- Opening Bell

- July 24, 2024

- 4 min read

Markets Eye BoC Rate Cut

The USD rebounded sharply, erasing recent losses, as EUR/USD dipped, and JPY, CHF, and GBP emerged as key winners. Meanwhile, anticipation builds around the Bank of Canada’s upcoming rate cut amidst ongoing Fed dovishness and market reactions to global political risks.

Check out our EUR/USD chart of the day here.

USD:

Data source: Investing and Yahoo Finance

The foreign exchange market saw a notable shift yesterday as EUR/USD dipped from its recent range, erasing the dollar’s losses from the softer June CPI report across most USD pairs. Key winners include the JPY, CHF, and GBP. Interestingly, Scandinavian and Antipodean currencies have weakened by 2.3-3.0% against the dollar since the assassination attempt on Donald Trump on July 13, despite some positive economic indicators like New Zealand’s above-consensus non-tradable CPI and strong employment figures in Australia.

This movement seems more like a market adjustment to Trump re-election uncertainties rather than the beginning of a sustained trend. The Federal Reserve’s outlook remains bearish for the dollar, likely capping short-term gains. A notable two-year Treasury auction yesterday drew the lowest yields since January, and the expected Bank of Canada rate cut today could further solidify expectations for Fed cuts.

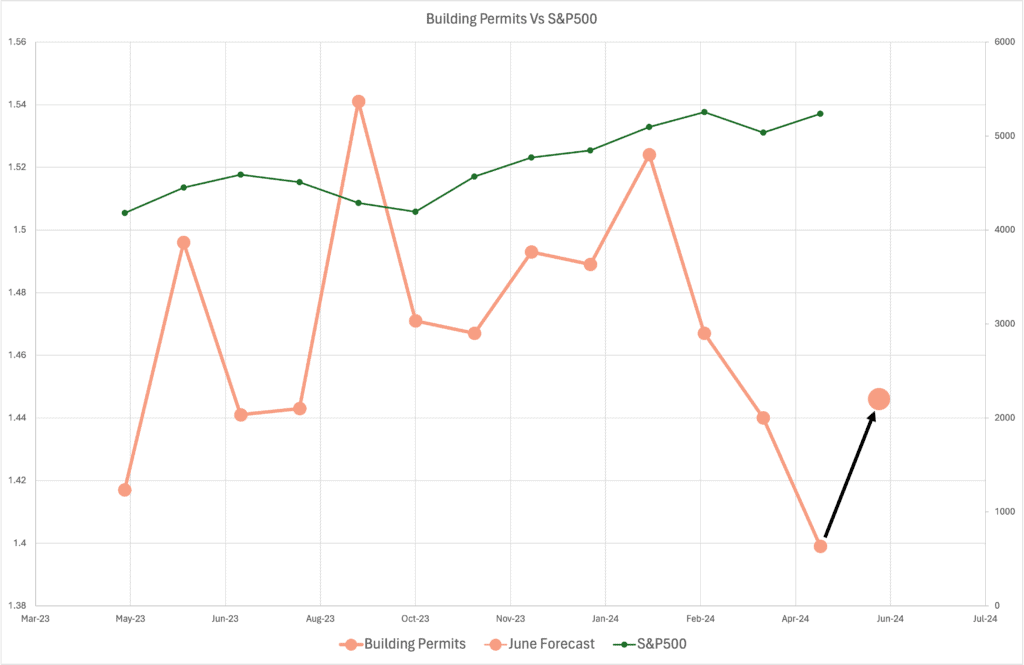

Building permits data, a leading indicator for the construction sector, plays a crucial role in forecasting economic trends, including GDP growth and inflation. With the previous month’s permits at 1.399 million and an expected growth to 1.446 million, positive or in-line data would signal a healthy future for residential and commercial real estate. This uptick suggests potential growth in the construction sector, which can contribute to GDP growth and may impact stock market performance, as increased building activity reflects economic confidence and expansion.

Today, the release of S&P Global PMIs across developed economies, including the US, offers some insights, albeit less influential than the ISM surveys. Consensus points to softer services PMIs but stable manufacturing. The PMI data has been more optimistic than the ISM, which reported declines in both services and manufacturing in June.

However, markets may overlook these releases, with the FX market focusing on domestic issues while currencies affected by Trump-related news struggle to recover. The current low FX volatility environment is not conducive to a return to carry trades.

Check out our EUR/USD chart of the day here.

CAD:

Data source: Trading Economics

A 25 basis point rate cut by the Bank of Canada is widely expected today, with market pricing suggesting 21 basis points are already factored in and a total of 65 basis points of easing by year-end. While not unanimous, the majority of economists favour a cut over a hold.

Our BoC preview highlighted a compelling macro case for continued easing post-June. Inflation metrics are within the BoC’s 1-3% target range, with headline and median core rates unexpectedly lower at 2.7% and 2.6% in June. The job market has also softened, with employment growth turning negative and unemployment rising to 6.4%. The BoC’s business outlook survey indicated further deterioration in Q2.

The only argument against cutting rates today is the potential divergence from the Fed. However, with markets increasingly expecting a Fed cut in September, the BoC seems unconcerned about decoupling from US policy. This could become an issue if US data or Fed communication reduce the likelihood of a September rate cut, possibly prompting the BoC to also hold off.

The widening gap between BoC and Fed policies impacts CAD, with concerns about excessive depreciation potentially stoking inflation. However, as long as USD/CAD stays below 1.40, the exchange rate is likely to remain a secondary consideration for the BoC.

Market focus will be on the BoC’s forward guidance, with Governor Tiff Macklem possibly adopting a cautious tone on further easing, emphasising a data-dependent approach. Nonetheless, risks remain tilted to the downside for CAD, with markets possibly fully pricing in another two cuts by year-end, potentially pushing USD/CAD into the 1.38-1.39 range and weakening CAD against other high-beta G10 currencies.