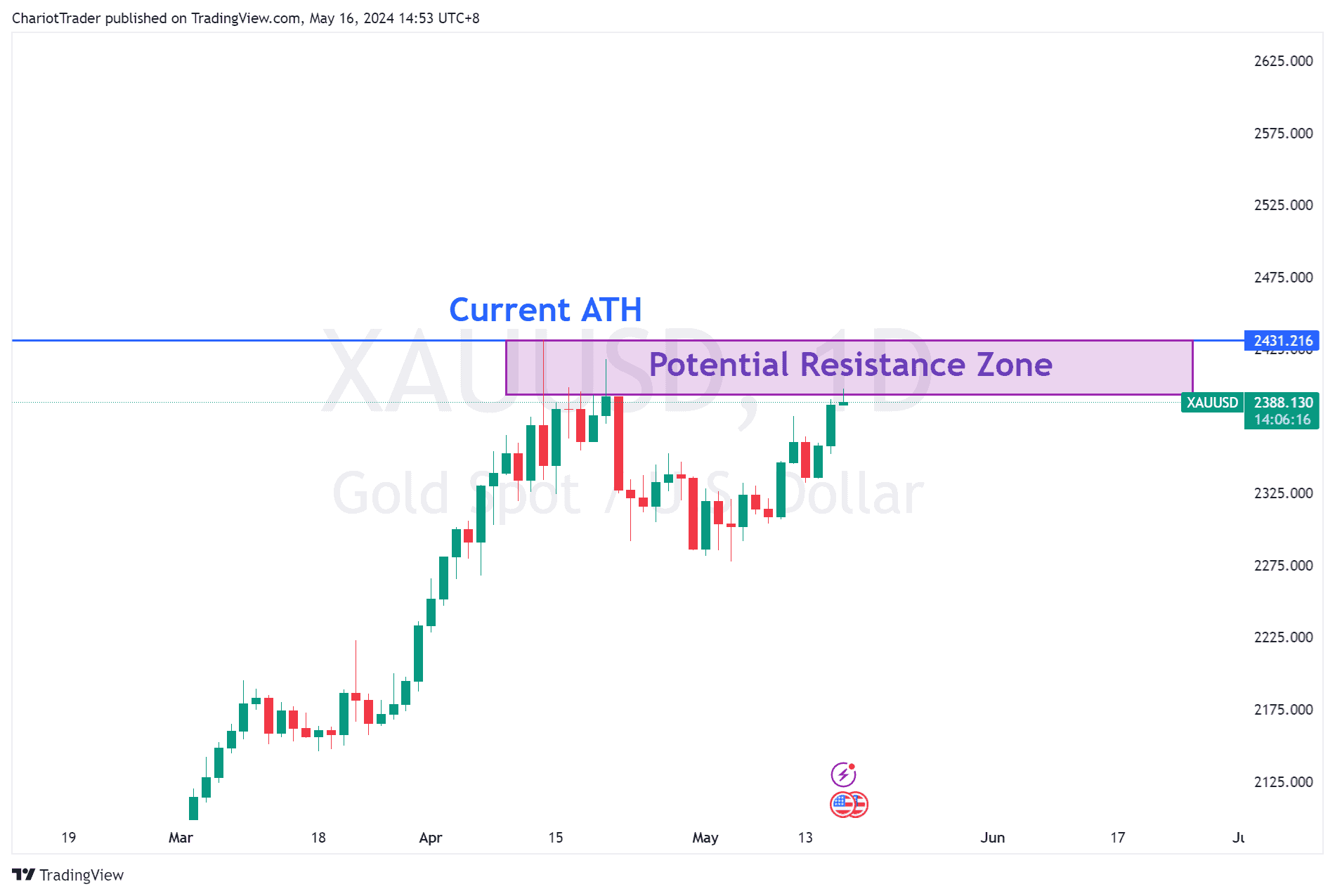

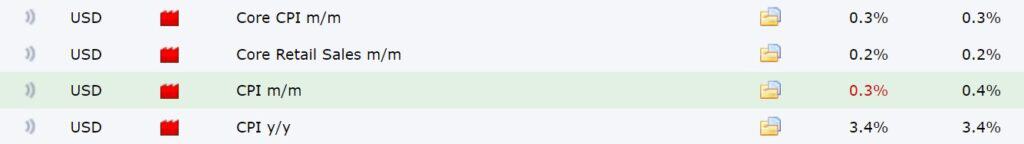

However, as positive CPI inflation data was released at 0.3% (versus the forecasted 0.4%) yesterday, the general markets rallied in optimism of a rate cut in September.

For bears, this rally may have squashed hopes of finding lower prices to invest in assets. We are now technically in bullish territory, with only support levels below on the S&P 500, Nasdaq and the DAX. However, all hope for bears isn’t lost. Bullish investors should watch the DXY, as it is sitting on a significant trendline.

| Key assets to take note of: |

|---|

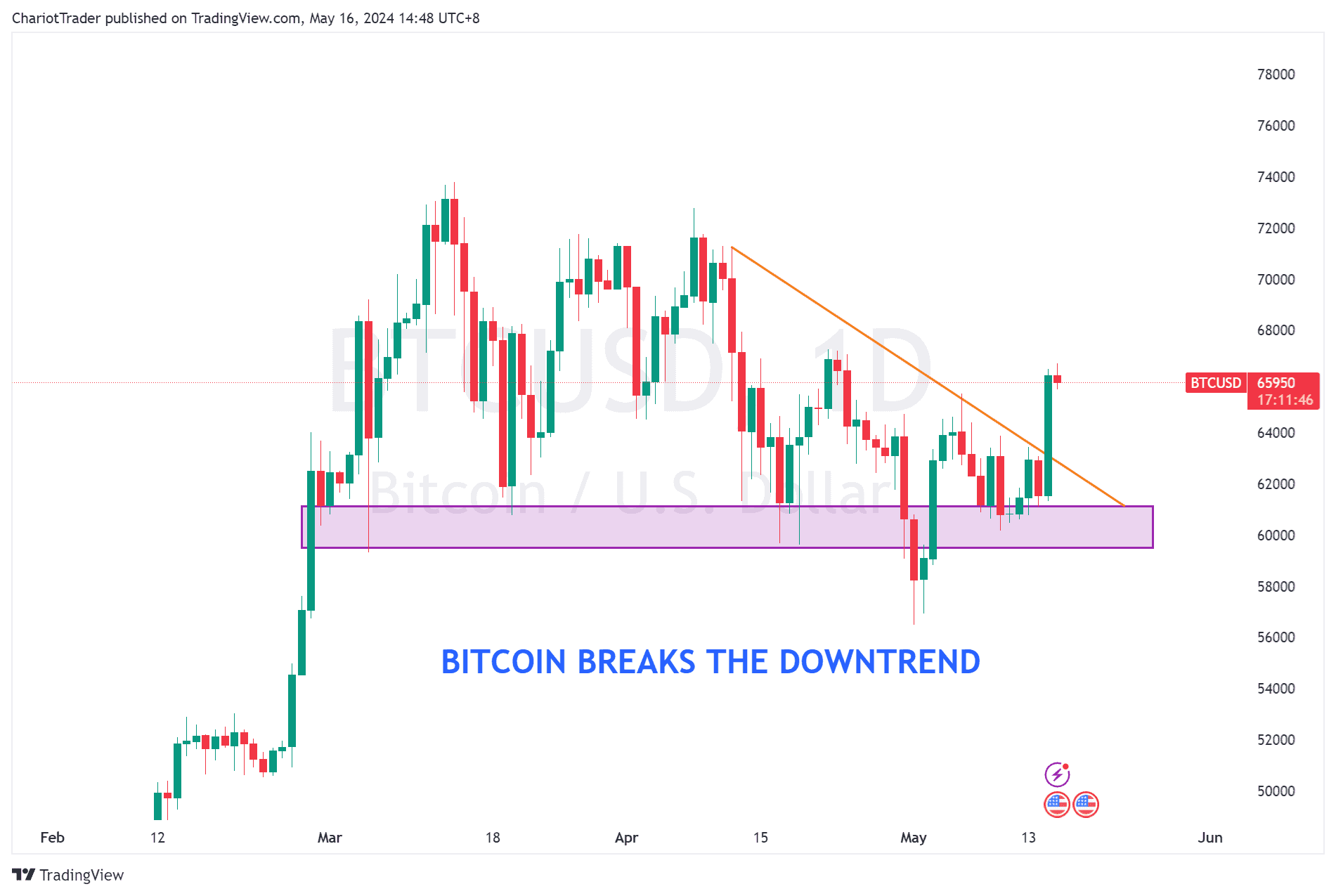

| • S&P 500 gaps up to form a new ATH, closing over $5,300. • Nasdaq 100 also formed a new ATH, closing over $18,000. • DAX pushes up by 0.89%, forming a new ATH and closing over €18,800. • Gold climbs by 1.45% and approaches its ATH (All-Time Highs) • Bitcoin makes a rally of over 7%, closing over $66,000 and reversing the downtrend. |

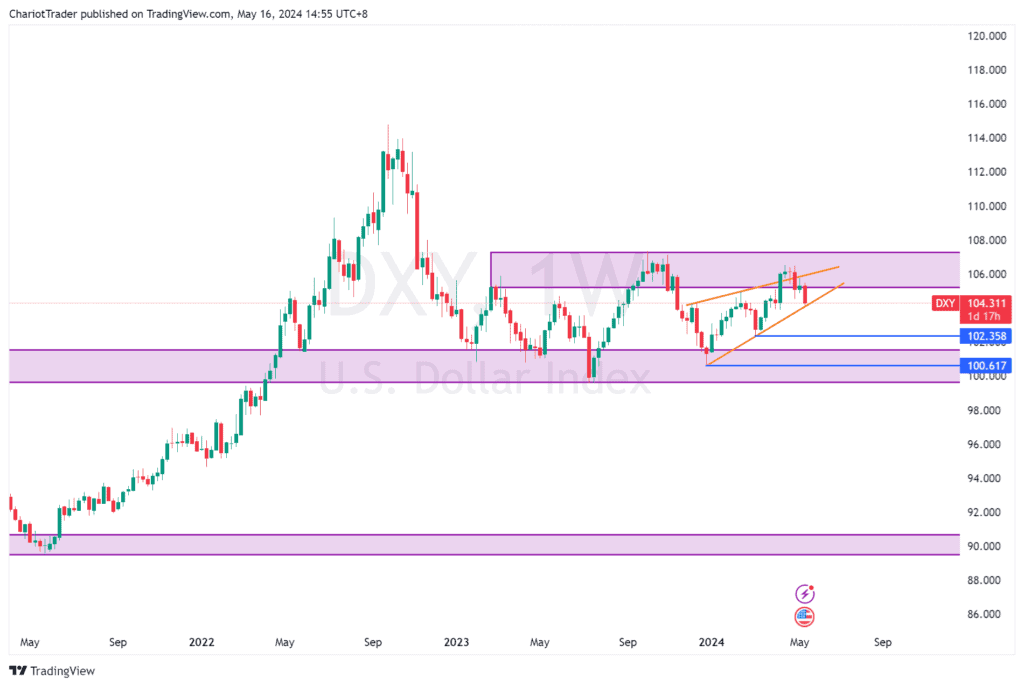

DXY Back Inside Rising Wedge, Sitting At Trendline

The first warning signs of a bearish US Dollar came two weeks ago at the close of the first week in May. This close puts the DXY back into a weekly rising wedge, and the index has continued to fall lower – indicating a weakening US Dollar.

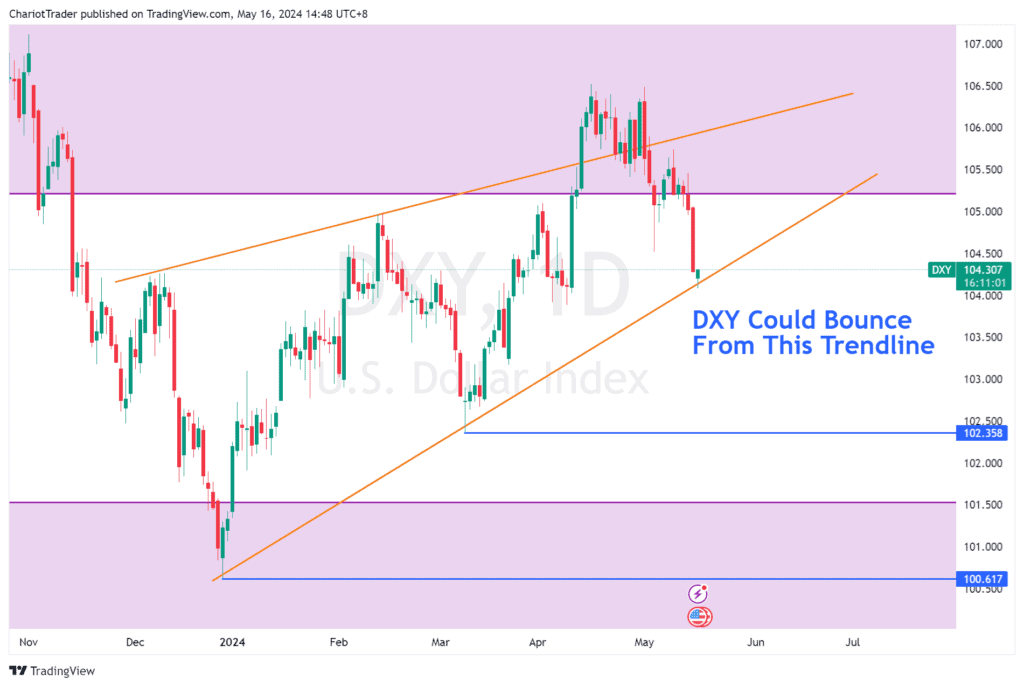

Currently, the DXY is sitting at 104.311, right at the rising wedge’s lower trendline formed since December 2023. If bears were to see any hope, the trendline here must hold and push the DXY back up to potentially retest the top of the rising wedge (at approximately 106.00).

Markets Could Correct if DXY Bounces From Here

While the ball remains in the court of the bulls – there is a possibility for a temporary bounce at this trendline. This would align with the idea of the markets making a small correction after such an impulsive move.

However, if the rising wedge begins to break down, the general markets would be allowed to rally. In that scenario, it would be wise to watch for a reaction at 102.218, and ultimately 100.596, marking approximately a 3.5% drop.

The rest of the week is free from any high-impact news regarding the USD, so it’s safe to say we should just focus on the price action and technicals until the weekly close.