- Opening Bell

- April 23, 2024

- 6min read

King Dollar Rules as Sentiment Improves, US Earnings in Focus

- US Dollar Holds the High Ground as Key Resistance Area Lies Ahead

- Japanese Officials Unhappy at the Yen Slide, Intervention Hints Resume

- Google, Meta, Tesla, and Microsoft are Among the Names Reporting

- Commodities Mixed as Oil and Gold Remain on Differing Trajectories

General Market Outlook

Euro Area and UK PMI releases kept sentiment positive this morning as both showed positive signs from a growth perspective. The data releases have added to what has been an intriguing start to a massive week, with UK businesses expanding at their fastest pace in 11 months.

UK PMI REPORT (FULL):

EU PMI REPORT (FULL)

Tensions in the Middle East have eased somewhat which has been a key factor to the broader optimism we are currently seeing. The easing of tensions has seen US equities recover from a slump last week, while the demand for safe-haven assets appears to have taken a breather as well.

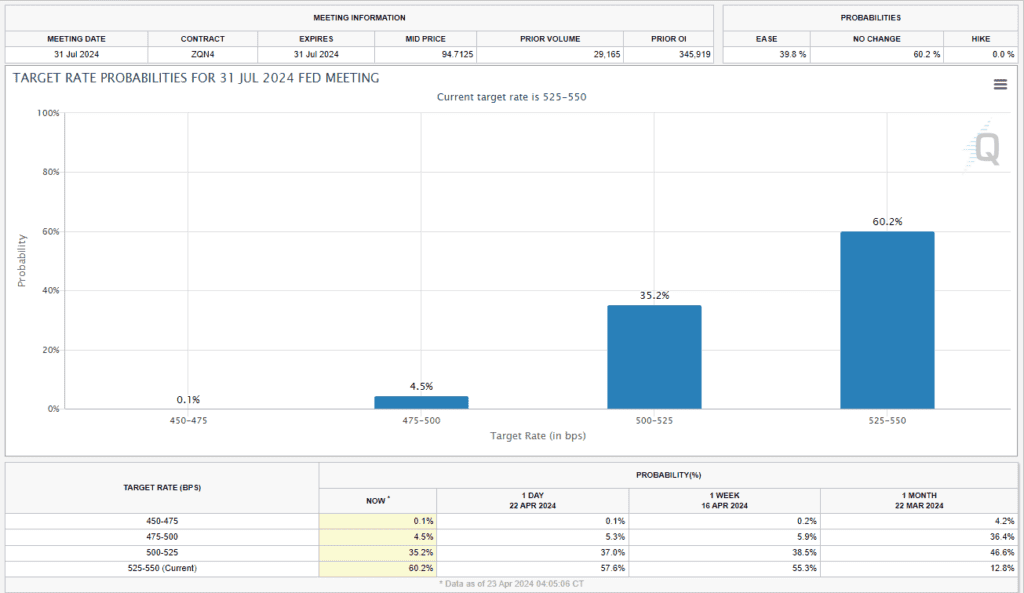

Looking at the interest rate picture, there is mounting speculation that the “higher for longer” narrative may prevail in the US. This follows positive US data over the past few weeks as well as hawkish comments from Fed policymakers last week. The Federal Reserve has entered its blackout period, meaning we will not hear any commentary from policymakers until the Fed meeting on May 1. Market participants had originally priced in rate cuts to start in July while eyeing a total of 75bps of cuts in the second half of 2024.

An example of the shifting narrative around rates may be found in the chart below, which indicates the probability of a rate cut at the upcoming Fed meetings. 1 Month ago markets were pricing in a 12.6% chance that rates would remain steady in July at 5.5%, this has now increased to 60.2% at the time of writing.

Source: CME FedWatch Tool

FX Movers: King Dollar Holds the High Ground

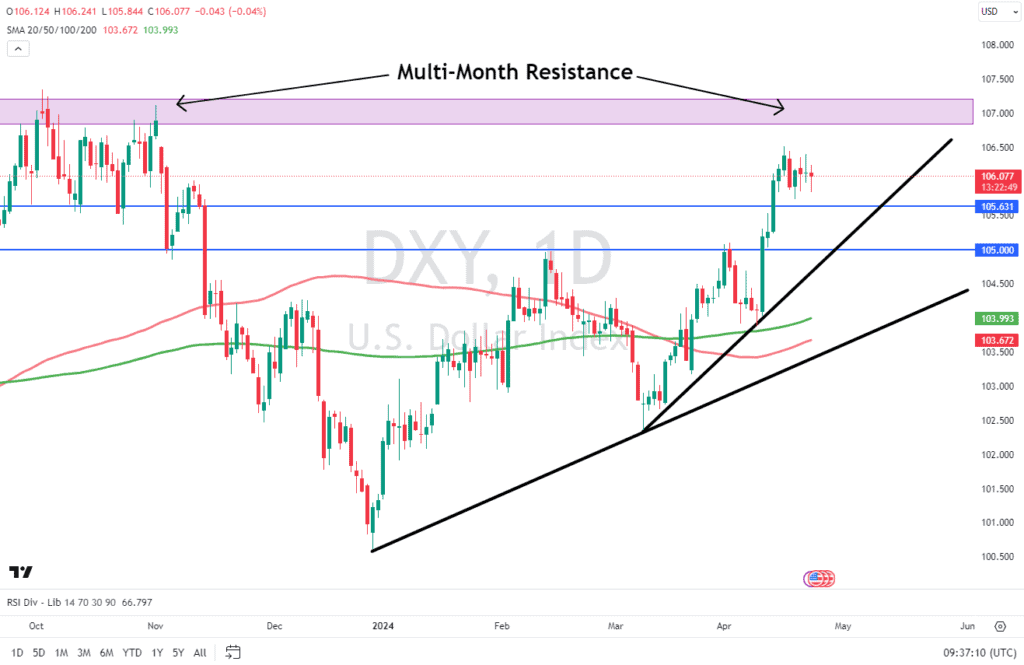

Looking across markets, the USD remains at the forefront of FX discussions. A recent surge in the Greenback has left policymakers across the globe on the edge of their seats. The greenback is now trading at its highest levels against major peers since November. There appears to have been significant US Dollar buying following the latest inflation numbers released in the US while diverging rate cut expectations will not help currencies like the Euro moving forward.

Looking at the DXY chart below, the price is currently trading between a multi-month resistance level at 107.00 and a key support area hovering around the 105-50-105.60 handles respectively.

The last few days have seen prices trade within a tight range as markets await another catalyst from the US. Looking at what’s to come this week, there is every chance that the DXY remains rangebound ahead of the Fed meeting on May 1. Confirmation of rate cuts being pushed back and a more hawkish outlook could then propel the USD beyond the key resistance level of 107.00.

US DOLLAR INDEX (DXY) Daily Chart

Source: TradingView

USDJPY remains interesting as it continues to flirt with the 155.00 handle. Overnight comments from Senior Japanese Official Katayam helped the Yen briefly before continuing its recent selloff. Katayama stated that Japanese authorities could intervene to prop the Yen up at any time. For a meaningful move in favor of the Yen, action will likely be needed rather than warnings as market participants have become accustomed to hearing such rhetoric from Japanese officials. The only positive for the Yen has been the stern resistance around the 155.00 mark in the case of USDJPY.

The EUR and GBP have both struggled to hold onto gains against the Greenback. This narrative has continued this week with the EU and UK PMI releases this morning failing to translate into sustainable gains for either currency against the Greenback.

Commodities

WTI Oil prices recovered yesterday despite tension easing in the Middle East as markets now refocus on supply-demand dynamics. There are growing calls that Oil prices could head toward the $100 a barrel mark even if tensions in the Middle East remain subdued. This does not bode well for Central Banks as this could put a spanner in the works regarding potential rate cuts. I will be keeping a close eye on the $80 a barrel mark which remains a key support area and could be the base from which Oil moves toward the $100 a barrel mark.

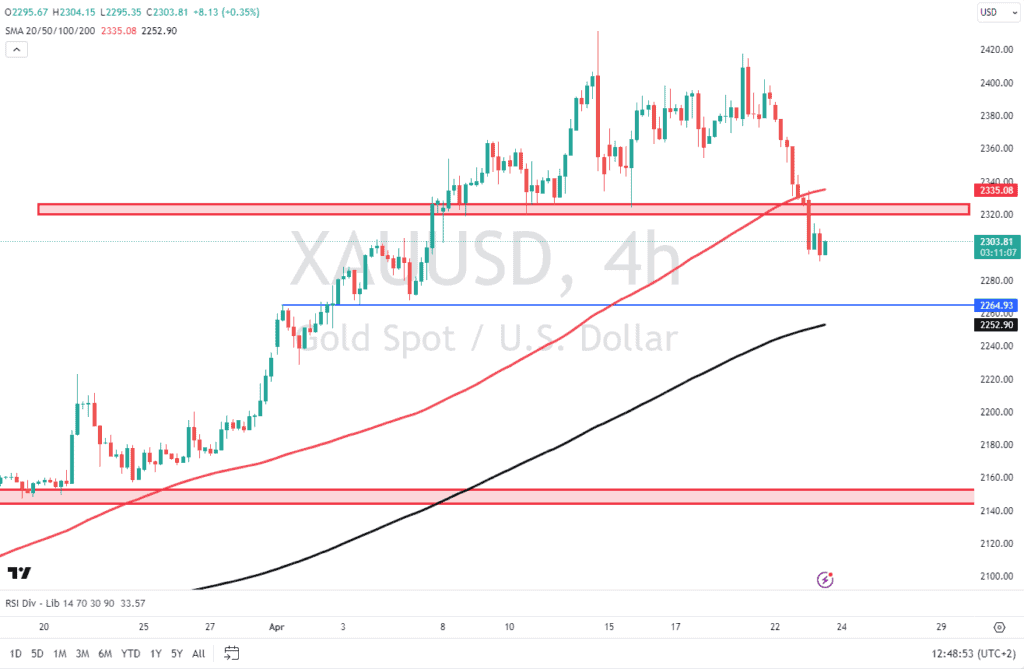

Gold has taken a hit early in the week as safe haven appeal appears to have waned. The precious metal recorded its largest daily decline since June 2021, falling around $60/oz on the day. At this stage, a deeper retracement remains a possibility but the shadow of increased Geopolitical tension continues to provide optimism for Gold bulls and could cap losses moving forward.

GOLD 4H Chart

Source: TradingView

Looking at the 4H Gold chart above, we have shifted to a bearish trend having broken a key support area resting just below the 100-day SMA at the 2325 mark. This support turned resistance level and the 100-day MA could hold the key for further downside while providing a potential opportunity for would-be shorts.

Looking to the downside, immediate support rests at 2265 with the 200-day MA resting slightly below at 2252/oz. Gold continues to be driven largely by external factors and this looks set to continue. Something to bear in mind if you are looking to get involved in the precious metal. Any sign that the Geopolitical situation in the Middle East may escalate could push Gold back toward recent highs and should be monitored moving forward.

Economic Data and US Earnings Ahead

Looking ahead to the rest of the day, US PMI data will be the main data release which will be followed by US earnings releases after the market close. Given that the majority of the big names will report after market close, we could see gains continue for US indices ahead of the earnings releases.

Yesterday saw US Indices look to recover following a lackluster end to the previous week. The Nasdaq 100 and S&P 500 finished the day with gains of 1.03% and 0.93% respectively. The question on everyones lips is whether the pullback in US Equities is the beginning of a prolonged selloff or a temporary malaise before pushing even higher. Markets are expecting positive earnings from Tech Stocks involved in the AI space and given the role AI-linked stocks have played in gains this year, a miss to the downside on the earnings front could accelerate a selloff in US stocks.

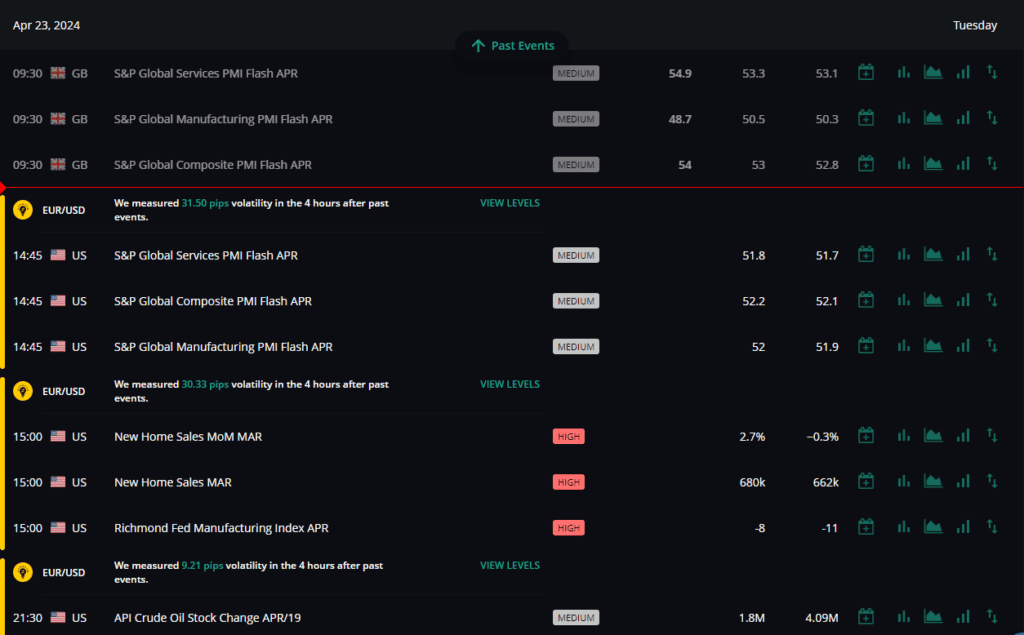

Economic Calendar for April 23, 2024. (UK Time, GMT + 1)

Source: FXIFY