- Opening Bell

- October 3, 2024

- 6 min read

Markets Eye Jobless Claims, ISM Services, and Middle East Tensions

The financial markets are set for another volatile day as key U.S. economic data and global events drive investor sentiment. Today’s releases of Initial Jobless Claims and the ISM Services PMI are likely to shape the immediate trajectory of the U.S. Dollar (USD) and influence the Federal Reserve’s policy outlook. These reports come on the heels of Tuesday’s disappointing ISM Manufacturing PMI data, which underperformed expectations, reigniting concerns about the U.S. economy’s growth trajectory.

Additionally, geopolitical tensions in the Middle East continue to loom over the markets, adding another layer of uncertainty. Oil prices have stabilised around $75 per barrel as the world awaits further developments in the Israel-Iran standoff. Investors are closely monitoring the situation, especially the U.S.’s efforts to prevent escalation, which could push the dollar further up in the short term, given its role as a safe-haven currency during times of geopolitical instability.

U.S. Dollar Gains: Market Reaction and Upcoming Data

The U.S. Dollar Index (DXY) has remained robust despite the ongoing volatility. Yesterday, the USD showed signs of strength, buoyed by stronger-than-expected ADP employment data, which saw the USD 2-year swap rate spike back to 3.40%, up from last week’s levels. This bullish move in the dollar reflects a market that is pricing in the possibility of continued hawkishness from the Federal Reserve, even as many traders anticipate a 50bp rate cut in either November or December.

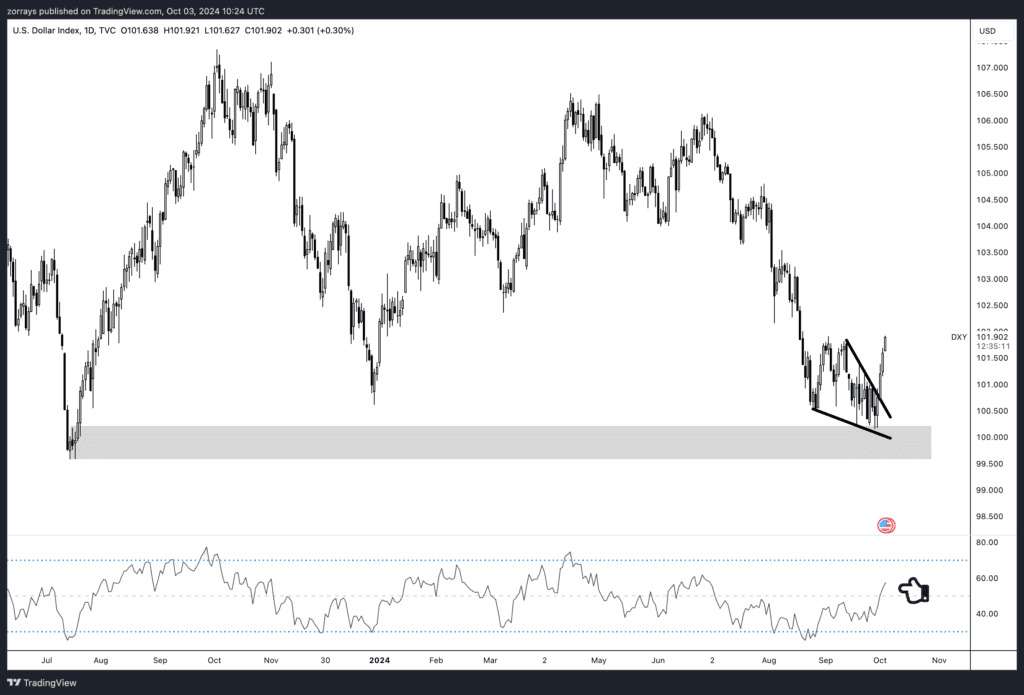

As shown in the attached chart, the Dollar Index has bounced off its recent support levels and is attempting a recovery. However, it remains unclear whether this move will turn into a complete reversal to the upside or simply a short-term correction. From a technical perspective, the current rally is encountering resistance, which may cap further gains unless today’s data and tomorrow’s Nonfarm Payrolls report deliver significant surprises.

- Initial Jobless Claims: Last month, we saw 218k and 222k claims, with expectations that today’s figures will rebound towards 230k. A lower-than-expected number could fuel further dollar strength as it would imply a tighter labor market.

- ISM Services PMI: Consensus is calling for a slight uptick to 51.7, but a reading below 51.0 could trigger a more noticeable dollar correction. With Fed Chair Jerome Powell recently pushing back against aggressive rate cuts, any disappointing data today would likely prompt a reassessment of the Fed’s dovish expectations.

Adding to the mix are today’s Durable Goods Orders and a lineup of speeches from hawkish-leaning FOMC members Jeff Schmid and Neel Kashkari. Investors should keep an eye on these, as any remarks that suggest further tightening could reinforce USD momentum heading into tomorrow’s crucial payrolls data.

USD/JPY Under Pressure: Japan’s Dovish Turn

While the U.S. dollar has been resilient, the Japanese yen (JPY) has struggled amid shifting domestic policy expectations. Japan’s new Prime Minister, Shigeru Ishiba, recently stated that the country is not yet prepared for a rate hike, effectively dashing hopes that his administration would take a stronger stance against inflation. This dovish shift in rhetoric has pushed USD/JPY higher, adding to the yen’s weakness against the dollar.

At the same time, Bank of Japan (BoJ) Governor Kazuo Ueda echoed the Prime Minister’s cautious tone, further tempering expectations for a rate hike this year. While Japan’s Consumer Price Index (CPI) still has one more print before the October BoJ meeting, it seems unlikely that the central bank will take action on October 31. Some analysts hold out hope for a December rate hike, but that would require an unexpected spike in inflation.

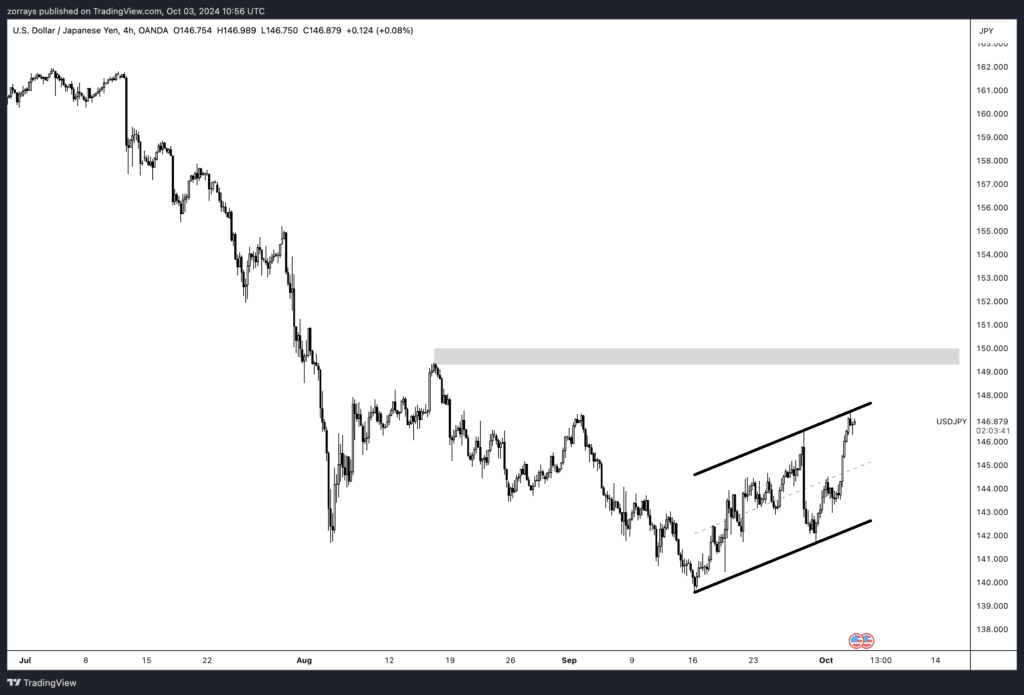

As a result, the yen has seen a significant unwinding of speculative longs, with USD/JPY now trading back toward the 150 level, as shown in the attached USD/JPY chart. The pair has been trending within an ascending channel, with the upper bound nearing the psychologically important 150 level. The yen’s depreciation is largely due to the market re-pricing BoJ expectations, but further weakness would likely need to come from a hawkish repricing in the U.S. dollar curve.

In this context, today’s U.S. data will be crucial in determining whether the USD/JPY rally continues. Should the ISM Services PMI and Initial Jobless Claims both surprise to the upside, we could see further upward momentum in the pair, possibly pushing it past the 150 resistance. On the other hand, weaker data could provide temporary relief for the yen.

Technical Outlook: Dollar Index and USD/JPY

The Dollar Index (DXY) chart suggests that while the USD has bounced off recent support, the rally is encountering significant resistance levels. With the backdrop of a potentially softer ISM Services report and rising jobless claims, it remains to be seen if the dollar’s current trajectory will hold. A decisive break above current resistance levels could signal a more sustained bullish move, but in the absence of a clear catalyst, this rally could also be short-lived, offering opportunities for retracement.

As for USD/JPY, the pair is trading within a clear ascending channel, with immediate resistance just below the 150 mark. While there is a possibility of the yen correcting in the short term, particularly if U.S. data disappoints, the broader trend appears supportive of further USD gains given the dovish outlook from the Bank of Japan.

Conclusion: Eyes on Data and Global Tensions

In summary, today’s Initial Jobless Claims and ISM Services PMI reports are poised to set the tone for U.S. dollar performance, with potential ramifications for the broader FX markets, including USD/JPY. Investors are also closely watching developments in the Middle East, as any escalation could boost the dollar’s safe-haven appeal further.

With the Federal Reserve’s stance still leaning hawkish and market expectations somewhat misaligned, today’s data will be critical in shaping the next steps for the U.S. Dollar. For now, the dollar retains decent momentum, but market sentiment could shift rapidly depending on how the numbers come in, as well as how global events unfold.

Stay tuned as we break down tomorrow’s Nonfarm Payrolls report, which could be the key factor determining whether the U.S. Dollar continues its upward march or faces a temporary setback.